500 Billion Euros – Muhahaha!

500 Billion Euros – Muhahaha!

This is, as they say in the Euro-zone, a good start. Money was offered and 523 banks requested a total of 489Bn Euros ($641Bn) in funding from the ECB at the delicious rate of 1% for three years.

We already discussed the merits of this program in Member chat this morning and Pharmboy and I will be debating the issue on National television very soon if this keeps up as it’s a shame to waste such a good debate.

Despite my bullish take on $641Bn being handed out to people who can lever it 10:1, this morning we shorted the run in the Dow Futures (/YM) to 12,100 and got a little dip to 12,070 but the big winner was, as usual, oil – which got all full of itself and ran up to $98.50, where we caught multiple rides down with the last hitting $97.50 so, as is often the case, the Egg McMuffins are paid for.

After the announcement of the "Longer-Term Refinancing Operation" (LTRO) – it did finally occur to some people that dropping that kind of money bomb on the EU might, somehow, devalue the Euros that are currently in circulation. Some theory about "supply and demand" which you may have hear of… Well, it seems the people who took Econ 101 were of the opinion that $1.32 was a bit much for the Euro under the circumstances (5am) and by 6am it was back down to $1.305 – a pretty crazy drop for a currency in an hour in any of the other 100 years of currency trading but, in 2011, we call just another it Wednesday morning.

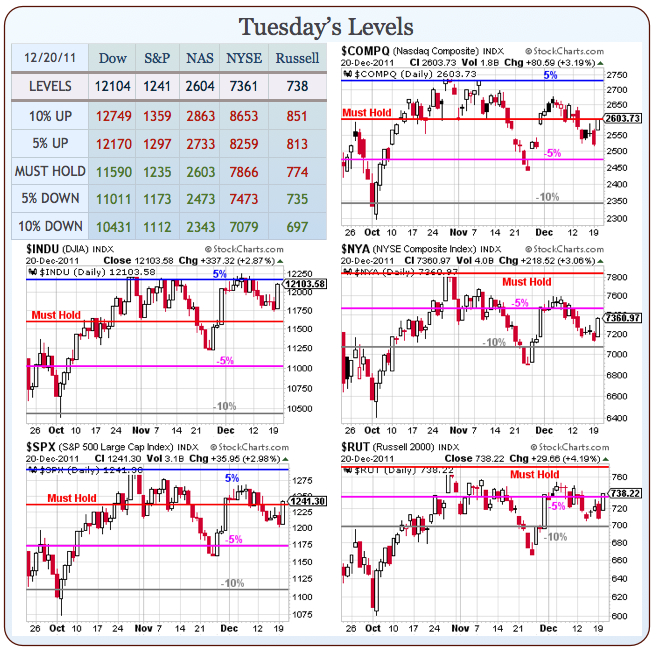

So we’re done with our event-driven bearish bet on the futures and now we can go back to being bullish until and unless our levels fail to hold on our Big Chart.

So we’re done with our event-driven bearish bet on the futures and now we can go back to being bullish until and unless our levels fail to hold on our Big Chart.

Unlike those voodoo moving averages, our Big Chart lines are fixed according to our 5% rule and these are the same lines we used to predict the market since early 2009 and the only reason we move the lines is to adjust for major changes in Dollar valuation, which the market is priced in.

Other than that, we are rock-solid on target to finish at our 1,250 goal for the S&P, which is (after taking into account the net 4% drop in the Dollar) almost exactly…