PNC Financial Services Group has had an impressive run over the past six months as its shares have beaten the S&P 500 by 10.8%. The stock now trades at $227.76, marking a 20.5% gain. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy PNC Financial Services Group, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is PNC Financial Services Group Not Exciting?

Despite the momentum, we don't have much confidence in PNC Financial Services Group. Here are three reasons why PNC doesn't excite us and a stock we'd rather own.

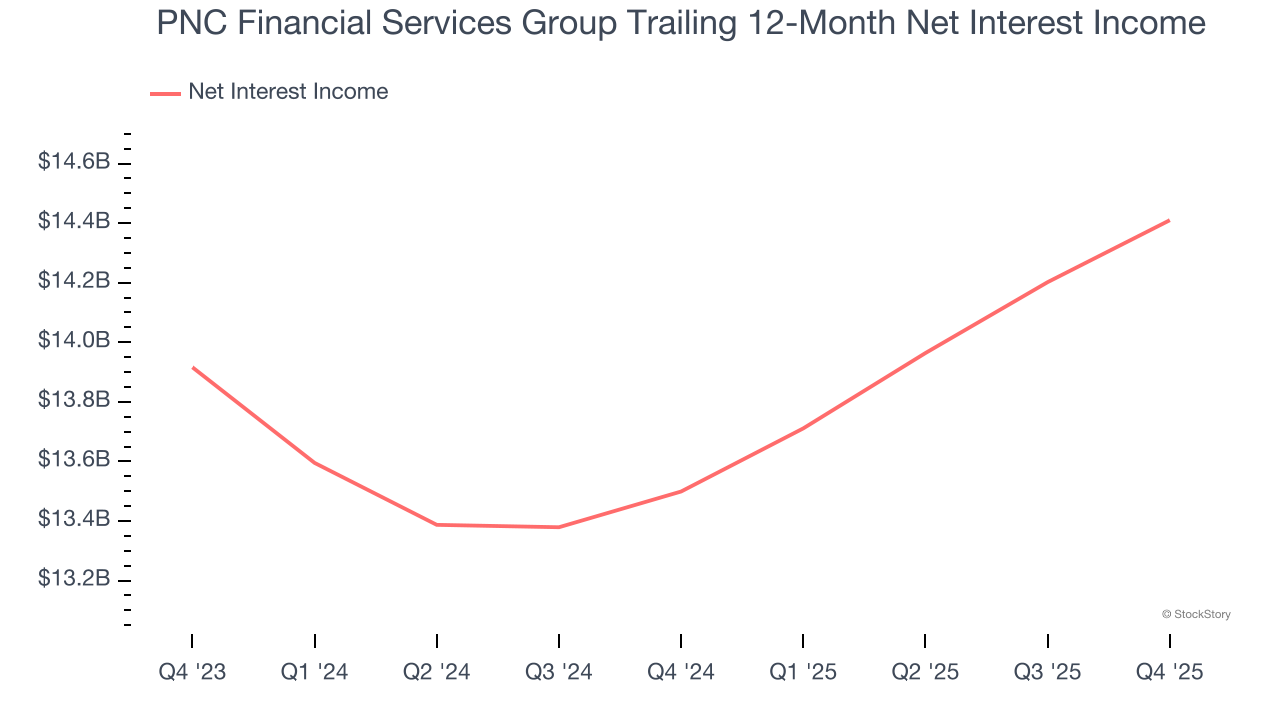

1. Net Interest Income Points to Soft Demand

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

PNC Financial Services Group’s net interest income has grown at a 7.7% annualized rate over the last five years, worse than the broader banking industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

