Commercial real estate firm CBRE (NYSE: CBRE) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 12.3% year on year to $8.91 billion. Its non-GAAP profit of $0.86 per share was 11.2% above analysts’ consensus estimates.

Is now the time to buy CBRE? Find out by accessing our full research report, it’s free.

CBRE (CBRE) Q1 CY2025 Highlights:

- Revenue: $8.91 billion vs analyst estimates of $8.86 billion (12.3% year-on-year growth, 0.6% beat)

- Adjusted EPS: $0.86 vs analyst estimates of $0.77 (11.2% beat)

- Adjusted EBITDA: $540 million vs analyst estimates of $503.4 million (6.1% margin, 7.3% beat)

- Operating Margin: 3.1%, in line with the same quarter last year

- Free Cash Flow was -$610 million compared to -$560 million in the same quarter last year

- Market Capitalization: $36.05 billion

“CBRE had a strong start to 2025 across our lines of business and around the world. Notably, as the first quarter ended, most of our businesses were performing better than expected and our new business pipelines were strong. This was equally true for both our Resilient and Transactional businesses,” said Bob Sulentic, CBRE’s chair and CEO.

Company Overview

Established in 1906, CBRE (NYSE: CBRE) is one of the largest commercial real estate services firms in the world.

Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Sales Growth

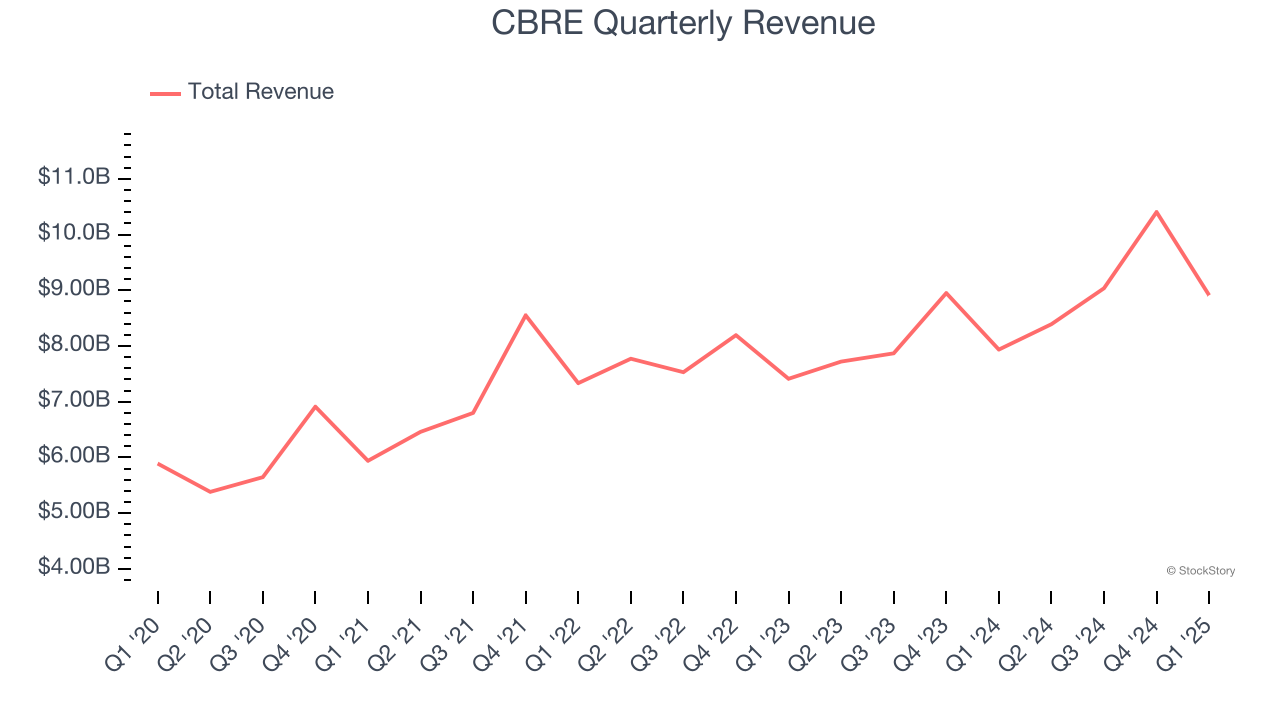

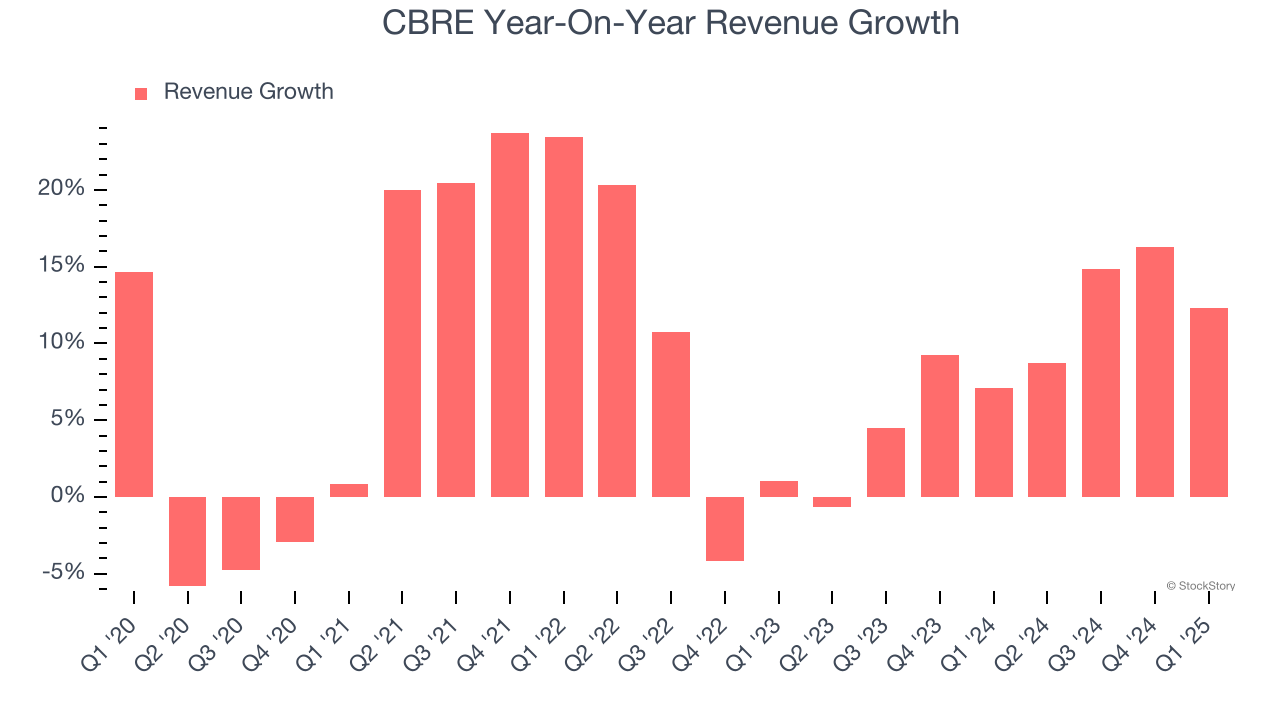

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, CBRE grew its sales at a sluggish 8.3% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. CBRE’s annualized revenue growth of 9% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

CBRE also breaks out the revenue for its most important segment, Advisory Services. Over the last two years, CBRE’s Advisory Services revenue (leasing, capital markets) was flat. This segment has lagged the company’s overall sales.

This quarter, CBRE reported year-on-year revenue growth of 12.3%, and its $8.91 billion of revenue exceeded Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 10.4% over the next 12 months, similar to its two-year rate. Although this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

