Artificial Intelligence (AI) has dominated the news so much that we almost forget how the gaming industry influenced major chipmakers like Nvidia (NVDA) and Advanced Micro Devices (AMD). The GPUs that are propelling the AI industry to new heights were first developed to render graphics for video games and 3D applications! While the focus has recently changed for the chipmakers, the gaming industry still depends on them.

At one point in 2023, the gaming segment brought in over a quarter of AMD’s revenue. But circumstances have since changed for the worse, and the same segment now only produces 10% of the revenue. This is just how the cyclical gaming industry works and is not necessarily AMD’s fault. The company continues to innovate, and the recent news coming out of the gaming arenas proves that. Valve’s new Steam Machine will be powered by AMD’s RDNA 3 semi-custom GPU and Zen 4 CPU. It will come out at some point next year but the adoption shows how AMD’s chiplet design is maturing.

Will it move the needle for AMD stock? Highly unlikely. But that shouldn’t worry investors. In fact, if investors see the cyclicality of the gaming industry as a problem, then this development provides the solution. It may not bring in immediate revenue, but it should help the company improve brand visibility and diversification, the exact two things that will help it survive industry downturns in the future.

Innovation like this doesn’t come at any significant cost for AMD, as it just leverages its CPU and GPU technologies to build gaming devices. In fact, AMD was the one that pioneered the concept of an Accelerated Processing Unit (APU), which combines a CPU and GPU onto a single chip. This is AMD’s specialty, so it’s unlikely to cause any distraction from the core, high-margin business of AI accelerators and data centers.

About AMD Stock

Santa Clara, California-based Advanced Micro Devices is the maker of semiconductor chips, mainly CPUs and GPUs that power data centers, gaming equipment, and many other embedded systems.

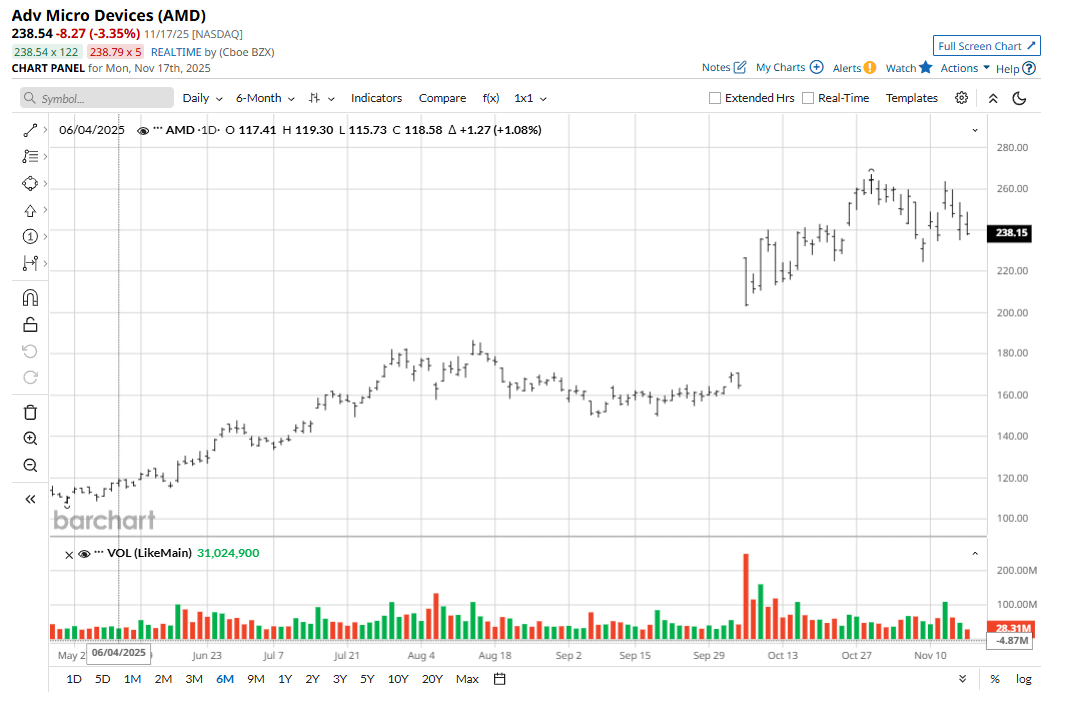

AMD stock has given returns of nearly 80% in the last one year, comfortably outperforming the S&P 500 Index ($SPX). Consistent AI-induced deals helped the stock go up steadily since April, but it was the OpenAI deal that really accelerated the stock price in October.

When it comes to AMD’s valuation, one would expect high multiples. A forward price-earnings multiple of 102.88x is high when compared to the broader market. Nvidia (NVDA) trades at a forward P/E of 42.72x while other chipmakers like Qualcomm (QCOM) and Texas Instruments (TXN) trade much lower. And despite this huge difference, AMD’s multiple is only 9.76% higher than its own 5-year average, which includes the time before the emergence of AI. AMD has always commanded high multiples as a leading chipmaker, and that is not changing anytime soon.

AMD Beats Earnings and Revenue Estimates

AMD announced its Q3 earnings on Nov. 4 and comfortably beat Wall Street estimates. It reported EPS of $1.20 vs. consensus estimates of $1.16 on revenue of $9.25 billion against the expected $8.76 billion. This translated to a 35.6% top-line growth year-over-year (YOY).

Management guided for Q4 revenue of $9.6 billion, which was also above expectations of $9.17 billion. And what is now the norm regarding China, AMD did not include China revenue from its MI308 chips.

On the earnings call, CEO Lisa Su emphasized that the OpenAI partnership will accelerate the company’s AI revenue. Also, Oracle (ORCL) announced the deployment of 50,000 MI450 AI chips in 2026. So management went into the earnings call on the back of some amazing deals. While AMD’s role in powering the new Steam Machine may not be significant enough to generate similar comments on an earnings call, it certainly goes a long way in cementing the company’s reputation as an innovator.

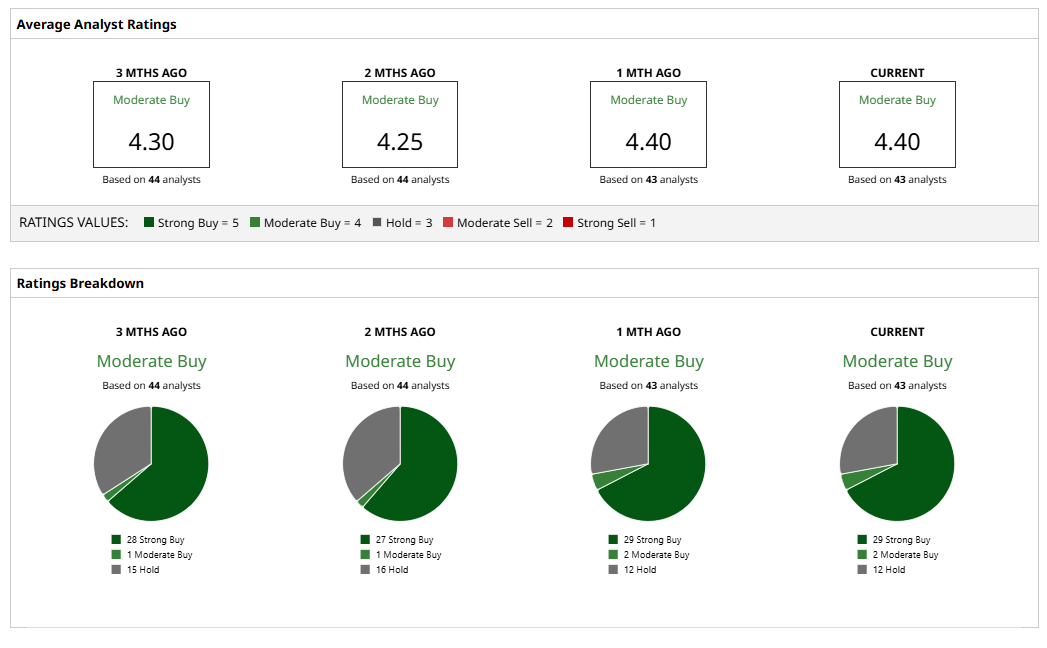

What Are Analysts Saying About AMD Stock?

AMD is covered by 43 analysts on Wall Street, with 29 of them extremely bullish with a “Strong Buy” rating. Recently, Wedbush Securities made an interesting comment on the company, wondering if there is anything that will move the needle in terms of the forward expectations. The firm has a $290 price target on the stock, which is slightly above the Wall Street mean target price of $288.30. Wedbush analyst Matt Bryson said the only thing that could spur further bullishness would be information on the gross margins of AMD’s AI products. However, that information is unlikely to be made public anytime soon.

On the date of publication, Jabran Kundi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Unusual Options Activity Shows 71,000 Calls Hit the Tape for Applied Digital Stock – How You Should Play APLD Here

- AMD Is Powering the New Steam Machine. Will It Move the Needle for AMD Stock?

- MicroStrategy Is Buying the Bitcoin Dip. Should You Buy the Dip in MSTR Stock?

- Should You Buy Netflix Stock Today After Its 10-for-1 Split?