Over the last six months, Two Harbors Investment’s shares have sunk to $9.89, producing a disappointing 8.5% loss - a stark contrast to the S&P 500’s 26.5% gain. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Two Harbors Investment, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think Two Harbors Investment Will Underperform?

Even with the cheaper entry price, we don't have much confidence in Two Harbors Investment. Here are three reasons there are better opportunities than TWO and a stock we'd rather own.

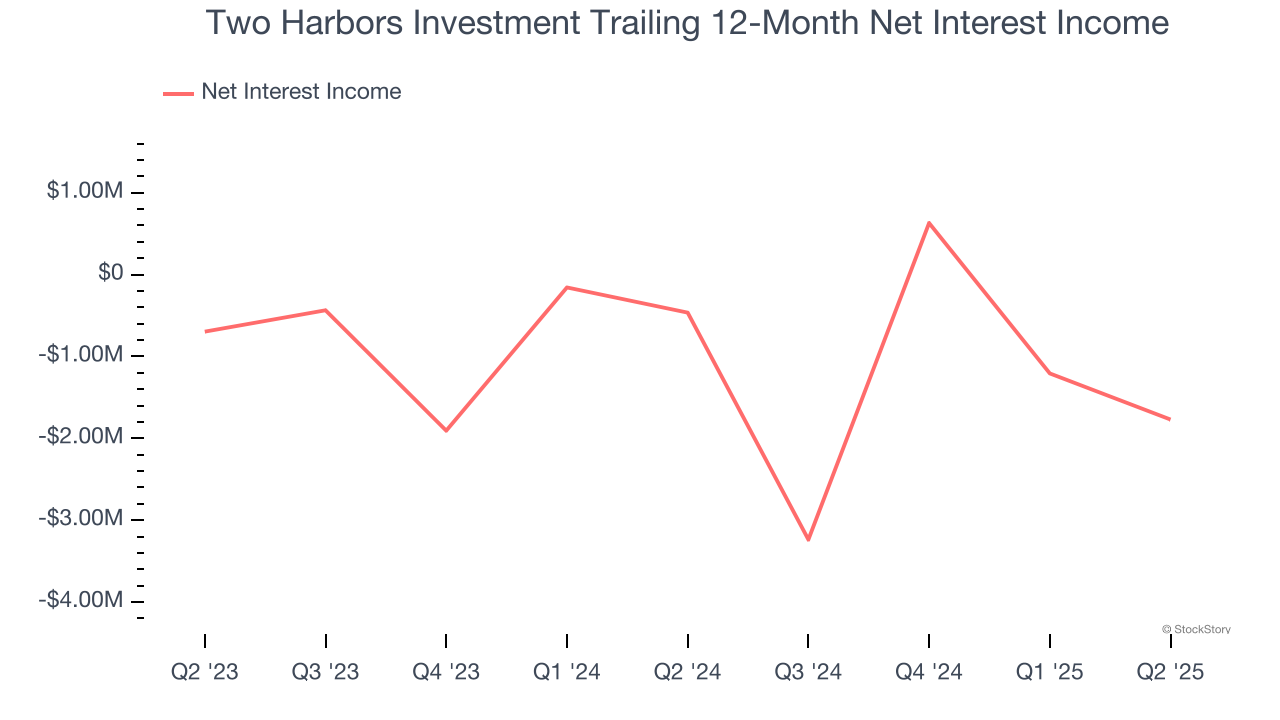

1. Declining Net Interest Income Reflects Weakness

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

Two Harbors Investment’s net interest income has declined by 47.1% annually over the last five years, much worse than the broader banking industry. This shows that lending underperformed its other business lines.

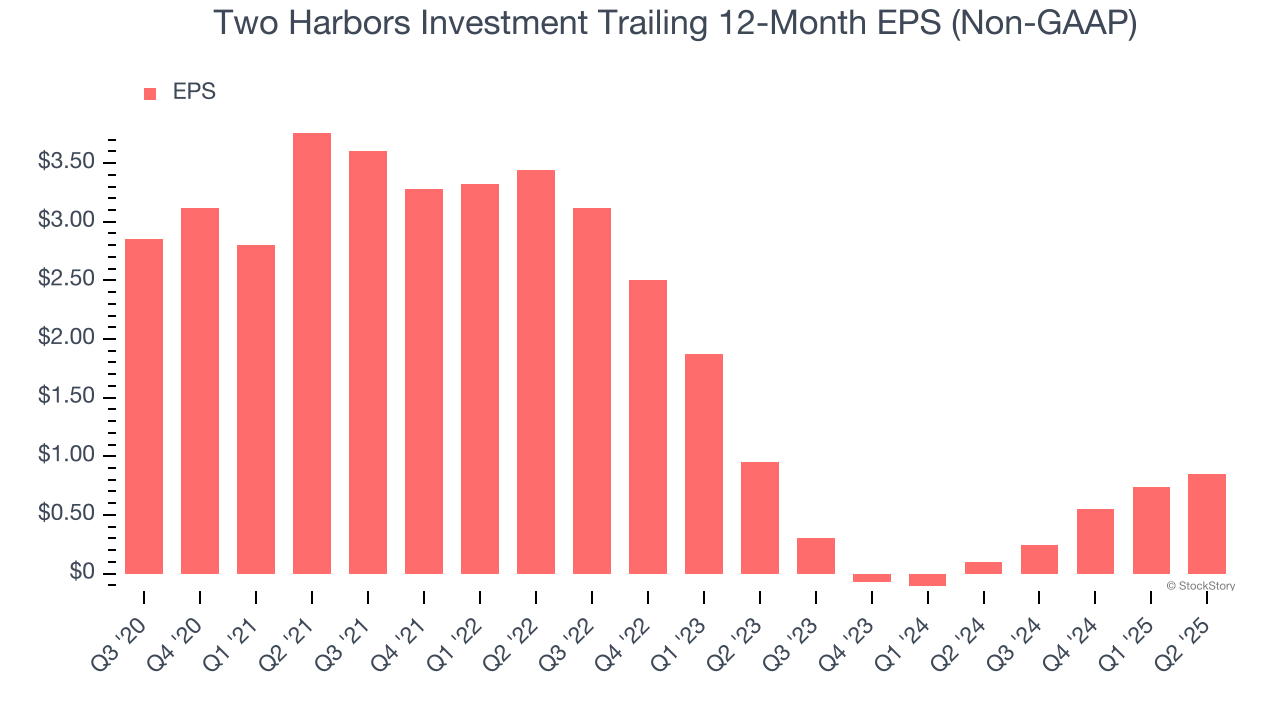

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Two Harbors Investment, its EPS declined by 16.1% annually over the last five years while its revenue grew by 1.6%. This tells us the company became less profitable on a per-share basis as it expanded.

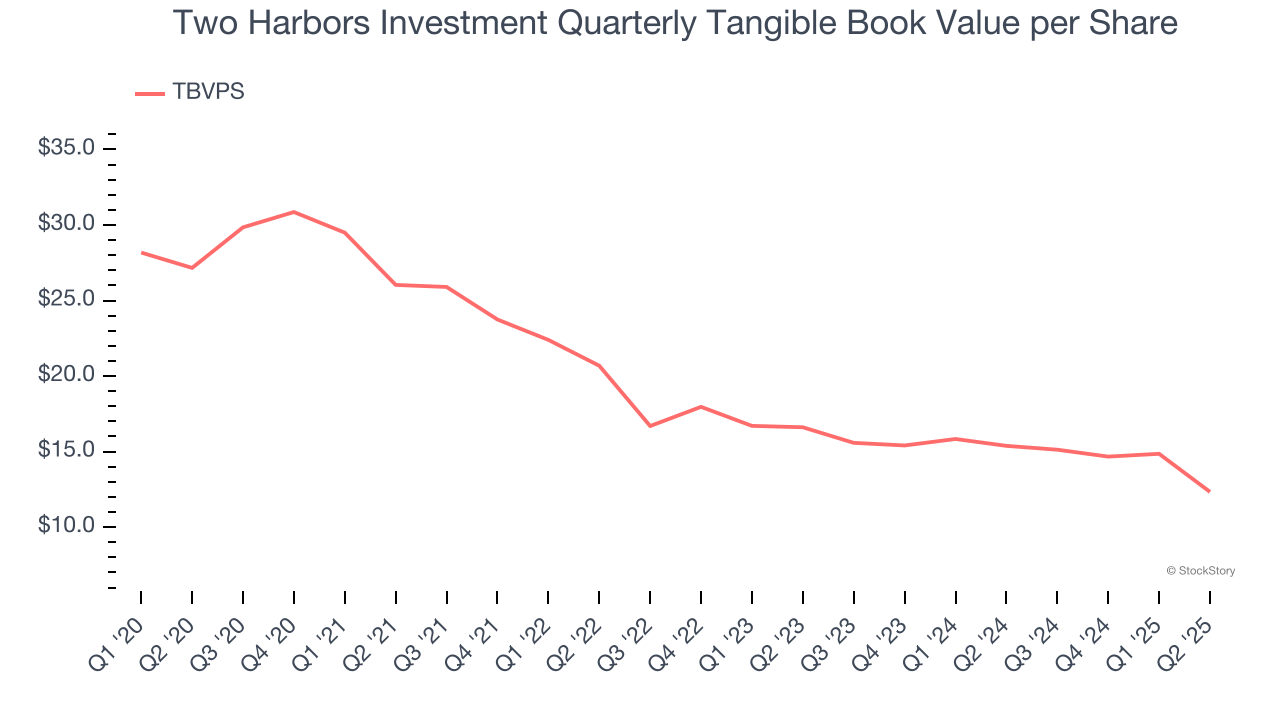

3. Declining TBVPS Reflects Erosion of Asset Value

In the banking industry, tangible book value per share (TBVPS) provides the clearest picture of shareholder value, as it focuses on concrete assets while excluding intangible items that may not hold value during challenging times.

To the detriment of investors, Two Harbors Investment’s TBVPS declined at a 13.8% annual clip over the last two years.

Final Judgment

We see the value of companies driving economic growth, but in the case of Two Harbors Investment, we’re out. After the recent drawdown, the stock trades at 0.8× forward P/B (or $9.89 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward our favorite semiconductor picks and shovels play.

Stocks We Like More Than Two Harbors Investment

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.