California’s personal injury regulations significantly impact businesses in many ways, from how liability is assigned to the requirements for reporting incidents. These rules affect not only potential compensation payouts but also operational practices, insurance policies, and risk management strategies. Understanding these laws helps businesses minimize legal exposure while effectively addressing claims.

New changes in the law, such as stricter reporting mandates and revised deadlines for filing claims, mean companies must adjust their procedures promptly to avoid penalties or increased liability. Businesses that fail to respond appropriately to incidents like workplace accidents or dog bite claims may face more severe consequences under the updated legal framework.

Companies seeking guidance on these evolving mandates often work with legal professionals skilled at handling personal injury matters. Access to resources like detailed personal injury information can assist businesses in aligning with current requirements and protecting their interests.

Core Elements of California’s Personal Injury Laws

California’s personal injury framework outlines specific criteria for establishing liability, time limits for claims, and the scope of compensation. Understanding these components is essential for businesses that could face legal action due to injury-related incidents on their premises or involving their operations.

Defining Personal Injury and Applicable Legal Standards

Personal injury refers to physical or psychological harm caused by another party’s failure to act with reasonable care. The law requires the responsible party to have breached a duty of care, resulting in injury. This standard revolves around what an average person would do under similar conditions.

Negligent conduct includes acts like distracted driving or unsafe property conditions that increase the risk of harm. Proving fault involves showing that the injury was directly linked to this misconduct. California applies a pure comparative fault rule, allowing recovery even if the injured party shares some responsibility, reducing compensation proportionally to their degree of fault.

This legal approach holds businesses accountable for maintaining safe environments but also considers shared blame, which affects how claims and payouts are calculated.

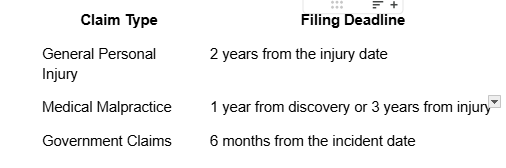

Statute of Limitations and Recent Legislative Updates

Claims related to personal injuries must be filed within a defined time frame, typically two years from when the injury occurred. This deadline ensures evidence remains reliable. Exceptions exist, such as for medical malpractice cases, where the filing period can extend to one year after discovering the injury, but no more than three years from the actual incident.

Certain claims against government entities have even shorter filing periods, often six months, requiring immediate attention to procedural details.

Recent legislative adjustments have refined these deadlines to allow more clarity for both claimants and businesses while emphasizing prompt action to preserve legal rights.

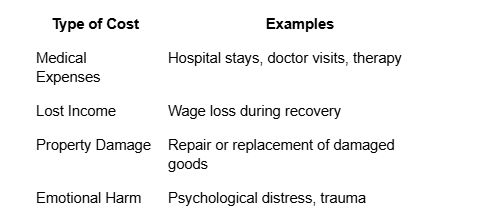

Types of Damages: Economic and Non-Economic Losses

Injury victims in California may seek compensation for measurable financial losses and intangible impacts. Economic damages cover direct expenses like medical treatment costs, lost earnings during recovery, and property repair or replacement.

Non-economic losses address pain endured, emotional distress, and reductions in life quality. These damages recognize suffering beyond monetary value but are more subjective and assessed case-by-case.

Businesses facing claims must prepare for liability that includes both tangible expenses and these less quantifiable hardships, which often represent significant portions of settlements or awards.

Understanding these categories is pivotal for calculating fair compensation and managing risk exposure in injury-related lawsuits.

Business Implications of Personal Injury Claims

Businesses face multiple challenges when personal injury allegations arise, including financial burdens, legal responsibilities, and reputational risks. Understanding how liability, fault distribution, and compensation assessments work is critical. Legal guidance plays a vital role in managing these risks and controlling potential damages.

Premises Liability and Duty of Care

Businesses have a legal obligation to keep their properties safe for visitors and employees. This duty includes regular inspections, maintenance, and prompt addressing of hazards that might cause injuries. Failure to meet these responsibilities can lead to claims based on negligence.

Common incidents involve slip-and-fall accidents due to wet floors, inadequate lighting, or damaged walkways. The claim process often requires documenting the injury event with medical records and property damage evidence. If the business does not take reasonable prevention measures, it can be held accountable.

Premises liability extends to contractors, vendors, and invitees. Businesses must implement clear safety policies and maintain logs of repairs or warnings issued. These practices reduce liability exposure and demonstrate an active commitment to protection.

Shared Fault and Comparative Negligence Impact on Businesses

California law permits assigning a percentage of fault to each party involved in an injury incident. This means a business may not be solely responsible for all damages if the injured party shares blame. The allocation of responsibility directly influences how much compensation is awarded.

In cases involving multiple defendants, courts require precise fault distribution. This ensures fairness, as businesses are liable only for their portion of the loss. It also discourages frivolous claims by clarifying how damages get divided.

Businesses should keep detailed incident reports and witness statements to support their position. Understanding these regulations allows companies to prepare more accurate defenses and potentially minimize financial consequences under shared blame doctrines.

Calculating Compensation: Direct and Indirect Costs

Compensation amounts include sums for medical expenses, lost income, property repairs, and pain or suffering beyond physical injury. Financial losses can escalate if injuries cause long-term emotional impacts or restrict earning capacity. Insurance claims often require thorough documentation of these factors.

Direct costs like hospital bills and therapy sessions must be itemized with medical documentation. Indirect costs such as emotional trauma or mental anguish are also recognized and can significantly raise settlement amounts.

Businesses often must cover damages related to productivity loss or the need for retraining replacement staff. This makes addressing claims proactively important to reduce extended financial liability.

Role of Legal Counsel and Risk Mitigation Strategies

Legal advisors assist companies in interpreting changing laws and building strong defenses against claims. Early involvement of attorneys helps manage timelines, avoid procedural errors, and negotiate favorable settlements.

Counsel also guides businesses on record-keeping, employee training, and safety compliance to lower incident risks. Proactive strategies include regular safety audits, quick hazard correction, and establishing clear communication channels for reporting concerns.

Employers benefit from tailored risk management plans that anticipate legal trends, reduce exposure, and provide support in challenging incidents involving multiple parties or evolving liability rules.

Engaging qualified legal representatives ensures better preparedness and can substantially decrease the financial and operational impacts of personal injury accusations. For details on recent legal updates impacting businesses, see the information on new California laws for personal injury claims.