As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the large-format grocery & general merchandise retailer industry, including Target (NYSE: TGT) and its peers.

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

The 4 large-format grocery & general merchandise retailer stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 4.2% on average since the latest earnings results.

Weakest Q3: Target (NYSE: TGT)

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE: TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

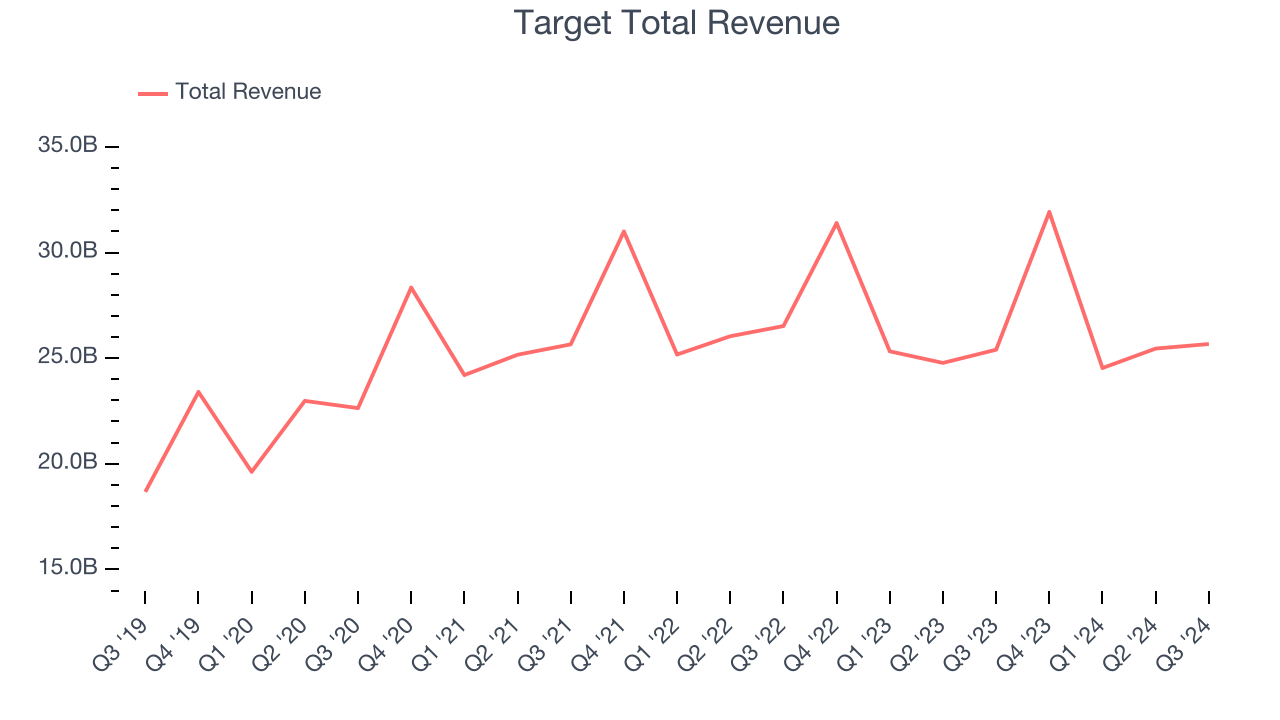

Target reported revenues of $25.67 billion, up 1.1% year on year. This print fell short of analysts’ expectations by 0.9%. Overall, it was a softer quarter for the company with full-year EPS guidance missing analysts’ expectations.

"I'm proud of our team's efforts to navigate through a volatile operating environment during the third quarter. We saw several strengths across the business, including a 2.4 percent increase in traffic, nearly 11 percent growth in the digital channel, and continued growth in beauty and frequency categories. At the same time, we encountered some unique challenges and cost pressures that impacted our bottom-line performance," said Brian Cornell, chair and chief executive officer of Target Corporation.

Target delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 15.8% since reporting and currently trades at $131.39.

Read our full report on Target here, it’s free.

Best Q3: BJ's (NYSE: BJ)

Appealing to the budget-conscious individual shopping for a household, BJ’s Wholesale Club (NYSE: BJ) is a membership-only retail chain that sells groceries, appliances, electronics, and household items, often in bulk quantities.

