Asset management firm Artisan Partners (NYSE: APAM) missed Wall Street’s revenue expectations in Q3 CY2025, but sales rose 7.8% year on year to $301.3 million. Its non-GAAP profit of $1.02 per share was 5.2% above analysts’ consensus estimates.

Is now the time to buy Artisan Partners? Find out by accessing our full research report, it’s free for active Edge members.

Artisan Partners (APAM) Q3 CY2025 Highlights:

- Assets Under Management: $177.4 billion vs analyst estimates of $179.5 billion (5.7% year-on-year growth, 1.2% miss)

- Revenue: $301.3 million vs analyst estimates of $304 million (7.8% year-on-year growth, 0.9% miss)

- Pre-tax Profit: $123.4 million (41% margin, 4.2% year-on-year decline)

- Adjusted EPS: $1.02 vs analyst estimates of $0.97 (5.2% beat)

- Market Capitalization: $3.15 billion

Company Overview

Founded in 1994 with a focus on autonomous investment teams and a "high-value-added" approach, Artisan Partners (NYSE: APAM) is an investment management firm that offers actively managed equity and fixed income strategies to institutional and individual investors.

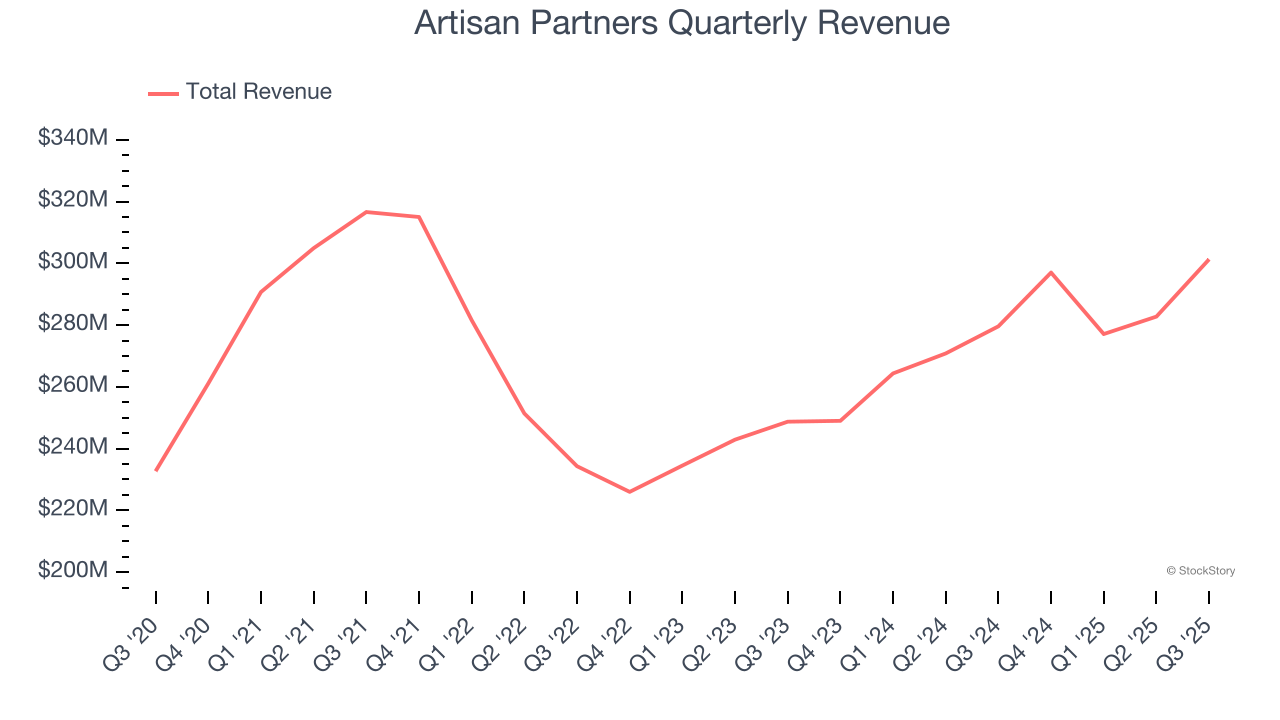

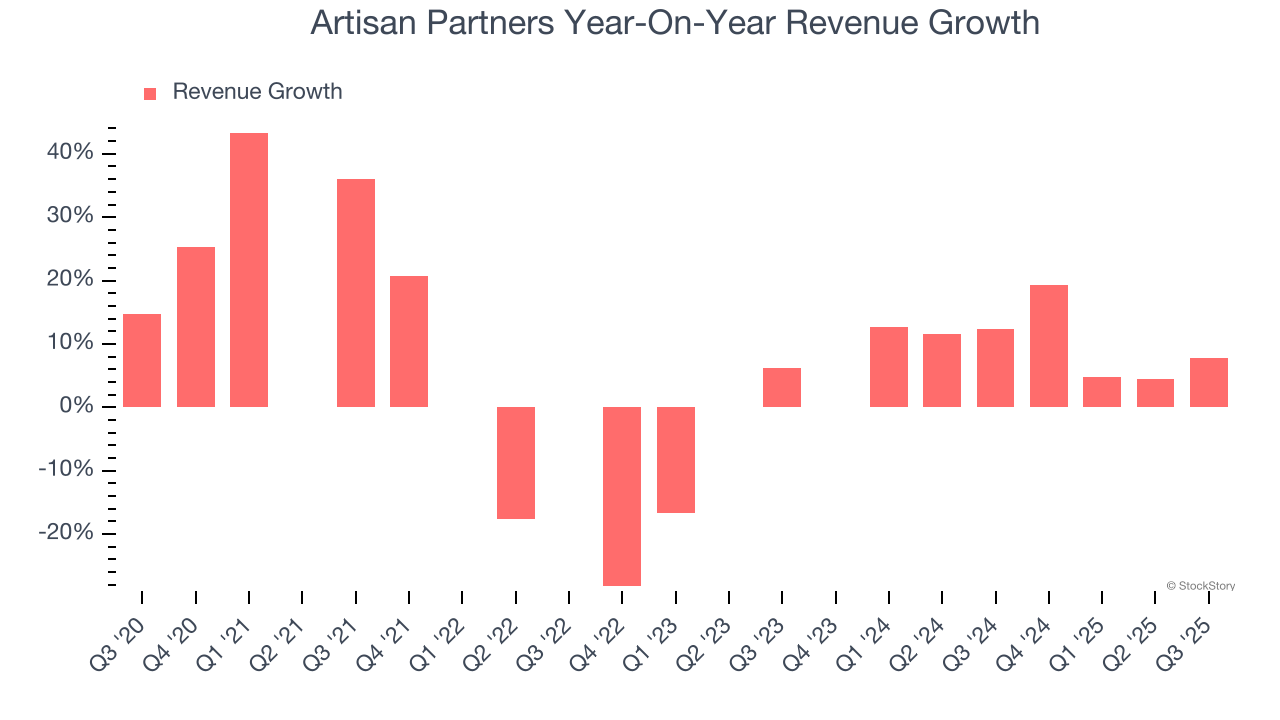

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Artisan Partners’s revenue grew at a mediocre 6.5% compounded annual growth rate over the last five years. This was below our standard for the financials sector and is a poor baseline for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Artisan Partners’s annualized revenue growth of 10.3% over the last two years is above its five-year trend, suggesting some bright spots.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Artisan Partners’s revenue grew by 7.8% year on year to $301.3 million, missing Wall Street’s estimates.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

