Specialty food company The Marzetti Company (NASDAQ: MZTI) met Wall Streets revenue expectations in Q4 CY2025, with sales up 1.7% year on year to $518 million. Its GAAP profit of $2.15 per share was 3.4% below analysts’ consensus estimates.

Is now the time to buy The Marzetti Company? Find out by accessing our full research report, it’s free.

The Marzetti Company (MZTI) Q4 CY2025 Highlights:

- Revenue: $518 million vs analyst estimates of $519.6 million (1.7% year-on-year growth, in line)

- EPS (GAAP): $2.15 vs analyst expectations of $2.23 (3.4% miss)

- Operating Margin: 14.5%, in line with the same quarter last year

- Sales Volumes fell 3.1% year on year (6% in the same quarter last year)

- Market Capitalization: $4.78 billion

CEO David A. Ciesinski commented, “We were pleased to complete the quarter with record gross profit and higher gross profit margin. The 1.1% decline in Retail segment net sales compares to strong prior-year growth of 6.3% and reflects softer demand during the timeframe of the U.S. government shutdown. Retail segment highlights included continued growth from our category-leading New York Bakery™ frozen garlic bread products and expanding distribution for our licensed Texas Roadhouse® dinner rolls. In the Foodservice segment, reported net sales were up 5.2% with Adjusted Foodservice Net Sales growth of 1.6% led by higher demand from several of our core national chain restaurant accounts and increased sales for our branded Foodservice products. Inflationary pricing also contributed to the increase in Foodservice net sales.”

Company Overview

Known for its frozen garlic bread and Parkerhouse rolls, The Marzetti Company (NASDAQ: MZTI) sells bread, dressing, and dips to the retail and food service channels.

