Company Sets Several Financial Performance Records as it Releases its Financial Results for the Quarter Ended March 31, 2024

Highlights of the Quarter and Trailing 12 Months

(Unless otherwise noted, all financial amounts in this news release are expressed in U.S. dollars.)

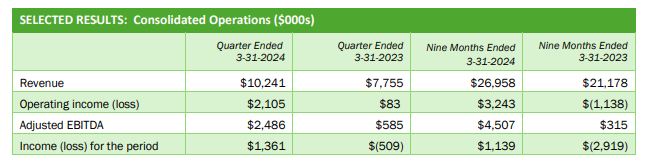

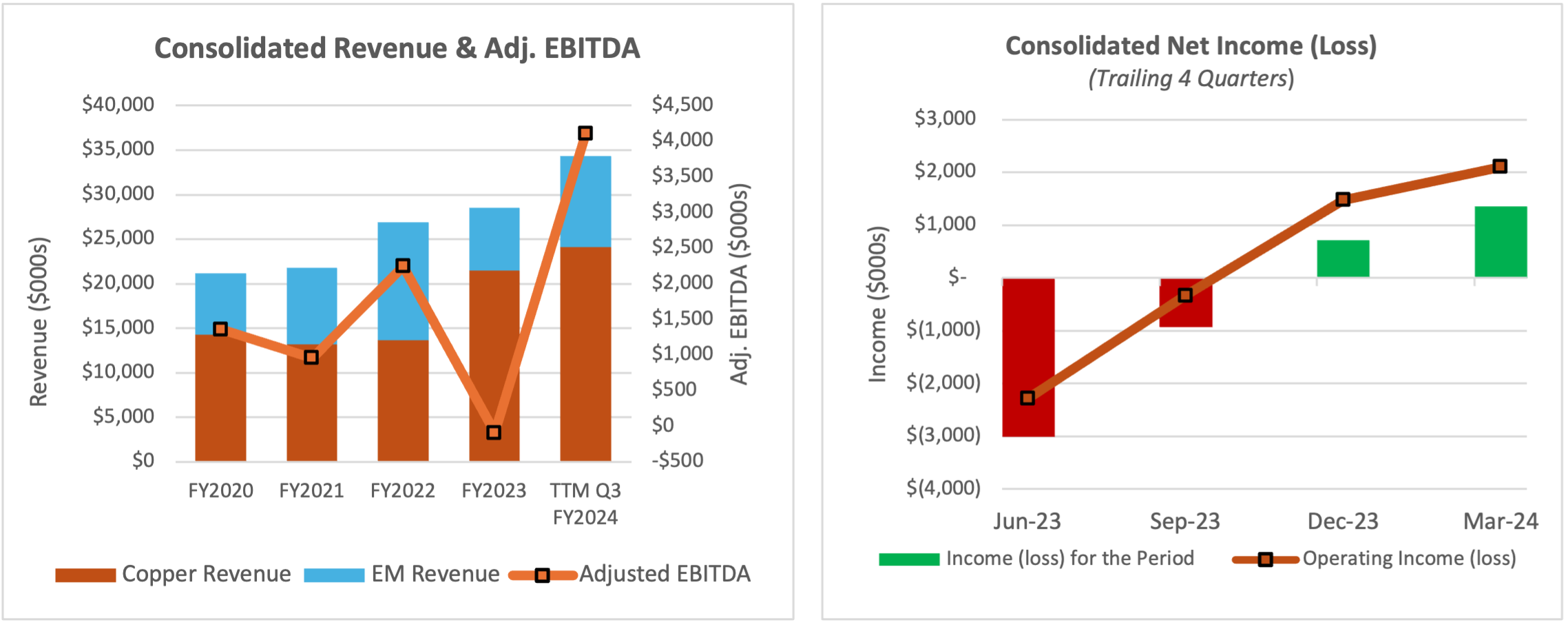

- Net income of $1.36 million, or $0.01 per share, in the quarter on sales of $10.2 million - a new quarterly record. Sales of $34.3 million on a trailing 12-month ("TTM") basis and sales of $27.0 million in the nine-month period ended March 31, 2024, also were the highest ever recorded.

