PITTSBURGH, PA / ACCESSWIRE / February 3, 2023 / SSB Bancorp, Inc (OTC PINK:SSBP - news) (the "Company"), the holding company for SSB Bank (the "Bank"), today announced the Company's unaudited, consolidated results of operations for the year ended December 31, 2022.

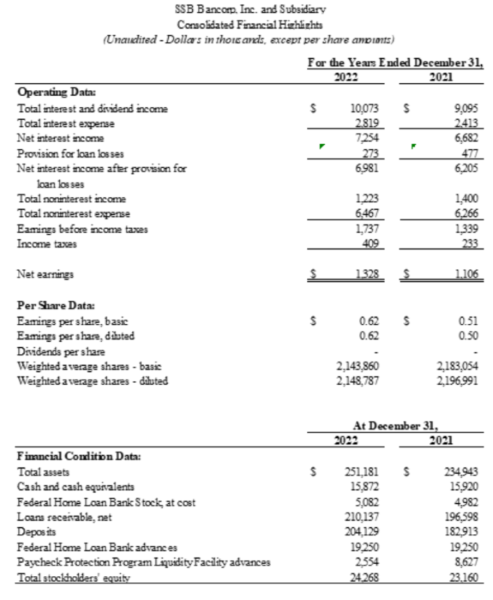

Total assets increased $16.2 million to $251.2 million at December 31, 2022, from $234.9 million at December 31, 2021. The increase in assets was due to an increase in deposits of $21.2 million. The increase in deposits was converted into a net increase of $13.5 million in loans as well as the decrease in Paycheck Protection Program Liquidity Facility advances of $6.1 million.

Net earnings for the year ended December 31, 2022, was $1.3 million, or $0.62 per basic and diluted share, compared to net earnings of $1.1 million, or $0.51 per basic and $0.50 per diluted share, for the prior year.

Total interest and fee income increased by $978,000, or 10.8%, when comparing the results of the year ended December 31, 2022, with the year ended December 31, 2021. This is due to the increase in average interest-earning assets from $220.2 million to $224.8 million as well as the increase in yield from 4.13% to 4.48% when comparing the two periods.

Interest expense increased by $406,000, or 16.8%, to $2.8 million in the year ended December 31, 2022, from $2.4 million in the year ended December 31, 2021. The increase in interest expense is due to the increase in cost of interest-bearing liabilities from 1.22% for the year ended December 31, 2021, to 1.41% for the year ended December 31, 2022.

Noninterest income decreased by $178,000, or 12.7% to $1.2 million from $1.4 million when comparing the year ended December 31, 2022, with the year ended December 31, 2021. With the rise in market interest rates, mortgage loan production has decreased, and has resulted in a decrease in gain on sale of loans of $612,000 when comparing the two periods. Offsetting this decrease is the increase in merchant acquirer sponsorship fees of $406,000 when comparing the two periods.

Noninterest expense increased by $201,000 or 3.2% to $6.5 million. This was mainly due to increases in salaries and benefits, occupancy, and federal deposit insurance when comparing the year ended December 31, 2022, with the year ended December 31, 2021.

This release may contain forward-looking statements within the meaning of the federal securities laws. These statements are not historical facts; rather, they are statements based on the Company's current expectations regarding its business strategies and their intended results and its future performance. Forward-looking statements are preceded by terms such as "expects", "believes", "anticipates", "intends" and similar expressions.

Forward-looking statements are not guarantees of future performance. Numerous risks and uncertainties could cause or contribute to the Company's actual results, performance and achievements to be materially different from those expected or implied by the forward-looking statements. Factors that may cause or contribute to these differences include, without limitation, general economic conditions, including changes in market interest rates and changes in monetary and fiscal policies of the federal government; legislative and regulatory changes.

Because of the risks and uncertainties inherent in forward-looking statements, readers are cautioned not to place undue reliance on them, whether included in this report or made elsewhere from time to time by the Company or on its behalf. The Company assumes no obligation to update any forward-looking statements.

Contact information:

Ben Contrucci - bcontrucci@ssbpgh.com

Dan Moon - danmoon@ssbpgh.com

April Miller - amiller@ssbpgh.com

Phone: 412-837-6955

SOURCE: SSB Bancorp, Inc.

View source version on accesswire.com:

https://www.accesswire.com/738105/SSB-Bancorp-Inc-Reports-Unaudited-Consolidated-Financial-Results-For-the-Year-Ended-December-31-2022