Boutique fitness studio franchisor Xponential Fitness (NYSE: XPOF) missed Wall Street’s revenue expectations in Q2 CY2025, with sales flat year on year at $76.21 million. The company’s full-year revenue guidance of $305 million at the midpoint came in 4.4% below analysts’ estimates. Its non-GAAP profit of $0.26 per share was 11.1% below analysts’ consensus estimates.

Is now the time to buy Xponential Fitness? Find out by accessing our full research report, it’s free.

Xponential Fitness (XPOF) Q2 CY2025 Highlights:

- Revenue: $76.21 million vs analyst estimates of $77.35 million (flat year on year, 1.5% miss)

- Adjusted EPS: $0.26 vs analyst expectations of $0.29 (11.1% miss)

- Adjusted EBITDA: $28.1 million vs analyst estimates of $29.27 million (36.9% margin, 4% miss)

- The company dropped its revenue guidance for the full year to $305 million at the midpoint from $320 million, a 4.7% decrease

- EBITDA guidance for the full year is $108.5 million at the midpoint, below analyst estimates of $121.2 million

- Operating Margin: 19.5%, up from -3.1% in the same quarter last year

- Free Cash Flow Margin: 1.3%, similar to the same quarter last year

- Market Capitalization: $360.4 million

Company Overview

Owner of CycleBar, Rumble, and Club Pilates, Xponential Fitness (NYSE: XPOF) is a boutique fitness brand offering diverse and specialized exercise experiences.

