Fast-food company Yum! Brands (NYSE: YUM) will be announcing earnings results this Wednesday before market hours. Here’s what you need to know.

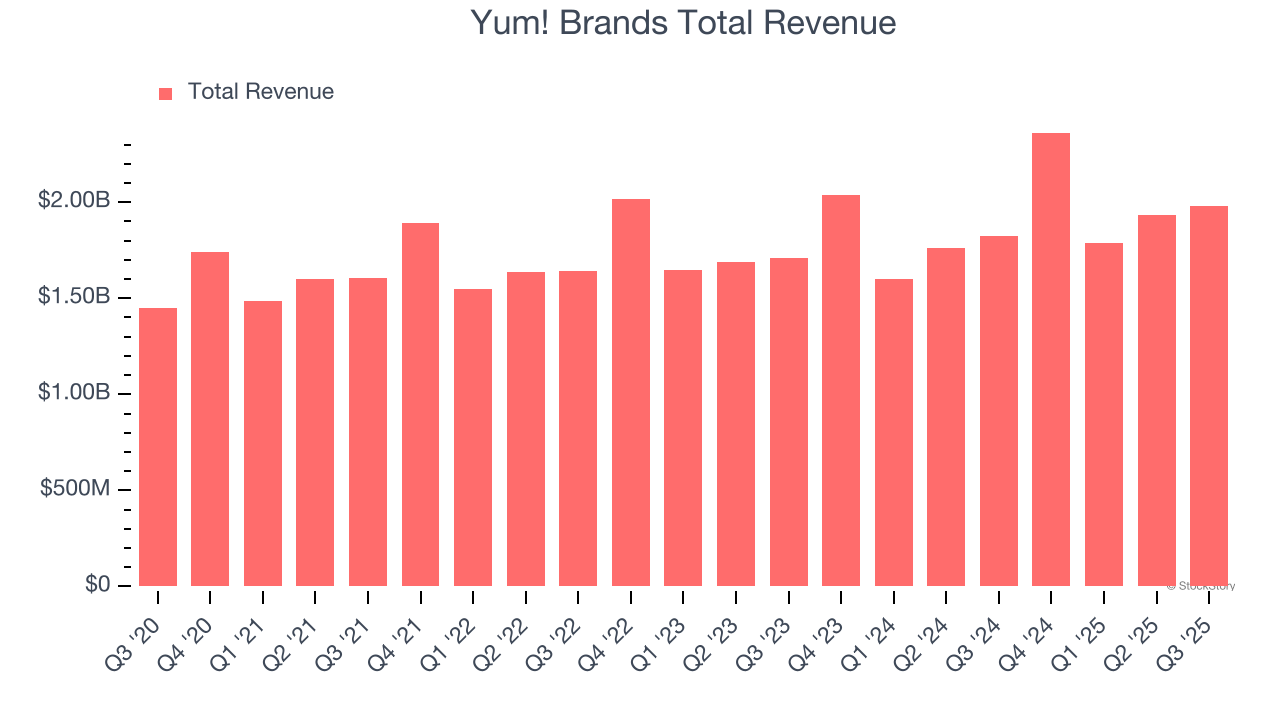

Yum! Brands missed analysts’ revenue expectations by 1.2% last quarter, reporting revenues of $1.98 billion, up 8.4% year on year. It was a mixed quarter for the company, with a solid beat of analysts’ EBITDA estimates but a slight miss of analysts’ revenue estimates.

Is Yum! Brands a buy or sell going into earnings? Read our full analysis here, it’s free for active Edge members.

This quarter, analysts are expecting Yum! Brands’s revenue to grow 3.8% year on year to $2.45 billion, slowing from the 16% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $1.76 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings.

Looking at Yum! Brands’s peers in the restaurants segment, some have already reported their Q4 results, giving us a hint as to what we can expect. Starbucks delivered year-on-year revenue growth of 5.5%, beating analysts’ expectations by 2.6%, and Brinker International reported revenues up 6.9%, topping estimates by 2.9%. Starbucks traded down 1.9% following the results while Brinker International was up 2.1%.

Read our full analysis of Starbucks’s results here and Brinker International’s results here.

There has been positive sentiment among investors in the restaurants segment, with share prices up 2.1% on average over the last month. Yum! Brands is up 3.1% during the same time and is heading into earnings with an average analyst price target of $167.54 (compared to the current share price of $155.67).

P.S. STOP buying the AI stocks everyone's talking about. The real money? It’s in the profitable pick nobody’s watching yet. We’ve identified an AI profit machine that’s flying under Wall Street’s radar—for now. We can’t keep this research public forever—grab your FREE copy before we pull it offline. GO HERE NOW.