Water management manufacturer Watts Water (NYSE: WTS) reported Q4 CY2024 results exceeding the market’s revenue expectations, but sales fell by 1.3% year on year to $540.4 million. Its non-GAAP profit of $2.05 per share was 7.3% above analysts’ consensus estimates.

Is now the time to buy Watts Water Technologies? Find out by accessing our full research report, it’s free.

Watts Water Technologies (WTS) Q4 CY2024 Highlights:

- Revenue: $540.4 million vs analyst estimates of $537.4 million (1.3% year-on-year decline, 0.6% beat)

- Adjusted EPS: $2.05 vs analyst estimates of $1.91 (7.3% beat)

- Operating Margin: 16.5%, up from 14.4% in the same quarter last year

- Free Cash Flow Margin: 23.6%, up from 18.1% in the same quarter last year

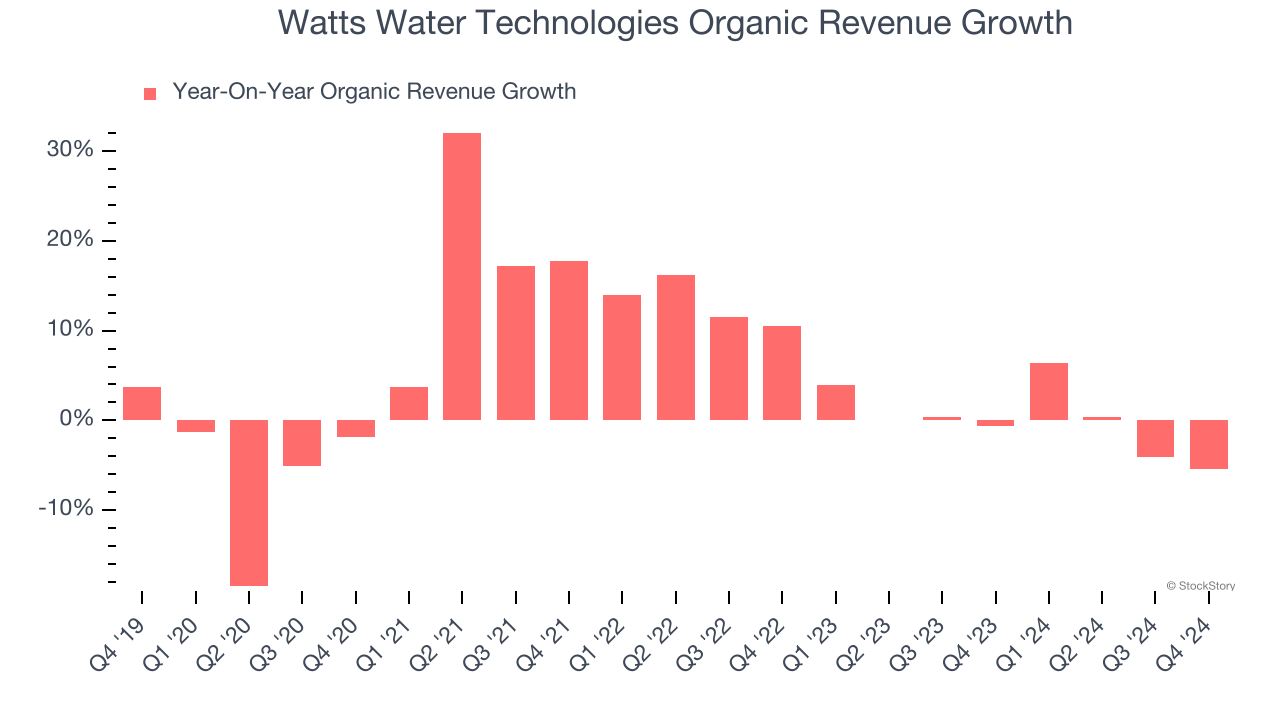

- Organic Revenue fell 5.4% year on year (-0.6% in the same quarter last year)

- Market Capitalization: $6.84 billion

Chief Executive Officer Robert J. Pagano Jr. commented, “We closed out 2024 with record results for the quarter and full year, including record operating income, adjusted earnings per share and full year sales. I would like to commend the Watts team for their dedication throughout 2024 as we delivered on our commitments to serve our customers, executed on new product development and advanced our long-term strategy.”

