President Donald Trump has threatened to impose a 10% cap on credit card interest rates for one year, effective Jan. 20, arguing that Americans are being “ripped off” by rates often exceeding 20% to 30%. This proposal aims to provide relief amid high consumer debt levels but faces substantial skepticism. Enacting such a cap would likely require congressional approval, as executive orders alone may not suffice, and industry pushback could lead to legal challenges from banks reliant on interest income.

Despite these doubts, the announcement has rattled markets, with Capital One Financial (COF) shares plunging about 3% in Friday's trading and another 7% this morning. As one of the biggest credit card issuers in the U.S., COF's heavy exposure to this segment raises the question: Should investors sell the stock because of the uncertainty or view this as a buy-the-dip opportunity?

About Capital One Stock

Capital One Financial is a diversified financial services holding company specializing in credit cards, auto loans, consumer and commercial banking, and savings products. Headquartered in McLean, Virginia, it operates through three main segments: credit card, consumer banking, and commercial banking, serving consumers, small businesses, and commercial clients across the U.S., Canada, and the UK.

Credit cards are its core business, generating approximately 70% of total revenue, with about $271 billion in card loans at the end of the third quarter following its $35.3 billion acquisition of Discover Financial last May. This deal made COF the largest U.S. credit card issuer by balances, with over 100 million cards in circulation and a 10% to 15% market share.

In 2025, COF stock delivered strong performance, rising 37.7%, including dividends, significantly outperforming the S&P 500's ($SPX) 16% gain. This outperformance reflects robust growth after the Discover acquisition, with Q3 revenues surging 53.4% year-over-year (YoY) to $15.36 billion. Yet valuation metrics show COF only trading at a forward P/E ratio around 12.7x, above its five-year historical average of 9.3x and slightly ahead of the sector average of 11.6x, indicating potential overvaluation driven by acquisition synergies and earnings growth expectations.

Its P/B ratio of 1.43x is in line with industry norms (1x to 2x for banks) but higher than historical levels, suggesting fair to slightly elevated valuation amid improved asset quality and profitability. Overall, the stock appears fairly valued, balancing growth prospects against elevated multiples, though today's dip could make it undervalued for long-term holders.

How Serious Is a Rate Cap to Capital One's Business?

Capital One stands out as a top financial stock due to its dominant position in credit cards, bolstered by the Discover acquisition. This expanded its scale to over $659 billion in assets and diversified revenue through enhanced merchant services and small business lending.

The company's tech-driven approach, focusing on data analytics for personalized products, has fueled member loyalty and cross-selling, with Q3 seeing a 29% increase in pre-provision earnings, a 4.61% net charge-off rate (down YoY), and a 39% increase in purchase volume. Year-to-date (YTD) adjusted earnings jumped 47.3% to $16 per share on 31% revenue growth and net interest margin expansion to 7.7%. Diversification from consumer loans (9%) and commercial banking (21%) provides a buffer, with COF targeting synergies saving it $2.7 billion by 2027.

Trump's 10% rate cap threat would pose a significant risk if it came to pass, as credit cards drive 70% of revenue, primarily from interest on balances. A cap could halve income from revolving debt (currently around 20% of the total), putting pressure on margins and potentially leading to tighter underwriting, reduced rewards, or higher fees to offset losses—estimated at 20% to 30% of card earnings. This might slow growth and increase charge-offs if riskier borrowers are cut off.

However, the proposal's enactment is unlikely, given congressional hurdles, industry opposition, and potential legal battles, as similar past efforts have stalled. Analysts view it as “highly unlikely,” suggesting today's selloff is an overreaction. Considering COF's strong fundamentals, credit performance, and diversification, it is positioned for 20% to 30% annual growth, meaning investors should view this as a buy-the-dip opportunity.

What Do Analysts Expect for COF Stock?

