iShares Russell 2000 ETF (NY:IWM)

All News about iShares Russell 2000 ETF

Why Aehr Test Systems Stock Tumbled Nearly 17% In After-Hours ↗

October 06, 2025

Via Stocktwits

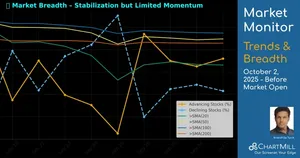

Via Chartmill

Via Stocktwits

Robinhood Soars, Oil Dips And Gold Defies Gravity: What's Moving Markets Monday? ↗

September 29, 2025

Via Benzinga

Stock Quote API & Stock News API supplied by www.cloudquote.io

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

Quotes delayed at least 20 minutes.

By accessing this page, you agree to the Privacy Policy and Terms Of Service.

© 2025 FinancialContent. All rights reserved.