Workforce solutions provider ManpowerGroup (NYSE: MAN) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 2.3% year on year to $4.63 billion. Its GAAP profit of $0.38 per share was 53.7% below analysts’ consensus estimates.

Is now the time to buy ManpowerGroup? Find out by accessing our full research report, it’s free for active Edge members.

ManpowerGroup (MAN) Q3 CY2025 Highlights:

- Revenue: $4.63 billion vs analyst estimates of $4.60 billion (2.3% year-on-year growth, 0.7% beat)

- EPS (GAAP): $0.38 vs analyst expectations of $0.82 (53.7% miss, included restructuring costs and Argentina hyperinflationary related non-cash currency translation losses which reduced earnings per share by $0.45 in the third quarter)

- Adjusted EBITDA: $93.6 million vs analyst estimates of $109.7 million (2% margin, 14.7% miss)

- EPS (GAAP) guidance for Q4 CY2025 is $0.83 at the midpoint, beating analyst estimates by 6.2%

- Operating Margin: 1.4%, in line with the same quarter last year

- Free Cash Flow Margin: 1%, similar to the same quarter last year

- Organic Revenue rose 1% year on year vs analyst estimates of 1.9% declines (288 basis point beat)

- Market Capitalization: $1.76 billion

Jonas Prising, ManpowerGroup Chair & CEO, said "After 11 consecutive quarters of organic constant currency revenue declines, we crossed back over to growth during the third quarter. The stabilization of demand in recent quarters in North America and Europe, despite ongoing tariff uncertainty, has been a key factor in the revenue trend improvement. Currently our entire organization has a relentless focus on two main outcomes - Winning In The Market to increase our market share and the acceleration of initiatives to remove structural costs from the organization to drive a more efficient ManpowerGroup for the future. We are pleased with our progress in both and confident in our ability to deliver long-term value to all of our stakeholders.

Company Overview

Founded during the post-World War II economic boom when businesses needed temporary workers, ManpowerGroup (NYSE: MAN) connects millions of people to employment opportunities through its global network of staffing, recruitment, and workforce management services.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $17.64 billion in revenue over the past 12 months, ManpowerGroup is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To expand meaningfully, ManpowerGroup likely needs to tweak its prices, innovate with new offerings, or enter new markets.

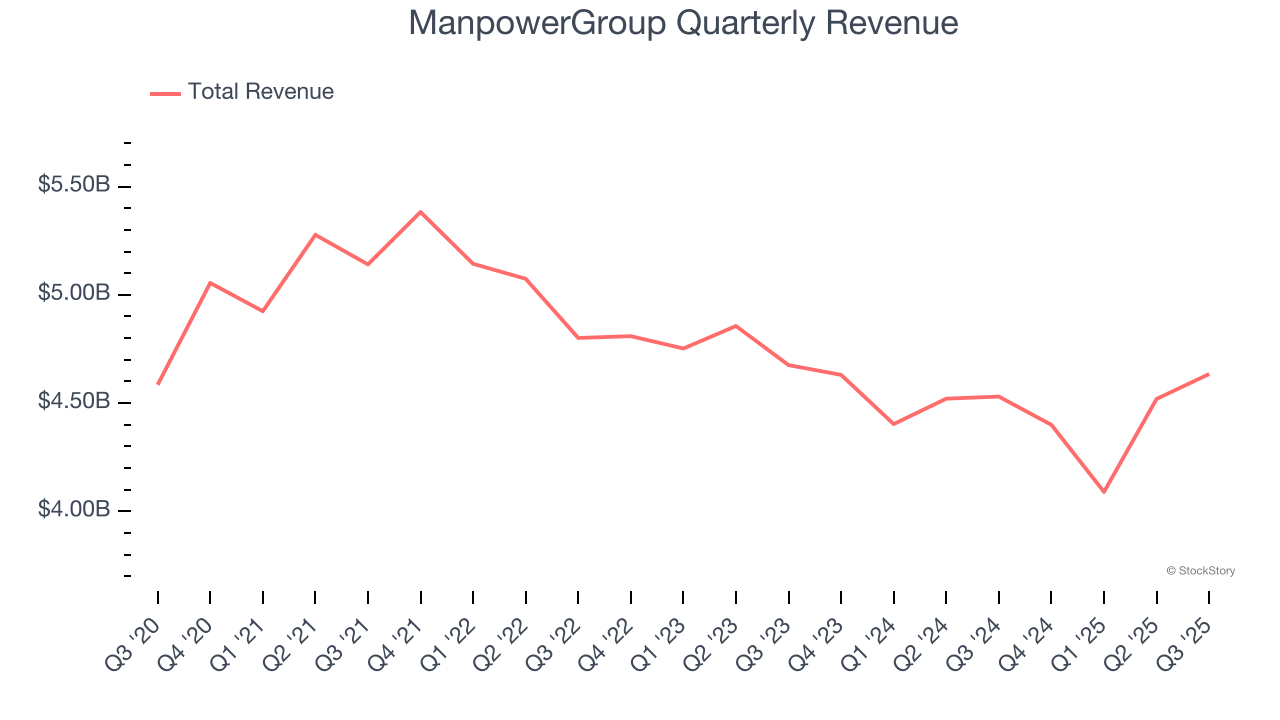

As you can see below, ManpowerGroup struggled to increase demand as its $17.64 billion of sales for the trailing 12 months was close to its revenue five years ago. This shows demand was soft, a tough starting point for our analysis.

