Telecom software provider Amdocs (NASDAQ: DOX) met Wall Streets revenue expectations in Q4 CY2025, with sales up 4.1% year on year to $1.16 billion. Its non-GAAP profit of $1.81 per share was 3% above analysts’ consensus estimates.

Is now the time to buy Amdocs? Find out by accessing our full research report, it’s free.

Amdocs (DOX) Q4 CY2025 Highlights:

- Revenue: $1.16 billion vs analyst estimates of $1.15 billion (4.1% year-on-year growth, in line)

- Adjusted EPS: $1.81 vs analyst estimates of $1.76 (3% beat)

- Adjusted EBITDA: $281.5 million vs analyst estimates of $292.6 million (24.4% margin, 3.8% miss)

- Operating Margin: 17.9%, in line with the same quarter last year

- Free Cash Flow Margin: 16.3%, up from 7% in the same quarter last year

- Backlog: $4.25 billion at quarter end, up 2.7% year on year

- Market Capitalization: $8.74 billion

"First quarter financial results were consistent with our guidance as we continue to focus on our primary goal of reaccelerating Amdocs' long-term growth and extending our position as a market leader for the generative AI era. I am proud to announce that Amdocs has extended our long-term relationship with T-Mobile under a new multi-year agreement which includes managed services, software development, and AI innovation. In addition, we signed an expanded multi-year engagement at Vodafone Germany, added two new western European logos, and closed the acquisition of Matrixx Software as a strategic consolidation move which complements and expands our activities at Verizon, Telus, Telefonica, Swisscom, Three, Virgin Media O2, Telstra and other customers. As to generative AI, our accelerated development roadmap is progressing as planned with today's announcement of aOS, an agentic operating system purpose-built for telecommunications which we expect can provide a new long-term growth engine for Amdocs," said Shuky Sheffer, president and chief executive officer of Amdocs Management Limited.

Company Overview

Powering the digital experiences of approximately 400 communications companies worldwide, Amdocs (NASDAQ: DOX) provides software and services that help telecommunications and media companies manage customer relationships, monetize services, and automate network operations.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $4.58 billion in revenue over the past 12 months, Amdocs is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. For Amdocs to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

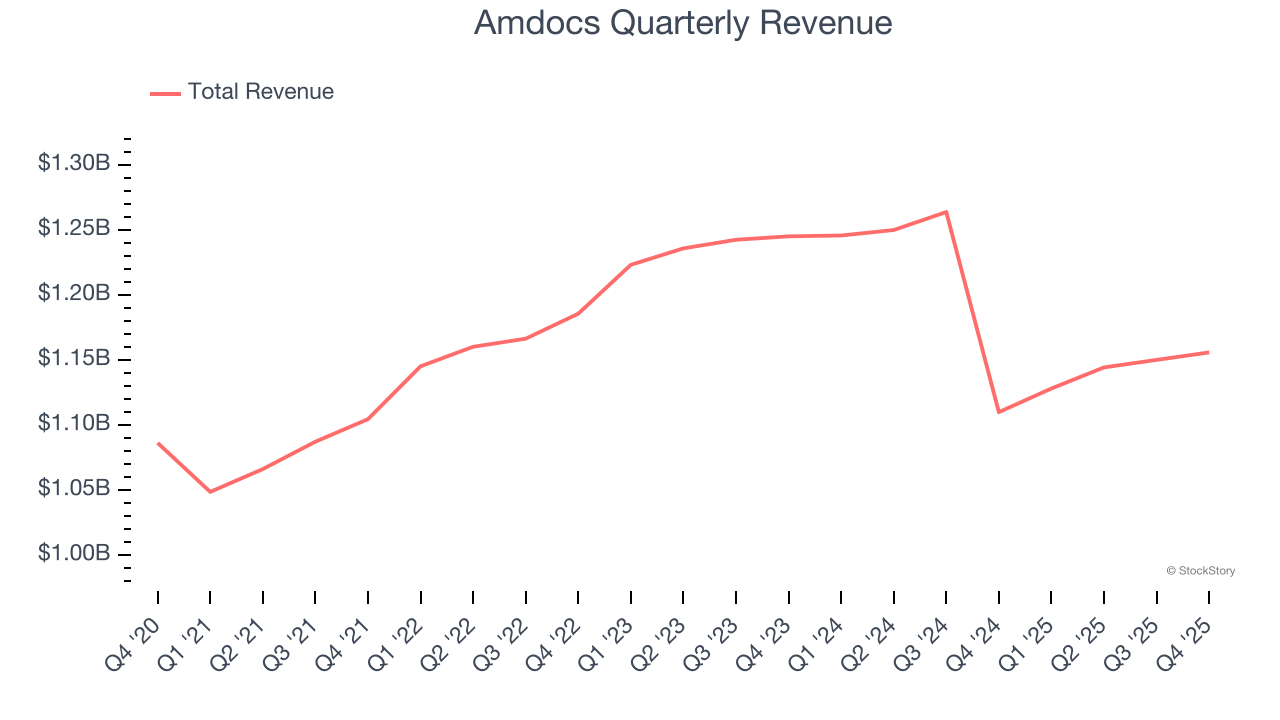

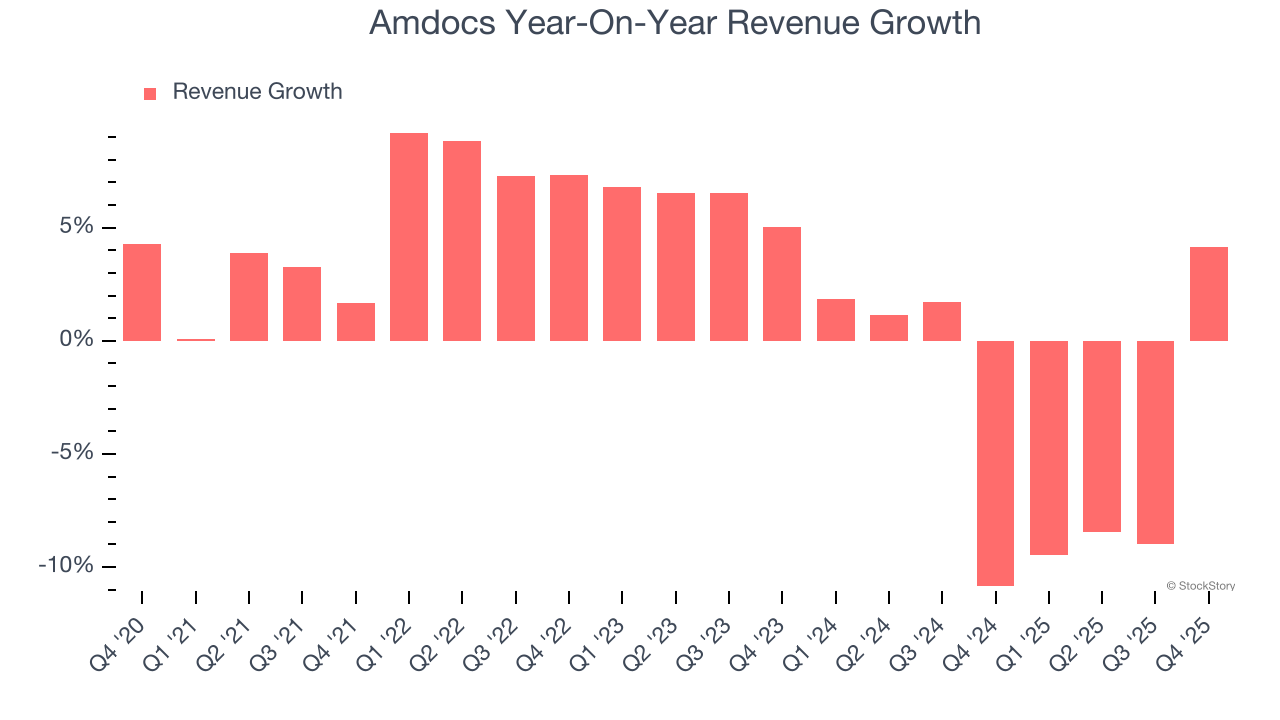

As you can see below, Amdocs grew its sales at a sluggish 1.7% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Amdocs’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 3.8% annually.

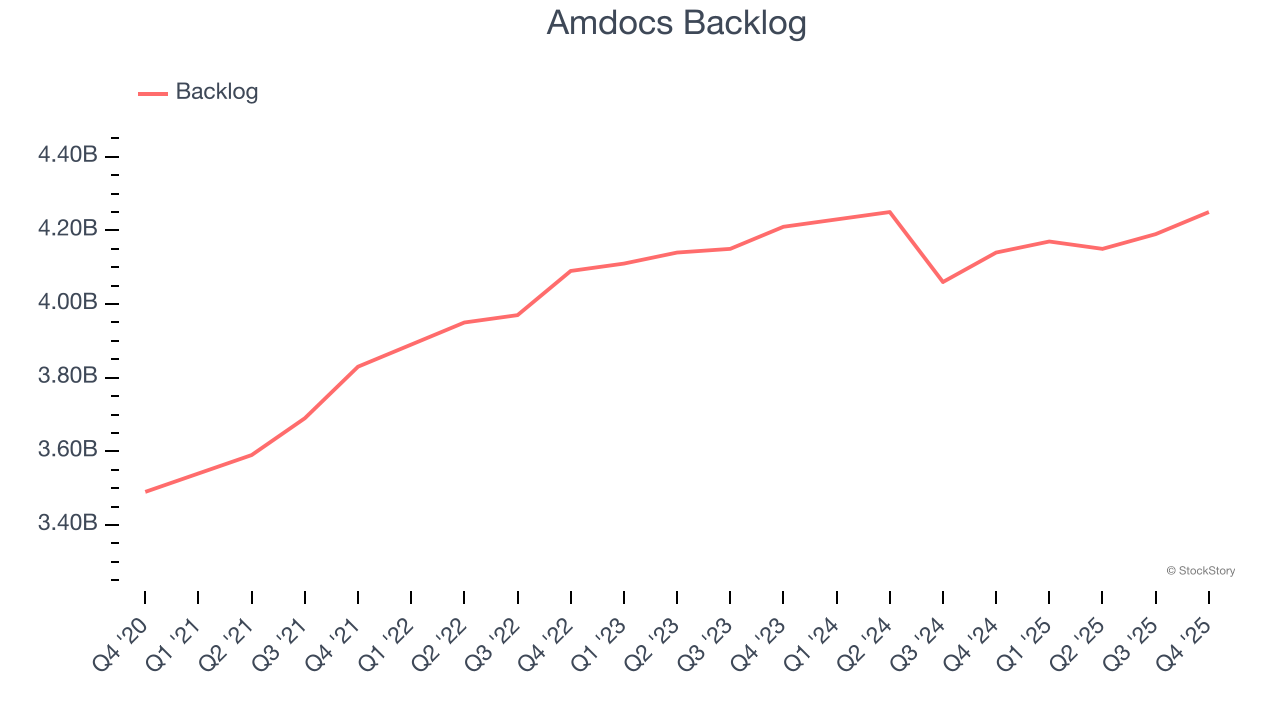

We can dig further into the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Amdocs’s backlog reached $4.25 billion in the latest quarter and was flat over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Amdocs’s products and services but raises concerns about capacity constraints.

This quarter, Amdocs grew its revenue by 4.1% year on year, and its $1.16 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months. While this projection indicates its newer products and services will catalyze better top-line performance, it is still below the sector average.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

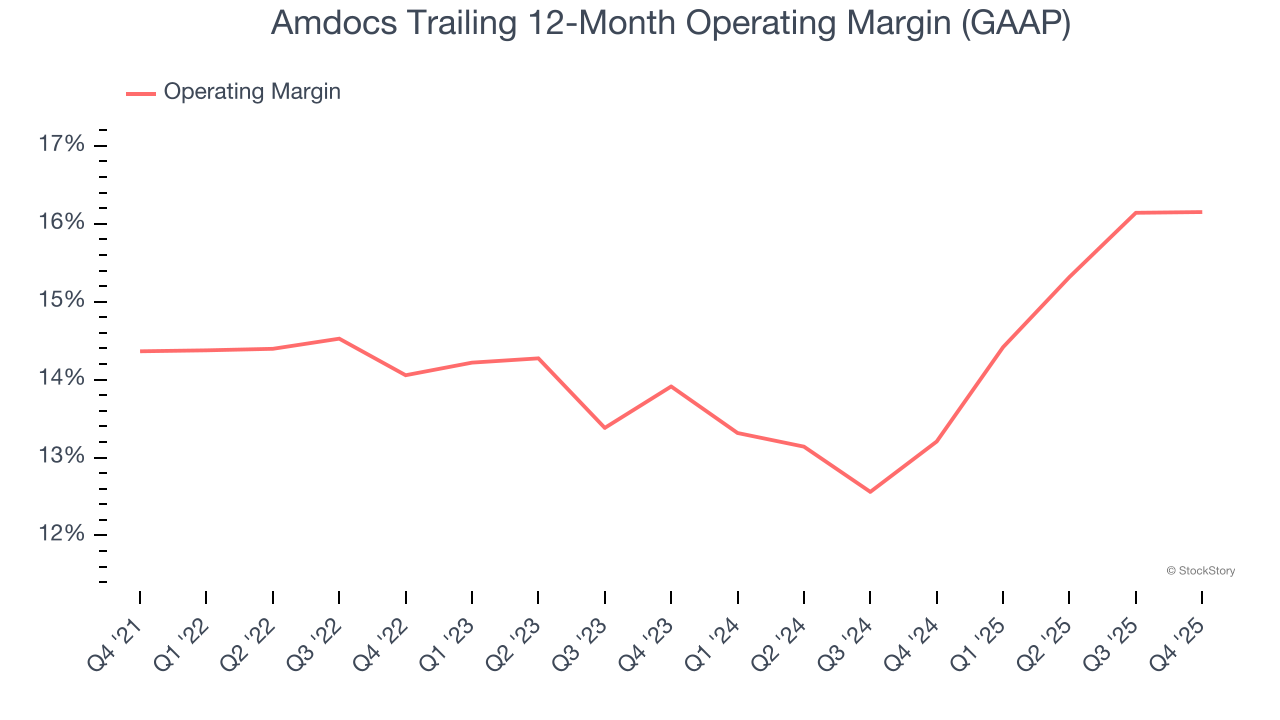

Amdocs has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 14.3%.

Analyzing the trend in its profitability, Amdocs’s operating margin rose by 1.8 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Amdocs generated an operating margin profit margin of 17.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

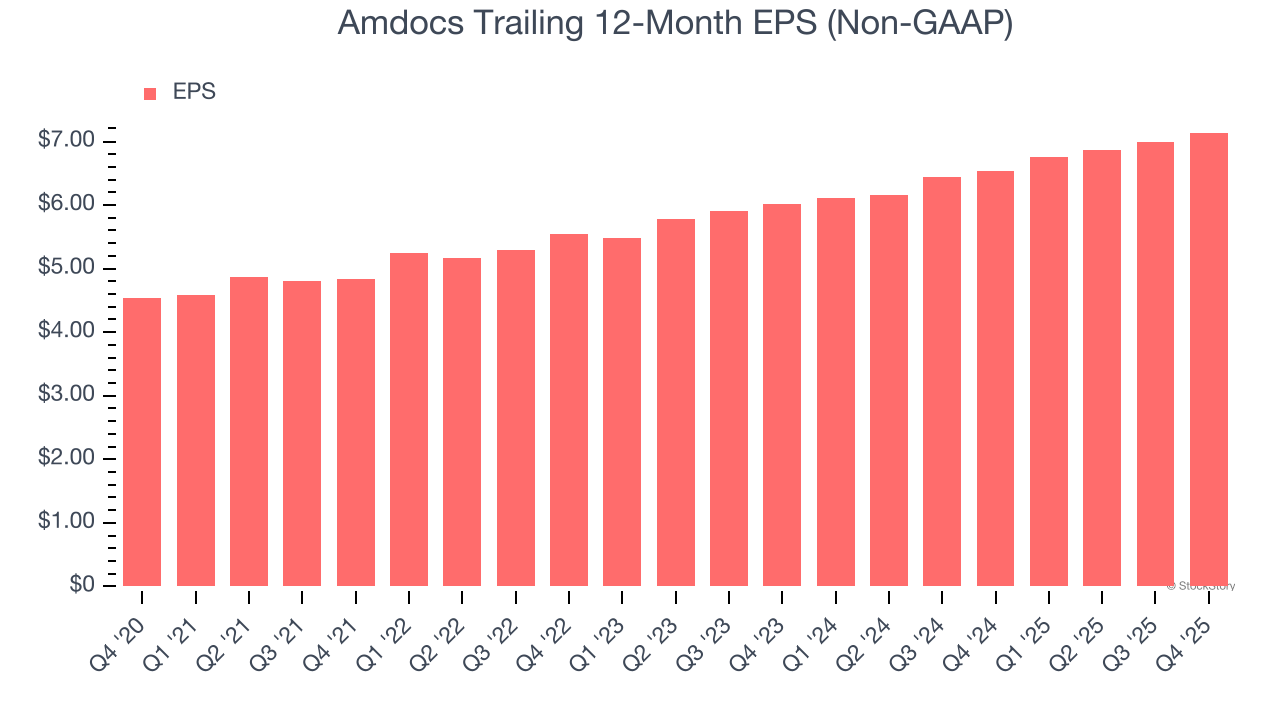

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

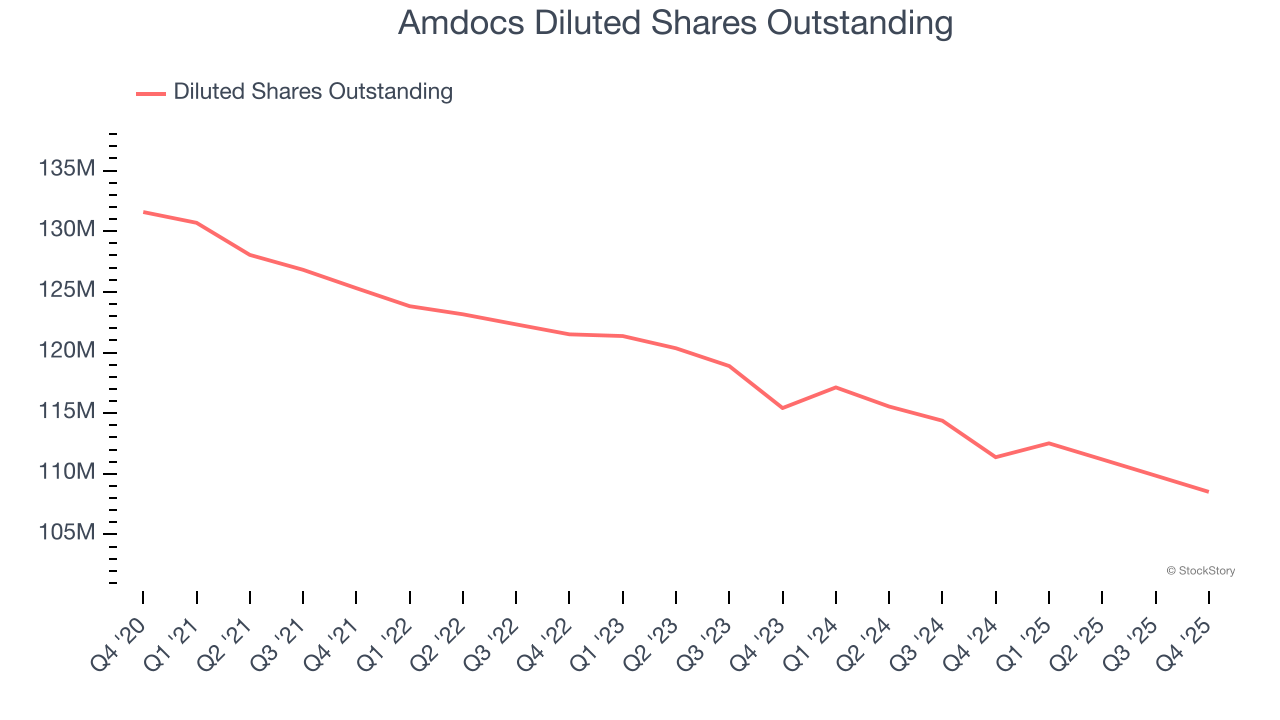

Amdocs’s EPS grew at a solid 9.5% compounded annual growth rate over the last five years, higher than its 1.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Amdocs’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Amdocs’s operating margin was flat this quarter but expanded by 1.8 percentage points over the last five years. On top of that, its share count shrank by 17.5%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Amdocs, its two-year annual EPS growth of 8.9% is similar to its five-year trend, implying stable earnings.

In Q4, Amdocs reported adjusted EPS of $1.81, up from $1.66 in the same quarter last year. This print beat analysts’ estimates by 3%. Over the next 12 months, Wall Street expects Amdocs’s full-year EPS of $7.14 to grow 6.7%.

Key Takeaways from Amdocs’s Q4 Results

It was good to see Amdocs narrowly top analysts’ backlog expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 2.9% to $76.16 immediately following the results.

Amdocs may have had a good quarter, but does that mean you should invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).