( click to enlarge )

( click to enlarge )Bio-Path Holdings Inc (NASDAQ: BPTH) should be on your radar screen Monday following news the company submitted a request for withdrawal of registration statement. Closed in after hours at $22.09. From a technical standpoint, the stock has been forming a nice base above the rising EMA50 marked at yellow. If this pattern is resolved on the upside, the stock can potentially test $25 levels. The short-term support is seen at $14.76 levels.

( click to enlarge )

( click to enlarge )Sphere 3D Corp (NASDAQ: ANY) Low float stocks continue to get lots of attention and im trying to play all the best setups, keeping my focus on these small names, because the returns could be tremendous in this enviroment but always using tight stops. I've seen low float stocks run on nothing, no news, no material events so I would not be surprised to see also ANY get a nice push based on this great bottom pattern. The stock looks ready to break out some point soon, and with the low float it won't take much buying pressure to get this stock back to where it belongs. After trading below its EMA50 ANY has broken out of that moving average placed on its daily candlestick charts in yesterday’s trade on volume. Im accumulating with a stop loss being placed below 2.4 and going forward we can expect a target of 3.4-4.

( click to enlarge )

( click to enlarge )Midatech Pharma (NASDAQ: MTP) has retraced most of its recent gains and looks ready to renew its bullish momentum. MTP is currently forming a falling wedge pattern, indicated by the two unparallel black lines in the chart above, while MACD Hist is displaying a positive divergence. That said, the stock should attempt to knock out the upper trendline of the falling wedge pattern and rally towards $3.5 as its primary upside target.

( click to enlarge )

( click to enlarge )New Age Beverages Corp (NASDAQ: NBEV) has been pulling back forming a potential bull flag formation on hourly and finding support in the 5.5 levels. Pullbacks are a normal part of an uptrend after a huge rally. This suggests that stock should resume to the upside as far as dips stay above 5.30. Lets see how this plays out next week.

( click to enlarge )

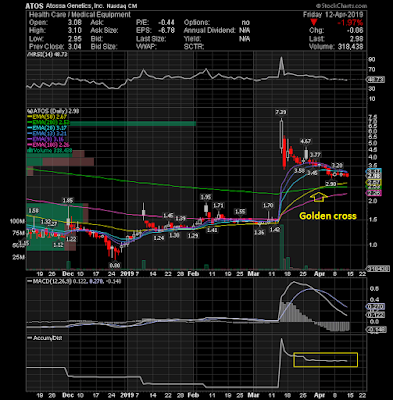

( click to enlarge )Atossa Genetics Inc (NASDAQ: ATOS) could get hot in the coming days and weeks. The continue to trade sideways, but I am seeing a lot of strong bullish signals, such as the Golden cross and the huge accumulation on the A/D indicator. Add this stock to your watchlist.

( click to enlarge )

( click to enlarge )Parsley Energy Inc (NYSE: PE) broke out of a consolidation that has been building for about 3 months on volume, and based on one market theory the stock is set to soar higher. Next major resistance lies at 21.37

( click to enlarge )

( click to enlarge )Second Sight Medical Products Inc (NASDAQ: EYES) after a nice pullback on Thursday the stock is back on the upswing. There could be more big gains on the way for this stock, and its worthy of getting recognizition on the watchlist. Next pivot resistance point is 1.2

( click to enlarge )

( click to enlarge )Navios Maritime Holdings Inc. (NYSE: NM) has come out of no where the last few sessions gaining nearly 80% in just two weeks. Volume and price is on the rise and that means you should be adding this name to your watchlist. As I always say, follow the smart money. I will be waiting for a pullback to enter.

( click to enlarge )

( click to enlarge )Boxlight Corp (NASDAQ: BOXL) closed up 17 cents and could see an even bigger move if the buyers continue to come into this stock. BOXL has a low float, a great story, and in my view, should be trading well over $4 in the short term. On watch.

During the day I tweet many times to my readers. I encourage everybody to subscribe AC Investor Blog twitter and newsletter, so you can receive my trade ideas and stock news in real time.

Disclaimer : This is not an investment advisory, and should not be used to make investment decisions. Information in AC Investor Blog is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The charts provided here are not meant for investment purposes and only serve as technical examples. Don't consider buying or selling any stock without conducting your own due diligence.

Thanks for visiting AC Investor Blog.

AC