Valued at a market cap of $43.6 billion, Corteva, Inc. (CTVA) is a leading agricultural science company based in Indianapolis, Indiana. It focuses on advancing sustainable farming through innovative seed and crop protection technologies.

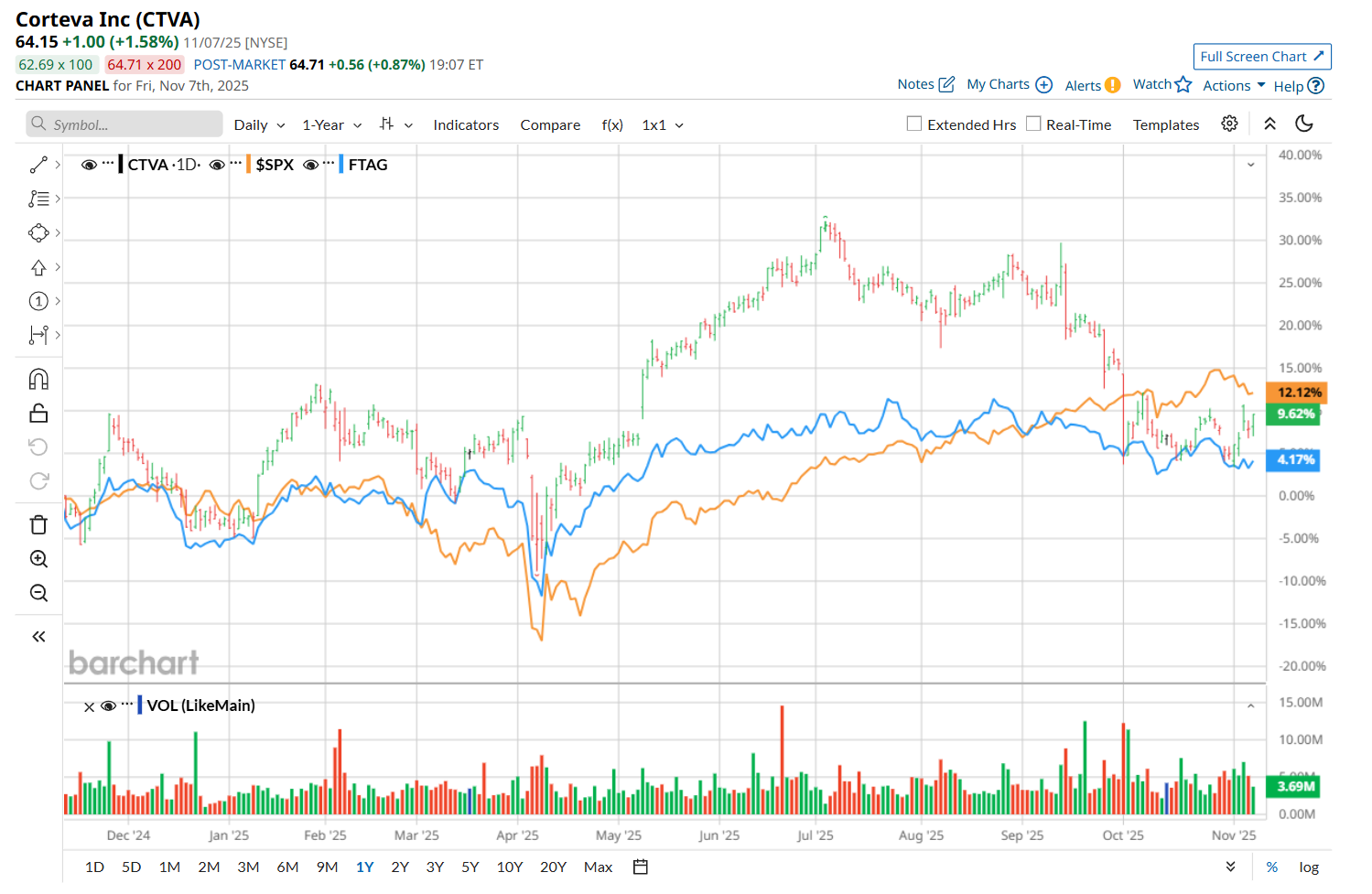

Shares of this agriculture company have lagged behind the broader market over the past 52 weeks. Corteva has gained 9.4% over this time frame, while the broader S&P 500 Index ($SPX) has surged 12.7%. Moreover, on a YTD basis, the stock is up 12.6%, compared to SPX’s 14.4% return.

However, zooming in further, CTVA has outperformed the First Trust Indxx Global Agriculture ETF’s (FTAG) 2.1% rise over the past 52 weeks and 9.8% uptick on a YTD basis.

Corteva delivered better-than-expected Q3 earnings results on Nov. 4, and its shares surged 1.9% in the following trading session. Due to strong growth in three of its four key regions, the company’s net sales increased 12.6% year over year to $2.6 billion, surpassing consensus estimates by 5.2%. Moreover, its operating loss of $0.23 per share came in well ahead of analysts' expectations of a loss of $0.49 per share. Additionally, noting its strong year-to-date performance, improved cost controls, and strength of growth platforms, CTVA raised its fiscal 2025 guidance, now expecting net sales in the range of $17.7 billion to $17.9 billion and operating EPS between $3.25 and $3.35 per share.

For the current fiscal year, ending in December, analysts expect CTVA’s EPS to grow 29.2% year over year to $3.32. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

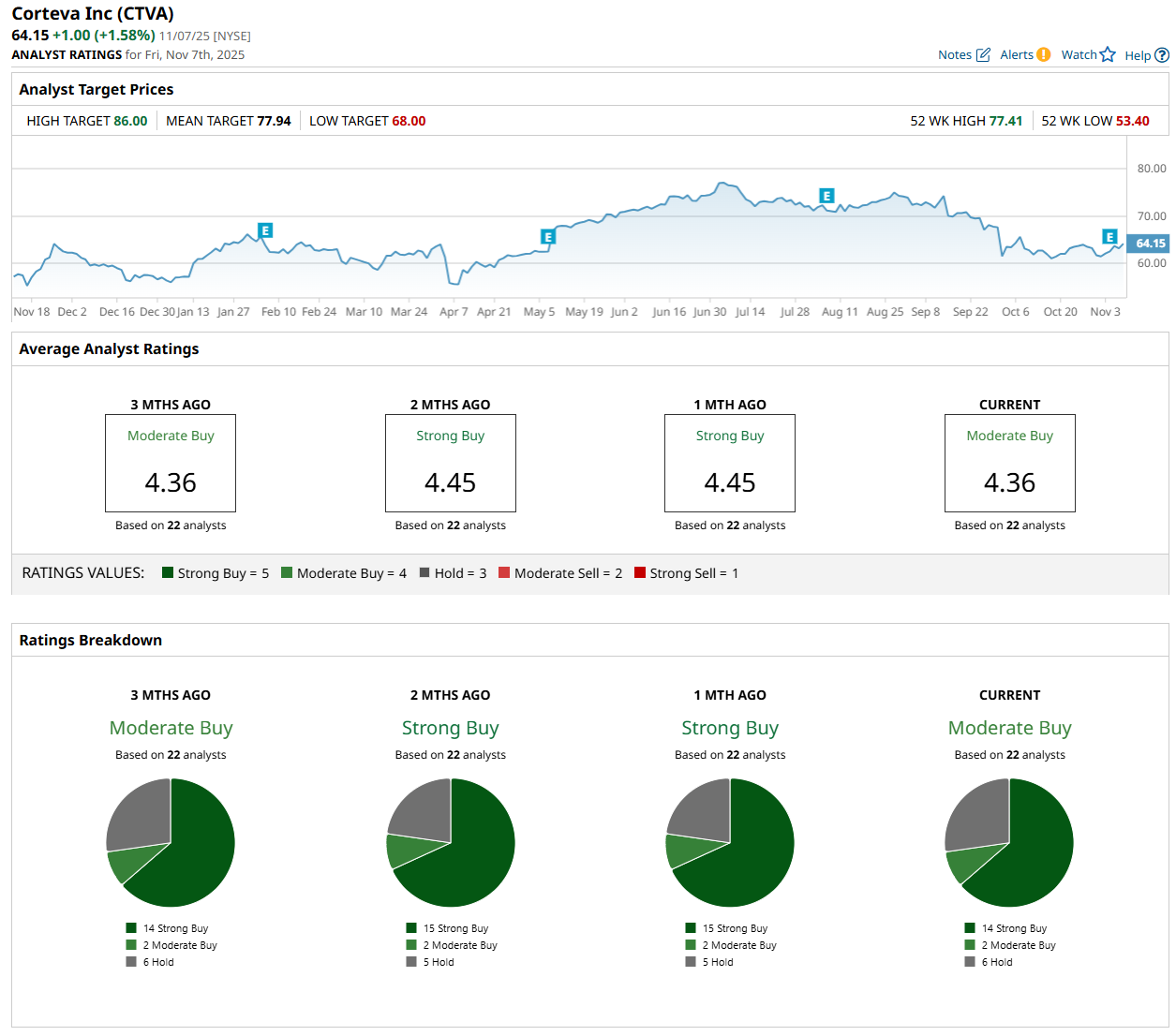

Among the 22 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 14 “Strong Buy,” two "Moderate Buy,” and six "Hold” ratings.

This configuration is less bullish than a month ago, with an overall “Strong Buy” rating, consisting of 15 analysts suggesting a “Strong Buy.”

On Nov. 7, Oppenheimer Holdings Inc. (OPY) maintained an "Outperform" rating on CTVA and raised its price target to $76, indicating an 18.5% potential upside from the current levels.

The mean price target of $77.94 represents a 21.5% premium from CTVA’s current price levels, while the Street-high price target of $86 suggests an upside potential of 34.1%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart