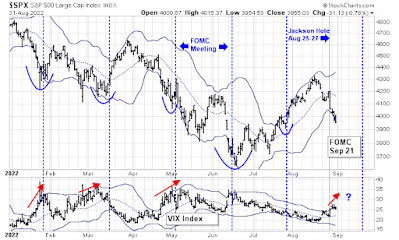

After the S&P 500 stalled and pulled back at its 200 dma, I thought that it might experience a minor setback The market action is pointing to a deeper downside as every rally attempt this week has been met with selling. Both the VIX and S&P 500 appear to be undergoing Bollinger Band rides: An upper BB ride for the VIX and a lower BB ride for the S&P 500.

The full post can be found here.