- Netflix shares crossed $400 for the first time Tuesday following a slew of positive Wall Street commentary.

- A consumer shift from traditional tv to digital, and Netflix's international prospects are two main points of optimism.

- Watch Netflix trade in real time here.

Netflix shares crossed $400 for the first time on Tuesday, propelled by a slew of positive commentary from Wall Street.

Piper Jaffray analyst Michael Olson highlighted data suggesting Netflix international subscriber growth could reach 48.7% year-over-year for the second-quarter, well above the Wall Street consensus of 40.9%.

"Our analysis of Netflix search trends (Google) points to a solid second-quarter (potential upside) for int'l subs, with domestic likely in-line," Olson wrote in a note out to clients. "We believe investors are focused on international subscriber growth, given the importance of ongoing int'l trajectory for the Netflix story."

Olson raised his price target from $367 to $420.

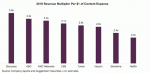

Elsewhere, Guggenheim analyst Michael Morris explained that even though Netflix is currently less efficient at leveraging its content expense into revenue, that trend will reverse because consumers are shifting from traditional television outlets to digital and streaming ones.

"Given that we see continued live audience declines and traditional bundle erosion, we see the taller bars for traditional channels owners as at risk over time as more consumers move to the more efficient (ad-free, stacked episode, vast content) experience provided by Netflix," he wrote in a note to clients.

Finally, Monness Crespi Hardt & Co. analyst Brian White raised his price target to $460, making him the second most bullish Netflix analyst on Wall Street. "The combination of engaging new content, momentum in overseas markets and a business model that scales globally increasingly sets Netflix apart from its legacy competitors," White wrote in a note out Tuesday, according to Bloomberg. His price target lags behind only Heath Terry of Goldman Sachs, who sees $490 a share.

On Friday, Terry wrote that "2018 will be the peak negative free cash flow year for Netflix, with revenue growth beginning to outpace content spend growth next year."

Netflix is up 109% this year.

NOW WATCH: This top economist has a radical plan to change the way Americans vote

See Also:

- Obama officials rushed to explain photos from 2014 that went viral showing locked-up immigrant children — and Trump's facilities look the same

- McDonald's employees share the 6 menu items they'd never eat

- These photos reveal why the 26-year-old organizer of the disastrous Fyre Festival could spend more than 10 years in prison