Nvidia (NVDA) investors have had plenty to keep an eye on this year—from soaring AI demand and blockbuster earnings to U.S.-China trade tensions and valuation concerns. But now, another storyline is taking center stage, and it comes from one of Wall Street’s most recognizable contrarian voices: Michael Burry. The famed “Big Short” investor has reemerged with a series of cryptic moves and comments that have put NVDA investors on alert.

In recent weeks, Burry has sharply criticized the AI boom, revealed massive bearish positions against Nvidia and Palantir, compared the current tech spending cycle to the dot-com bubble, and accused hyperscalers of using accounting maneuvers to inflate profits. Then he added a dramatic twist: Scion Asset Management, the hedge fund he has run for more than a decade, has now been deregistered with the SEC. Immediately after, Burry took to X to hint at what’s coming next—teasing that “much better things” will launch on Nov. 25.

The problem? No one knows exactly what he’s planning. Will he continue publicly attacking the AI trade? Will he double down on bearish positions against Nvidia? Or does he intend to unveil an entirely new venture unrelated to his recent bets? Regardless, NVDA investors now have one more date to circle on their calendars.

About Nvidia Stock

Nvidia is a premier technology firm known for its expertise in graphics processing units and artificial intelligence solutions. The company is renowned for its pioneering contributions to gaming, data centers, and AI-driven applications. NVDA’s technological solutions are developed around a platform strategy that combines hardware, systems, software, algorithms, and services to provide distinctive value. The chipmaker’s market cap stands at $4.62 trillion, ranking it as the most valuable company in the world.

Shares of the AI darling have climbed 38.3% on a year-to-date (YTD) basis. NVDA stock came under pressure last week as investors pulled back from AI-exposed chip names amid valuation concerns. A prolonged AI-driven rally has pushed the stock’s forward non-GAAP P/E to 41.82x, raising doubts among investors about how sustainable that valuation is.

Nvidia Investors, Circle Nov. 25 on Your Calendars

Burry made a dramatic return to the investing world when he ended a two-year social media silence on X with a pointed remark: “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play.” That’s a nod to the 1983 film WarGames, where an AI simulates thousands of U.S.-Soviet nuclear battles—only to conclude that every scenario ends in mutual destruction. “A strange game,” the supercomputer says. “The only winning move is not to play.” But now the reference was to a potential AI bubble. It was his first post since April 2023.

A few days later, he followed up with a post featuring three graphics, including one from Bloomberg last month illustrating how much of the AI boom is being driven by partnerships concentrated around just two companies—Nvidia and OpenAI. Another graph highlighted parallels between today’s surge in tech capital spending and the patterns seen during the dot-com era. Essentially, Burry compared the current AI boom to the dot-com bubble, stoking renewed concerns that AI speculation has pushed stock valuations to unsustainable levels.

Burry rattled markets even more when Scion Asset Management’s third-quarter filing showed that, as of Sept. 30, the fund held bearish put options on two of the AI boom’s standout names—Nvidia and Palantir (PLTR). Scion bought approximately $187.6 million worth of Nvidia put options and $912 million worth of Palantir put options. Notably, Palantir CEO Alex Karp called Scion’s bets “batshit crazy” in an interview, prompting Burry to fire back on X that he wasn’t surprised Karp “cannot crack a simple 13F.” Last Thursday, in a post on X, Burry laid out the math behind his latest bets. A screenshot he shared indicates he holds 50,000 Palantir put options expiring on Jan. 15, 2027, with a strike price of $50. He also noted that he bought the options for $1.84 apiece, totaling $9.2 million. In addition, the screenshot showed that he holds 10,000 Nvidia put options expiring on Dec. 17, 2027, with a strike price of $110, though he did not reveal the purchase price. In essence, these positions give Burry short exposure equal to roughly 5 million shares of Palantir and 1 million shares of Nvidia, granting him the right to sell the stocks at $50 and $110 in 2027, respectively, signaling that he’s betting on a steep decline in both names.

Burry Versus The Hyperscalers

Meanwhile, last Monday, Burry claimed in a post on X that hyperscalers are understating depreciation costs by assuming chip life cycles that are longer than what he believes is realistic.

“Understating depreciation by extending the useful life of assets artificially boosts earnings - one of the more common frauds of the modern era. Massively ramping capex through purchase of Nvidia chips/servers on a 2-3 yr product cycle should not result in the extension of useful lives of compute equipment. Yet this is exactly what all the hyperscalers have done,”

Burry estimated that between 2026 and 2028, this accounting approach could understate depreciation by roughly $176 billion, thereby inflating reported earnings across the industry.

Adding more drama to the story, Burry posted a screenshot on X last Thursday showing that he had terminated his hedge fund’s SEC registration. Scion Asset Management was officially deregistered last Monday, according to regulatory disclosures. Burry’s fund managed roughly $155 million across four accounts as of late March, according to its most recent Form ADV filing. With many questions remaining, the only clue Burry offered was the cryptic remark, “On to much better things Nov 25th.”

As Burry appears to prepare for a new venture, Nvidia investors remain on edge awaiting further updates from him. They have been closely watching Burry’s moves, given Nvidia’s dominant position in the AI industry. That could spell trouble for the chipmaker if Burry plans to continue his public criticism of the AI trade.

Burry has said that “more detail” is coming on Nov. 25 and urged readers to “stay tuned.” His current X bio reads, “Official X account for ‘The Big Short’ Michael Burry, M.D., dubbed ‘Cassandra’ by Warren Buffett. Now unchained -??? launches Nov 25th, Stay Tuned!”

What Do Analysts Expect for NVDA Stock Ahead of Q3 Results?

Mounting concerns around the AI trade are increasing pressure on Nvidia to deliver when it reports earnings after the market closes on Wednesday. Expectations are high, with Wall Street analysts projecting third-quarter revenue of $54.94 billion and adjusted earnings of $1.25 per share, representing year-over-year (YoY) increases of 56.62% and 54.65%, respectively. Data center revenue, the chips the company sells to train and run a wide range of AI models, is expected to climb 61% YoY and account for $49.53 billion of Nvidia’s total revenue. The top-line growth is expected to be fueled by strong demand for the company’s Blackwell chips, while improved margins from economies of scale and software integrations like CUDA should bode well for the bottom line.

Investors will also be closely watching Nvidia’s Q4 guidance, with analysts currently expecting revenue of roughly $61.5 billion. Notably, Nvidia continues to face restrictions on selling advanced AI chips to China, with CEO Jensen Huang recently confirming there was no H20 chip revenue in Q3 and no expectation that this will change.

Meanwhile, the chipmaker has topped Wall Street’s earnings estimates 90% of the time over the past five years, but its average beat has narrowed to just 6.5% over the last four quarters, compared to as high as 30% previously. Given growing concerns about the AI trade, Nvidia will need to deliver results and guidance that beat even some of the loftiest estimates to avoid disappointing the market.

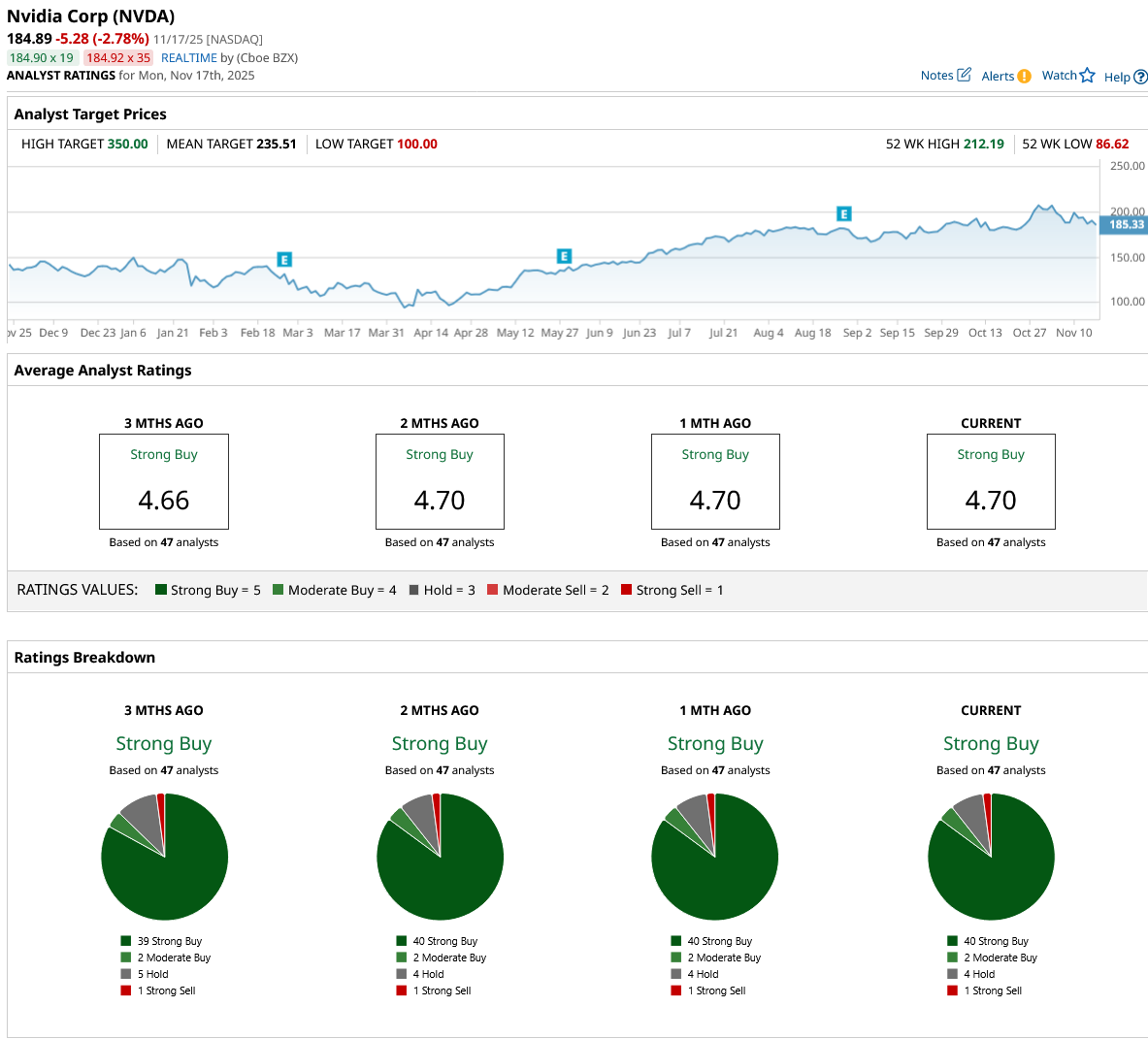

Wall Street analysts remain generally upbeat on Nvidia’s prospects, awarding the stock a top-tier consensus “Strong Buy” rating.

Last Friday, Morgan Stanley analyst Joseph Moore reiterated his “Overweight” rating on the stock and raised his price target to $220 from $210. “We expect something of a breakout quarter. Demand signals across Nvidia’s customers and suppliers in Q3 point to accelerating demand,” the analyst wrote in a note. Overall, among the 47 analysts covering the stock, 40 rate it a “Strong Buy,” two label it a “Moderate Buy,” four recommend holding, and one assigns a “Strong Sell” rating. The mean price target for NVDA is $235.51, implying a 27.4% upside potential from current levels.

On the date of publication, Oleksandr Pylypenko had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart