Payments and billing software maker Bill.com (NYSE: BILL) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 10.9% year on year to $358.2 million. On the other hand, next quarter’s revenue guidance of $375.5 million was less impressive, coming in 1.8% below analysts’ estimates. Its non-GAAP profit of $0.62 per share was 65.8% above analysts’ consensus estimates.

Is now the time to buy Bill.com? Find out by accessing our full research report, it’s free.

Bill.com (BILL) Q1 CY2025 Highlights:

- Revenue: $358.2 million vs analyst estimates of $355.4 million (10.9% year-on-year growth, 0.8% beat)

- Adjusted EPS: $0.62 vs analyst estimates of $0.37 (65.8% beat)

- Adjusted Operating Income: $53.3 million vs analyst estimates of $41.32 million (14.9% margin, 29% beat)

- Revenue Guidance for Q2 CY2025 is $375.5 million at the midpoint, below analyst estimates of $382.3 million

- Management raised its full-year Adjusted EPS guidance to $2.08 at the midpoint, a 8.1% increase

- Operating Margin: -8.1%, in line with the same quarter last year

- Free Cash Flow Margin: 25.3%, up from 19.8% in the previous quarter

- Customers: 488,600

- Market Capitalization: $4.73 billion

Company Overview

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE: BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

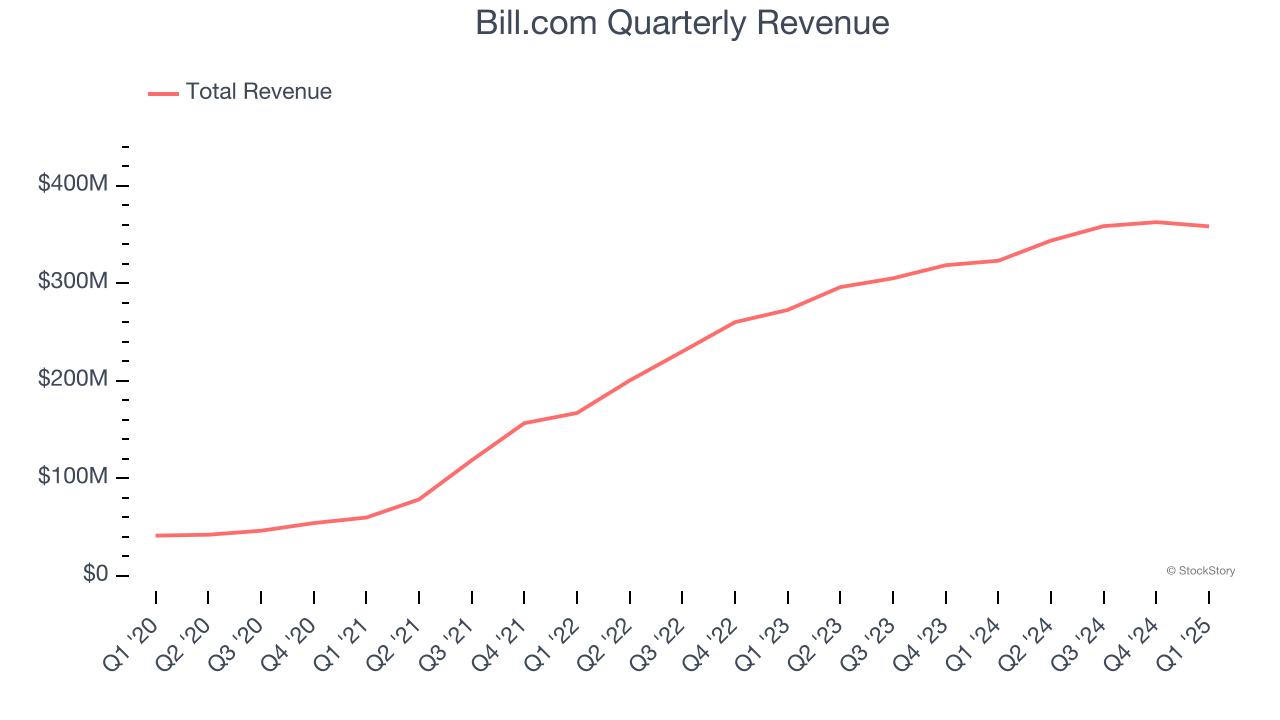

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Bill.com grew its sales at an exceptional 39.9% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

