A new survey from Altum Strategy Group, in partnership with YouGov, revealed the internal challenges currently top of mind for business leaders across various sectors. The study highlights that financial health, operational efficiency, people management, and maintaining high product/service quality are universal tensions for businesses in 2024. However, the most significant internal factors may differ based on the company's age, industry type, and size.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240312310066/en/

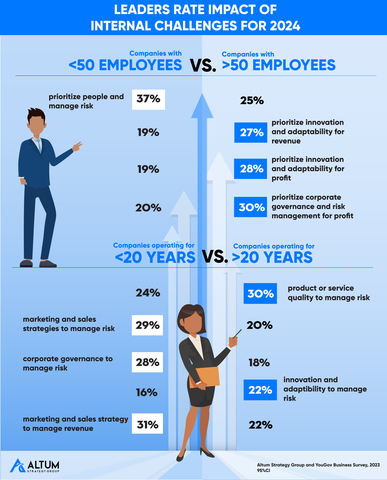

Leaders rate the internal challenges they face for 2024 by revenue, risk, and profitability. Focus Varies by company size and age. (Graphic: Business Wire)

"These findings not only underscore what business leaders face every day in navigating today's economic and business complexities but also highlight the differences across sectors and company sizes,” said Matt Gantner, CEO of Altum Strategy Group. “It's clear that financial health remains a cornerstone of business sustainability, yet the emphasis on operational efficiency, people management, and innovation points to a multifaceted approach that leaders must take to thrive.”

The data showcases a broad concern for financial health across companies of all sizes, with 37% of leaders from companies with less than 50 employees and 34% from those with 50+ employees ranking it among their top two challenges. This concern is even more pronounced in businesses ranging from 11-50 employees and those with 500+ employees, emphasizing the significance of financial health in achieving revenue targets.

Interestingly, the data shows differentiators within these challenges based on company size, sector, and leadership roles:

- Larger companies (+50 employees) are more focused on internal innovation and adaptability (27%) to grow revenue than smaller ones (19%). The service industry is less likely to focus on innovation and adaptability factors (20%) than the asset (26%) and knowledge (27%) industries.

- Younger companies (31%) are more concerned about marketing and sales strategies driving revenue than older companies (22%).

- Smaller companies (<50 employees) are focused on people management (37%) to reduce company-wide risk. In contrast, older companies (20+ years) are more likely to focus on product or service quality (30%) and innovation and adaptability (22%). At the same time, the knowledge-based industry is also significantly more focused on people management than the service industry.

- Young companies (<20 years) indicated that they are significantly more focused on marketing and sales strategies (29%) and corporate governance and risk management (28%) to reduce risk when compared to older companies (20% and 18%, respectively).

- Older companies (20+ years) focus more on product or service quality (30%) and innovation and adaptability (22%) to manage risk.

- Disparity exists in risk perception among leadership roles, with Managing Directors showing the highest concern for financial health (48%) compared to their counterparts in roles such as Partner/Chairperson/Chief Executive (40%).

- Regarding profitability, larger companies (50+ employees) are more focused on innovation and adaptability (30%) and marketing and sales strategy (28%) than smaller companies (<50 employees; 20% and 19%, respectively).

Additionally:

- Smaller companies (6-10 employees) prioritize product or service quality (37%), while those with 51-100 employees focus more on people management (40%).

- Younger companies (less than 5 years old) report a heightened concern for financial health risks (57%) compared to their more established counterparts (33% to 45%).

- Business leaders in the Asset sector place a stronger emphasis on operational efficiency (35%) and people management (32%), whereas those in the Service and Knowledge sectors lean more heavily into financial health (36% and 37%, respectively).

Survey results can be found at https://altumstrategy.com/wp-content/uploads/2024/03/Altum-Internal-Factors-Report-US-business-leaders-survey-Dec2023_From-YouGov.pdf.

About Altum Strategy Group

Altum Strategy Group delivers the next technology wave to clients in a tailored way to empower teams and create value. Thinking boldly, deploying inclusive collaboration and active engagement is how we work. Altum applies our diverse expertise to lead strategy development at all levels, enabling us to incorporate cutting-edge digital solutions and innovative business operations that deliver impactful results. Altum powers our clients and their teams so they can ride the current wave and anticipate the next one.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240312310066/en/

Contacts

For media inquiries, please contact:

Suzanne Lyons

media@confidentstrategygroup.com

201.647.9421