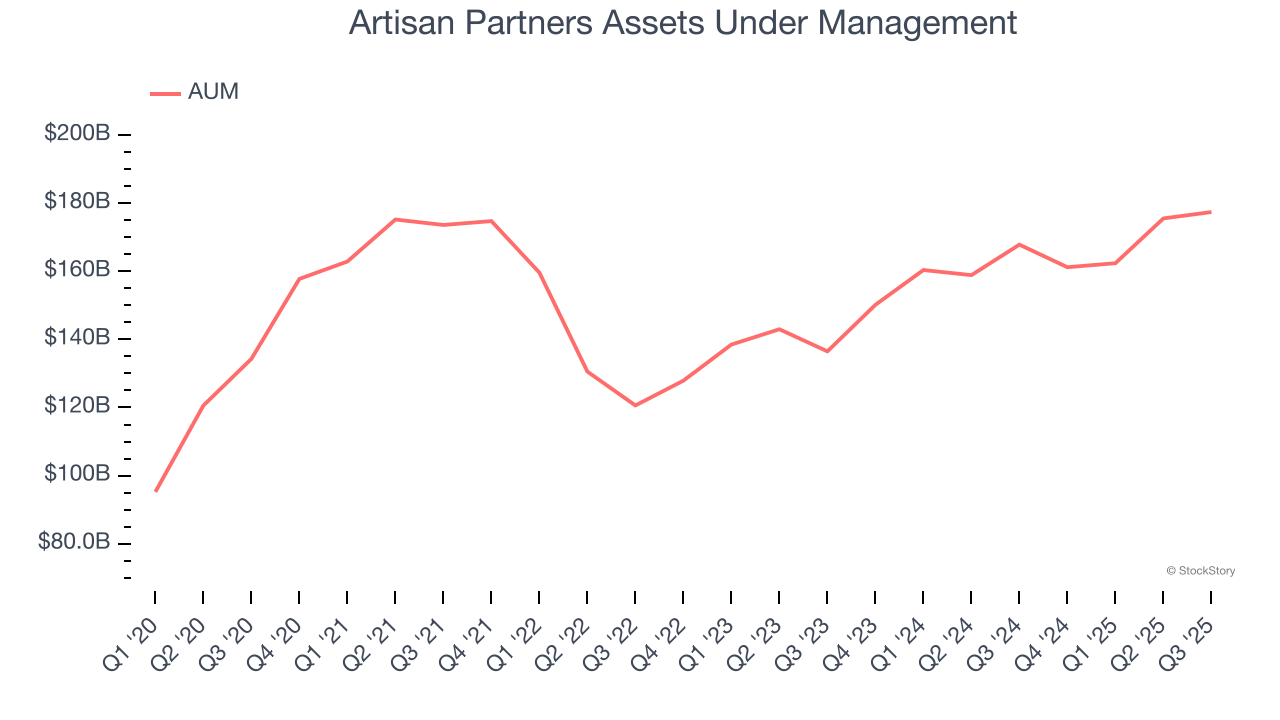

Assets Under Management (AUM)

Assets Under Management (AUM) encompasses all client funds under a firm's investment management umbrella. The recurring fee structure on these assets provides consistent revenue generation, offering financial stability even during periods of poor investment returns, though sustained underperformance can impact future asset flows.

Artisan Partners’s AUM was flat over the last four years, much worse than the broader financials industry. When analyzing Artisan Partners’s AUM over the last two years, we can see that growth accelerated to 11.3% annually. Fundraising or short-term investment performance were net contributors for the company over this shorter period since assets grew faster than total revenue. Keep in mind that asset growth can be erratic and seasonal, so we don't rely on it too heavily for our business quality analysis.

In Q3, Artisan Partners’s AUM was $177.4 billion, falling 1.2% short of analysts’ expectations. This print was 5.7% higher than the same quarter last year.

Key Takeaways from Artisan Partners’s Q3 Results

It was good to see Artisan Partners beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed Wall Street’s estimates due to worse-than-anticipated AUM growth. Zooming out, we think this was a mixed quarter. The stock traded up 3% to $45.50 immediately after reporting.

So should you invest in Artisan Partners right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.