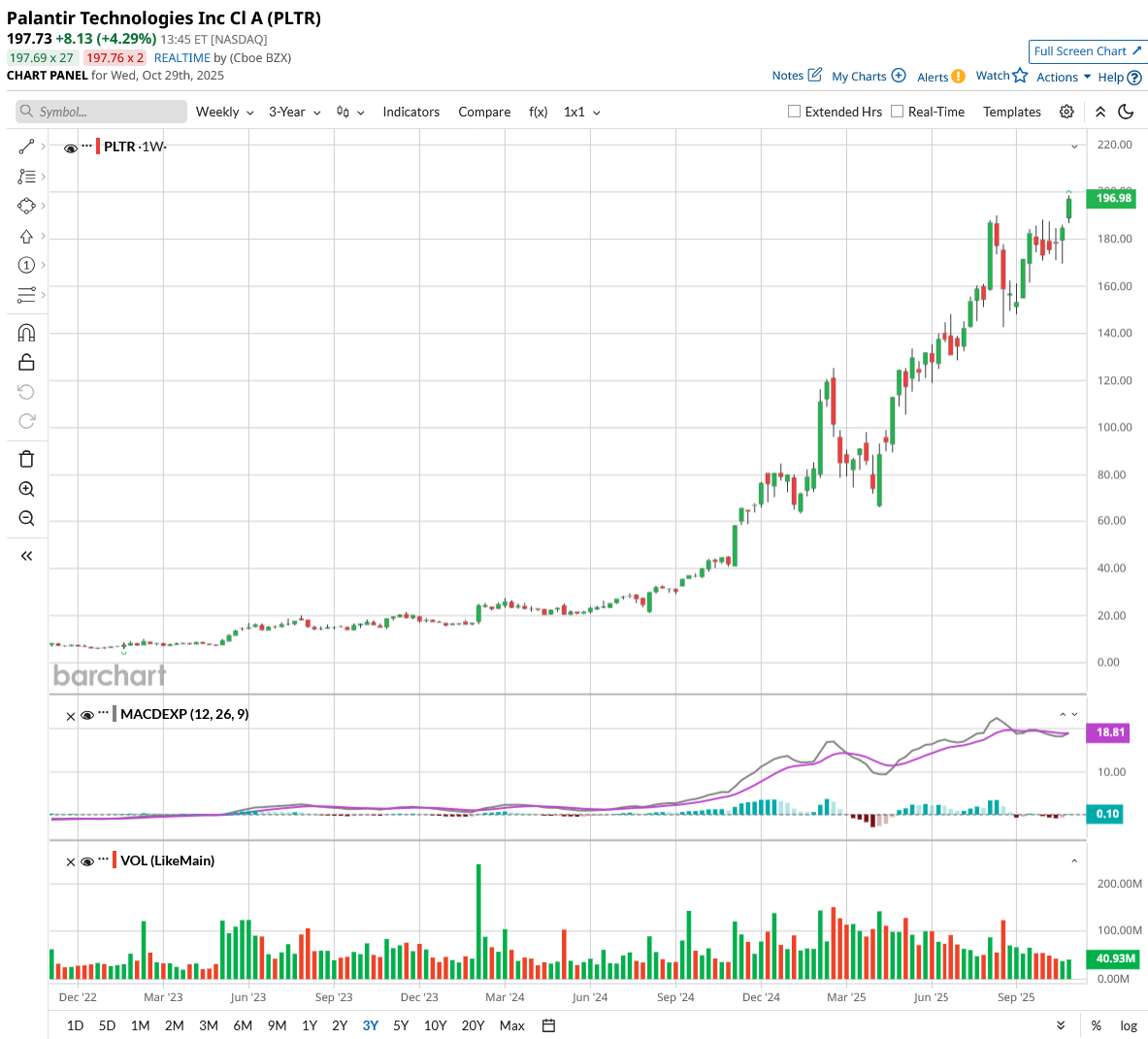

Valued at a market cap of $450 billion, Palantir (PLTR) stock has returned a monstrous 2,290% over the last three years. Palantir Technologies builds software platforms that assist government agencies and enterprises in integrating, analyzing, and operationalizing massive datasets.

Its core products include Gotham for intelligence and defense operations, Foundry for enterprise data management, Apollo for software deployment, and an AI platform that leverages large language models to transform organizational data into actionable intelligence and automated workflows.

Palantir has increased sales from $742.5 million in 2019 to $2.86 billion in 2024. In the last 12 months, it has increased revenue to $3.44 billion. The AI-powered tech behemoth is scheduled to report its Q3 results on Nov. 3, which will be a key driver of its stock price in the near term.

Analysts tracking PLTR stock forecast revenue to increase 50.5% year-over-year (YoY) to $1.09 billion in Q3 of 2025. Compared with the prior year, adjusted earnings are forecast to expand by almost 70% to $0.17 per share.

Palantir would need to beat these estimates comfortably and raise its guidance for 2025 and beyond to support its lofty valuation. Wall Street estimates Palantir to increase revenue by 45% YoY to $4.16 billion in 2025, while earnings growth is forecast at 58%.

Palantir's Meteoric Rise

As stated above, Palantir Technologies has delivered one of the most remarkable performances in modern stock market history since its September 2020 direct listing. The data analytics company is now among the 20 most valuable U.S. companies, ahead of established giants like Cisco (CSCO) and IBM (IBM). Quarterly revenue topped $1 billion for the first time in Q2, with full-year sales expected to reach $4.2 billion, up nearly sixfold from 2019.

