It has been a rollercoaster ride for Netflix (NFLX) investors this year. The stock was considered a bastion of safety and a defensive play amid the tariff war earlier in the year and was outperforming tech peers by a wide margin in the first four months. Then came the period of consolidation, and the stock traded flat for the next few months.

As economic and tariff worries receded, investors pivoted to other tech names, ditching Netflix. However, the worst was yet to come for the streaming giant, and it crashed following its Q3 2025 earnings. Netflix saw some traction following the stock split—the old rulebook of shares rising after the split announcement almost invariably holds—but soon came under selling pressure after the company announced that it would acquire Warner Bros. (WBD) following the separation of Discovery Global.

Netflix and Paramount Battle It Out for WBD

The deal, valued at an enterprise value of $82.7 billion, is the biggest in Netflix’s history, and according to the company, it would combine “Netflix’s innovation, global reach and best-in-class streaming service with Warner Bros.’ century-long legacy of world-class storytelling.” The deal won’t go through easily, though, and Paramount (PSKY) has made a counteroffer of $30 per share in cash, which is higher than the $27.75 that Netflix offered in the cash and stock transaction.

Even if Netflix can win over support from WBD shareholders, the deal is set to face regulatory scrutiny given the size of the transaction. Bob Iger, CEO of rival streamer Disney (DIS), has expressed concerns over the deal, citing the alleged pricing power it would give to Netflix.

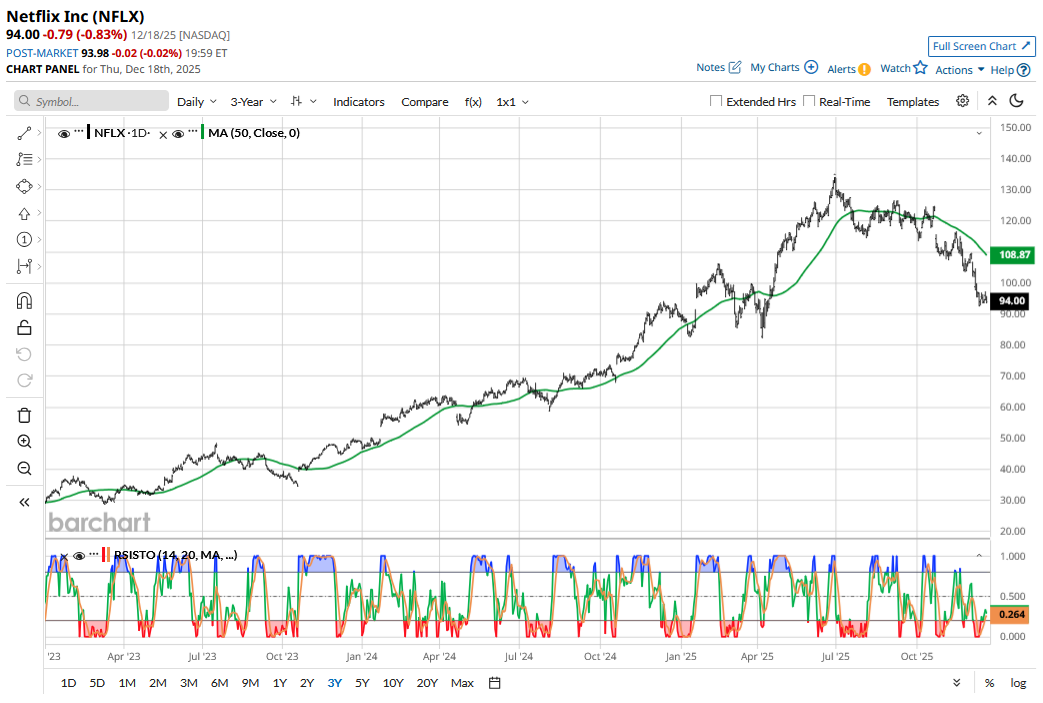

Meanwhile, NFLX shares have moved southward amid all the drama over the WBD acquisition and are now up just around 6% for the year. Let alone outperforming the S&P 500 Index ($SPX), the stock is now trailing its returns by a wide margin and is in bear market territory after falling almost 30% from its 2025 highs.

