Agricultural supply chain giant Archer-Daniels-Midland (NYSE: ADM) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 13.7% year on year to $18.56 billion. Its non-GAAP profit of $0.87 per share was 9.2% above analysts’ consensus estimates.

Is now the time to buy Archer-Daniels-Midland? Find out by accessing our full research report, it’s free.

Archer-Daniels-Midland (ADM) Q4 CY2025 Highlights:

- Revenue: $18.56 billion vs analyst estimates of $21.24 billion (13.7% year-on-year decline, 12.6% miss)

- Adjusted EPS: $0.87 vs analyst estimates of $0.80 (9.2% beat)

- Operating Margin: 2.6%, in line with the same quarter last year

- Market Capitalization: $32.72 billion

“2025 was marked by a dynamic global trade landscape, and ongoing uncertainty around U.S. biofuel policy created a challenging operating environment for ADM. Despite these external headwinds, the business units showed impressive resilience and we delivered meaningful progress in the areas within our control. We advanced portfolio optimization initiatives, executed targeted cost-reduction actions, improved plant efficiency, generated strong cash flow, and achieved an important safety milestone by having the lowest injury rate on record,” said Chair of the Board and CEO Juan Luciano.

Company Overview

Transforming crops from the world's most productive agricultural regions into everyday essentials, Archer-Daniels-Midland (NYSE: ADM) processes and transports agricultural commodities like grains and oilseeds while manufacturing ingredients for food, beverages, feed, and industrial applications.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $80.27 billion in revenue over the past 12 months, Archer-Daniels-Midland is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because there are only a finite number of major retail partners, placing a ceiling on its growth. To expand meaningfully, Archer-Daniels-Midland likely needs to tweak its prices, innovate with new products, or enter new markets.

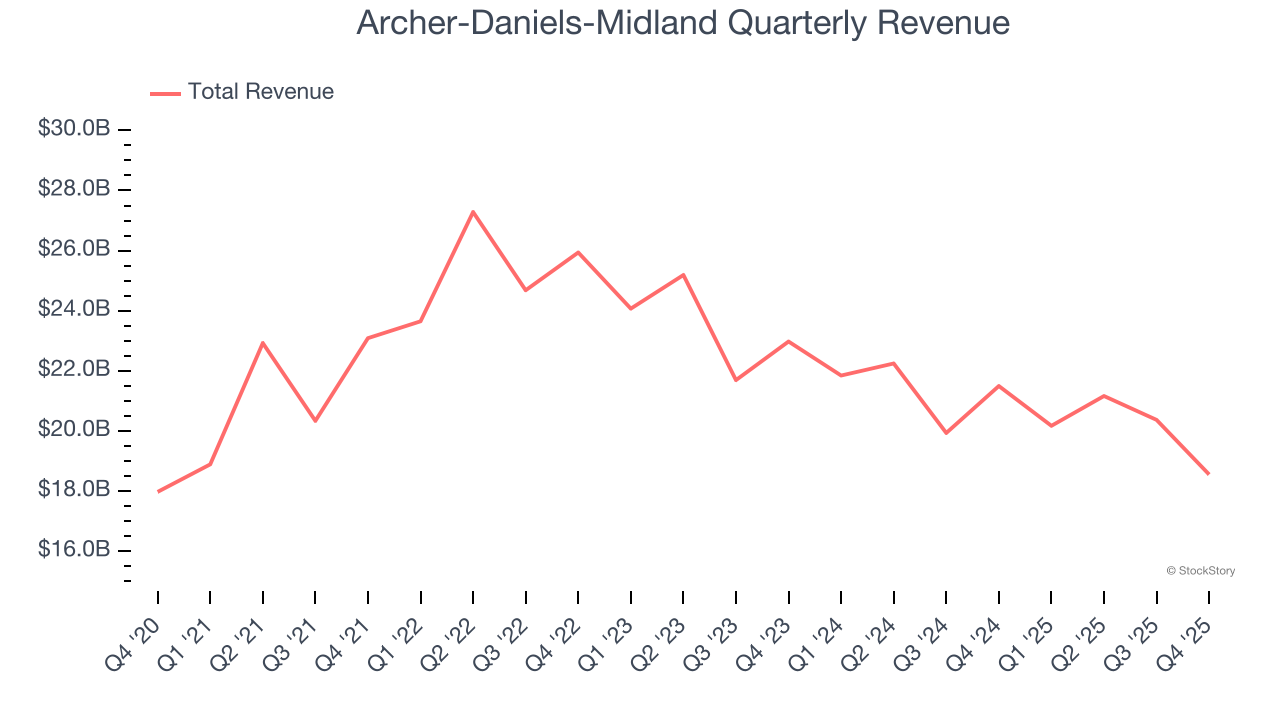

As you can see below, Archer-Daniels-Midland’s revenue declined by 7.5% per year over the last three years, a poor baseline for our analysis.