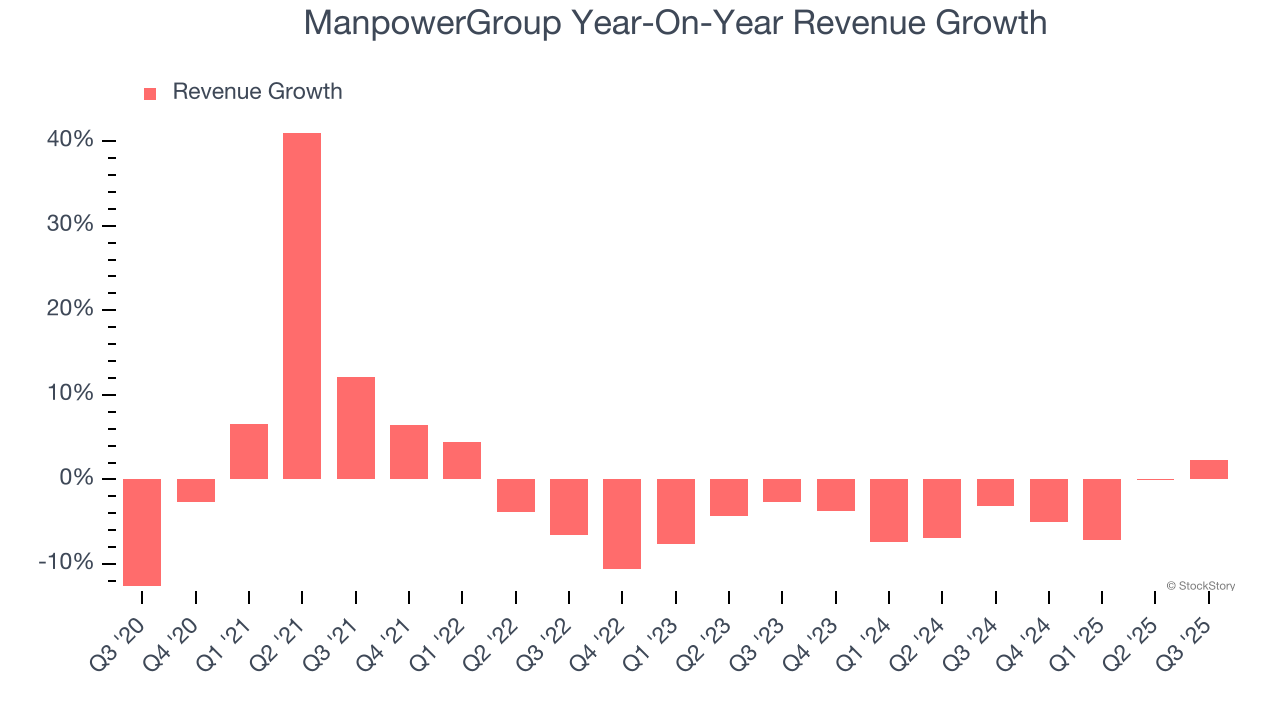

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. ManpowerGroup’s recent performance shows its demand remained suppressed as its revenue has declined by 3.9% annually over the last two years.

