Intuit currently trades at $589.99 per share and has shown little upside over the past six months, posting a small loss of 3.6%. The stock also fell short of the S&P 500’s 16% gain during that period.

Is now the time to buy INTU? Find out in our full research report, it’s free.

Why Does Intuit Spark Debate?

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Two Things to Like:

1. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Intuit is extremely efficient at acquiring new customers, and its CAC payback period checked in at 12.7 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation due to its scale. These dynamics give Intuit more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

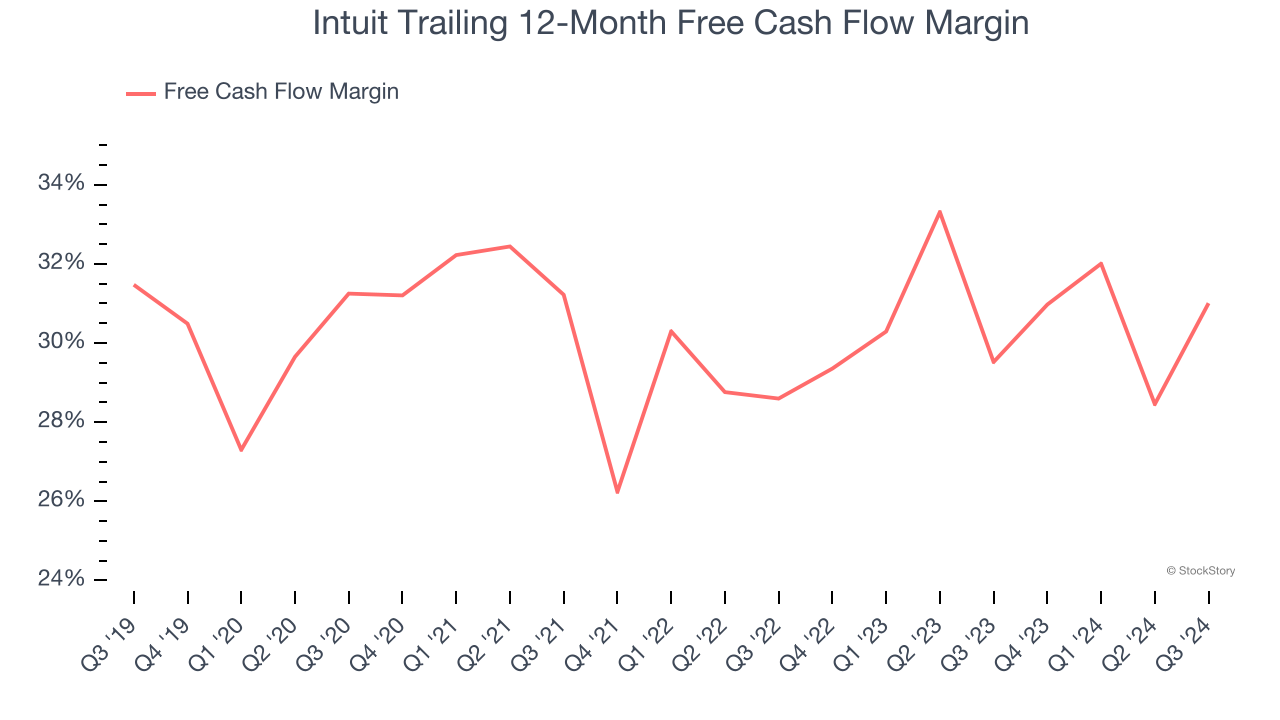

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Intuit has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 31% over the last year.

One Reason to be Careful:

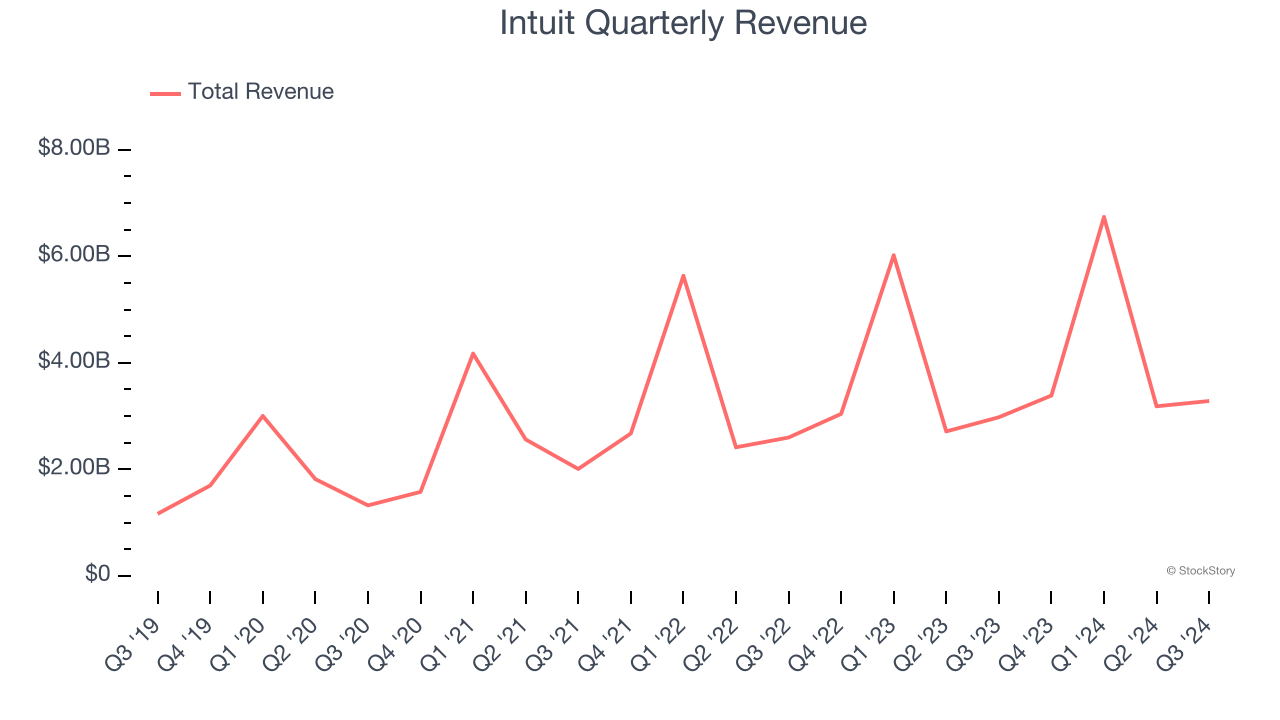

Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Intuit grew its sales at a 17.2% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our benchmark for the software sector, which enjoys a number of secular tailwinds. Luckily, there are other things to like about Intuit.

Final Judgment

Intuit has huge potential even though it has some open questions. With its shares trailing the market in recent months, the stock trades at 8.9× forward price-to-sales (or $589.99 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Intuit

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.