Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Light & Wonder (NASDAQ: LNW) and the best and worst performers in the gaming solutions industry.

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

The 7 gaming solutions stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.7%.

In light of this news, share prices of the companies have held steady as they are up 2.8% on average since the latest earnings results.

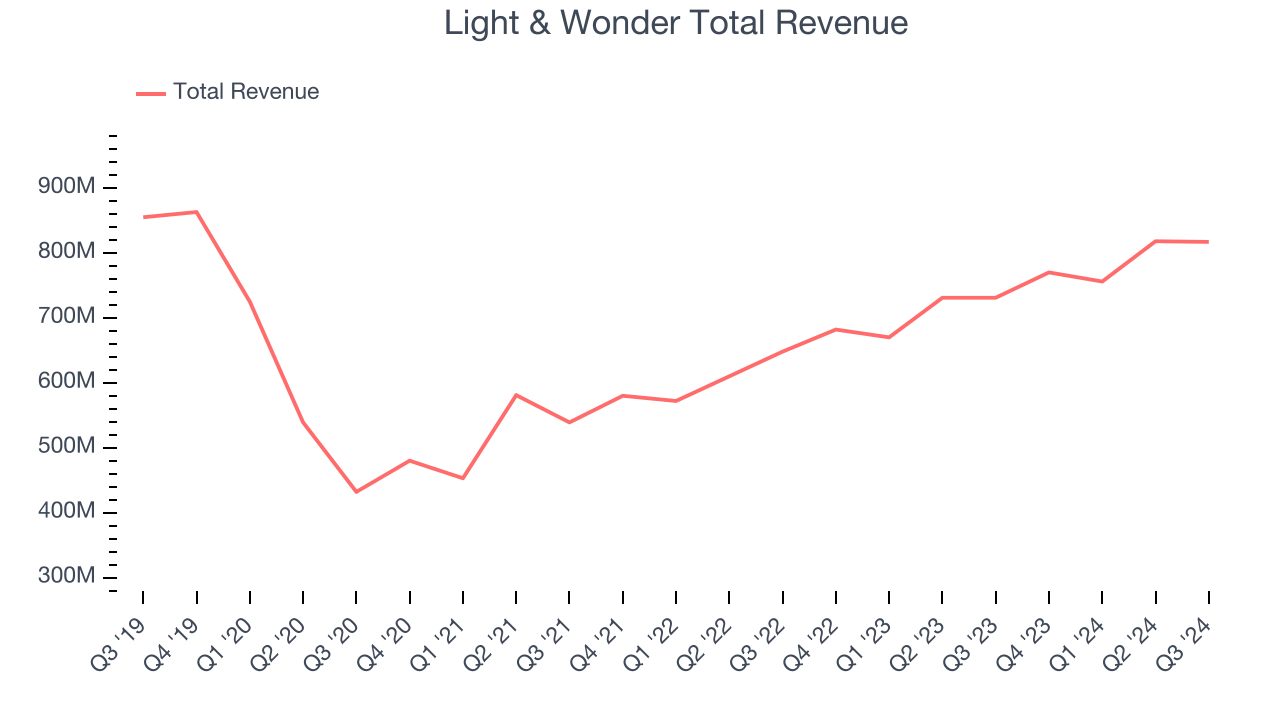

Light & Wonder (NASDAQ: LNW)

With names as crazy as Ultimate Fire Link Power 4 for its products, Light & Wonder (NASDAQ: LNW) is a gaming company supplying the casino industry with slot machines, table games, and digital games.

Light & Wonder reported revenues of $817 million, up 11.8% year on year. This print was in line with analysts’ expectations, but overall, it was a softer quarter for the company with a significant miss of analysts’ EPS and Social Gaming revenue estimates.

Unsurprisingly, the stock is down 9.2% since reporting and currently trades at $93.01.

Read our full report on Light & Wonder here, it’s free.