NFLX Stock Forecast

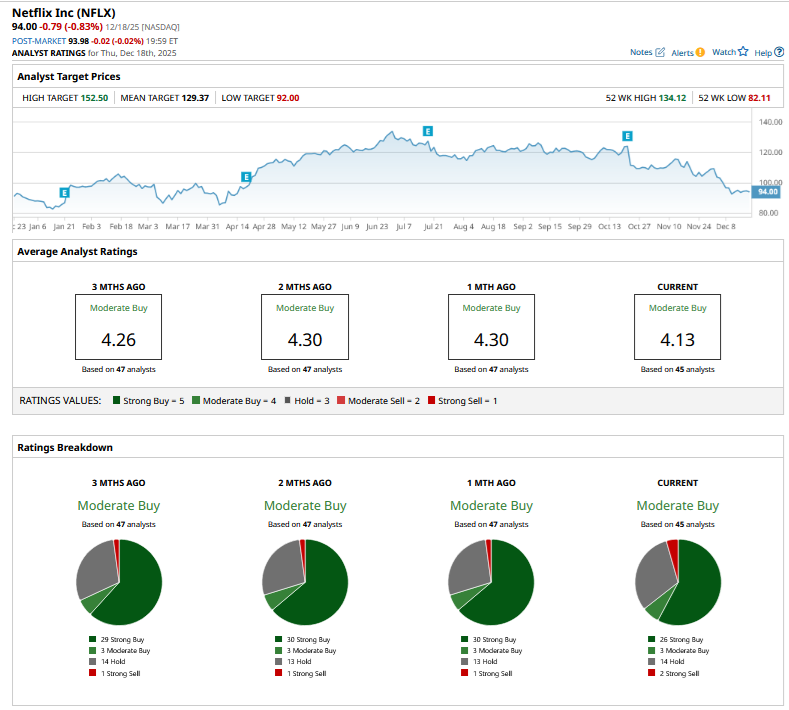

Netflix’s proposed acquisition of WBD wasn’t received well by sell-side analysts, and at least three have downgraded the stock. Here’s a brief rundown:

- Pivotal Research, which had a $160 target price on Netflix, downgraded the stock from a “Buy” to “Hold,” calling the deal to buy WBD “expensive.” The brokerage—which had a Street-high target price on NFLX for much of this year—lowered its target price to $105.

- Huber Research double-downgraded Netflix stock from an “Overweight” to “Underweight” while slashing its target price from $137.50 to $92, with analyst Craig Huber terming the deal “very risky.”

- Rosenblatt downgraded Netflix from a “Buy” to “Neutral” while slashing its target price from $152 to $105. Analyst Barton Crockett sees “an extended period of uncertainty and risks” for Netflix and assigned a “more cautious multiple” to NFLX shares.

- Bernstein and Wolfe lowered Netflix’s target price following the WBD deal while maintaining their respective ratings.

Meanwhile, Netflix sees the WBD acquisition as a driver of long-term growth and cost savings. The management sees the deal being accretive to its GAAP earnings by the second year after the deal’s closure and expects it to help it cut costs by “at least $2-$3 billion” by the third year.

Should You Buy the Dip in NFLX Stock?

What’s implied in Netflix’s comments on the acquisition is that the deal would be EPS dilutive in the initial few quarters after the close. Moreover, since the bulk of the consideration would be in cash, Netflix would need to raise a lot of debt to fund the transaction. Markets have been concerned about the impact of higher debt, as Netflix otherwise has a strong balance sheet with a net debt of just around $5.2 billion at the end of September.

Netflix’s valuations have plummeted amid the recent fall, and it trades at a forward price-to-earnings (P/E) multiple of 37.4x. The multiples would have looked quite tempting if not for the concerns over the WBD acquisition, including a possible bidding war.

All said, I believe the worst is over for NFLX after the sharp fall from the peak, and the stock remains among the best ways to play the streaming industry. The company has several growth drivers like ad sales, live events, sports, and merchandise sales, which would keep its top line and bottom line in good shape in the coming years.

Overall, I see Netflix’s risk-reward as quite balanced here and stay invested. I used the dip to add to my existing positions and see the stock going higher over the medium term as the drama over the WBD acquisition settles down.

On the date of publication, Mohit Oberoi had a position in: NFLX , DIS . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Zillow Stock Plunged on Google Listing News, But 1 Analyst Still Thinks It Can Gain 50% from Here

- Netflix Stock Went from Boom to Bust This Year: How to Play the Stock for 2026

- As Intuit Jumps Into Stablecoin Business, Should You Buy, Sell, or Hold INTU Stock?

- ConocoPhillips Stock Still Looks 18% Undervalued - How to Play COP Stock?