Radiation technology company Mirion (NYSE: MIR) reported revenue ahead of Wall Street’s expectations in Q4 CY2024, with sales up 10.4% year on year to $254.3 million. Its non-GAAP profit of $0.17 per share was 15.1% above analysts’ consensus estimates.

Is now the time to buy Mirion? Find out by accessing our full research report, it’s free.

Mirion (MIR) Q4 CY2024 Highlights:

- Revenue: $254.3 million vs analyst estimates of $245 million (10.4% year-on-year growth, 3.8% beat)

- Adjusted EPS: $0.17 vs analyst estimates of $0.15 (15.1% beat)

- Adjusted EBITDA: $69.6 million vs analyst estimates of $65.16 million (27.4% margin, 6.8% beat)

- Adjusted EPS guidance for the upcoming financial year 2025 is $0.48 at the midpoint, missing analyst estimates by 3.3%

- EBITDA guidance for the upcoming financial year 2025 is $222.5 million at the midpoint, below analyst estimates of $224.2 million

- Operating Margin: 11.4%, up from 5.8% in the same quarter last year

- Free Cash Flow Margin: 19.3%, down from 23.9% in the same quarter last year

- Market Capitalization: $3.37 billion

“We are pleased to report record 2024 performance, with good momentum continuing into 2025,” commented Mirion’s Chief Executive Officer Thomas Logan.

Company Overview

With its monitoring devices installed on spacecraft, Mirion (NYSE: MIR) offers radiation technology to government agencies, healthcare providers, and industrial companies.

Inspection Instruments

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

Sales Growth

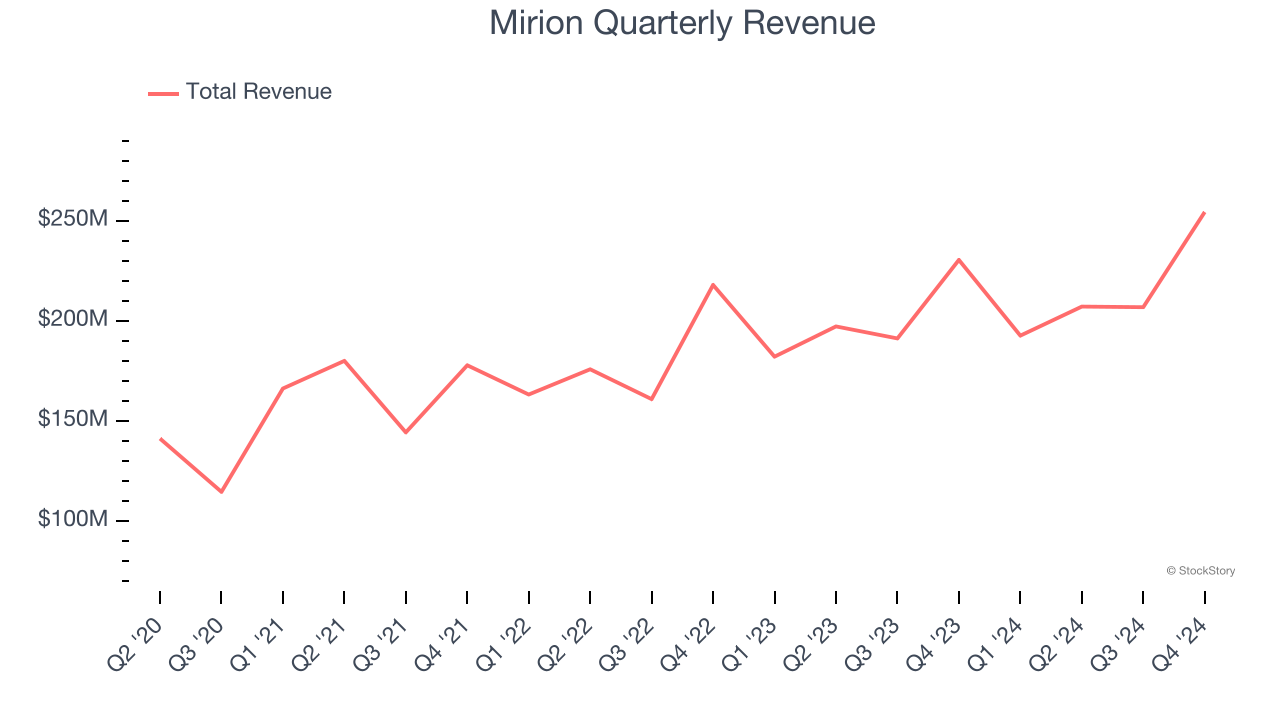

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Mirion grew its sales at a decent 8.8% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Mirion’s annualized revenue growth of 9.5% over the last two years aligns with its three-year trend, suggesting its demand was stable.