This quarter, Archer-Daniels-Midland missed Wall Street’s estimates and reported a rather uninspiring 13.7% year-on-year revenue decline, generating $18.56 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 9.1% over the next 12 months, an acceleration versus the last three years. This projection is particularly healthy for a company of its scale and suggests its newer products will spur better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

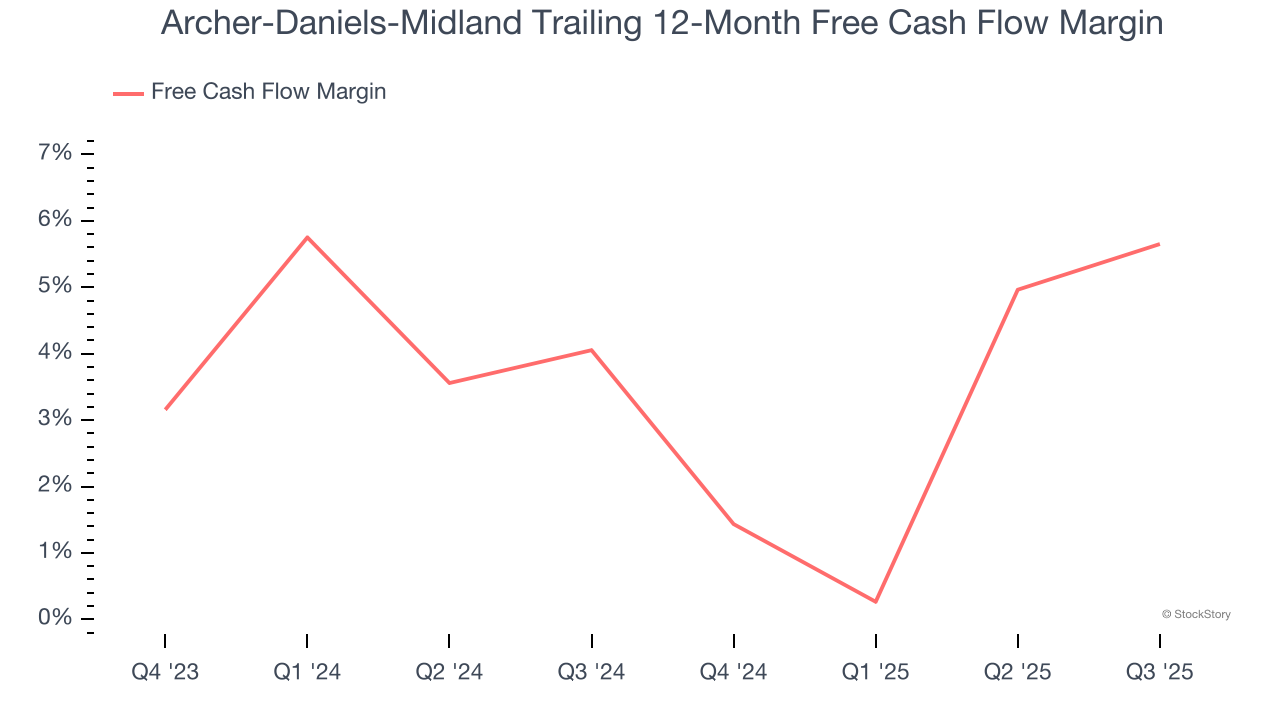

Archer-Daniels-Midland has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.1%, subpar for a consumer staples business.

Key Takeaways from Archer-Daniels-Midland’s Q4 Results

We were impressed by how significantly Archer-Daniels-Midland blew past analysts’ gross margin expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed. Overall, this was a softer quarter. The stock traded down 3.4% to $65.79 immediately following the results.

Archer-Daniels-Midland may have had a tough quarter, but does that actually create an opportunity to invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).