As the Q2 earnings season wraps, let’s dig into this quarter’s best and worst performers in the semiconductor manufacturing industry, including Amkor (NASDAQ: AMKR) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a strong Q2. As a group, revenues beat analysts’ consensus estimates by 3.8% while next quarter’s revenue guidance was in line.

Luckily, semiconductor manufacturing stocks have performed well with share prices up 30.5% on average since the latest earnings results.

Best Q2: Amkor (NASDAQ: AMKR)

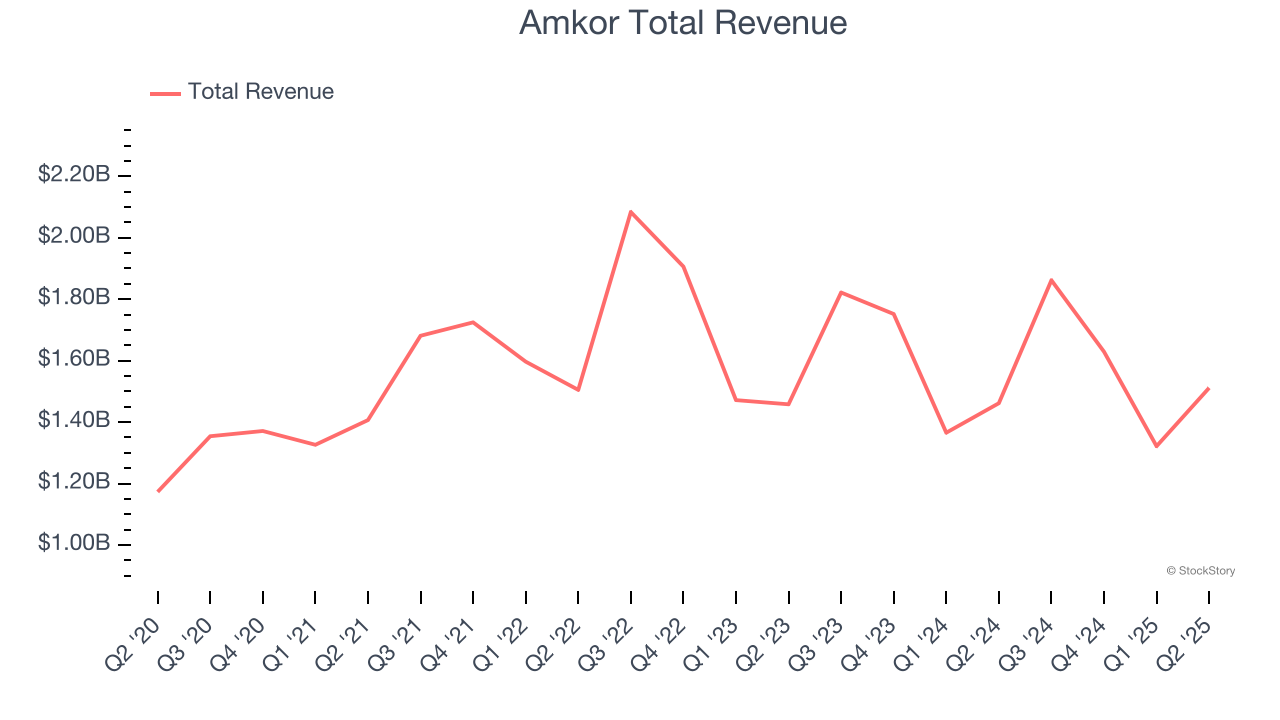

Operating through a largely Asian facility footprint, Amkor Technologies (NASDAQ: AMKR) provides outsourced packaging and testing for semiconductors.

Amkor reported revenues of $1.51 billion, up 3.4% year on year. This print exceeded analysts’ expectations by 6.3%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS and adjusted operating income estimates.

Interestingly, the stock is up 48% since reporting and currently trades at $31.44.

Is now the time to buy Amkor? Access our full analysis of the earnings results here, it’s free for active Edge members.

Lam Research (NASDAQ: LRCX)

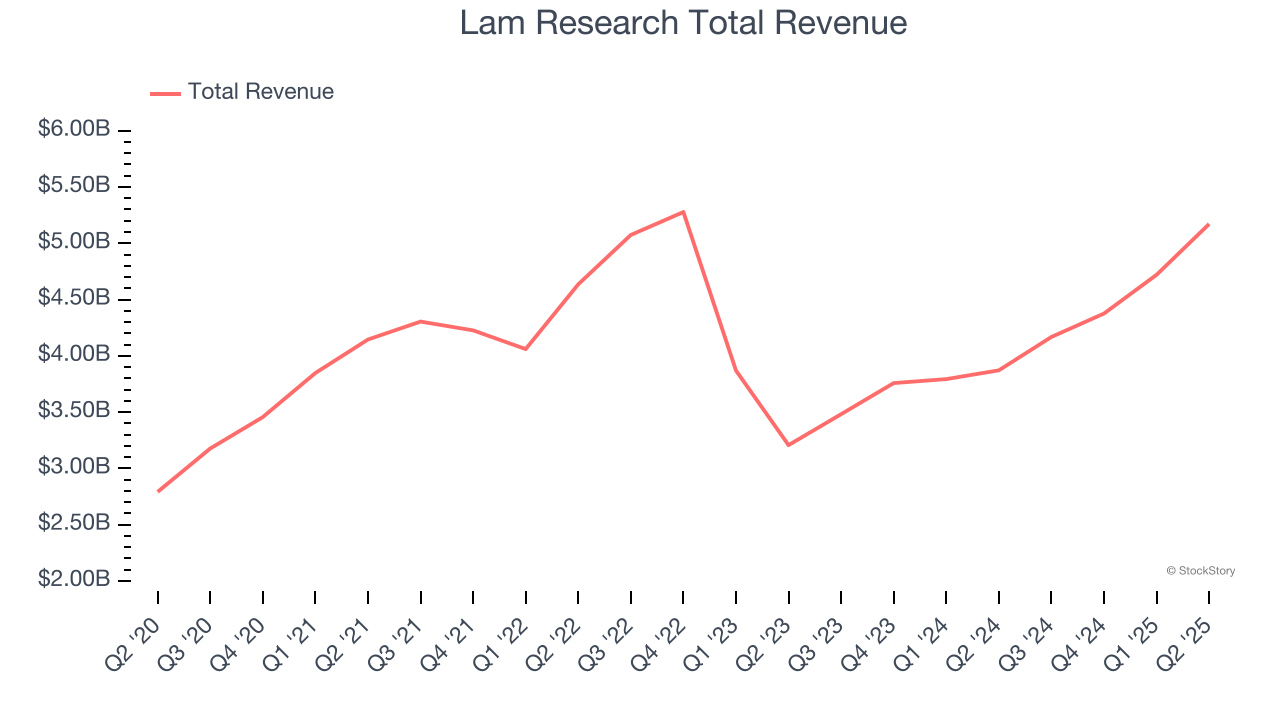

Founded in 1980 by David Lam, the man who pioneered semiconductor etching technology, Lam Research (NASDAQ: LRCX) is one of the leading providers of wafer fabrication equipment used to make semiconductors.

Lam Research reported revenues of $5.17 billion, up 33.6% year on year, outperforming analysts’ expectations by 3.3%. The business had a stunning quarter with a significant improvement in its inventory levels and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 46.2% since reporting. It currently trades at $144.94.

Is now the time to buy Lam Research? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q2: Marvell Technology (NASDAQ: MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $2.01 billion, up 57.6% year on year, in line with analysts’ expectations. It was a slower quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and revenue in line with analysts’ estimates.

Marvell Technology delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. Interestingly, the stock is up 14.8% since the results and currently trades at $88.75.

Read our full analysis of Marvell Technology’s results here.

Applied Materials (NASDAQ: AMAT)

Founded in 1967 as the first company to develop tools for other businesses in the semiconductor industry, Applied Materials (NASDAQ: AMAT) is the largest provider of semiconductor wafer fabrication equipment.

Applied Materials reported revenues of $7.30 billion, up 7.7% year on year. This print topped analysts’ expectations by 1.2%. Taking a step back, it was a mixed quarter as it also recorded a beat of analysts’ EPS estimates but revenue guidance for next quarter missing analysts’ expectations.

The stock is up 20.8% since reporting and currently trades at $227.25.

Read our full, actionable report on Applied Materials here, it’s free for active Edge members.

Nova (NASDAQ: NVMI)

Headquartered in Israel, Nova (NASDAQ: NVMI) is a provider of quality control systems used in semiconductor manufacturing.

Nova reported revenues of $220 million, up 40.2% year on year. This number beat analysts’ expectations by 2.4%. It was a very strong quarter as it also logged a solid beat of analysts’ adjusted operating income estimates and a beat of analysts’ EPS estimates.

The stock is up 28.7% since reporting and currently trades at $331.90.

Read our full, actionable report on Nova here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.