Arm Holdings plc (NASDAQ: ARM) is a British semiconductor company with a virtual lock on most mobile computer chips produced worldwide. Estimates indicate that Arm has a 90% market share in mobile processors used in smartphones, tablets and smartwatches. Arm is continuing to grow its market share in servers, laptops and internet-of-things (IoT) devices driven by artificial intelligence (AI), NASDAQ: GOOGL">cloud computing and automotive tailwinds.

Arm’s intellectual property (IP) focuses significantly on energy-efficient CPUs used in portable devices. Since they don’t have the expenses of manufacturing chips or owning fabs, Arm is an asset-light, high-margin, capex and profitable business in the computer and technology sector.

Legacy License and Royalty Model

While Arm is a semiconductor company, it doesn't actually manufacture or produce computer chips. It designs and patents processor architecture licenses intellectual property (IP) to semiconductor companies and collects royalties. The license is a one-time upfront fee, and the royalties are payments made to Arm-based on every chip sold that uses the licensed architecture. Some of its well-known customers include Advanced Micro Devices Inc. (NASDAQ: AMD), Qualcomm Inc. (NASDAQ: QCOM), Broadcom Inc. (NASDAQ: AVGO) and Huawei.

Migration to Subscription Licensing Model

Like so many technology companies, including Pure Storage Inc. (NYSE: PSTG) and C3.ai Inc. (NYSE: AI), that have adopted the subscription model, Arm is also transitioning to a subscription-based licensing model called Arm Total Access (ATA) license. The company has 27 ATA licensees, up from 22 in the previous quarter. V9 royalties are expected to generate twice as much revenue as its V8 designs. This is attributed to higher average rate increases of 3% to 5%, greater number of cores and higher average selling prices (ASPs). Check out the sector heatmap on MarketBeat.

Surviving Locking Expiration

Arm had its first lock-up expiration on March 11, 2024. Shares didn’t drop too much. SoftBank Co. (OTCMKTS: SOBKY) owns a 90% stake in Arm, and they haven't indicated being a material seller. Other investors consist mostly of strategic investors that are also customers, including Nvidia Co. (NASDAQ: NVDA), Apple Inc. (NASDAQ: AAPL), Taiwan Semiconductor Manufacturing Ltd. (NYSE: TSM), Samsung Electronics Co. Ltd. (OTCMKTS: SSNLF) and Intel Co. (NASDAQ: INTC).

Swing and a Homerun

On February 7, 2024, Arm reported fiscal Q3 2024 EPS of 29 cents, beating consensus analyst estimates of 25 cents by 4 cents. Revenue rose 13.8% YoY to $824 million versus $762.5 million consensus estimates.

Raised Guidance for Arm Holdings

Arm issued upside guidance for fiscal Q4 2024 EPS of 28 cents to 32 cents versus 20 cents consensus analyst estimates. Revenues are expected between $850 million to $900 million versus $778.83 million consensus estimates.

The Virtuous Monopoly Cycle Drives Market Share Growth

Royalty revenues will drive growth as demand for compute continues to grow as the performance requirements of computers and electronic devices rise. AI tailwinds became very apparent in the quarter as demand for anything that assists chips with AI acceleration skyrockets.

As more Arm-based chips go into more products, more software is written for them, which in turn drives more demand for Arm-based chips. This compounding effect grows market share and raises royalty revenues. Arm V9 technology contributes 15% of total royalty revenue, up from 10% in the previous quarter.

CEO Comments

Arm CEO Rene Haas commented, “Arm has the most fundamental, foundational pervasive compute platform really in the history of digital design. Over 280 billion units in the 30 plus years that Arm has been a company have been built. And that has underpinned a software ecosystem and hardware ecosystem like no other.”

Hass continued, “And given the fact that a CPU design is really driven by the hardware and the software, it creates a flywheel for continuous development. That is the more hardware that exists on Arm, the more software that's written for Arm, the more software that's written for Arm, the more popular the hardware.”

Gamechanger for AI Data Center Processors

Arm unveiled details of two Neoverse Compute Subsystems that can cut down the time to develop data center chips to less than a year. Compute Subsystems (CSS) are complete finished blocks of designs put together for end customers, saving them significant amounts of time validating their engineering work and time-to-market.

The Arm Neoverse CSS V3 has a 50% improvement in performance, and Neoverse CSS N3 provides 20% higher performance per watt than its earlier version. Both are built on the third-gen Neoverse IP. The new compute subsystems can handle the massive processing loads required to operate AI applications.

Arm Holdings analyst ratings and price targets are at MarketBeat. Arm Holdings peers and competitor stocks can be found with the MarketBeat stock screener.