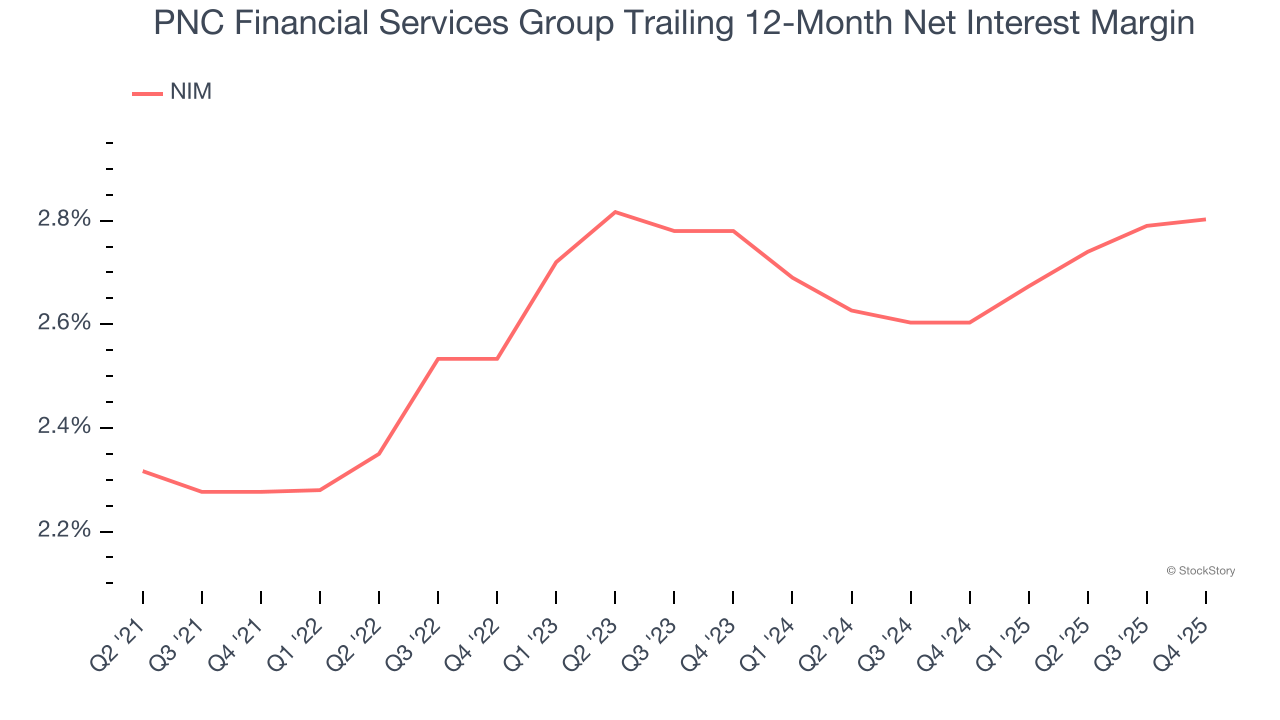

2. Low Net Interest Margin Reveals Weak Loan Book Profitability

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, we can see that PNC Financial Services Group’s net interest margin averaged a weak 2.7%, reflecting its high servicing and capital costs.

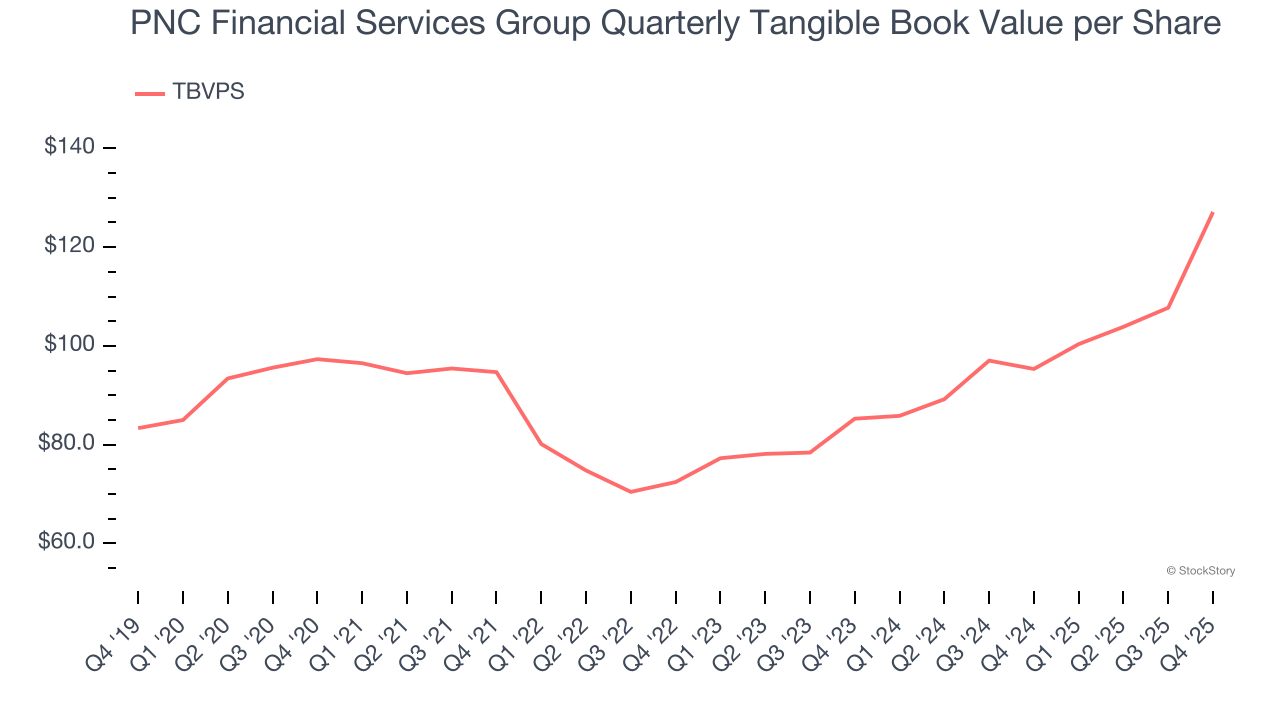

3. TBVPS Projections Show Stormy Skies Ahead

Tangible book value per share (TBVPS) growth is driven by a bank’s ability to earn more than its cost of capital through lending activities while maintaining a strong balance sheet.

Over the next 12 months, Consensus estimates call for PNC Financial Services Group’s TBVPS to shrink by 7.7% to $117.27, a sour projection.

Final Judgment

PNC Financial Services Group isn’t a terrible business, but it doesn’t pass our bar. With its shares beating the market recently, the stock trades at 1.5× forward P/B (or $227.76 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of PNC Financial Services Group

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.