Footwear and apparel retailer Foot Locker (NYSE: FL) fell short of the market’s revenue expectations in Q1 CY2025, with sales falling 4.5% year on year to $1.79 billion. Its non-GAAP loss of $0.07 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Foot Locker? Find out by accessing our full research report, it’s free.

Foot Locker (FL) Q1 CY2025 Highlights:

- Revenue: $1.79 billion vs analyst estimates of $1.84 billion (4.5% year-on-year decline, 2.3% miss)

- Adjusted EPS: -$0.07 vs analyst estimates of -$0.02 (significant miss)

- Adjusted EBITDA: -$214 million vs analyst estimates of $52.35 million (-11.9% margin, significant miss)

- Operating Margin: -15.1%, down from 1% in the same quarter last year

- Free Cash Flow was -$61 million compared to -$18 million in the same quarter last year

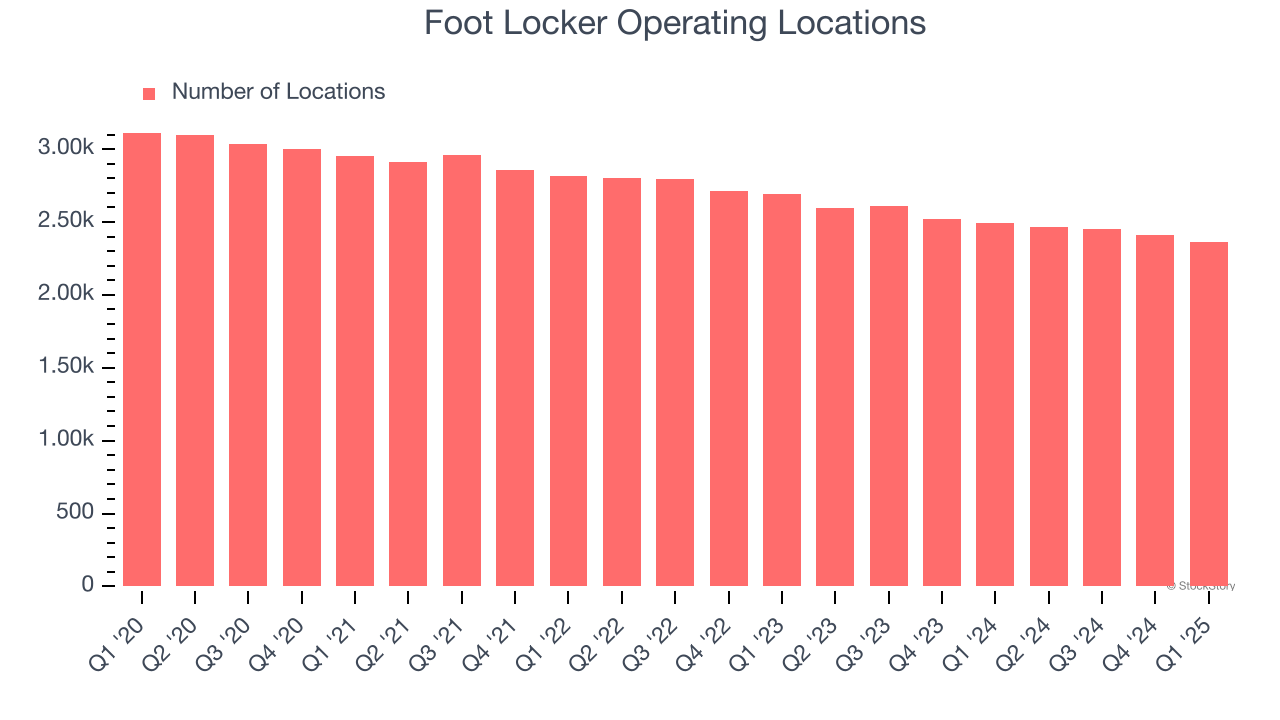

- Locations: 2,363 at quarter end, down from 2,490 in the same quarter last year

- Same-Store Sales fell 2.6% year on year, in line with the same quarter last year