The customer base exploded from 125 in early 2020 to 849 by mid-2025. U.S. commercial revenue nearly doubled YoY to $306 million, while government revenue jumped 53% to $426 million as the company has benefited from federal efficiency initiatives.

The catalyst driving this growth is Palantir's AIP platform, launched in April 2023, which helps organizations securely integrate large language models with sensitive data. This AI capability has attracted corporate clients like Wendy's (WEN) and American Airlines (AAL) while deepening relationships with government agencies. The Pentagon recently lifted Palantir's Maven Smart Systems contract ceiling to $1.3 billion, and the company secured a software deal with the Army worth up to $10 billion.

Is PLTR Stock Overvalued?

Palantir trades at 93x forward sales and 256x forward earnings, making it among the most expensive large-cap stocks on Wall Street. Short-seller Andrew Left called PLTR stock detached from fundamentals, arguing it should trade at $40 based on comparable revenue multiples. CEO Alex Karp dismissed critics, telling detractors to exit if they dislike the price.

Analysts forecast Palantir's sales to increase from $4.16 billion in 2025 to $14.68 billion in 2029. In this period, free cash flow is forecast to improve from $1.94 billion to $7.28 billion. If PLTR stock is priced at 100x FCF, it should gain 62% within the next 40 months.

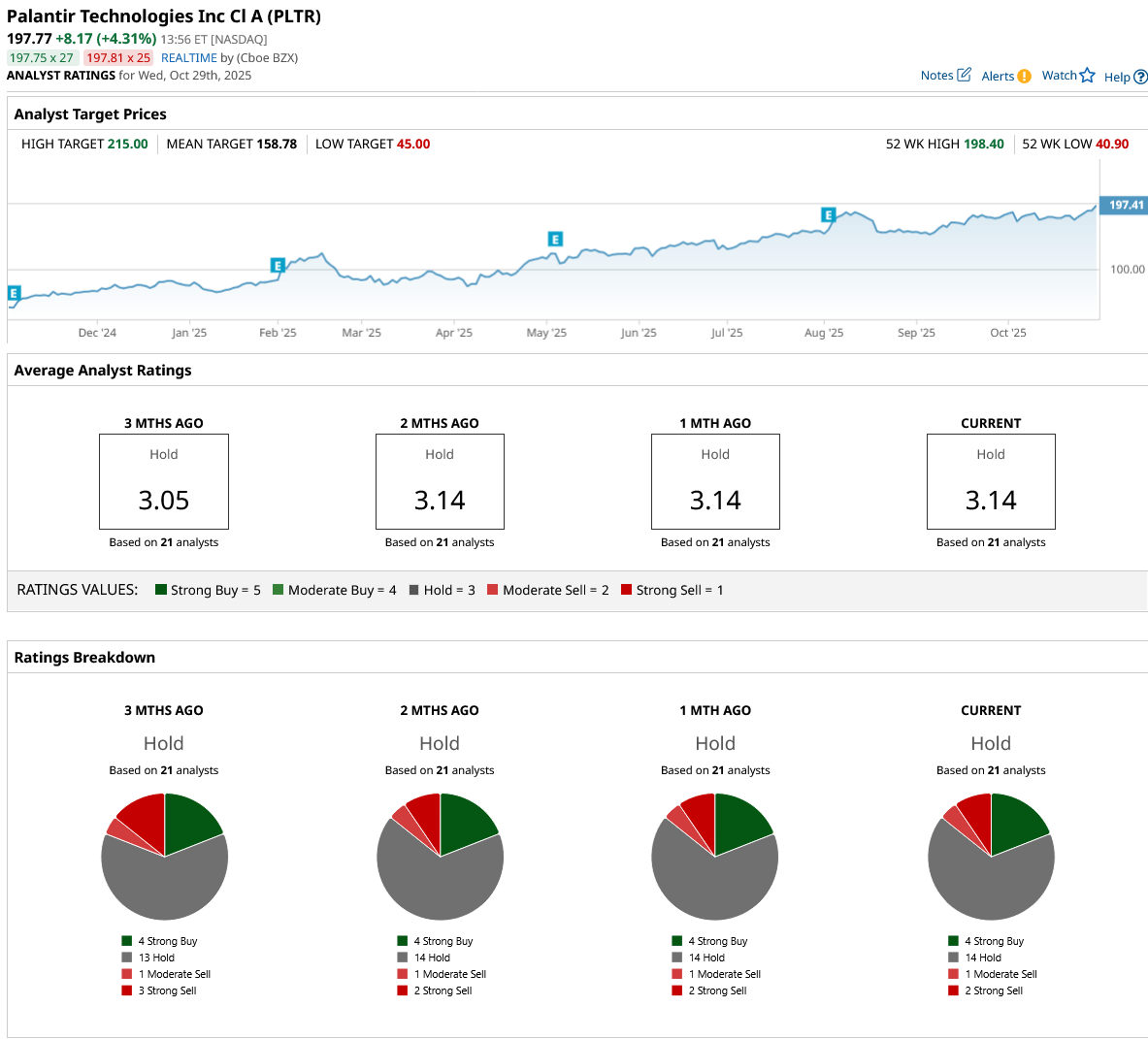

Out of the 21 analysts covering PLTR stock, four recommend “Strong Buy,” 14 recommend “Hold,” one recommends “Moderate Sell,” and two recommend “Strong Sell.” The average PLTR stock price target is $159, below the current price of $197.

Investors should expect PLTR stock to underperform significantly, especially if market sentiment turns bearish. For instance, Palantir stock lost two-thirds of its value during the 2022 bear market before the AI megatrend boosted its fundamentals.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart