Shareholders of Copart would probably like to forget the past six months even happened. The stock dropped 24.9% and now trades at $44.65. This may have investors wondering how to approach the situation.

Following the pullback, is this a buying opportunity for CPRT? Find out in our full research report, it’s free for active Edge members.

Why Is Copart a Good Business?

Starting as a single salvage yard in California in 1982, Copart (NASDAQ: CPRT) operates an online auction platform that connects sellers of damaged and salvage vehicles with buyers ranging from dismantlers and rebuilders to used car dealers and exporters.

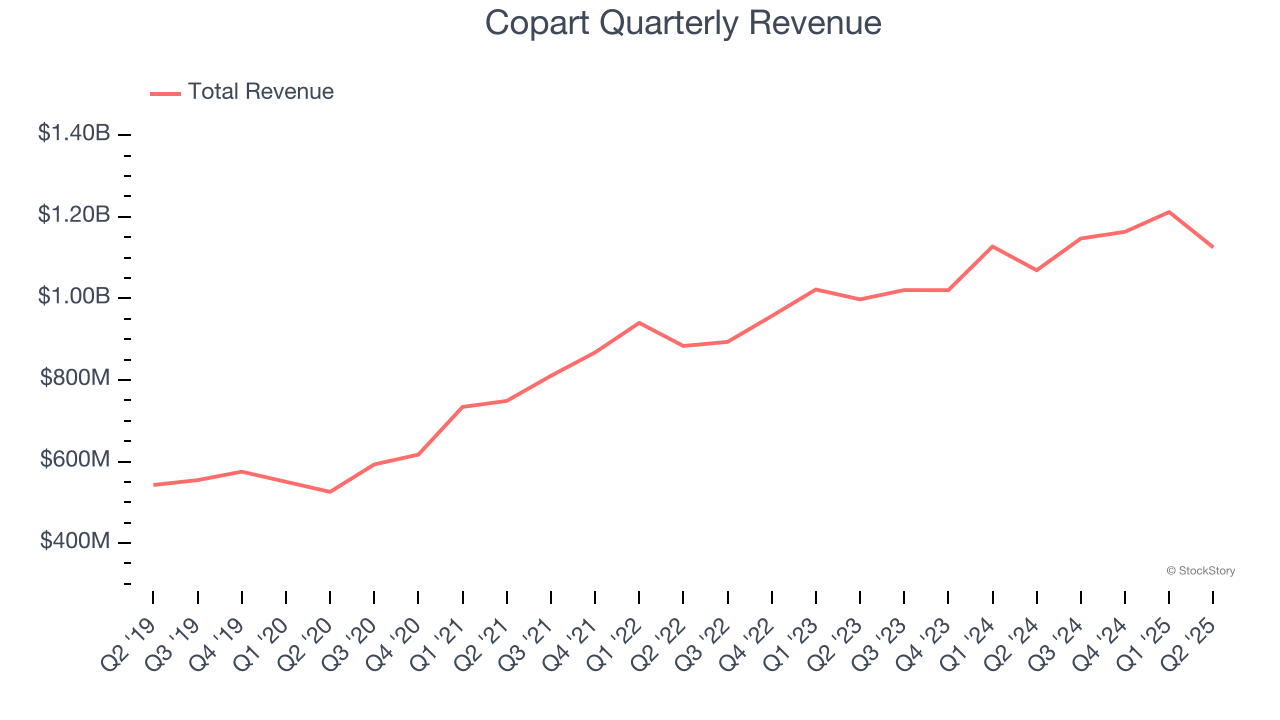

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Thankfully, Copart’s 16.1% annualized revenue growth over the last five years was incredible. Its growth beat the average business services company and shows its offerings resonate with customers.

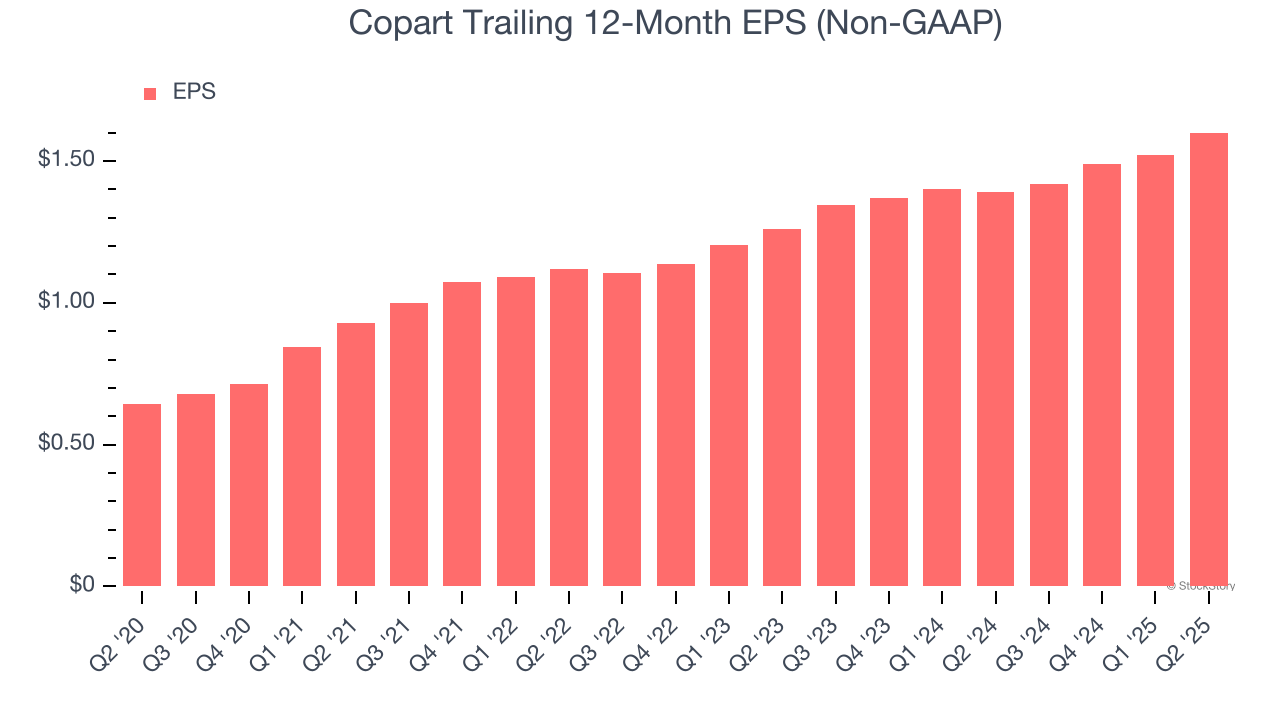

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Copart’s EPS grew at an astounding 20% compounded annual growth rate over the last five years, higher than its 16.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

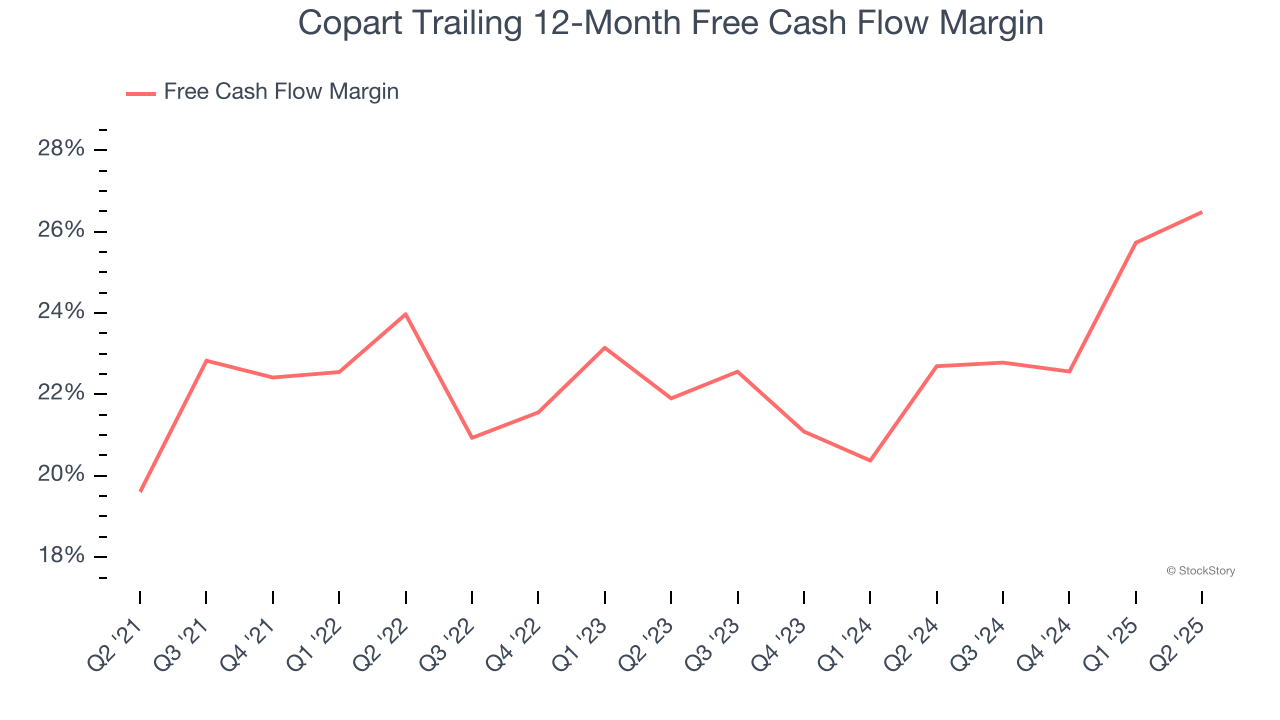

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Copart has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 23.3% over the last five years.

Final Judgment

These are just a few reasons Copart is a rock-solid business worth owning. With the recent decline, the stock trades at 26.4× forward P/E (or $44.65 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Copart

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.