- Market Capitalization: $2.28 billion

Mary Dillon, Chief Executive Officer said, "We are continuing to execute our Lace Up Plan strategies as we look forward to the successful completion of our transaction with DICK'S Sporting Goods. As we noted at the time we reported preliminary first quarter results, we experienced softer traffic trends globally that impacted our performance. During the quarter, we remained focused on the rollout of our Reimagined and Refresh programs to elevate our in-store experience, enhancing our digital offerings, deepening customer engagement through our FLX program and leveraging our strong brand partnerships to generate excitement for our customers. As we have executed these and other initiatives to further advance our strategy, our teams have also remained nimble to navigate the uncertain macroeconomic environment, including managing our promotional levels, inventories, and expenses and remaining disciplined with our cash flows."

Company Overview

Known for store associates whose uniforms resemble those of referees, Foot Locker (NYSE: FL) is a specialty retailer that sells athletic footwear, clothing, and accessories.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $7.90 billion in revenue over the past 12 months, Foot Locker is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

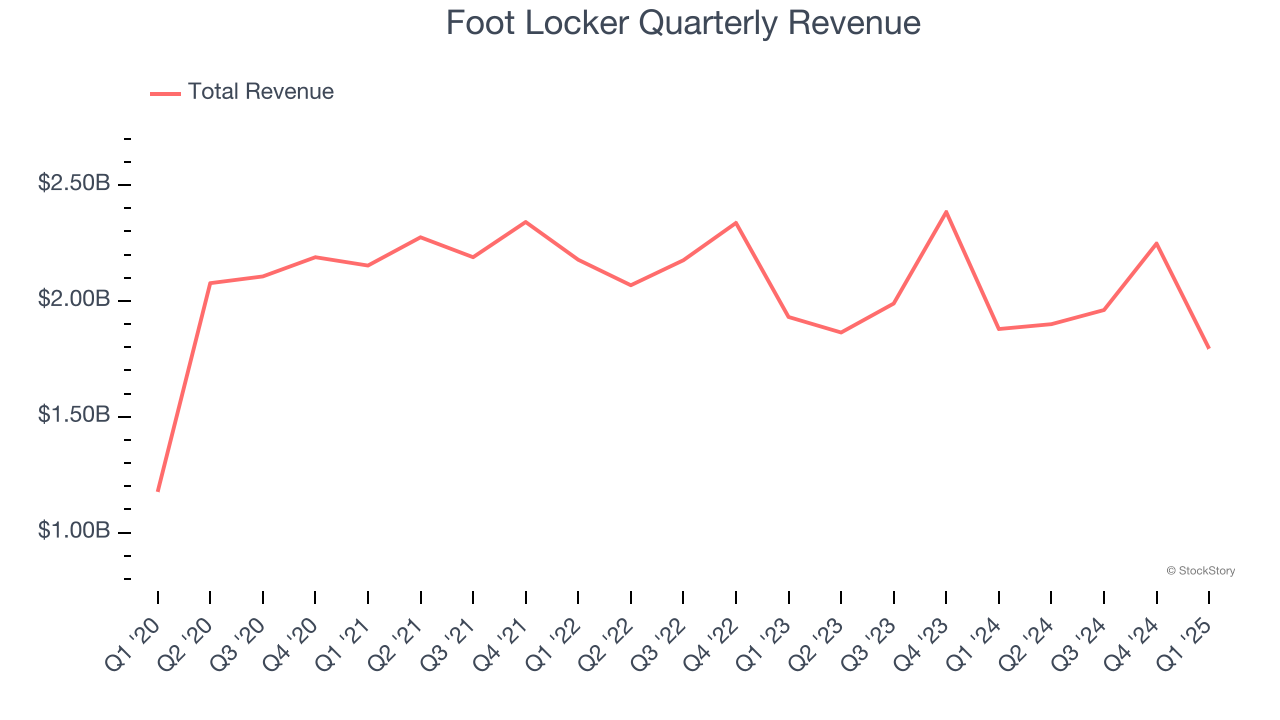

As you can see below, Foot Locker struggled to increase demand as its $7.90 billion of sales for the trailing 12 months was close to its revenue six years ago (we compare to 2019 to normalize for COVID-19 impacts). This was mainly because it closed stores and observed lower sales at existing, established locations.

