The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Bumble (NASDAQ: BMBL) and the rest of the consumer subscription stocks fared in Q3.

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 8 consumer subscription stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was 2.2% below.

Luckily, consumer subscription stocks have performed well with share prices up 11.2% on average since the latest earnings results.

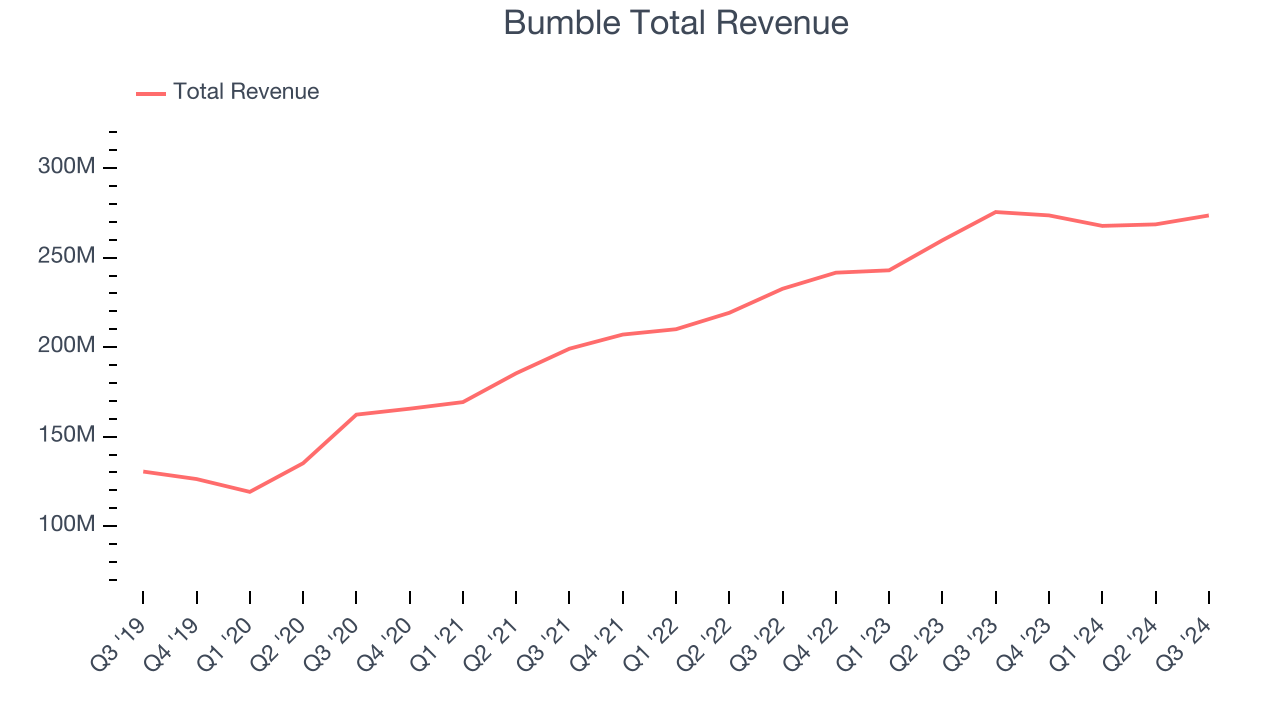

Bumble (NASDAQ: BMBL)

Founded by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ: BMBL) is a leading dating app built with women at the center.

Bumble reported revenues of $273.6 million, flat year on year. This print exceeded analysts’ expectations by 0.7%. Despite the top-line beat, it was still a mixed quarter with EBITDA guidance for next quarter missing analysts’ expectations.

“We delivered on our financial objectives for the third quarter as we executed on our plans to reimagine Bumble App to enable the next generation of online-to-real-world connections,” said Lidiane Jones, CEO of Bumble Inc.

Interestingly, the stock is up 10.8% since reporting and currently trades at $8.70.

Read our full report on Bumble here, it’s free.