This quarter, Mirion reported year-on-year revenue growth of 10.4%, and its $254.3 million of revenue exceeded Wall Street’s estimates by 3.8%.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

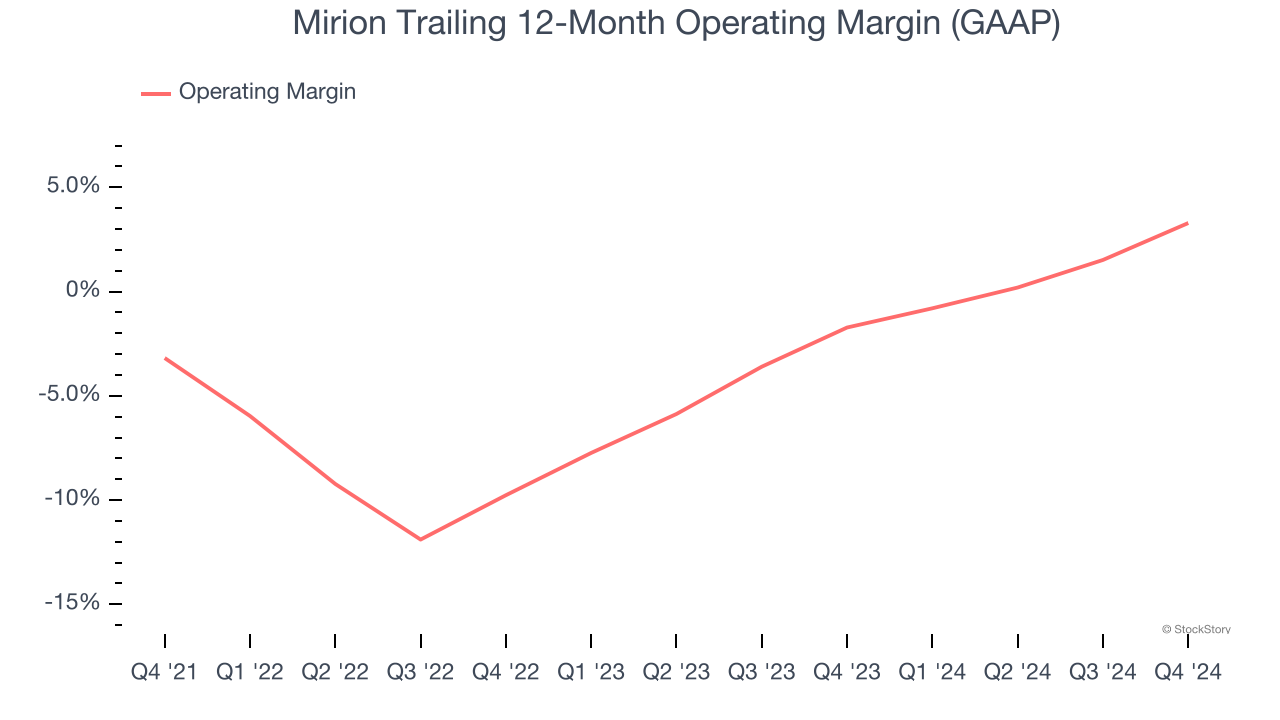

Although Mirion was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Mirion’s operating margin decreased by 7.6 percentage points over the last five years. The company’s performance was poor no matter how you look at it - it shows operating expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, Mirion generated an operating profit margin of 11.4%, up 5.6 percentage points year on year. The increase was solid, and since its operating margin rose more than its gross margin, we can infer it was recently more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

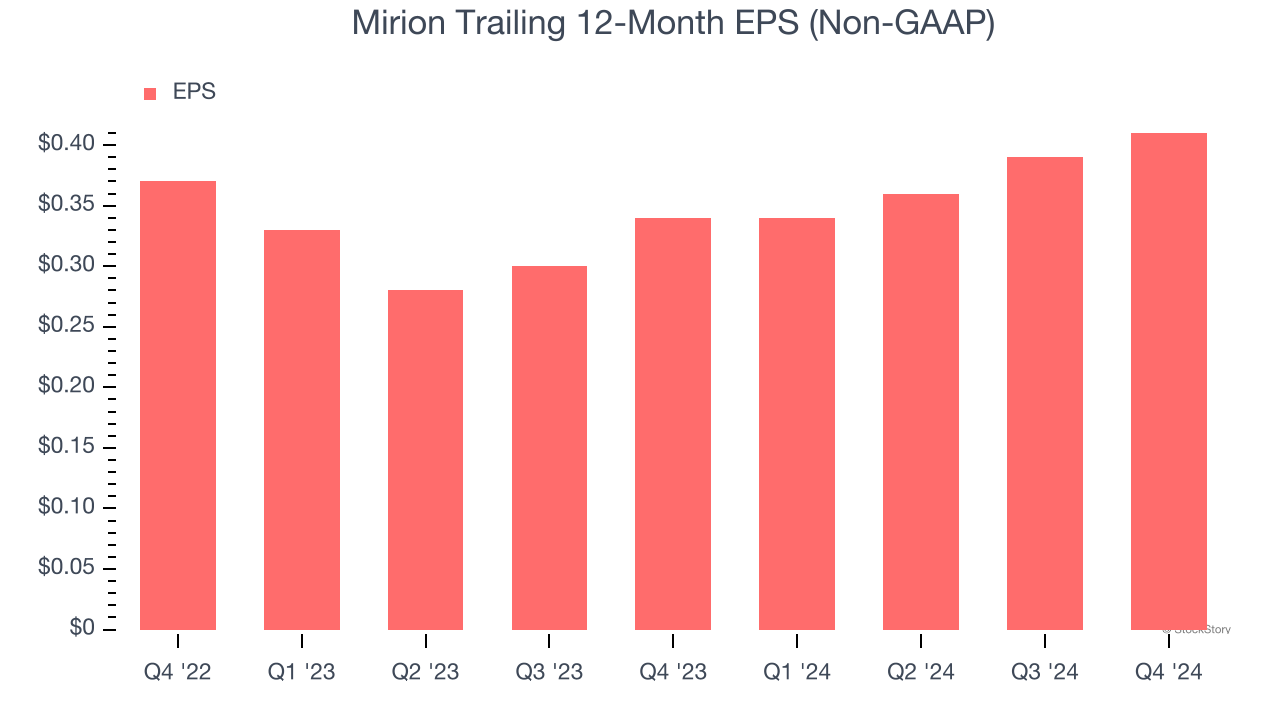

Mirion’s EPS grew at an unimpressive 5.3% compounded annual growth rate over the last two years, lower than its 9.5% annualized revenue growth. However, its operating margin actually expanded during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

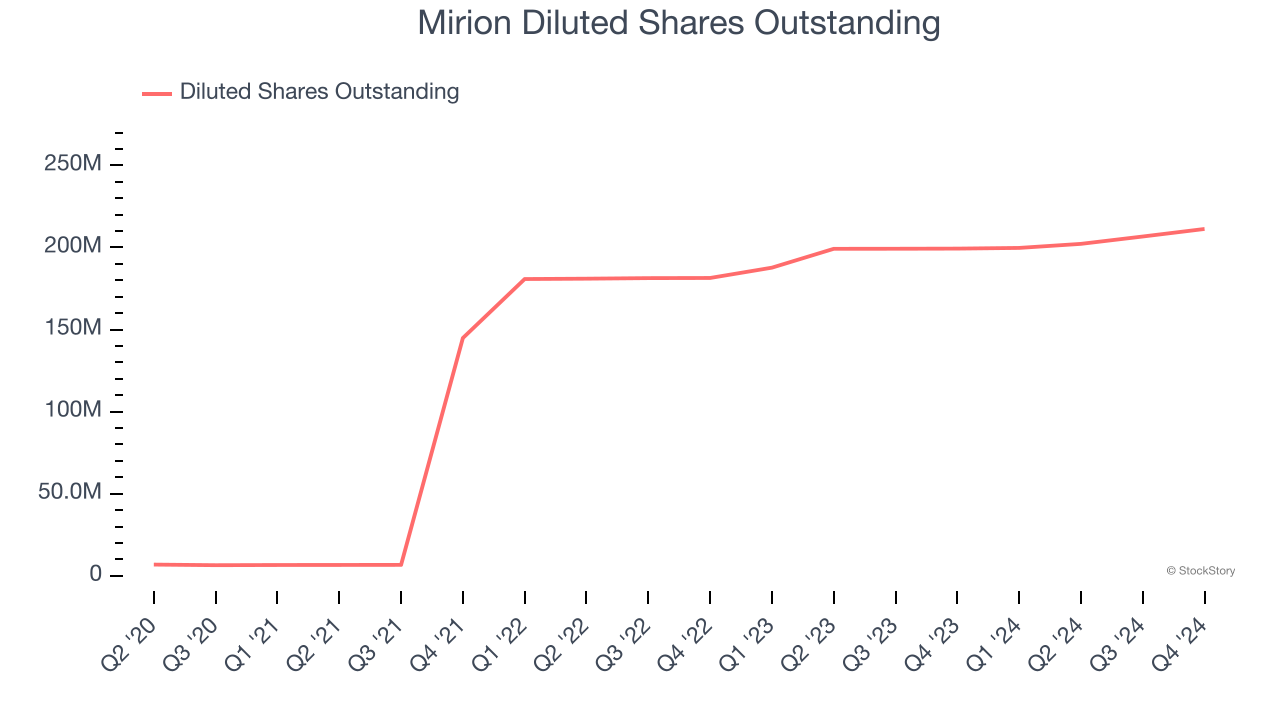

Diving into the nuances of Mirion’s earnings can give us a better understanding of its performance. A two-year view shows Mirion has diluted its shareholders, growing its share count by 16.5%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Mirion reported EPS at $0.17, up from $0.15 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Mirion to perform poorly. Analysts forecast its full-year EPS of $0.41 will hit $0.48.

Key Takeaways from Mirion’s Q4 Results

We were impressed by how significantly Mirion blew past analysts’ revenue expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year EBITDA guidance slightly missed. Zooming out, we think this was a good quarter with some key areas of upside. The stock traded up 6% to $17.15 immediately following the results.

Mirion had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.