The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how WillScot Mobile Mini (NASDAQ: WSC) and the rest of the construction and maintenance services stocks fared in Q3.

Construction and maintenance services companies not only boast technical know-how in specialized areas but also may hold special licenses and permits. Those who work in more regulated areas can enjoy more predictable revenue streams - for example, fire escapes need to be inspected every five years. More recently, services to address energy efficiency and labor availability are also creating incremental demand. But like the broader industrials sector, construction and maintenance services companies are at the whim of economic cycles as external factors like interest rates can greatly impact the new construction that drives incremental demand for these companies’ offerings.

The 13 construction and maintenance services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

Luckily, construction and maintenance services stocks have performed well with share prices up 13.3% on average since the latest earnings results.

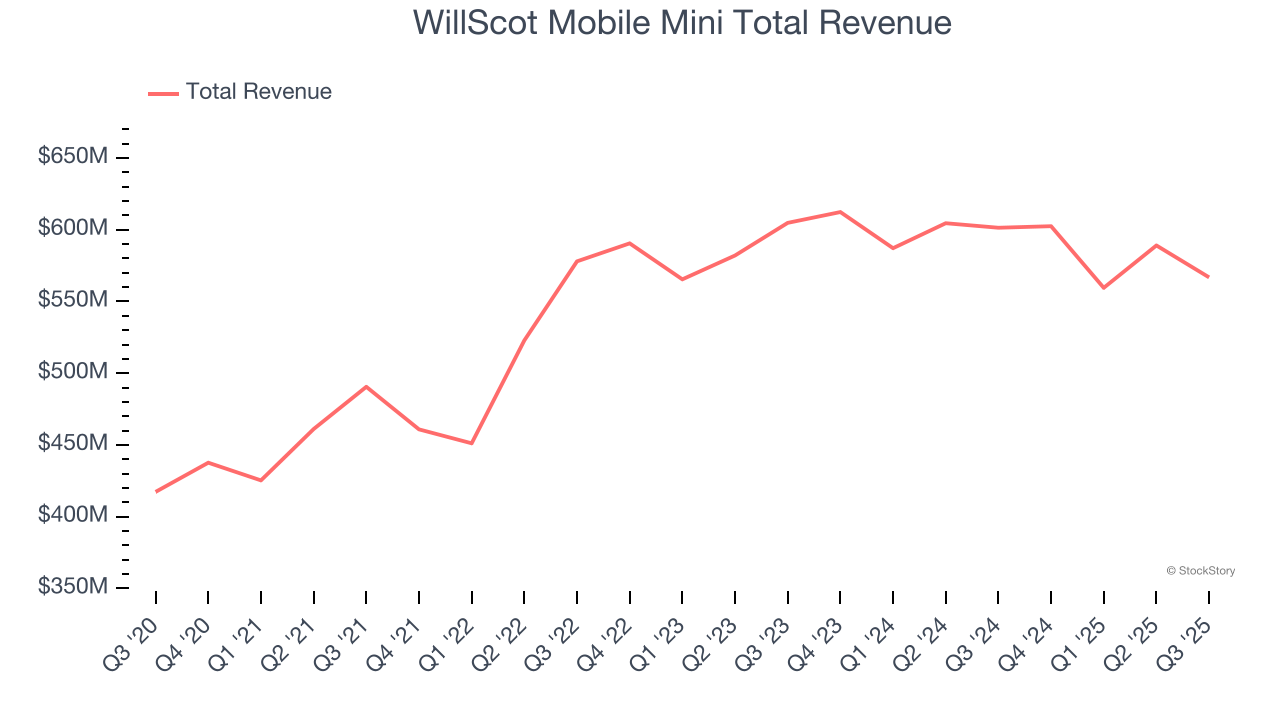

Weakest Q3: WillScot Mobile Mini (NASDAQ: WSC)

Originally focusing on mobile offices for construction sites, WillScot (NASDAQ: WSC) provides ready-to-use temporary spaces, largely for longer-term lease.

WillScot Mobile Mini reported revenues of $566.8 million, down 5.8% year on year. This print fell short of analysts’ expectations by 2.3%. Overall, it was a softer quarter for the company with a miss of analysts’ Delivery and Installation revenue estimates and revenue guidance for next quarter missing analysts’ expectations significantly.

Brad Soultz, Chief Executive Officer of WillScot, commented, “Our third quarter 2025 financial results were mixed. We delivered strong cash flow, and the team remains focused on executing the growth and operational excellence initiatives we outlined in March at our 2025 Investor Day. Our customer service team made significant progress improving our collections processes where we are realizing meaningful improvements in customer satisfaction and steady improvements in days sales outstanding, as well as a temporary increase in accounts receivable write-offs. Leasing revenues excluding write-offs were stable sequentially, with favorable rate and mix offsetting year-over-year volume headwinds. With that impact of increased write-offs largely confined to 2025, we are focused on the areas in our portfolio where we believe strong demand and our differentiated products and services will drive growth into 2026, particularly in Enterprise Accounts and more differentiated service offerings. With ongoing uncertainty around the market trajectory, we remain agile in terms of controlling what we can control, specifically adjusting our cost structure and implementing our operating improvement initiatives to maintain our free cash flow and return profile. I want to thank our entire team for its steadfast dedication and hard-work which are the cornerstones to providing value to our customers and shareholders.”