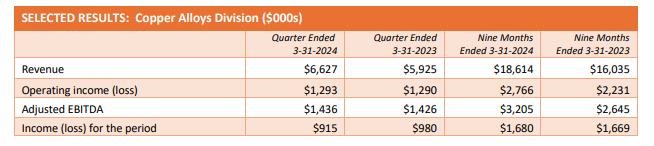

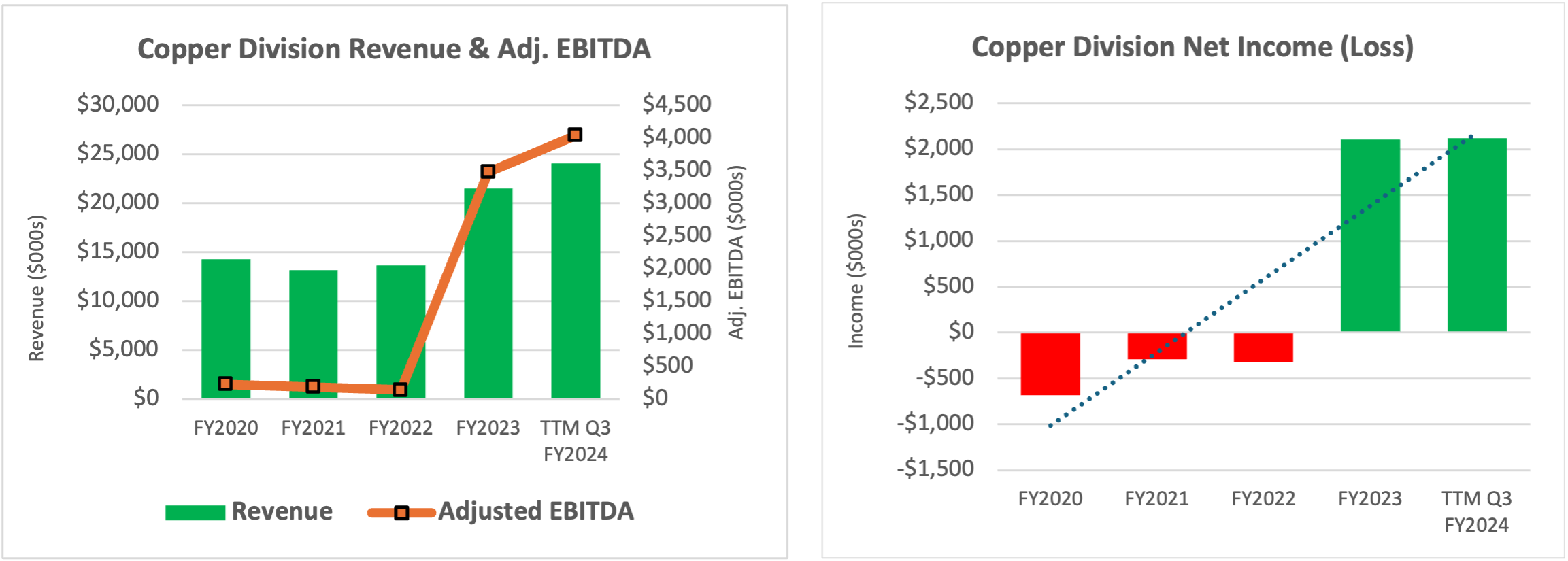

- Copper Alloys division sales of $6.6 million were higher by 11.9% quarter over quarter ("Q/Q"), and Engineered Materials division sales were higher by 97.5% Q/Q. On a TTM basis, Copper Alloys sales of $24 million set a record for a 12-month period for the division.

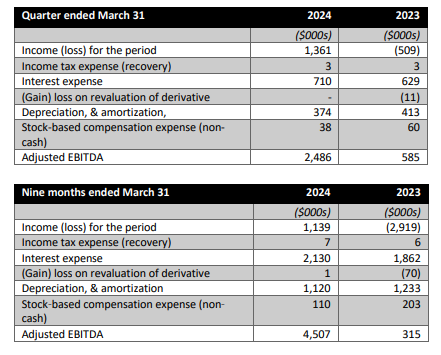

- Consolidated adjusted earnings before interest, taxes, depreciation, and amortization ("Adjusted EBITDA")1 rose to $2.5 million, a Q/Q increase of 325%. Year-to-date Adjusted EBITDA rose to $4.5 million.