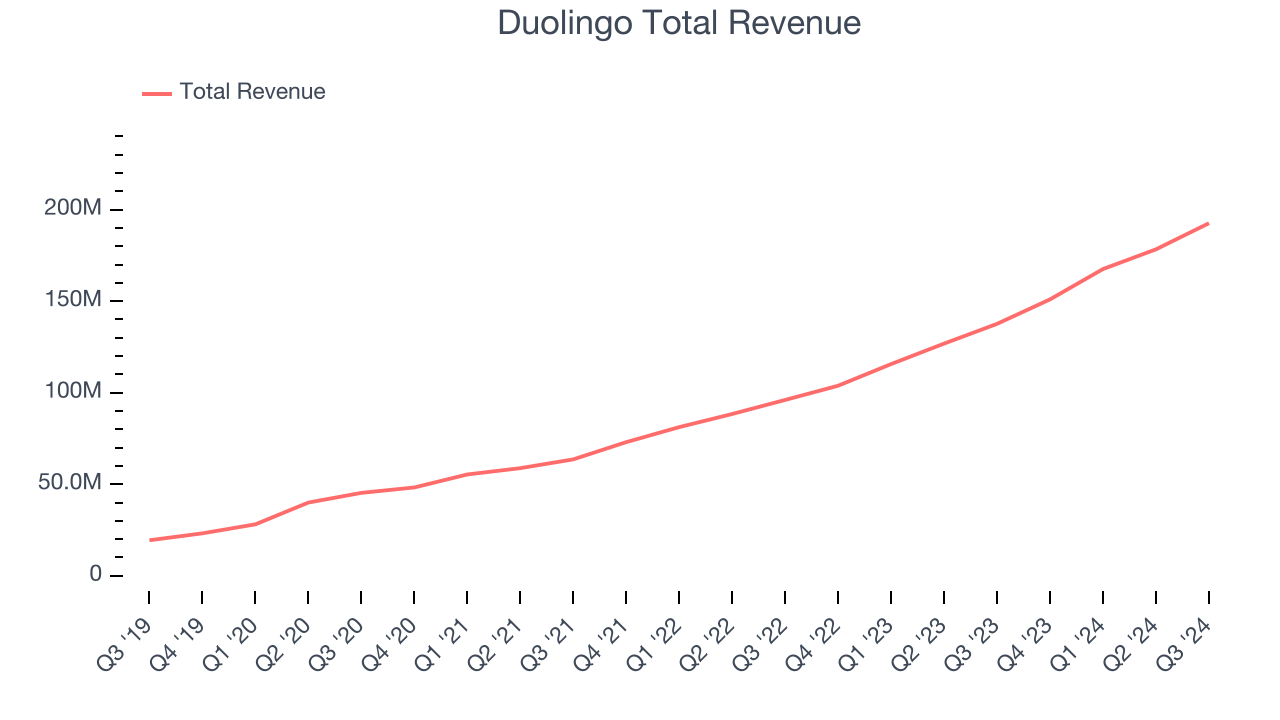

Best Q3: Duolingo (NASDAQ: DUOL)

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ: DUOL) is a mobile app helping people learn new languages.

Duolingo reported revenues of $192.6 million, up 39.9% year on year, outperforming analysts’ expectations by 1.8%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates.

Duolingo achieved the fastest revenue growth and highest full-year guidance raise among its peers. The company reported 113.1 million users, up 36.1% year on year. The market seems happy with the results as the stock is up 13.4% since reporting. It currently trades at $361.84.

Is now the time to buy Duolingo? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Chegg (NYSE: CHGG)

Started as a physical textbook rental service, Chegg (NYSE: CHGG) is now a digital platform addressing student pain points by providing study and academic assistance.

Chegg reported revenues of $136.6 million, down 13.5% year on year, exceeding analysts’ expectations by 1.9%. Still, it was a slower quarter as it posted a decline in its users and a significant miss of analysts’ number of services subscribers estimates.

Chegg delivered the slowest revenue growth in the group. The company reported 3.83 million users, down 12.9% year on year. Interestingly, the stock is up 39.3% since the results and currently trades at $2.48.

Read our full analysis of Chegg’s results here.

Roku (NASDAQ: ROKU)

Spun out from Netflix, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $1.06 billion, up 16.5% year on year. This print topped analysts’ expectations by 4.5%. Zooming out, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EBITDA estimates.

Roku scored the biggest analyst estimates beat among its peers. The company reported 85.5 million monthly active users, up 12.8% year on year. The stock is down 2.9% since reporting and currently trades at $75.35.

Read our full, actionable report on Roku here, it’s free.

Udemy (NASDAQ: UDMY)

With courses ranging from investing to cooking to computer programming, Udemy (NASDAQ: UDMY) is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

Udemy reported revenues of $195.4 million, up 5.8% year on year. This print topped analysts’ expectations by 1.4%. Taking a step back, it was a mixed quarter as it also logged a solid beat of analysts’ EBITDA estimates but number of monthly active buyers in line with analysts’ estimates.

The company reported 16,848 active buyers, up 9.6% year on year. The stock is up 1% since reporting and currently trades at $8.55.

Read our full, actionable report on Udemy here, it’s free.

Market Update

In response to the Fed's rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed's 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.