Data infrastructure software company, Confluent (NASDAQ: CFLT) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 22.5% year on year to $261.2 million. On the other hand, next quarter’s revenue guidance of $253.5 million was less impressive, coming in 3.7% below analysts’ estimates. Its non-GAAP profit of $0.09 per share was 57.7% above analysts’ consensus estimates.

Is now the time to buy Confluent? Find out by accessing our full research report, it’s free.

Confluent (CFLT) Q4 CY2024 Highlights:

- Revenue: $261.2 million vs analyst estimates of $256.8 million (22.5% year-on-year growth, 1.7% beat)

- Adjusted EPS: $0.09 vs analyst estimates of $0.06 (57.7% beat)

- Adjusted Operating Income: $13.6 million vs analyst estimates of $5.32 million (5.2% margin, significant beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $1.12 billion at the midpoint, missing analyst estimates by 3.7% and implying 16.1% growth (vs 24.1% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $0.35 at the midpoint, beating analyst estimates by 1.4%

- Operating Margin: -40.5%, in line with the same quarter last year

- Free Cash Flow Margin: 11.1%, up from 3.7% in the previous quarter

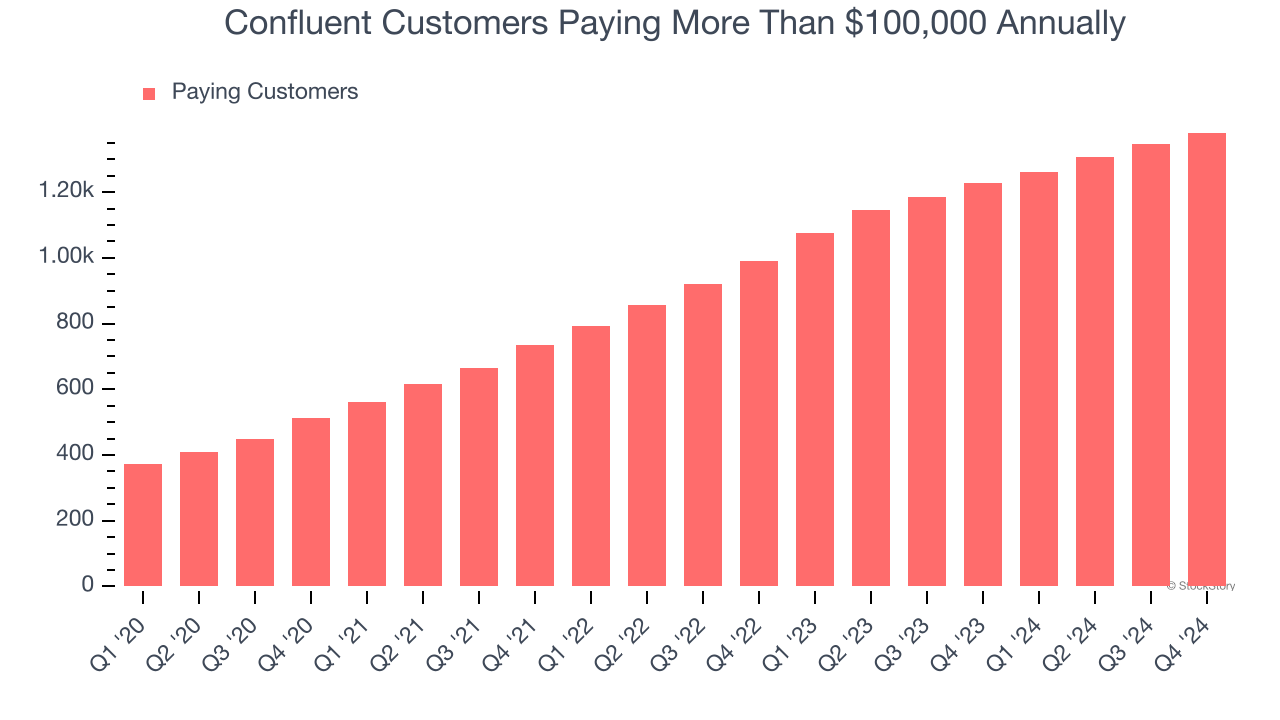

- Customers: 1,381 customers paying more than $100,000 annually

- Market Capitalization: $10.32 billion

“Confluent closed the year with a strong Q4, highlighted by beating all guided metrics and achieving 38% year-over-year Confluent Cloud revenue growth,” said Jay Kreps, co-founder and CEO, Confluent.