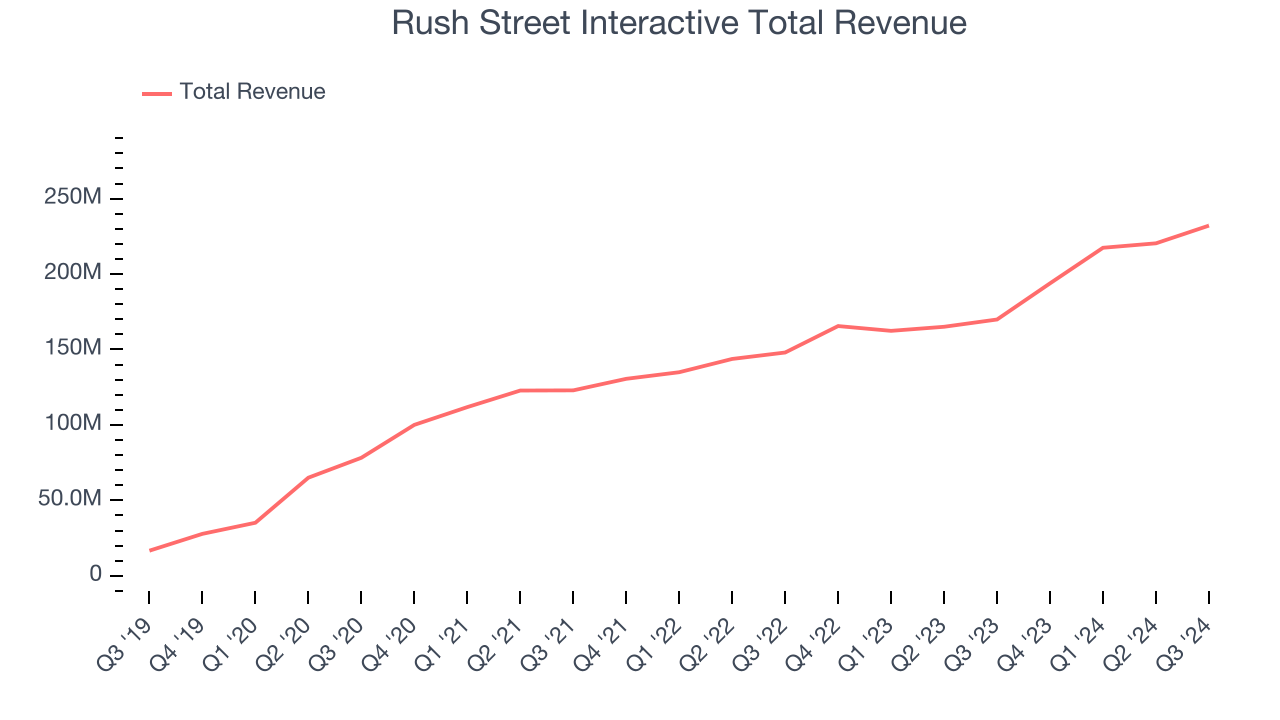

Best Q3: Rush Street Interactive (NYSE: RSI)

Specializing in online casino gaming and sports betting, Rush Street Interactive (NYSE: RSI) is an operator of digital gaming platforms.

Rush Street Interactive reported revenues of $232.1 million, up 36.6% year on year, outperforming analysts’ expectations by 11.9%. The business had an incredible quarter with an impressive beat of analysts’ EPS and EBITDA estimates.

Rush Street Interactive achieved the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 3.5% since reporting. It currently trades at $11.13.

Is now the time to buy Rush Street Interactive? Access our full analysis of the earnings results here, it’s free.

Slowest Q3: Inspired (NASDAQ: INSE)

Specializing in digital casino gaming, Inspired (NASDAQ: INSE) is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

Inspired reported revenues of $78 million, down 20% year on year, falling short of analysts’ expectations by 4.1%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Inspired delivered the weakest performance against analyst estimates and slowest revenue growth in the group. The stock is flat since the results and currently trades at $10.09.

Read our full analysis of Inspired’s results here.

PlayStudios (NASDAQ: MYPS)

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ: MYPS) offers free-to-play digital casino games.

PlayStudios reported revenues of $71.23 million, down 6.1% year on year. This number surpassed analysts’ expectations by 3.9%. It was a strong quarter as it also produced a solid beat of analysts’ adjusted operating income estimates.

PlayStudios had the weakest full-year guidance update among its peers. The company reported 2.96 million monthly active users, down 78.4% year on year. The stock is up 18.8% since reporting and currently trades at $1.64.

Read our full, actionable report on PlayStudios here, it’s free.

Accel Entertainment (NYSE: ACEL)

Established in Illinois, Accel Entertainment (NYSE: ACEL) is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Accel Entertainment reported revenues of $302.2 million, up 5.1% year on year. This print beat analysts’ expectations by 1.7%. Taking a step back, it was a satisfactory quarter as it also logged a decent beat of analysts’ EPS estimates but a miss of analysts’ adjusted operating income estimates.

The stock is up 1.5% since reporting and currently trades at $11.55.

Read our full, actionable report on Accel Entertainment here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.