Revenue Growth

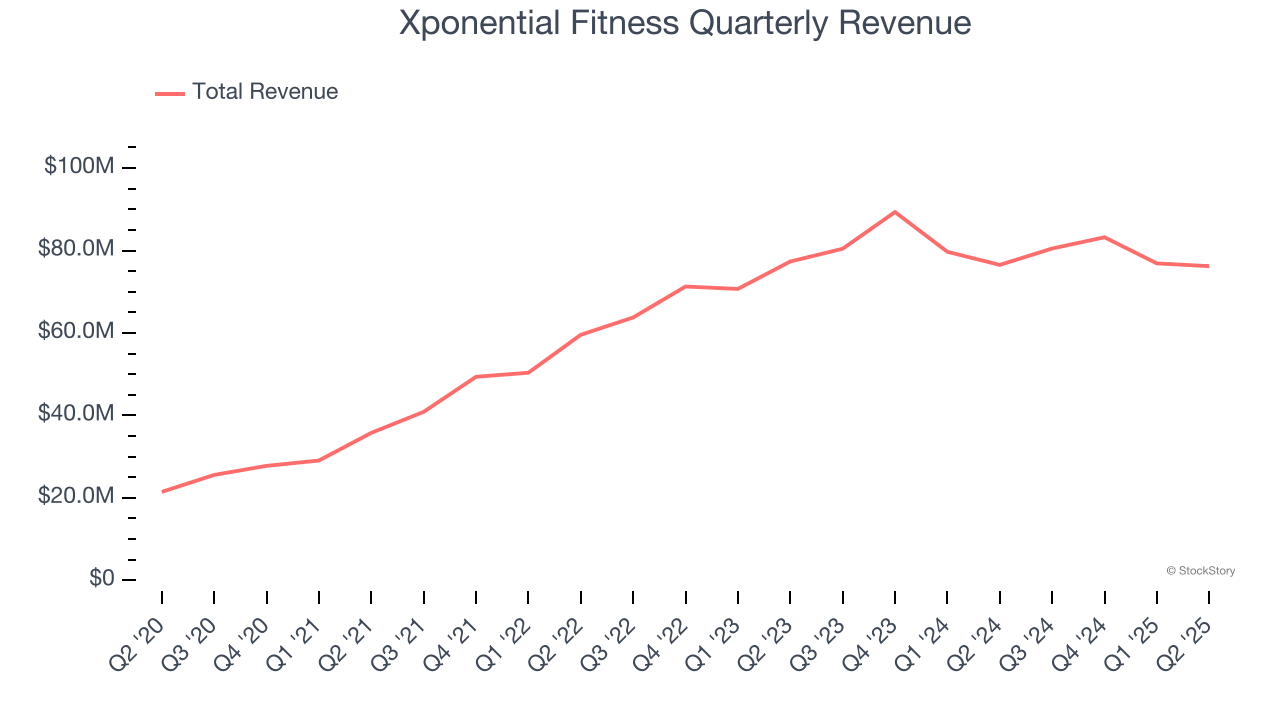

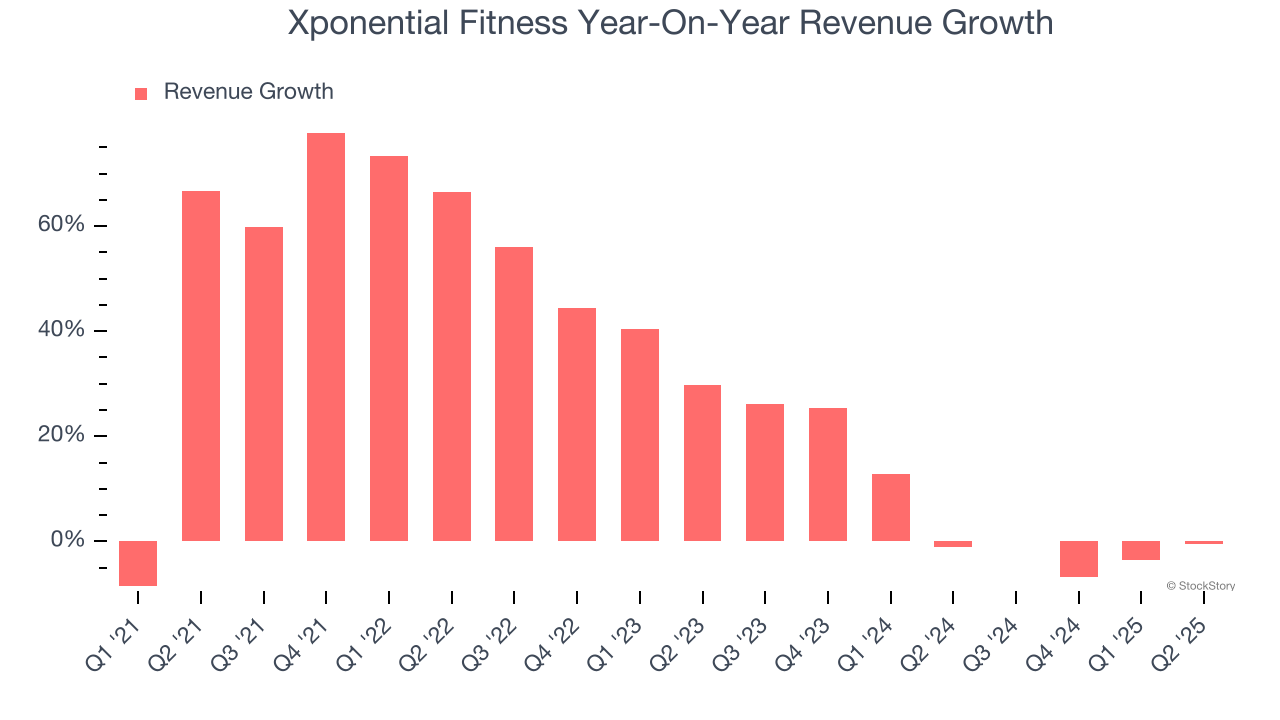

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Xponential Fitness grew its sales at an impressive 23.5% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Xponential Fitness’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 5.8% over the last two years was well below its five-year trend. Note that COVID hurt Xponential Fitness’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

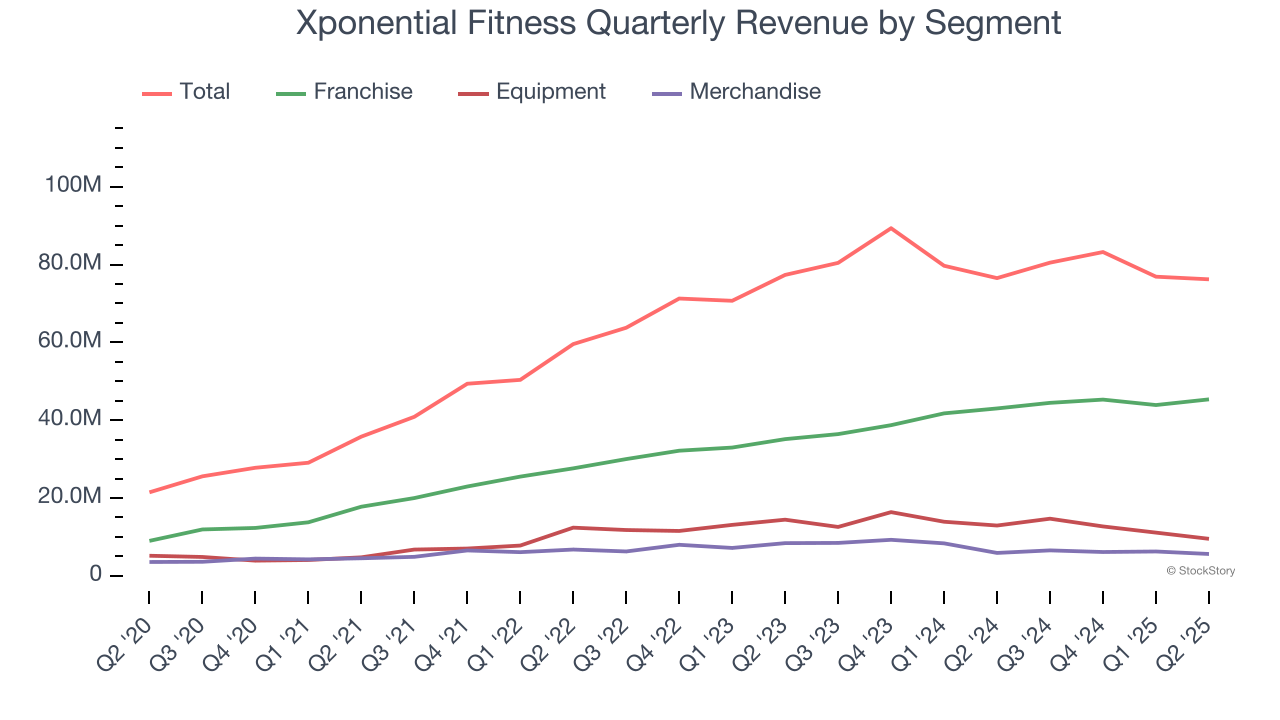

Xponential Fitness also breaks out the revenue for its three most important segments: Franchise, Equipment, and Merchandise, which are 59.5%, 12.5%, and 7.4% of revenue. Over the last two years, Xponential Fitness’s Franchise revenue (royalty fees) averaged 17.6% year-on-year growth. On the other hand, its Equipment revenue (workout equipment sold to franchisees) was flat while its Merchandise revenue (apparel sold to franchisees) averaged 6.1% declines.

This quarter, Xponential Fitness missed Wall Street’s estimates and reported a rather uninspiring 0.4% year-on-year revenue decline, generating $76.21 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.7% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

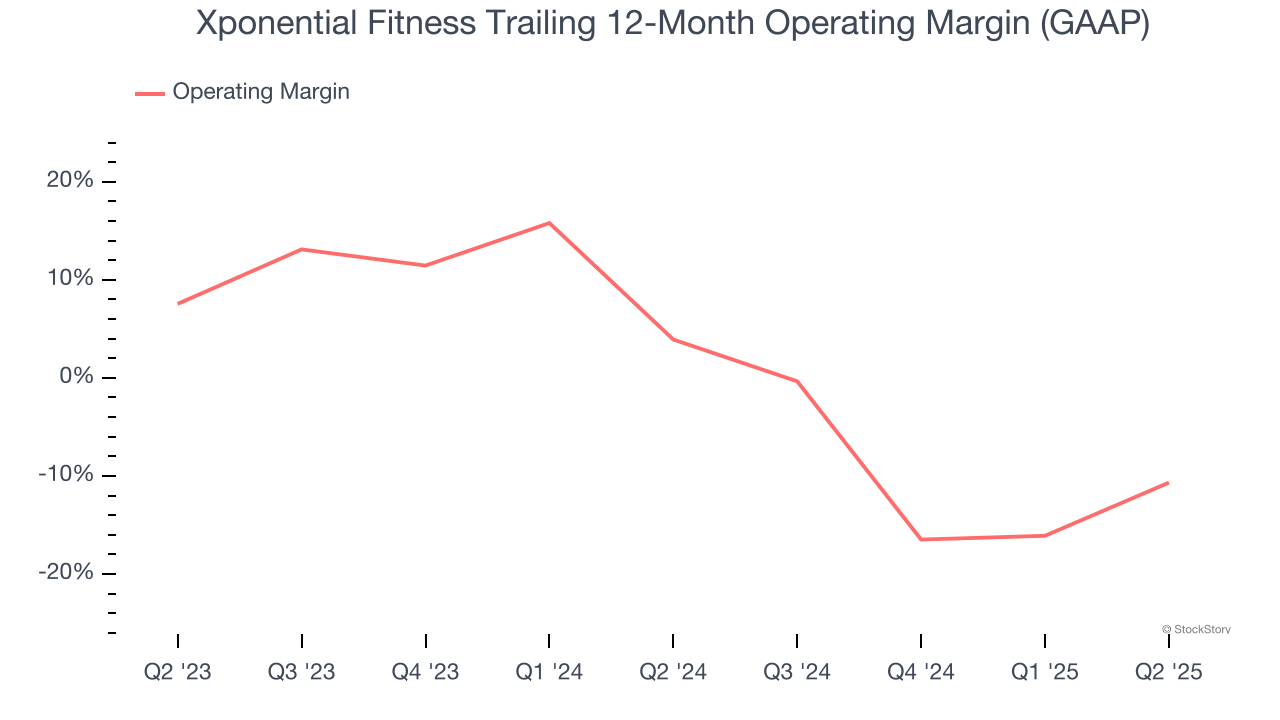

Xponential Fitness’s operating margin has been trending down over the last 12 months and averaged negative 3.3% over the last two years. Unprofitable, high-growth companies warrant extra scrutiny, especially if their margins fall because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q2, Xponential Fitness generated an operating margin profit margin of 19.5%, up 22.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

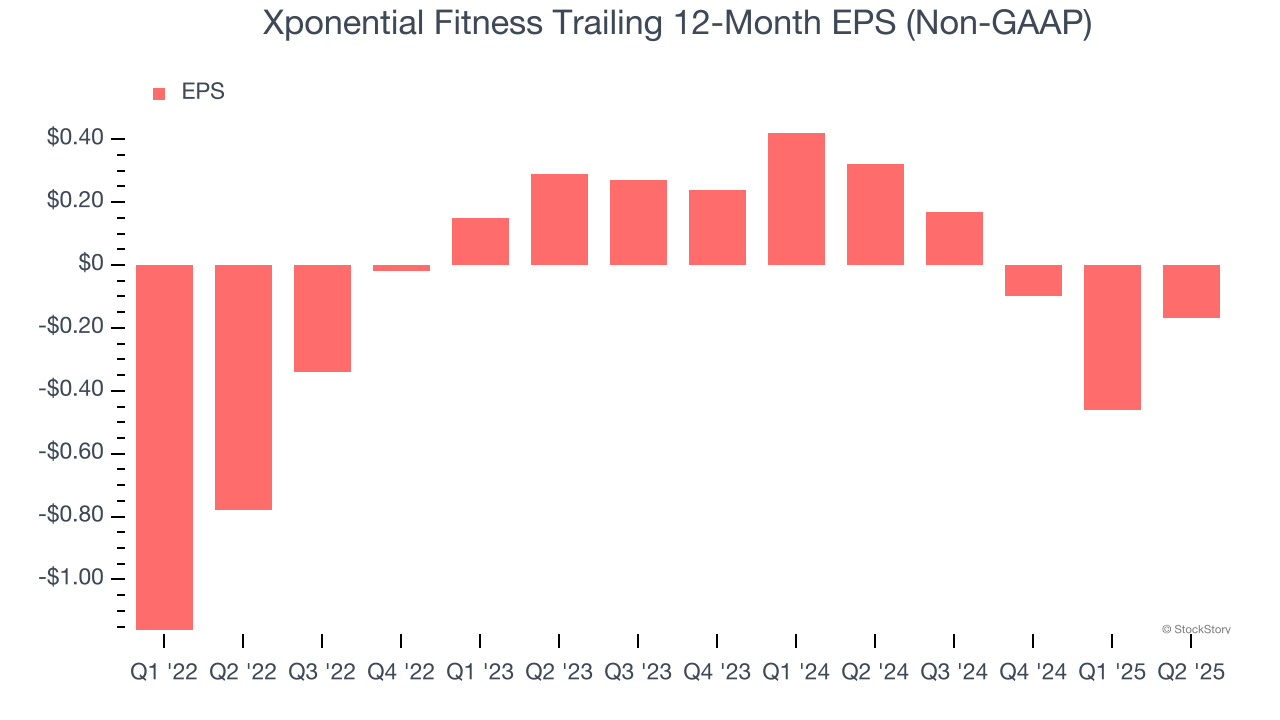

Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q2, Xponential Fitness reported adjusted EPS at $0.26, up from negative $0.03 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Xponential Fitness’s full-year EPS of negative $0.17 will flip to positive $1.50.

Key Takeaways from Xponential Fitness’s Q2 Results

We struggled to find many positives in these results. Its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 14.8% to $8.20 immediately after reporting.

Xponential Fitness may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.