- Consolidated operating income of $2.1 million was 24.4% higher Q/Q and flipped to a positive $3.2 million year-over-year ("YOY").

- Company to host live investor webinar to discuss results on Monday, May 20, 2024 at 11 AM EDT.

FRANKLIN, IN / ACCESSWIRE / May 16, 2024 / IBC Advanced Alloys Corp. ("IBC" or the "Company") (TSX-V:IB)(OTCQB:IAALF) announces its financial results for the quarter ended March 31, 2024.

IBC recorded its highest ever quarterly net income in the quarter of $1.36 million, or $0.01 per share, on sales of $10.2 million. Both net income and sales revenue set new quarterly records for the Company. Consolidated sales of $34.3 million on a TTM basis and sales of $27.0 million in the nine-month period ended March 31, 2024 also were the highest ever recorded.

Consolidated Adjusted EBITDA1 rose to $2.5 million, a Q/Q increase of 325%, while YTD Adjusted EBITDA rose to $4.5 million. Consolidated operating income1 of $2.1 million was 24.4% higher Q/Q and flipped to a positive $3.2 million YOY.

Net income for the nine months ended March 31, 2024 was $1.14 million ($0.01 per share) on sales of $27.0 million compared to a loss of $2.92 million ($0.03 per share) on sales of $21.2 million in the comparative period, representing a marked turnaround.

This record performance was driven largely by increased sales and stronger gross margin performance in IBC's Copper Alloys division, coupled with higher sales revenue from the Engineered Materials division of beryllium-aluminum products used in defense markets, and the recovery of an onerous contracts provision booked in the prior year.

The Copper Alloys division also achieved near-record quarterly sales of $6.6 million, eclipsed only by sales of $7.1 million in the preceding quarter. A portion of the division's sales over the preceding two quarters was driven by the completion of two special non-recurring projects.

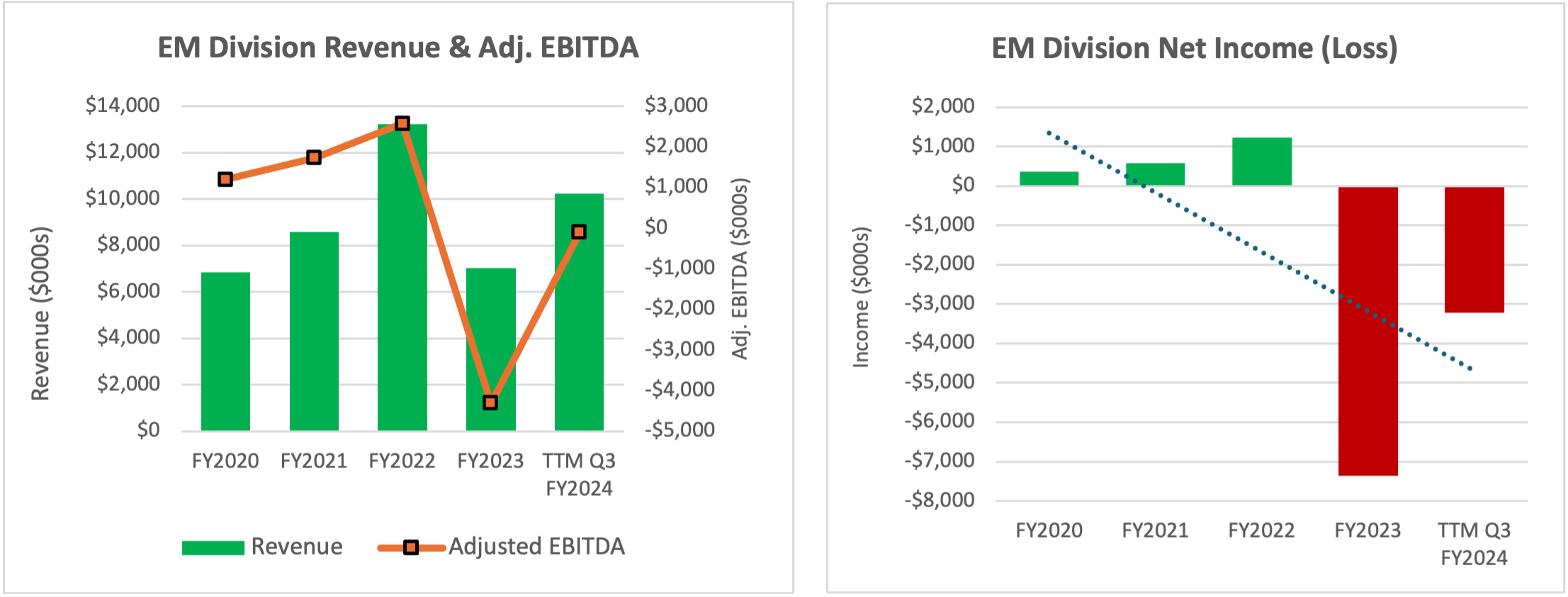

"The IBC team worked tirelessly to achieve some fantastic numbers and historic gains in the third fiscal quarter, which continued the strong sales and gross margin performance of the previous quarter," said Mark A. Smith, Chairman and CEO of IBC. "I like the momentum that we are generating, particularly with the leading performance of our Copper Alloys division. While market conditions have triggered closure of our Engineered Materials division sometime this summer, that team is striving to generate substantially to IBC's bottom line as Engineered Materials completes contracts on hand."

IBC expects to incur a charge to operations in respect of its April decision to close the Engineered Materials division and is negotiating with suppliers and the building landlord to minimize such costs.

CONSOLIDATED RESULTS

COPPER ALLOYS DIVISION

Sales increased for the quarter and nine-month period ended March 31, 2024, mostly due to increased demand from customers in the defense and power generation sectors. Gross profit was positively impacted by improved material yield but negatively impacted by higher subcontract costs.

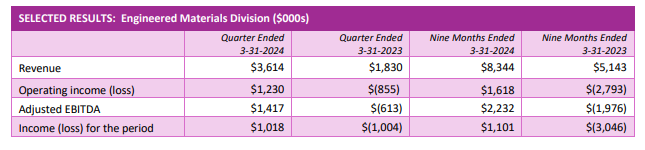

ENGINEERED MATERIALS DIVISION

Sales increased for the quarter and nine-month period ended March 31, 2024, largely due to more favorable prices for the division's products in the commercial and defense markets.

Full results can be seen in the Company's financial statements and management's discussion and analysis ("MD&A"), available at sedarplus.ca and on the Company's website at https://ibcadvancedalloys.com/investors-center/.

INVESTOR WEBCAST SCHEDULED FOR MONDAY 20, 2024

IBC will host a live investor webcast on Monday, May 20, 2024 at 11 a.m. Eastern featuring Mark A. Smith, CEO and Board Chairman, and Toni Wendel, Chief Financial Officer. They will discuss the Company's financial results for the quarter and nine-month periods ended March 31, 2024. Participants can join the webcast by going here at the scheduled start time: https://us06web.zoom.us/j/81738838656?pwd=ZO9lyUWDbFp5GMmFwaHDGhXuEkAKgP.1

To call into a listen-only phone line to the webcast, please the toll numbers listed here:

• +1 719 359 4580 US

• +1 253 205 0468 US

NON-IFRS MEASURES

To supplement its consolidated financial statements, which are prepared and presented in accordance with IFRS, IBC uses "operating income (loss)" and "Adjusted EBITDA", which are non-IFRS financial measures. IBC believes that operating income (loss) helps identify underlying trends in the business that could otherwise be distorted by the effect of certain income or expenses that the Company includes in loss for the period, and provides useful information about core operating results, enhances the overall understanding of past performance and future prospects, and allows for greater visibility with respect to key metrics used by management in financial and operational decision-making. The Company believes that Adjusted EBITDA is a useful indicator for cash flow generated by the business that is independent of IBC's capital structure.

Operating income (loss) and Adjusted EBITDA should not be considered in isolation or construed as an alternative to loss for the period or any other measure of performance or as an indicator of our operating performance. Operating income (loss) and Adjusted EBITDA presented here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to IBC's data.