WillScot Mobile Mini delivered the slowest revenue growth of the whole group. Interestingly, the stock is up 3.2% since reporting and currently trades at $20.19.

Read our full report on WillScot Mobile Mini here, it’s free.

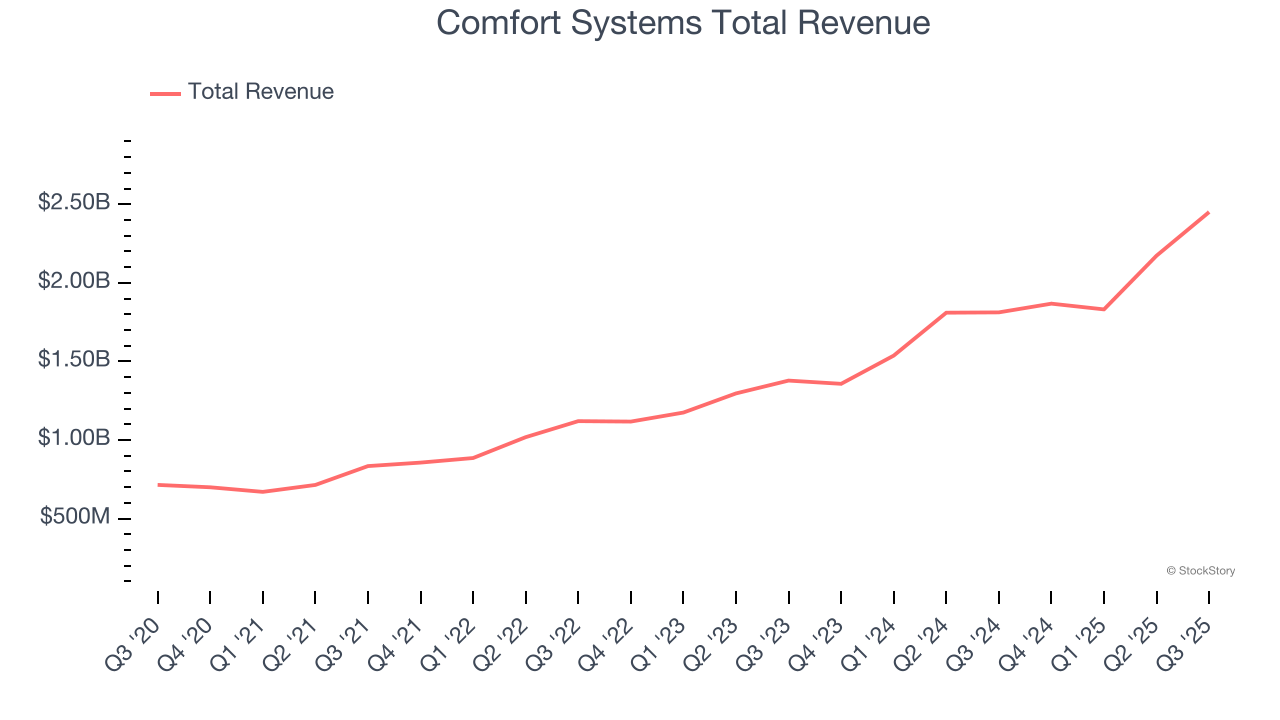

Best Q3: Comfort Systems (NYSE: FIX)

Formed through the merger of 12 companies, Comfort Systems (NYSE: FIX) provides mechanical and electrical contracting services.

Comfort Systems reported revenues of $2.45 billion, up 35.2% year on year, outperforming analysts’ expectations by 13.2%. The business had an incredible quarter with an impressive beat of analysts’ backlog estimates and a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 42.6% since reporting. It currently trades at $1,176.

Is now the time to buy Comfort Systems? Access our full analysis of the earnings results here, it’s free.

Matrix Service (NASDAQ: MTRX)

Founded in Oklahoma, Matrix Service (NASDAQ: MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

Matrix Service reported revenues of $211.9 million, up 28% year on year, exceeding analysts’ expectations by 2.5%. Still, it was a slower quarter as it posted a significant miss of analysts’ EBITDA estimates and EPS in line with analysts’ estimates.

Matrix Service delivered the weakest full-year guidance update in the group. As expected, the stock is down 8.4% since the results and currently trades at $14.30.

Read our full analysis of Matrix Service’s results here.

Orion (NYSE: ORN)

Established in 1994, Orion (NYSE: ORN) provides construction services for marine infrastructure and industrial projects.

Orion reported revenues of $225.1 million, flat year on year. This number was in line with analysts’ expectations. Overall, it was a strong quarter as it also logged a beat of analysts’ EPS estimates and full-year EBITDA guidance slightly topping analysts’ expectations.

The stock is up 44.4% since reporting and currently trades at $12.52.

Read our full, actionable report on Orion here, it’s free.

MYR Group (NASDAQ: MYRG)

Constructing electrical and phone lines in the American Midwest dating back to the 1890s, MYR Group (NASDAQ: MYRG) is a specialty contractor in the electrical construction industry.

MYR Group reported revenues of $950.4 million, up 7% year on year. This result topped analysts’ expectations by 2.8%. It was a strong quarter as it also produced a solid beat of analysts’ revenue estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 12.9% since reporting and currently trades at $254.64.

Read our full, actionable report on MYR Group here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.