With a market cap of $11.9 billion, Paramount Skydance Corporation (PSKY) is a global media and entertainment company operating across Studios, Direct-to-Consumer, and TV Media segments, with a broad portfolio spanning broadcast television, cable networks, streaming platforms, and film production. It produces, distributes, and licenses content worldwide through well-known brands, studios, and digital platforms across theatrical, television, and streaming markets.

Shares of the New York-based company have underperformed the broader market over the past 52 weeks. PSKY stock has decreased 4.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.6%. Moreover, shares of the company are down 18.4% on a YTD basis, compared to SPX’s marginal rise.

Looking closer, shares of Paramount Skydance have lagged behind the State Street Communication Services Select Sector SPDR ETF’s (XLC) 9.9% return over the past 52 weeks.

Shares of Paramount Skydance climbed 9.8% following its Q3 2025 results on Nov. 10 as investors reacted positively to management’s growth outlook, including a $30 billion total revenue target for 2026 and adjusted OIBDA guidance of $3.5 billion. The rally was also driven by plans to invest over $1.5 billion in incremental programming across theatrical and direct-to-consumer platforms and to expand theatrical output to at least 15 films per year starting in 2026, signaling confidence in content-led growth.

Additionally, strong D2C momentum - 1.4 million net subscriber adds in Q3, bringing Paramount+ to 79 million subscribers, alongside a higher run-rate efficiency target raised to at least $3 billion.

For the fiscal year that ended in December 2025, analysts expect PSKY's EPS to decline 58.4% year-over-year to $0.64. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

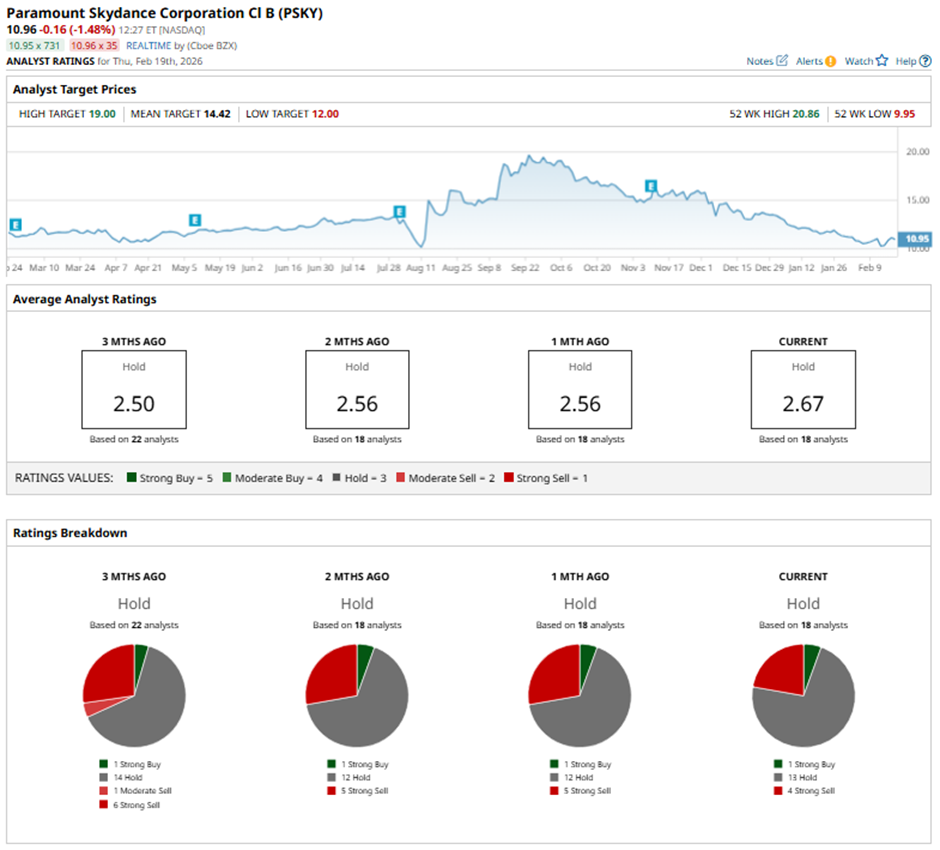

Among the 18 analysts covering the stock, the consensus rating is a “Hold.” That’s based on one “Strong Buy” rating, 13 “Holds,” and four “Strong Sells.”

On Jan. 23, Laurent Yoon of Bernstein maintained a “Sell” rating on Paramount Skydance, setting a price target of $12.

The mean price target of $14.42 represents a premium of 31.6% to PSKY's current levels. The Street-high price target of $19 implies a potential upside of 73.4% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart