Personal care and home fragrance retailer Bath & Body Works (NYSE: BBWI) met Wall Street’s revenue expectations in Q1 CY2025, with sales up 2.9% year on year to $1.42 billion. On the other hand, next quarter’s revenue guidance of $1.54 billion was less impressive, coming in 1.6% below analysts’ estimates. Its GAAP profit of $0.49 per share was in line with analysts’ consensus estimates.

Is now the time to buy Bath and Body Works? Find out by accessing our full research report, it’s free.

Bath and Body Works (BBWI) Q1 CY2025 Highlights:

- Revenue: $1.42 billion vs analyst estimates of $1.42 billion (2.9% year-on-year growth, in line)

- EPS (GAAP): $0.49 vs analyst estimates of $0.49 (in line)

- Adjusted EBITDA: $283 million vs analyst estimates of $275.8 million (19.9% margin, 2.6% beat)

- Revenue Guidance for Q2 CY2025 is $1.54 billion at the midpoint, below analyst estimates of $1.57 billion

- EPS (GAAP) guidance for the full year is $3.43 at the midpoint, missing analyst estimates by 3.9%

- Operating Margin: 14.7%, up from 13.5% in the same quarter last year

- Free Cash Flow Margin: 10.6%, up from 2.2% in the same quarter last year

- Locations: 2,424 at quarter end, up from 2,341 in the same quarter last year

- Market Capitalization: $6.49 billion

Daniel Heaf, CEO of Bath & Body Works, commented, “I’m honored to join this iconic brand with a deep sense of purpose and a powerful foundation. I have already had the privilege of meeting many associates across the company, and I’m incredibly impressed by the passion, dedication, and talent across our teams. I believe we’re incredibly well positioned to define and lead the home fragrance and beauty categories globally and accelerate growth.”

Company Overview

Spun off from L Brands in 2020, Bath & Body Works (NYSE: BBWI) is a personal care and home fragrance retailer where consumers can find specialty shower gels, scented candles for the home, and lotions.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $7.35 billion in revenue over the past 12 months, Bath and Body Works is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

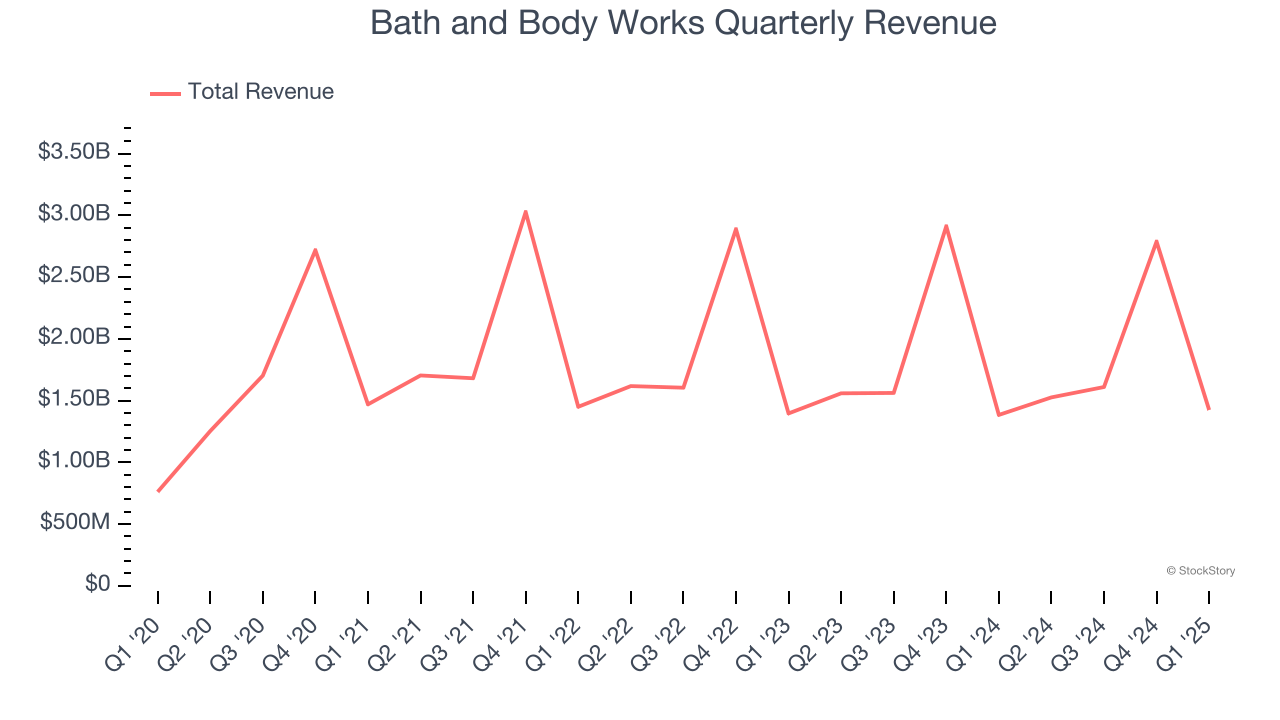

As you can see below, Bath and Body Works’s sales grew at a tepid 6.7% compounded annual growth rate over the last six years (we compare to 2019 to normalize for COVID-19 impacts).

This quarter, Bath and Body Works grew its revenue by 2.9% year on year, and its $1.42 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.3% over the next 12 months, a deceleration versus the last six years. This projection is underwhelming and indicates its products will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Store Performance

Number of Stores

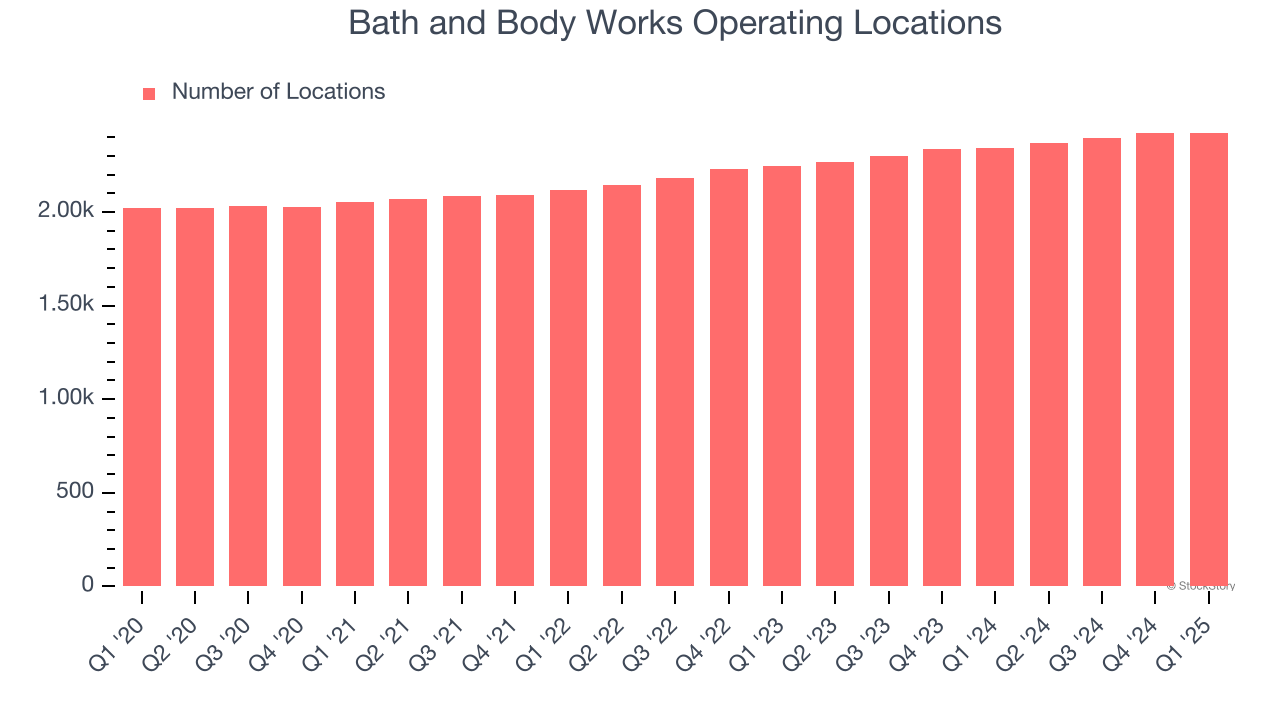

A retailer’s store count often determines how much revenue it can generate.

Bath and Body Works sported 2,424 locations in the latest quarter. Over the last two years, it has opened new stores at a rapid clip by averaging 4.5% annual growth, among the fastest in the consumer retail sector. This gives it a chance to become a large, scaled business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

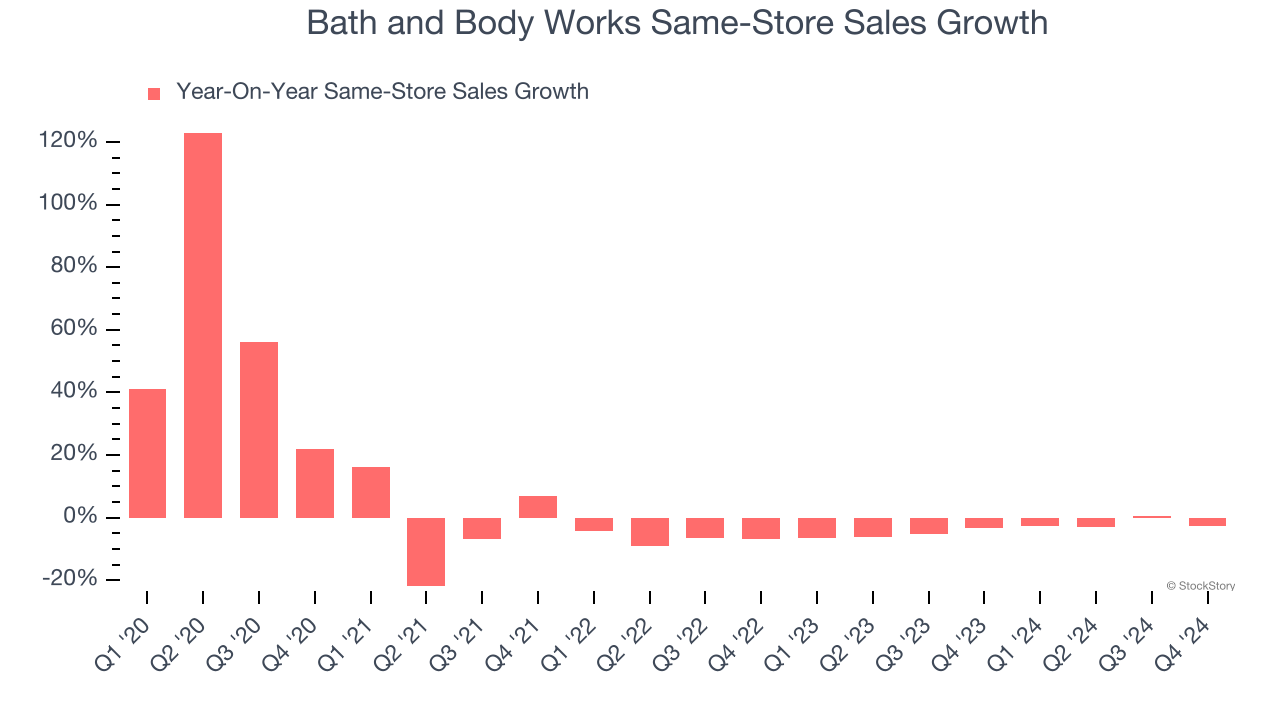

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

Bath and Body Works’s demand has been shrinking over the last two years as its same-store sales have averaged 3.3% annual declines. This performance is concerning - it shows Bath and Body Works artificially boosts its revenue by building new stores. We’d like to see a company’s same-store sales rise before it takes on the costly, capital-intensive endeavor of expanding its store base.

Note that Bath and Body Works reports its same-store sales intermittently, so some data points are missing in the chart below.

Key Takeaways from Bath and Body Works’s Q1 Results

We enjoyed seeing Bath and Body Works beat analysts’ gross margin and EBITDA expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $30.56 immediately after reporting.

Bath and Body Works may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.