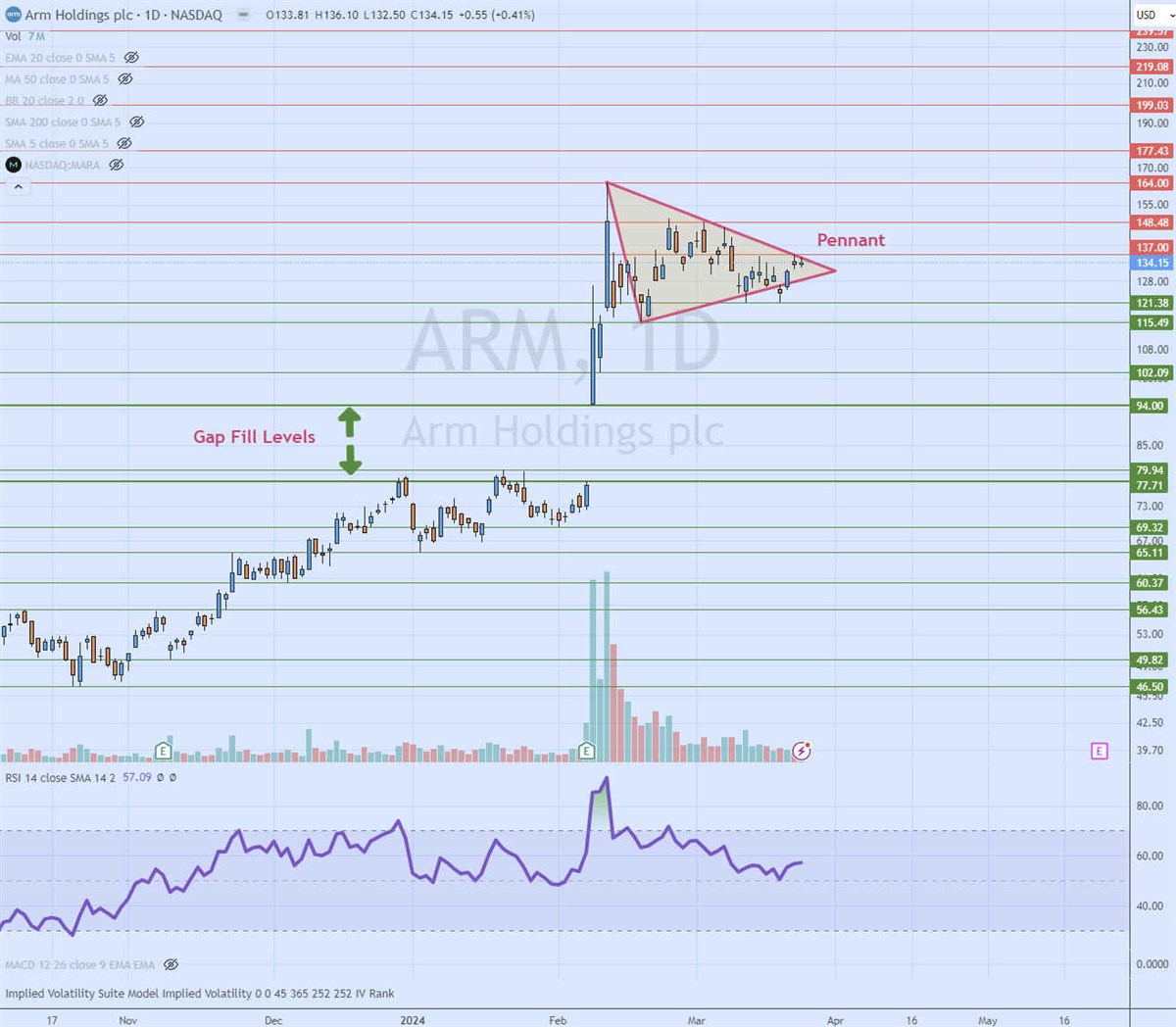

Daily Pennant Pattern

The daily candlestick chart on ARM illustrates a pennant pattern. The pennant is comprised of lower highs and higher lows, with the descending upper trend line meeting the ascending lower trendline at the apex point. A break of either trend line triggers the breakout or breakdown. While this sounds like a symmetrical triangle, a pennant has a flagpole comprised of a sharp parabolic rise that precedes the symmetrical triangle.

ARM commenced its flagpole at the $46.50 swing on October 23, 2023, rising to a swing high of $164.00 on February 12, 2024, preceding the pennant. The daily relative strength index (RSI) is attempting to rise through the 60-band. Pullback support levels are at $121.38, $102.09, $94.00 and $77.71.