This quarter, Bill.com reported year-on-year revenue growth of 10.9%, and its $358.2 million of revenue exceeded Wall Street’s estimates by 0.8%. Company management is currently guiding for a 9.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 12.6% over the next 12 months, a deceleration versus the last three years. Still, this projection is above average for the sector and suggests the market is baking in some success for its newer products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

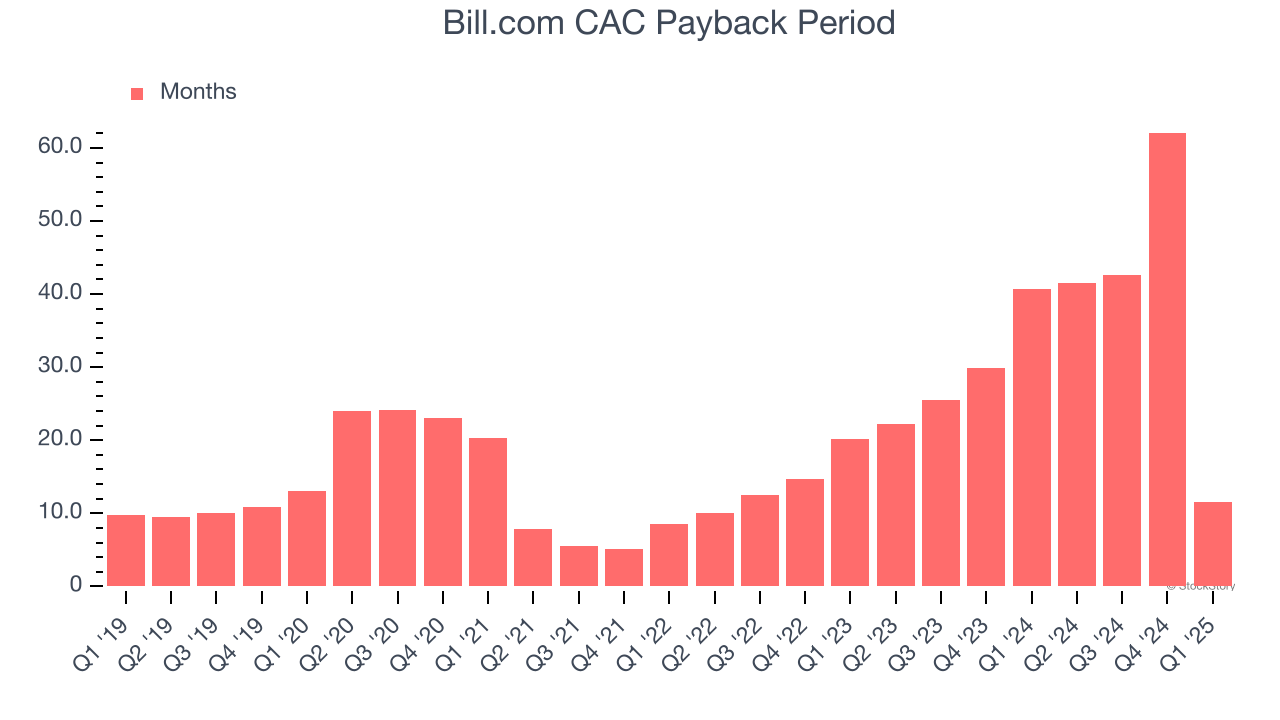

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Bill.com is extremely efficient at acquiring new customers, and its CAC payback period checked in at 11.6 months this quarter. The company’s rapid sales cycles stem from its strong brand reputation and self-serve model, where it can onboard many small customers with little to no oversight. These dynamics give Bill.com more resources to pursue new product initiatives so it can potentially move up market and serve enterprise clients, which can provide a second leg of growth.

Key Takeaways from Bill.com’s Q1 Results

We were impressed by Bill.com’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed significantly and its full-year revenue guidance was in line with Wall Street’s estimates. Overall, this print was mixed but still had some key positives. Investors were likely hoping for more, and shares traded down 2.2% to $46.50 immediately after reporting.

Should you buy the stock or not? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.