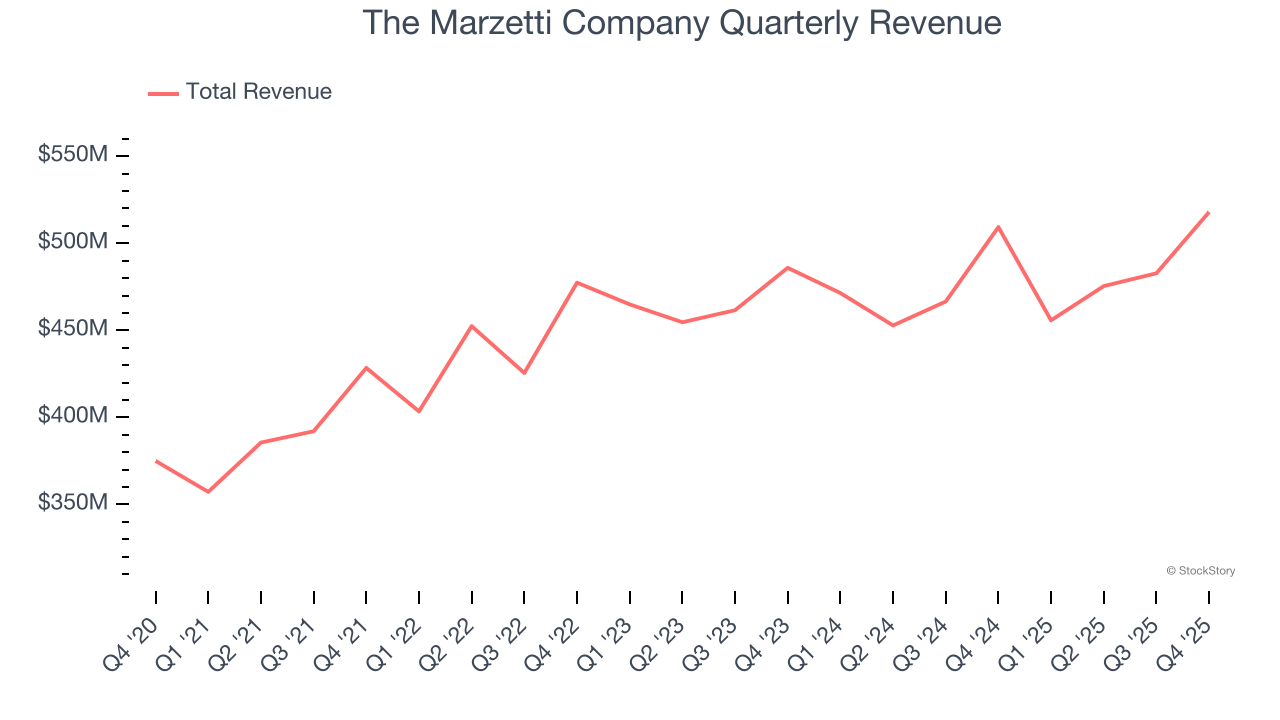

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.93 billion in revenue over the past 12 months, The Marzetti Company is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, The Marzetti Company’s 3.2% annualized revenue growth over the last three years was sluggish, but to its credit, consumers bought more of its products.

This quarter, The Marzetti Company grew its revenue by 1.7% year on year, and its $518 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 2.1% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and suggests its products will see some demand headwinds.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

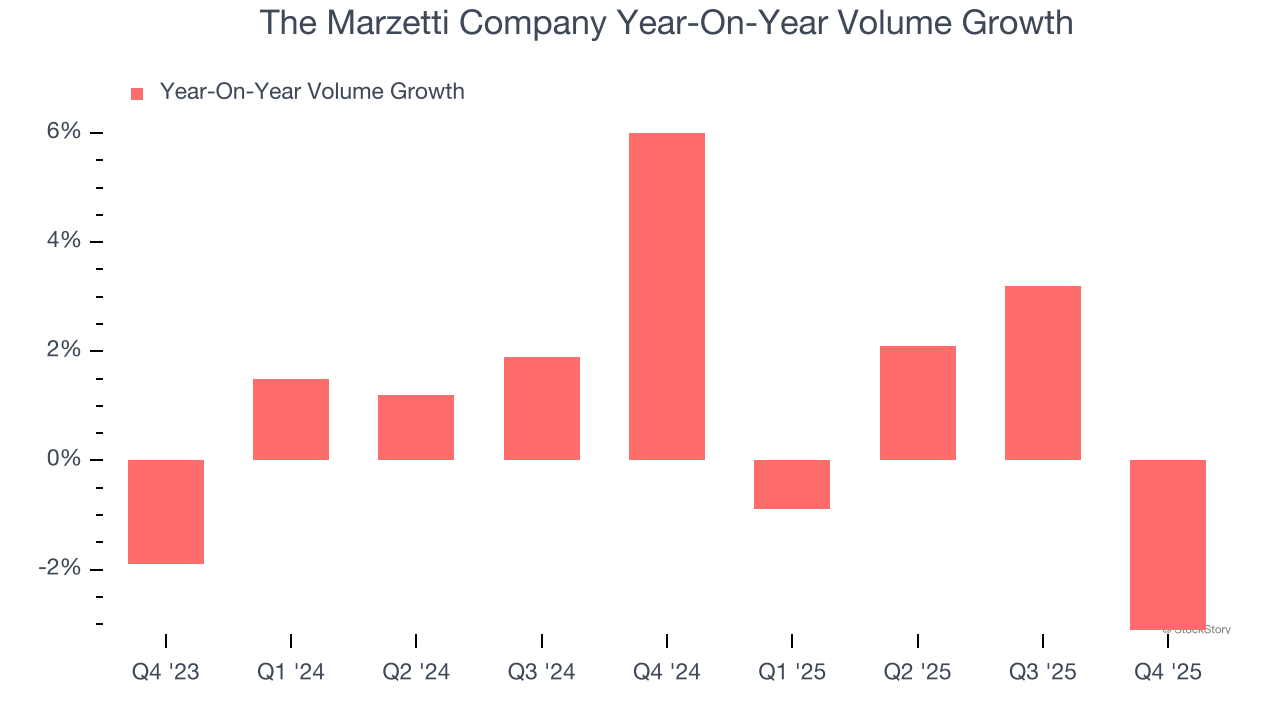

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

The Marzetti Company’s average quarterly volume growth was a healthy 1.5% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In The Marzetti Company’s Q4 2026, sales volumes dropped 3.1% year on year. This result was a reversal from its historical levels.

Key Takeaways from The Marzetti Company’s Q4 Results

We struggled to find many positives in these results. Overall, this was a softer quarter. The stock remained flat at $174.08 immediately after reporting.

Big picture, is The Marzetti Company a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).