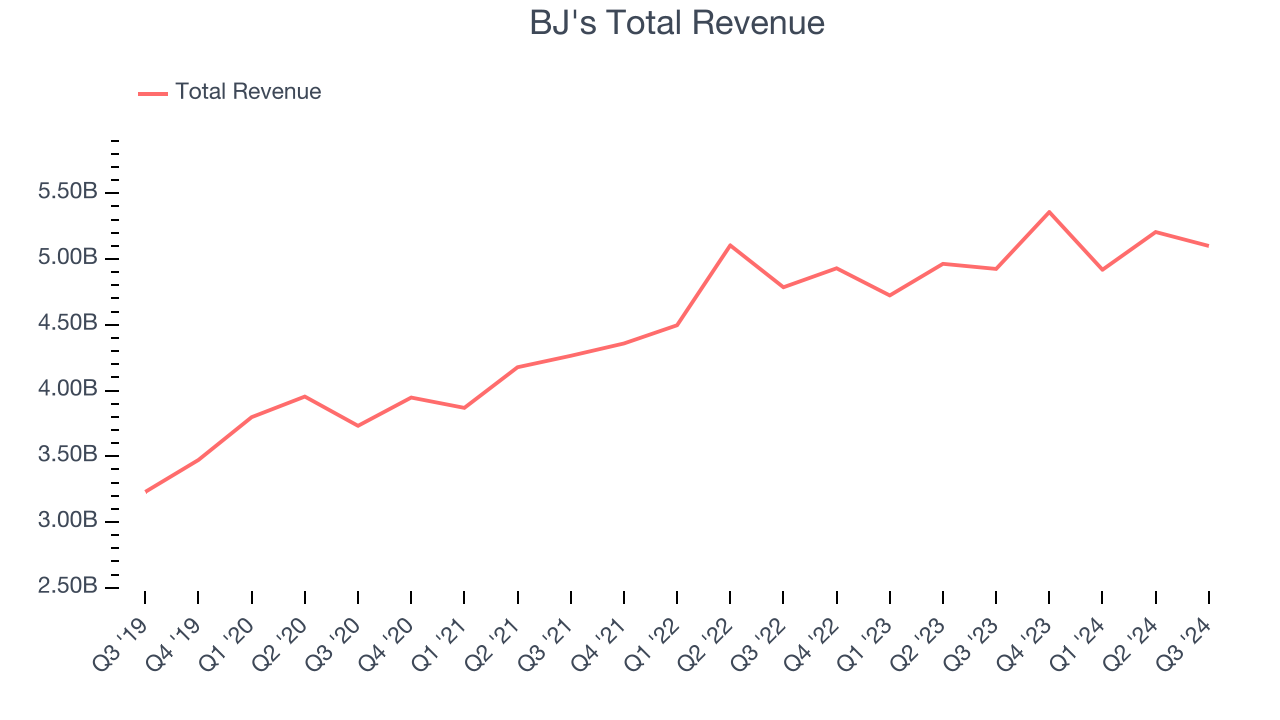

BJ's reported revenues of $5.10 billion, up 3.5% year on year, in line with analysts’ expectations. The business had a strong quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 12.6% since reporting. It currently trades at $96.50.

Is now the time to buy BJ's? Access our full analysis of the earnings results here, it’s free.

Walmart (NYSE: WMT)

Known for its large-format Supercenters, Walmart (NYSE: WMT) is a retail pioneer that serves a budget-conscious consumer who is looking for a wide range of products under one roof.

Walmart reported revenues of $169.6 billion, up 5.5% year on year, exceeding analysts’ expectations by 1.8%. It was a good quarter as it also locked in a solid beat of analysts’ gross margin estimates and a decent beat of analysts’ EPS estimates.

Interestingly, the stock is up 11.2% since the results and currently trades at $93.53.

Read our full analysis of Walmart’s results here.

Costco (NASDAQ: COST)

Designed to be a one-stop shop for the suburban consumer, Costco (NASDAQ: COST) is a membership-only retail chain that sells groceries, apparel, toys, and household items, often in bulk quantities.

Costco reported revenues of $79.7 billion, flat year on year. This number met analysts’ expectations. It was a strong quarter as it also put up an impressive beat of analysts’ gross margin estimates and a decent beat of analysts’ EBITDA estimates.

Costco had the slowest revenue growth among its peers. The stock is up 8.8% since reporting and currently trades at $981.51.

Read our full, actionable report on Costco here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market has thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.