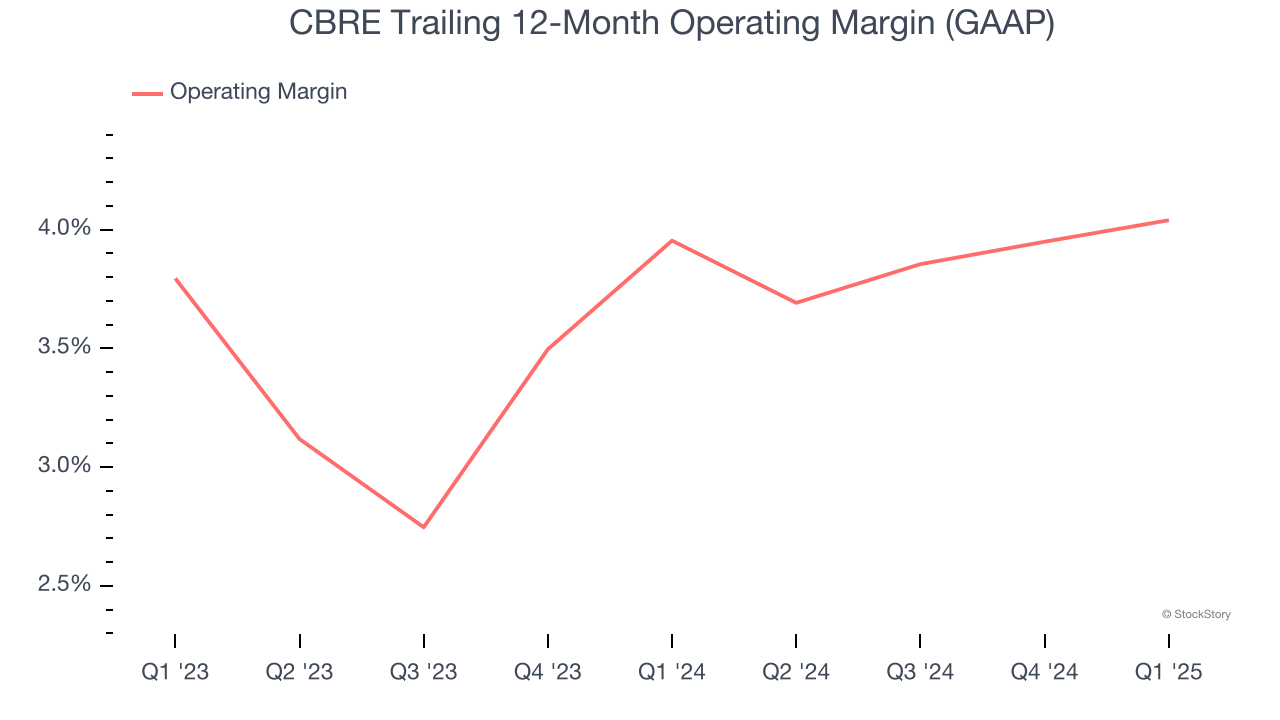

CBRE’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 4% over the last two years. This profitability was lousy for a consumer discretionary business and caused by its suboptimal cost structure.

In Q1, CBRE generated an operating profit margin of 3.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

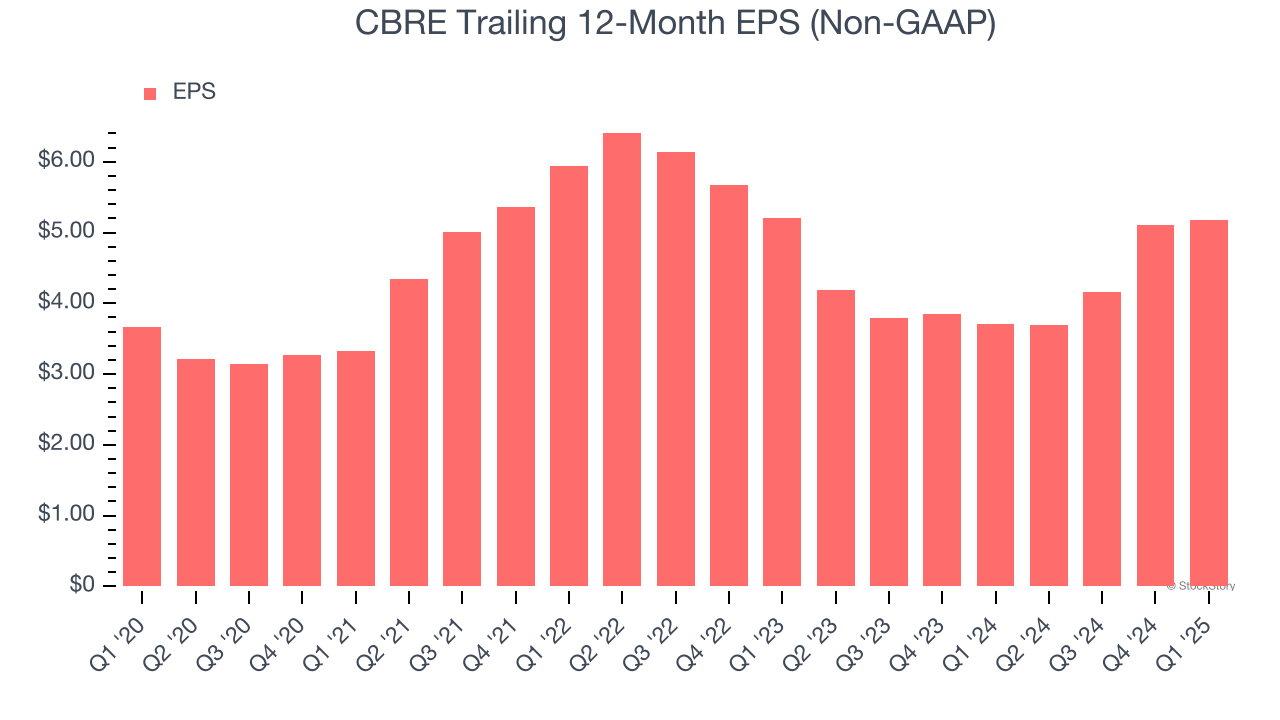

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

CBRE’s EPS grew at an unimpressive 7.1% compounded annual growth rate over the last five years, lower than its 8.3% annualized revenue growth. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

In Q1, CBRE reported EPS at $0.86, up from $0.78 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects CBRE’s full-year EPS of $5.18 to grow 18.7%.

Key Takeaways from CBRE’s Q1 Results

It was encouraging to see CBRE beat analysts’ revenue, EPS, and EBITDA expectations this quarter. Overall, this quarter had some key positives. The stock traded up 1.6% to $123.90 immediately following the results.

CBRE may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.