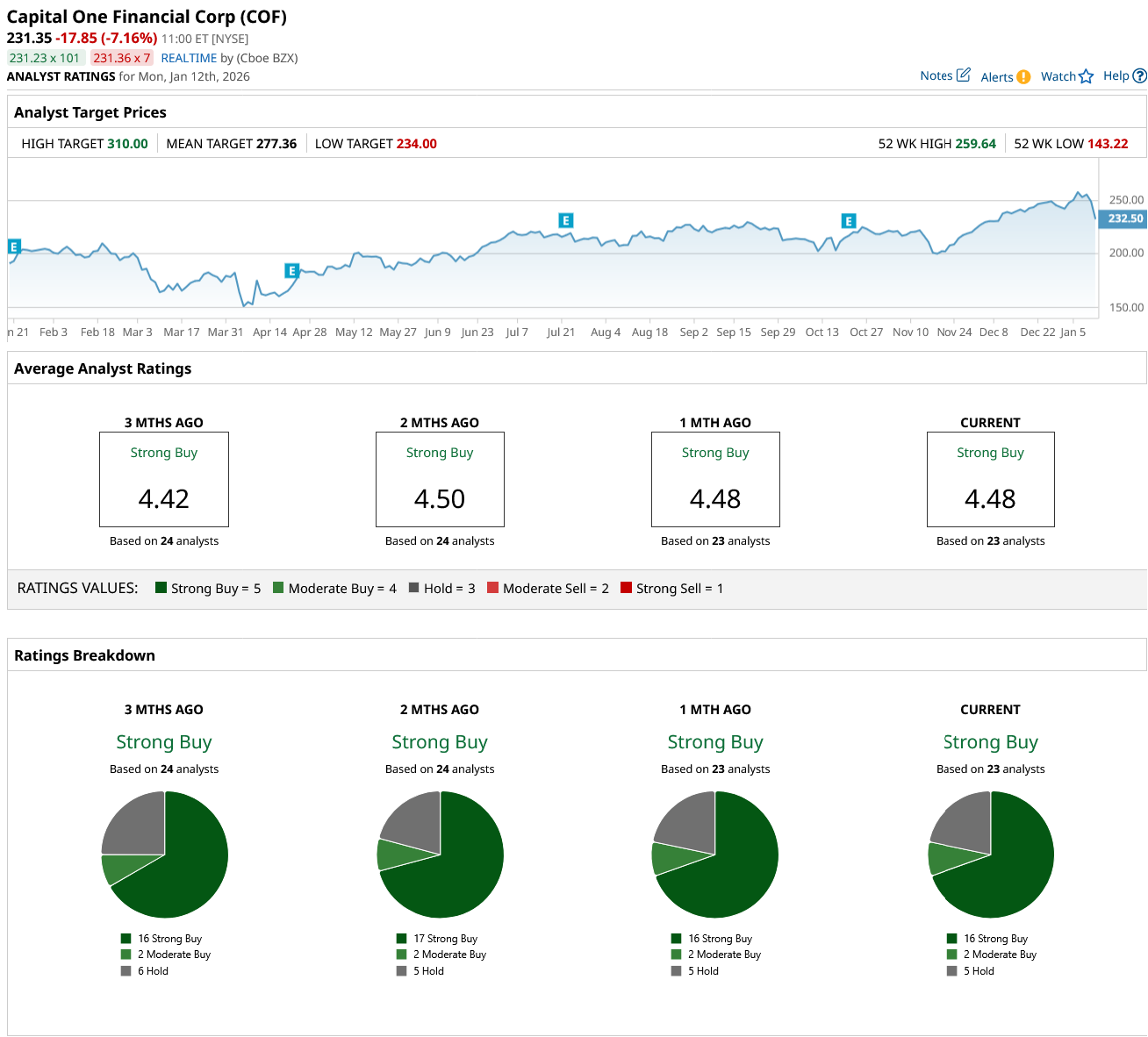

Consensus analyst ratings for COF stock are a “Strong Buy,” based on coverage from 23 analysts, with a breakdown of 16 “Strong Buy,” two “Moderate Buy,” and five “Hold.” There are no "Sell" ratings, with little change over the past three months, though numerous firms raised price targets after its earnings beat, citing improved credit metrics and acquisition synergies. The mean price target stands at $277.36, reflecting optimism for EPS growth. Its mean target represents a potential upside of 20% from the current share price around $231, underscoring value despite short-term volatility.

On the date of publication, Rich Duprey did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart