Over the last six months, Federal Signal’s shares have sunk to $112.02, producing a disappointing 10.1% loss - a stark contrast to the S&P 500’s 9.6% gain. This may have investors wondering how to approach the situation.

Following the drawdown, is now the time to buy FSS? Find out in our full research report, it’s free.

Why Is Federal Signal a Good Business?

Developing sirens that warned of air raid attacks or fallout during the Cold War, Federal Signal (NYSE: FSS) provides safety and emergency equipment for government agencies, municipalities, and industrial companies.

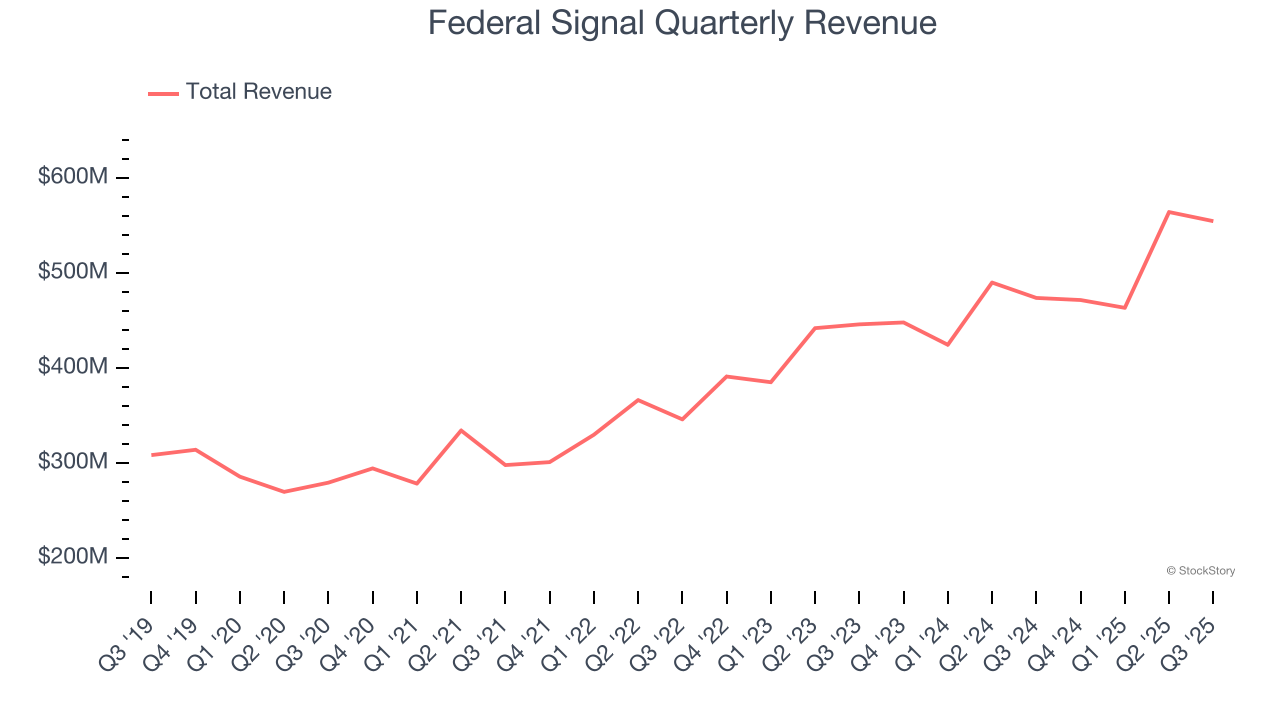

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Federal Signal grew its sales at an excellent 12.3% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Federal Signal’s revenue to rise by 15.6%, an improvement versus its 12.3% annualized growth for the past five years. This projection is eye-popping and suggests its newer products and services will fuel better top-line performance.

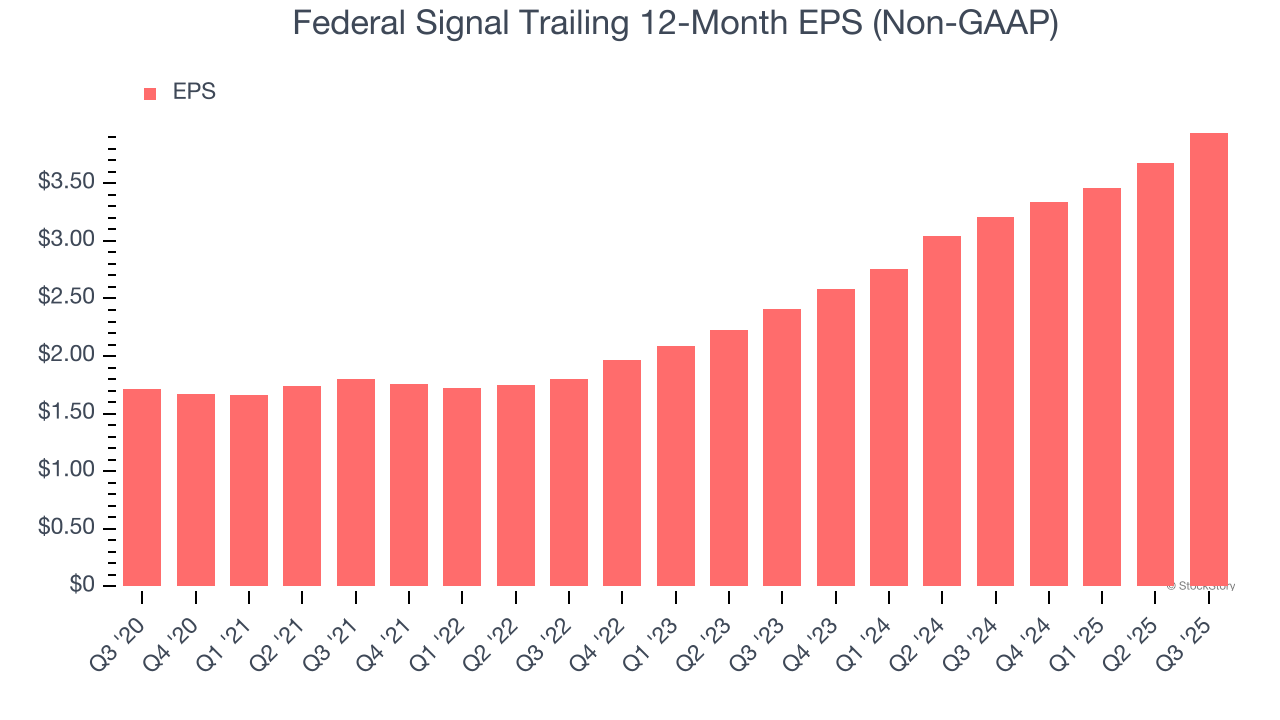

3. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Federal Signal’s EPS grew at an astounding 18.2% compounded annual growth rate over the last five years, higher than its 12.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we think Federal Signal is a high-quality business. With the recent decline, the stock trades at 23.8× forward P/E (or $112.02 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Federal Signal

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.