This quarter, Foot Locker missed Wall Street’s estimates and reported a rather uninspiring 4.5% year-on-year revenue decline, generating $1.79 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. This projection doesn't excite us and implies its newer products will not catalyze better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Store Performance

Number of Stores

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Foot Locker operated 2,363 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 6.1% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

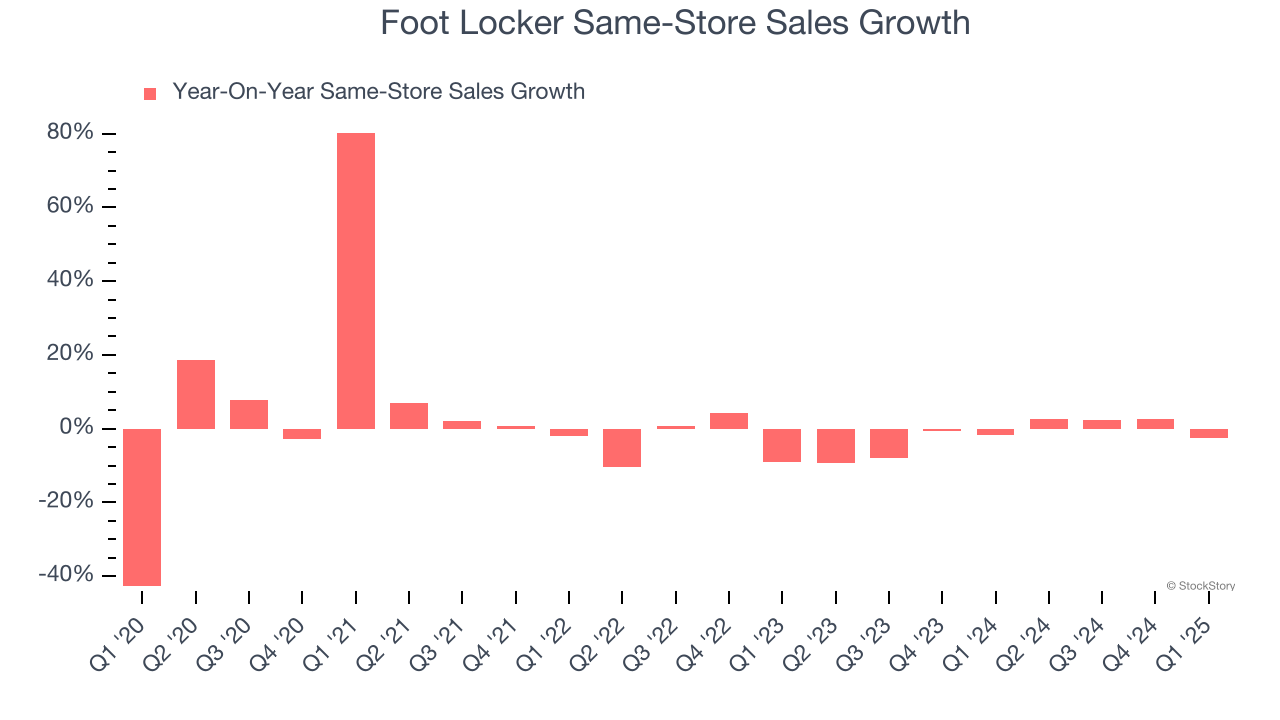

Foot Locker’s demand has been shrinking over the last two years as its same-store sales have averaged 1.9% annual declines. This performance isn’t ideal, and Foot Locker is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Foot Locker’s same-store sales fell by 2.6% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Foot Locker’s Q1 Results

It was encouraging to see Foot Locker beat analysts’ gross margin expectations this quarter. On the other hand, its revenue, EPS, and EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $23.94 immediately after reporting.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.