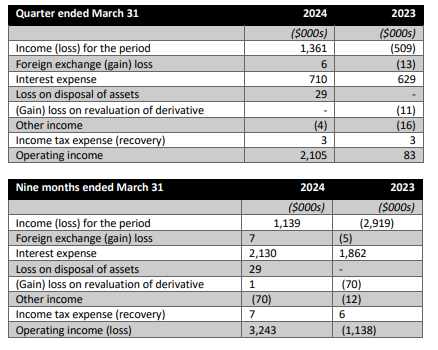

OPERATING INCOME (LOSS)

Operating income (loss) represents income or loss for the quarter, and year-to-date, excluding foreign exchange loss, interest expense, interest income, other income (expense) and income taxes that the Company does not believe are reflective of its core operating performance during the periods presented. A reconciliation of the quarter and year-to-date loss to operating income (loss) follows:

ADJUSTED EBITDA

Adjusted EBITDA represents the Company's income (loss) for the period, and year-to-date, before interest, income taxes, depreciation, amortization, and share-based compensation. A reconciliation of the quarter and year-to-date loss to Adjusted EBITDA follows:

1IBC reports non-IFRS measures such as "Adjusted EBITDA," "Operating Income," and "Free Cash Flow." Please see information on this and other non-IFRS measures in the "Non-IFRS Measures" section of this news release and in IBC's MD&A, available on sedarplus.ca

For more information on IBC and its innovative alloy products, go here.

On Behalf of the Board of Directors:

"Mark A. Smith"

Mark A. Smith, CEO & Chairman of the Board

# # #

CONTACTS:

Mark A. Smith, Chairman of the Board

Jim Sims, Director of Investor and Public Relations

+1 (303) 503-6203

Email: jim.sims@ibcadvancedalloys.com

Website: www.ibcadvancedalloys.com

@IBCAdvanced $IB.TO $IAALF #copper #beryllium #F35

ABOUT IBC ADVANCED ALLOYS CORP.

IBC is a leading advanced copper alloys manufacturer serving a variety of industries such as defense, aerospace, automotive, telecommunications, precision manufacturing, and others. At its vertically integrated production facility in Franklin, Indiana, IBC manufactures and distributes a variety of copper alloys as castings and forgings, including beryllium copper, chrome copper, and aluminum bronze. The Company's common shares are traded on the TSX Venture Exchange under the symbol "IB" and the OTCQB under the symbol "IAALF".

CAUTIONARY STATEMENTS REGARDING FORWARD LOOKING STATEMENTS

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain information contained in this news release may be forward-looking information or forward-looking statements as defined under applicable securities laws. Forward-looking information and forward-looking statements are often, but not always identified by the use of words such as "expect", "anticipate", "believe", "foresee", "could", "estimate", "goal", "intend", "plan", "seek", "will", "may" and "should" and similar expressions or words suggesting future outcomes. This news release includes forward-looking information and statements pertaining to, among other things, the Company's expectation of further growth in revenue and market demand, and the ability of the Copper Alloy division to increase its production capacity, reduce unit costs of production, expand its product portfolio and expand into new markets, the closure of the Engineered Materials division and the expected charge to operations in connection therewith, and the completion of existing contracts by the Engineered Materials division. Forward-looking statements involve substantial known and unknown risks and uncertainties, certain of which are beyond the Company's control including: the risk that the Company may not be able to make sufficient payments to retire its debt, the impact of general economic conditions in the areas in which the Company or its customers operate, including the semiconductor manufacturing and oil and gas industries, risks associated with manufacturing activities, changes in laws and regulations including the adoption of new environmental laws and regulations and changes in how they are interpreted and enforced, increased competition, the lack of availability of qualified personnel or management, limited availability of raw materials, fluctuations in commodity prices, foreign exchange or interest rates, stock market volatility and obtaining required approvals of regulatory authorities. As a result of these risks and uncertainties, the Company's future results, performance or achievements could differ materially from those expressed in these forward-looking statements. All statements included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. These statements are based on assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances.

Please see "Risks Factors" in our Annual Information Form available under the Company's profile at www.sedarplus.ca, for information on the risks and uncertainties associated with our business. Readers should not place undue reliance on forward-looking information and statements, which speak only as of the date made. The forward-looking information and statements contained in this release represent our expectations as of the date of this release. We disclaim any intention or obligation or undertaking to update or revise any forward-looking information or statements whether as a result of new information, future events or otherwise, except as required under applicable securities laws.

SOURCE: IBC Advanced Alloys Corp.

View the original press release on accesswire.com