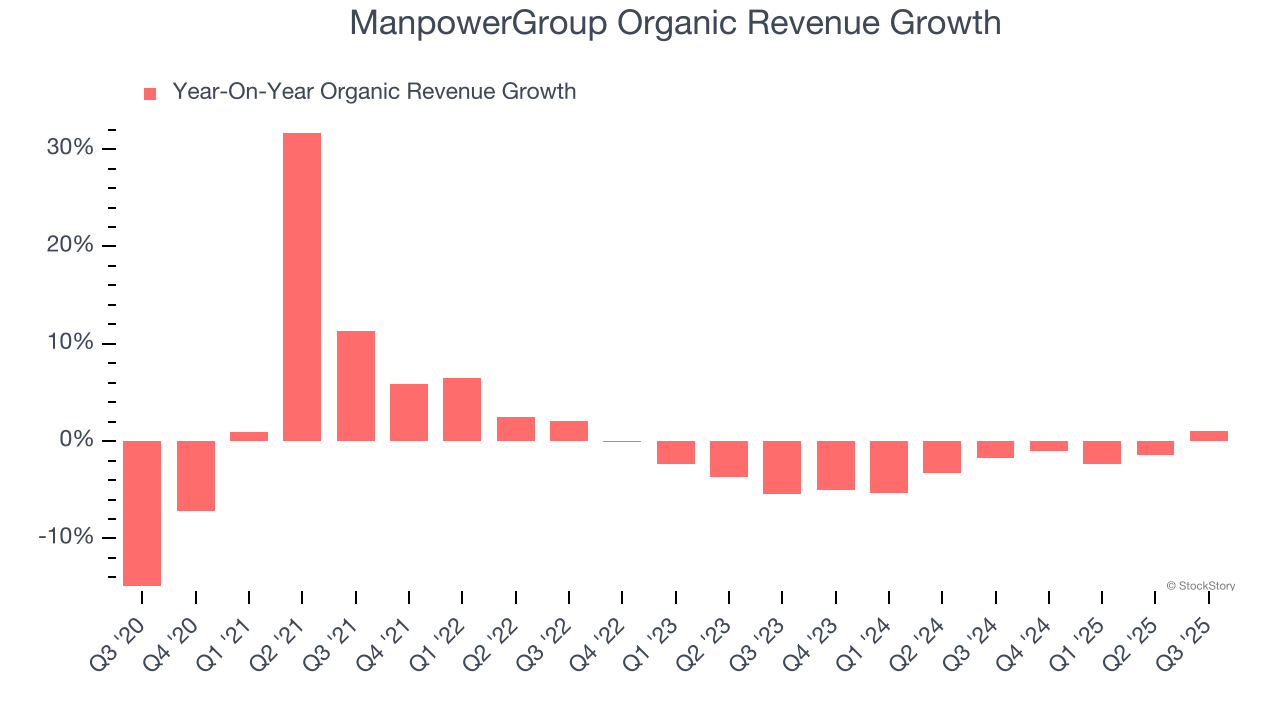

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, ManpowerGroup’s organic revenue averaged 2.4% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, ManpowerGroup reported modest year-on-year revenue growth of 2.3% but beat Wall Street’s estimates by 0.7%.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

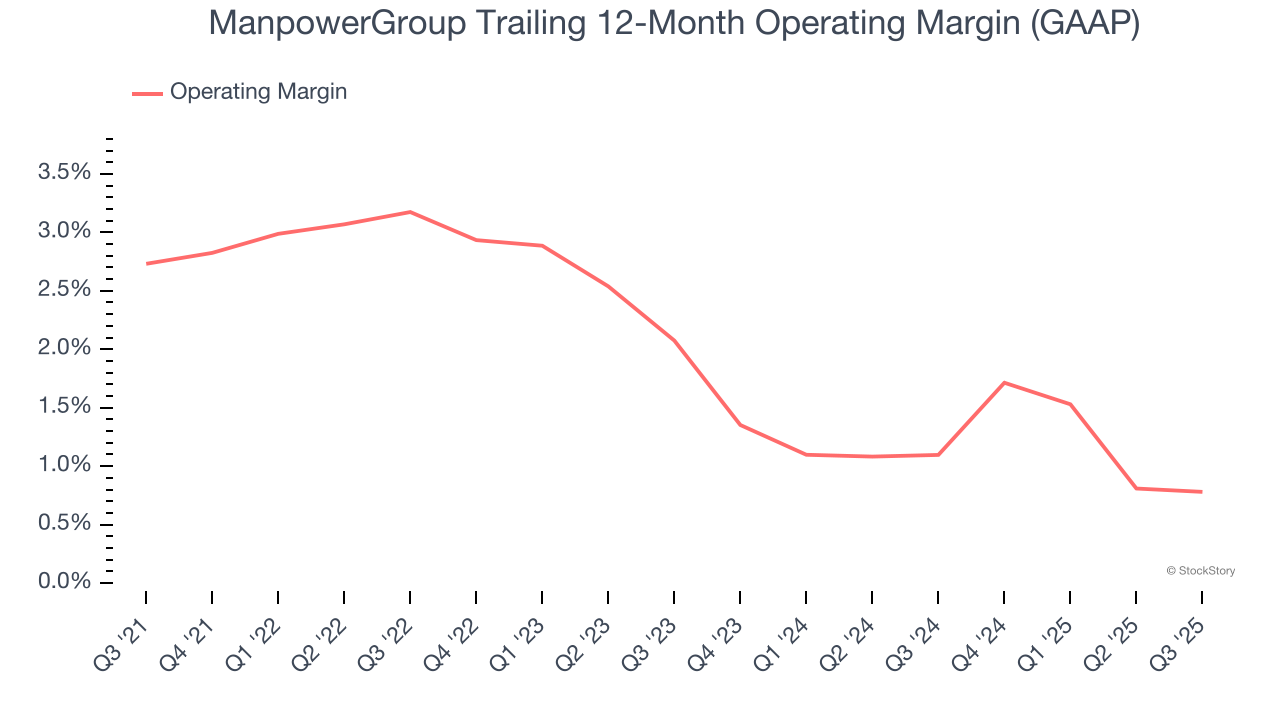

ManpowerGroup was profitable over the last five years but held back by its large cost base. Its average operating margin of 2% was weak for a business services business.

