Alibaba (BABA) shares are rallying this morning after China announced a new action plan aimed at accelerating artificial intelligence (AI) adoption in manufacturing.

The initiative dubbed “AI+ Manufacturing” will fund thousands of Beijing’s “little giant” startups, helping them invest more in research and development (R&D).

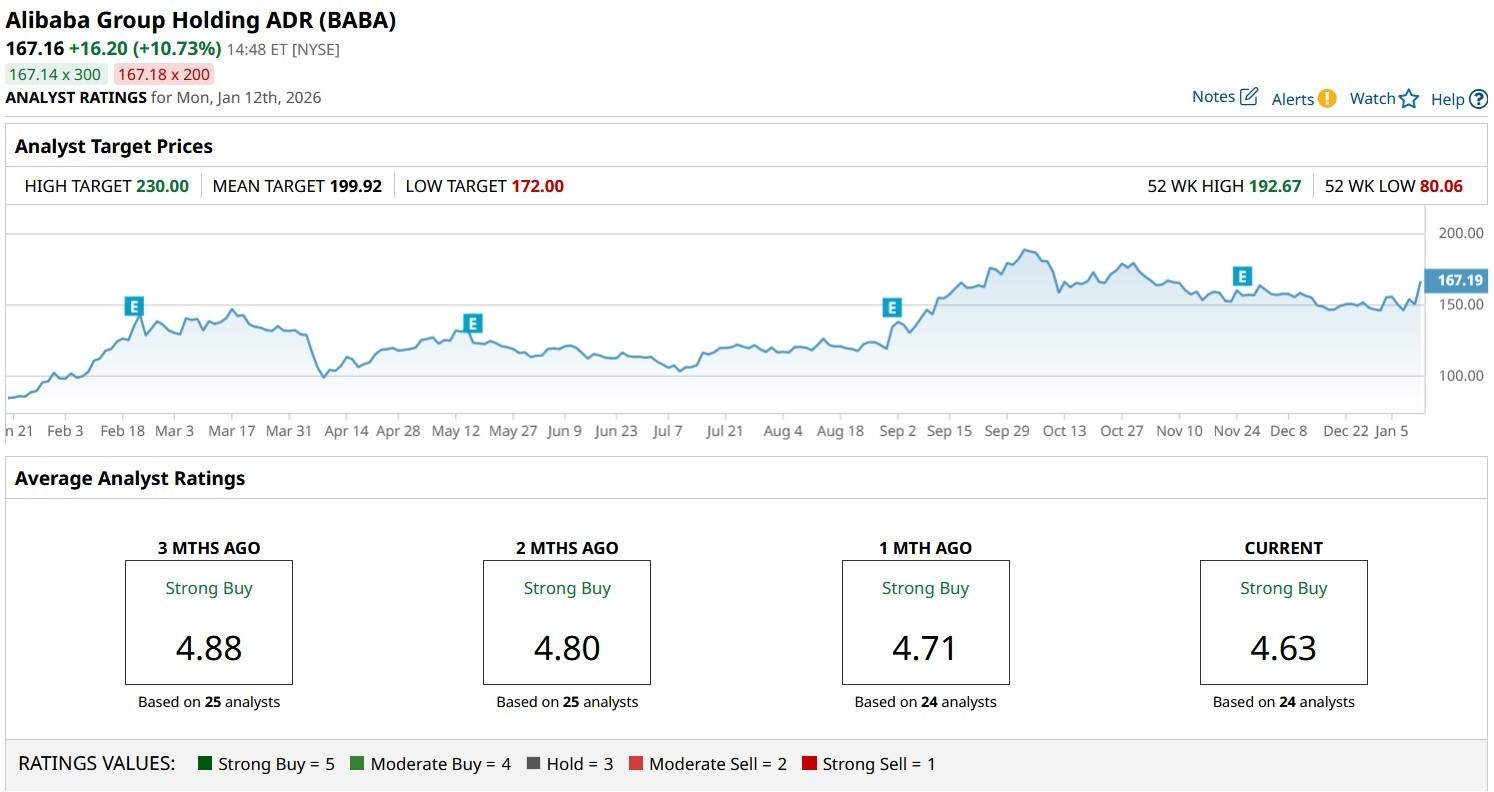

Even after today’s surge, Alibaba stock is down more than 11% versus its 52-week high.

What AI+ Manufacturing Initiative Means for Alibaba Stock

Beijing’s new action plan is a “material” catalyst for BABA stock primarily because it transforms the company from a “consumer app” specialist into Beijing’s essential industrial backbone.

Under its “AI+ Manufacturing” initiative, China has committed to accelerating AI adoption to 70% within the next two years, which will force over 50,000 factories to invest in cloud and AI services.

As the market leader, Alibaba Cloud stands to massively benefit from this unprecedented migration

More importantly, this strategic alignment signals end of the tech crackdown, repositioning BABA as a “national champion” critical to China’s ambitious economic goals.

Why Else Are BABA Shares Attractive to Own in 2026

Alibaba shares are worth owning in 2026 also because “Qwen,” the company’s flagship LLMs, are seeing rapid adoption across both enterprise and consumer verticals.

Cumulative downloads on Hugging Face have surpassed 700 million, after a strong December that witnessed Qwen exceeding the combined tally of the next eight most-used large language models.

Still, BABA is trading at 26x forward earnings only, offering exposure to artificial intelligence at an attractive price.

From a fundamental perspective, the NYSE-listed firm continues to generate solid cash flow from its e-commerce segment while growing its footprint in the higher-margin cloud and AI business as well.

A 0.63% dividend yield makes Alibaba even more exciting as a long-term holding, at least for the income-focused investors.

Wall Street Remains Constructive on Alibaba Group

Investors should also note that Wall Street analysts continue to see BABA shares as an undervalued Chinese tech gem in 2026.

According to Barchart, the consensus rating on Alibaba stock currently sits at “Strong Buy” with the mean target of about $200 indicating potential upside of roughly 20% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Watch This Overlooked Stock Chart as the Secular Commodity Bull Run Heats Up

- A $107 Million Reason to Buy This Red-Hot Penny Stock Now

- China Is Stepping in to Help Alibaba Amid a Major Price War. Does That Make BABA Stock a Buy Here?

- As SanDisk Eyes Doubling Memory Prices, Should You Buy Red-Hot SNDK Stock?