$2,142,405!

$2,142,405!

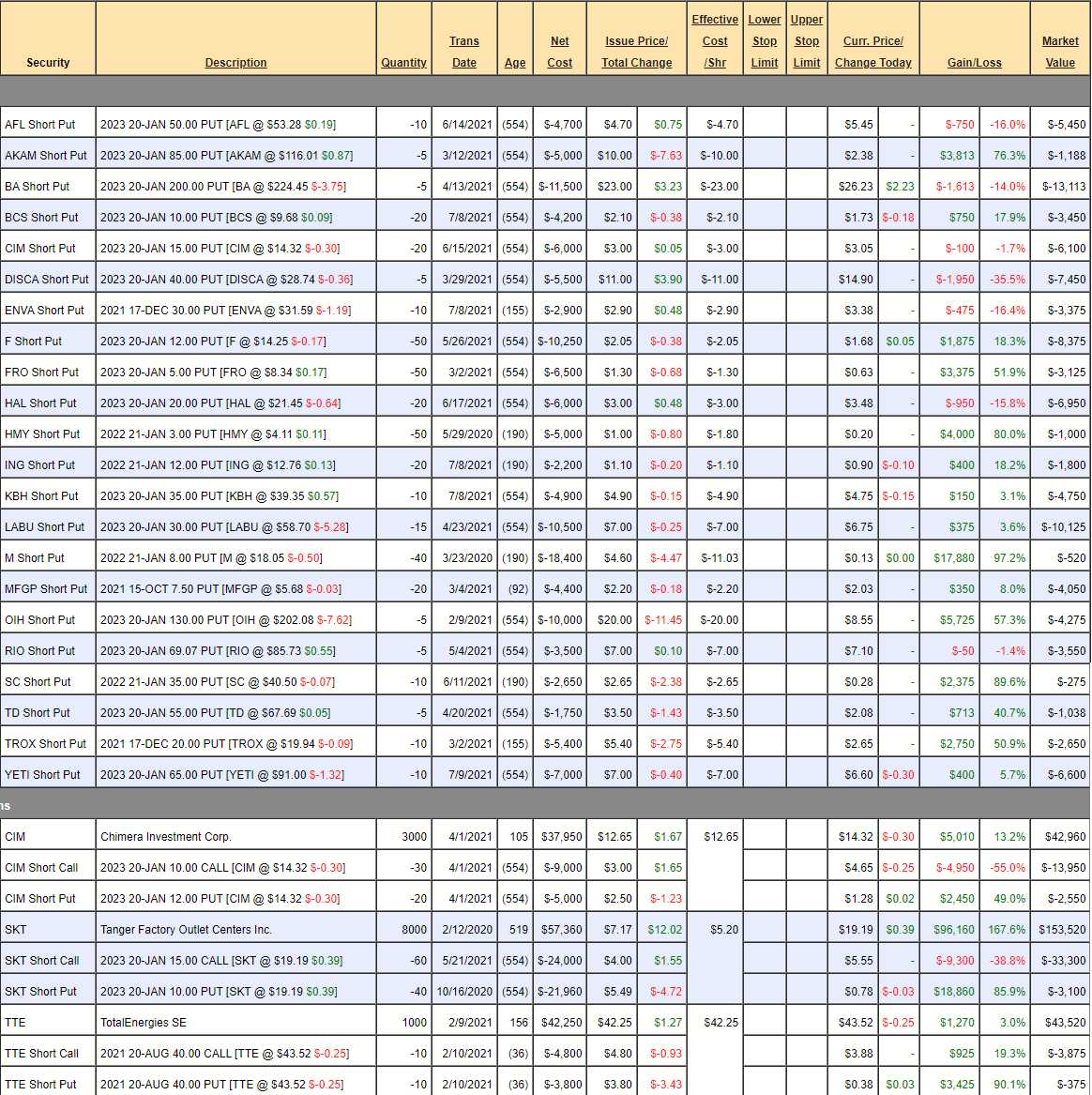

That is DOWN $4,838 since our last review as our Short-Term Portfolio (STP) hedges continue to be hammered by this relentless rally. Of course, the Long-Term Portfolio (LTP) gained $39,937 and, in theory, we have locked in those gains with the STP, which has $585,435 of downside protection and that should be enough to cover our $886,945 worth of longs against a 20% drop. We also have $1,072,340 in CASH!!! in our LTP and that too makes a nice hedge. Keep in mind we started with a combined $600,000 – which is why we're so keen to protect our $1.5M in gains.

We did a detailed review last month, so I won't be doing that today. Our positions at the time had the potential to gain $676,193 over the next 18 months and that means $40,000 per month is just about "on track" in an up market. While $40,000 is "only" 2% of $1.9M, it's a whopping 4.5% monthly gain on the actual positions (not the cash). Clearly we have an abundance of caution coming into Q2 earnings but I know I sleep a lot better at night knowing our portfolio is fairly shock-proof.

Being well-hedged has allowed us to add new positions on BCS, ENVA, ING, KBH, MU and YETI in the past month – $21,000 worth of short puts and the MU spread is a $22,500 spread that is still a net $115 credit so, as we should do, we picked up another $43,500 worth of upside potential for the month to replace the $39,937 we have realized (and locked in with our hedges).

As long as we continue to do this in an up market – even if we end up burning the entire $183,290 balance in our STP, we'll still be about $300,000 ahead for the year – that's without doing anything smart along the way! BALANCE, Danielson, BALANCE is the key to everything. If you have balance, like a good surfer, you can make little adjustments and ride almost any wave. If not – Wipeout!

Short Puts – We have 22 of them now with about $90,000 of upside potential remaining. On the whole we…