Company Overview

Founded in 1874, Watts Water (NYSE: WTS) specializes in manufacturing water products and systems for residential, commercial, and industrial applications globally.

Water Infrastructure

Trends towards conservation and reducing groundwater depletion are putting water infrastructure and treatment products front and center. Companies that can innovate and create solutions–especially automated or connected solutions–to address these thematic trends will create incremental demand and speed up replacement cycles. On the other hand, water infrastructure and treatment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Sales Growth

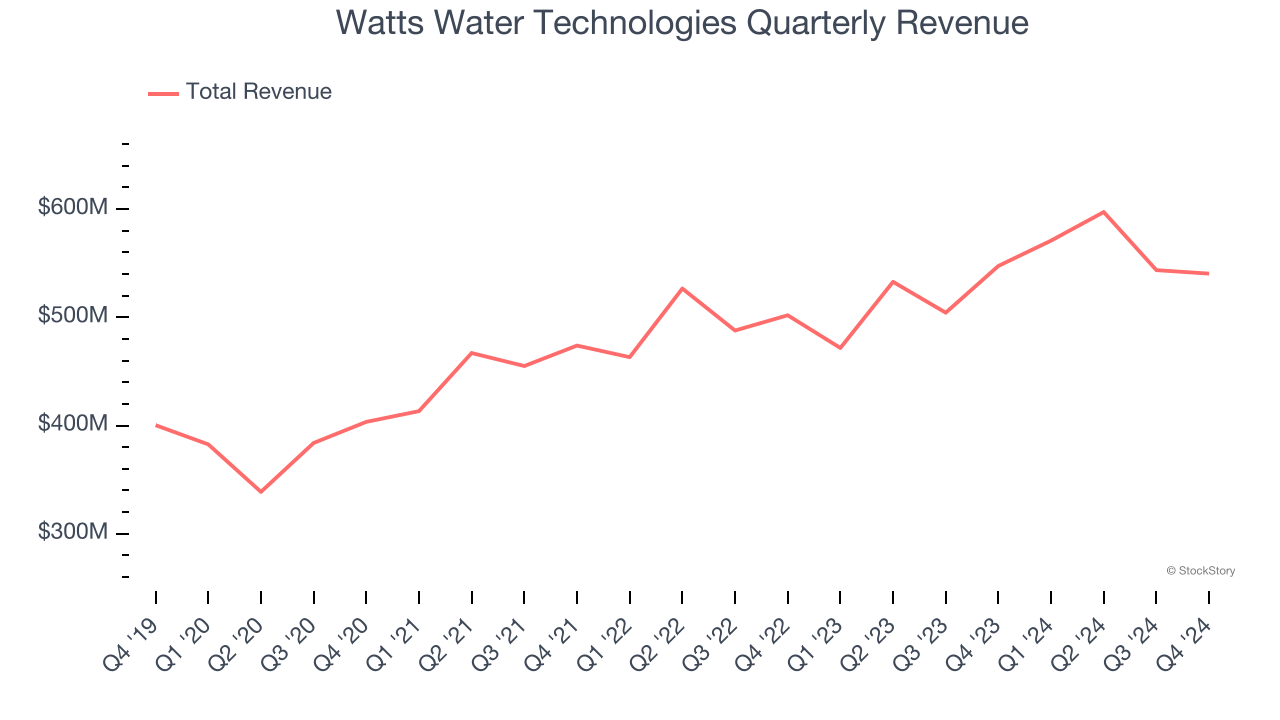

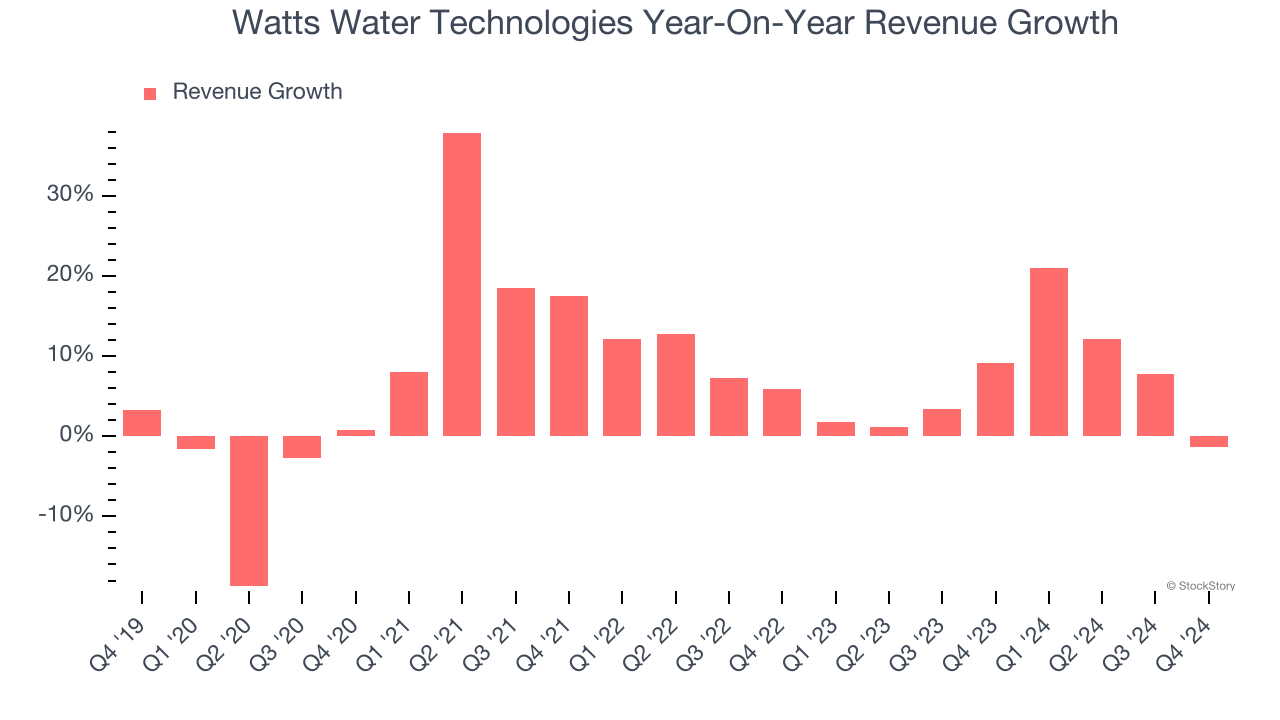

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Watts Water Technologies’s sales grew at a mediocre 7.1% compounded annual growth rate over the last five years. This fell short of our benchmark for the industrials sector, but there are still things to like about Watts Water Technologies.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Watts Water Technologies’s annualized revenue growth of 6.7% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Watts Water Technologies’s organic revenue was flat. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Watts Water Technologies’s revenue fell by 1.3% year on year to $540.4 million but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 1% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