Company Overview

Started in 2014 by the team of engineers at LinkedIn who originally built it as an internal tool, Confluent (NASDAQ: CFLT) provides infrastructure software for organizations that makes it easy and fast to collect and move large amounts of data between different systems.

Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

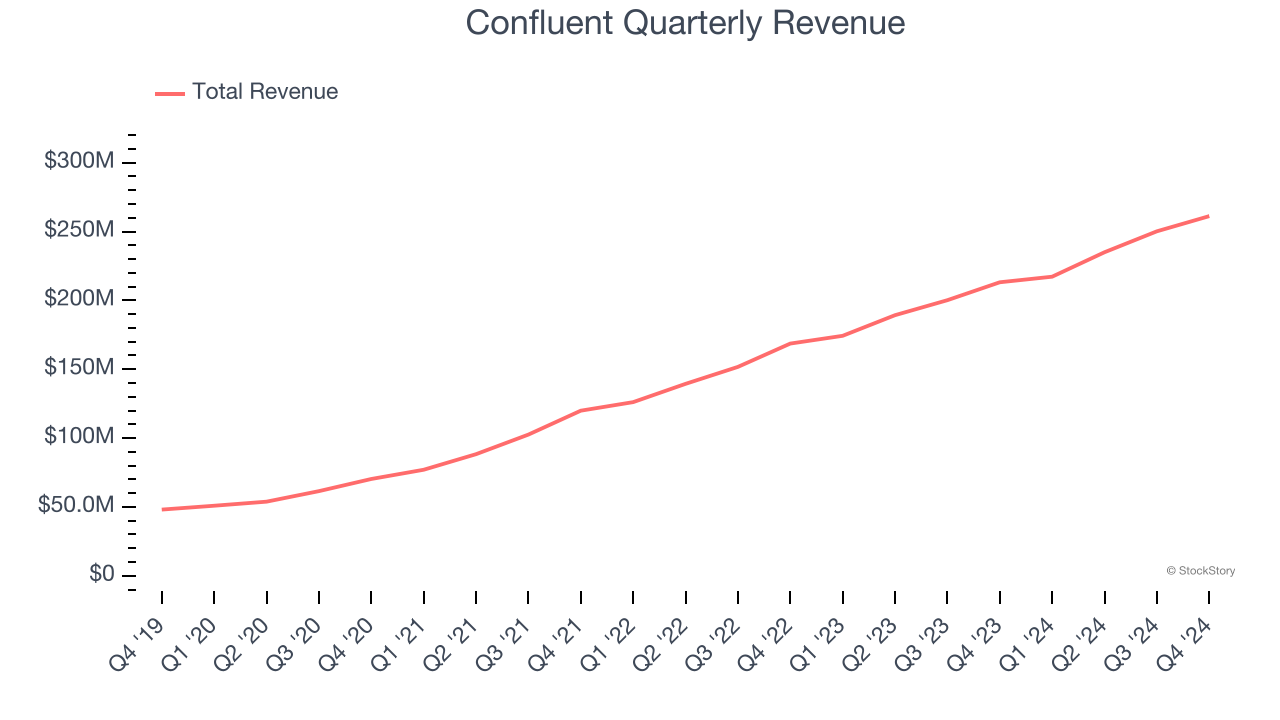

Sales Growth

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Confluent grew its sales at an excellent 35.4% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Confluent reported robust year-on-year revenue growth of 22.5%, and its $261.2 million of revenue topped Wall Street estimates by 1.7%. Company management is currently guiding for a 16.7% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 20.3% over the next 12 months, a deceleration versus the last three years. Still, this projection is noteworthy and suggests the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Enterprise Customer Base

This quarter, Confluent reported 1,381 enterprise customers paying more than $100,000 annually, an increase of 35 from the previous quarter. That’s a bit fewer contract wins than last quarter and quite a bit below what we’ve observed over the previous year, suggesting its sales momentum with new enterprise customers is slowing. It also implies that Confluent will likely need to upsell its existing large customers or move down market to accelerate its top-line growth.

Key Takeaways from Confluent’s Q4 Results

Revenue and operating profit beat in the quarter. We were also impressed by Confluent’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance came in slightly higher than Wall Street’s estimates. Overall, this was a solid quarter. The stock traded up 11.3% to $33.51 immediately following the results.

So should you invest in Confluent right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.