Analyzing the trend in its profitability, ManpowerGroup’s operating margin decreased by 2 percentage points over the last five years. ManpowerGroup’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, ManpowerGroup generated an operating margin profit margin of 1.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

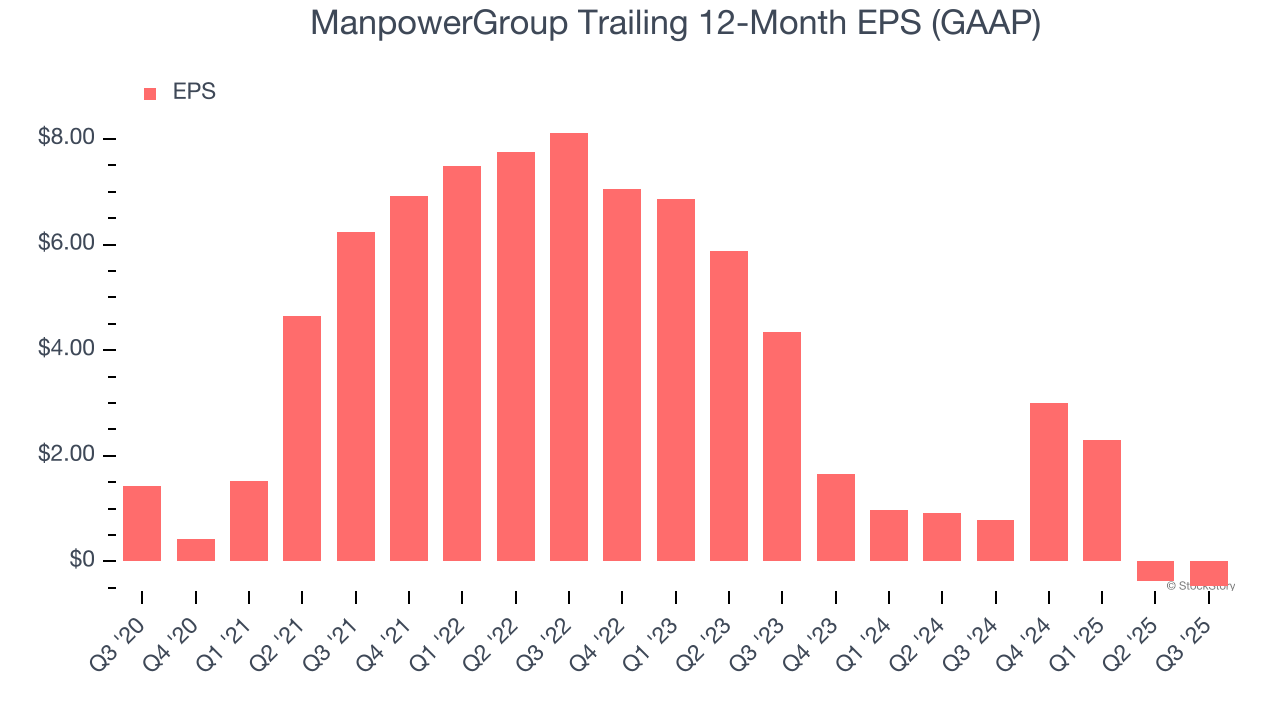

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for ManpowerGroup, its EPS declined by 18.4% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Diving into the nuances of ManpowerGroup’s earnings can give us a better understanding of its performance. As we mentioned earlier, ManpowerGroup’s operating margin was flat this quarter but declined by 2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For ManpowerGroup, its two-year annual EPS declines of 45.2% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, ManpowerGroup reported EPS of $0.38, down from $0.47 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast ManpowerGroup’s full-year EPS of negative $0.47 will flip to positive $3.69.

Key Takeaways from ManpowerGroup’s Q3 Results

We were impressed by how significantly ManpowerGroup blew past analysts’ EPS guidance for next quarter expectations this quarter. We were also glad its organic revenue outperformed Wall Street’s estimates. On the other hand, its GAAP EPS missed but this was due to restructuring costs and Argentina hyperinflationary related non-cash currency translation losses which reduced earnings per share by $0.45 in the third quarter. Overall, this print had some key fundamental positives. The stock traded up 5.2% to $40 immediately following the results.

Is ManpowerGroup an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.