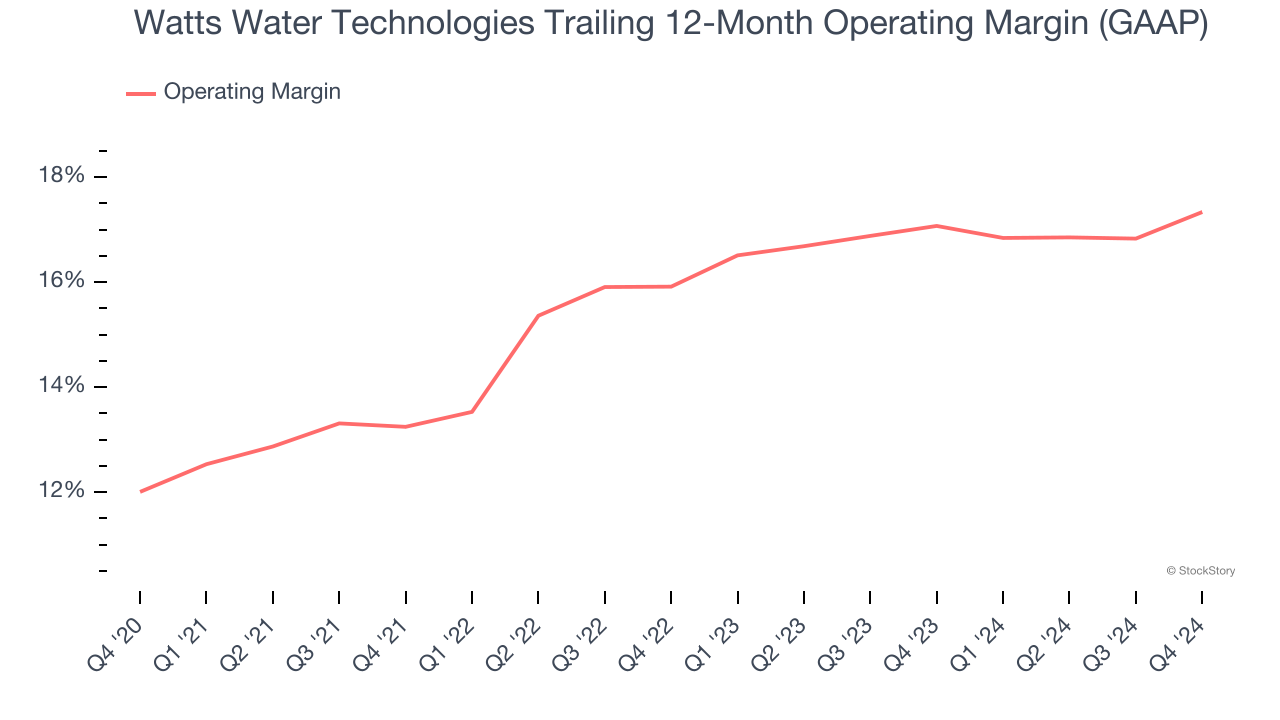

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Watts Water Technologies has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Watts Water Technologies’s operating margin rose by 5.3 percentage points over the last five years, showing its efficiency has meaningfully improved.

In Q4, Watts Water Technologies generated an operating profit margin of 16.5%, up 2.1 percentage points year on year. The increase was encouraging, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

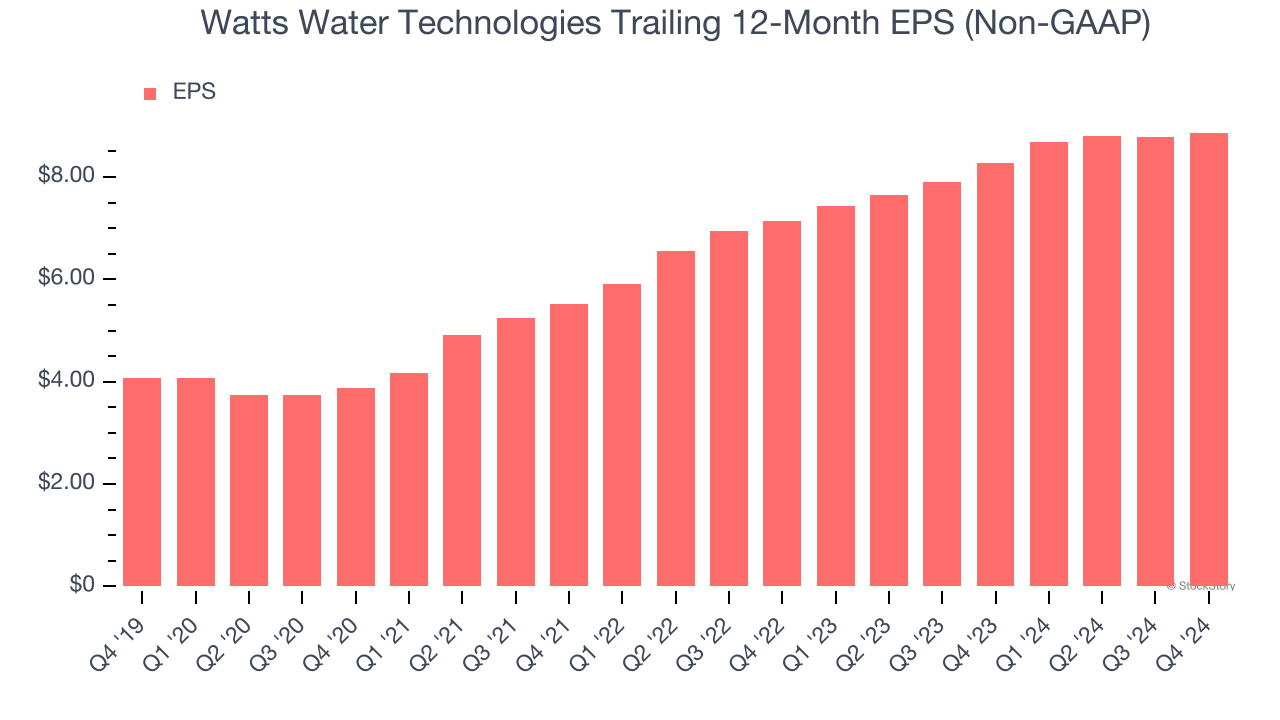

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

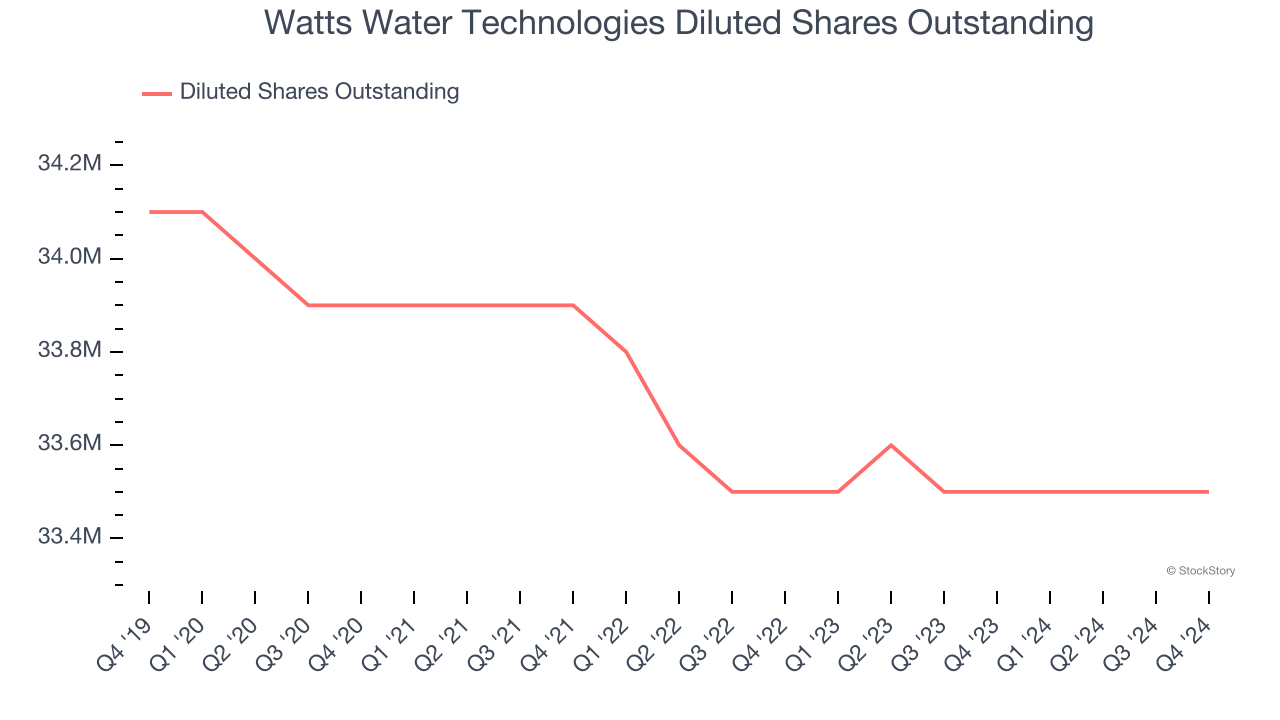

Watts Water Technologies’s EPS grew at a spectacular 16.9% compounded annual growth rate over the last five years, higher than its 7.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Watts Water Technologies’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Watts Water Technologies’s operating margin expanded by 5.3 percentage points over the last five years. On top of that, its share count shrank by 1.8%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Watts Water Technologies, its two-year annual EPS growth of 11.5% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Watts Water Technologies reported EPS at $2.05, up from $1.97 in the same quarter last year. This print beat analysts’ estimates by 7.3%. Over the next 12 months, Wall Street expects Watts Water Technologies’s full-year EPS of $8.87 to grow 1.1%.

Key Takeaways from Watts Water Technologies’s Q4 Results

It was encouraging to see Watts Water Technologies beat analysts’ EPS expectations this quarter. We were also happy its organic revenue narrowly outperformed Wall Street’s estimates. Overall, this quarter had some key positives. The stock remained flat at $208.75 immediately following the results.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.