Nvidia (NVDA) shares are inching down on Monday after regulatory filings confirmed billionaire Peter Thiel’s namesake fund sold its entire stake in the chipmaker in the third quarter of 2025.

The news arrives only days after Japanese multinational conglomerate SoftBank (SFTBY) said it has unloaded its position in artificial intelligence (AI) darling for about $5.8 billion.

Nvidia stock has been under pressure amid a broader selloff in AI-driven names in November. At the time of writing, it’s down more than 10% versus its recent high.

Why Is Thiel’s Exit Meaningful for Nvidia Stock?

Thiel’s exit from NVDA shares adds fuel to growing caution around the semiconductor behemoth.

Together with a similar announcement from SoftBank last week, it suggests high-profile investors are reassessing the firm’s lofty valuation amid AI bubble concerns and macroeconomic uncertainty.

Moreover, the venture capitalist is widely followed by both institutional and retail investors. His decision to sell could, therefore, trigger a ripple effect, prompting others to follow suit.

This could compound the downward pressure on Nvidia stock moving forward. All in all, the dual exits reinforce that smart money is starting to see limited upside in the AI chips specialist heading into 2026.

BofA Sees Massive Upside in NVDA Shares

Bank of America’s senior analyst Vivek Arya does not agree with Thiel’s cautious view on Nvidia, though.

In a research note this morning, Arya argued that NVDA’s transformation from a PC graphics chip vendor into an AI and high-performance compute (HPC) enabler is actually “underappreciated” at present.

The BofA analyst maintained his “Buy” rating on NVDA stock, with a $275 price target indicating potential upside of a whopping 50% from here.

According to him, the giant’s Q3 earnings on Nov. 19 will prove a near-term catalyst, driving its stock price to record levels heading into 2026.

Wall Street Agrees with BofA on Nvidia

Other Wall Street analysts also agree with Arya’s constructive view on Nvidia shares for the next 12 months.

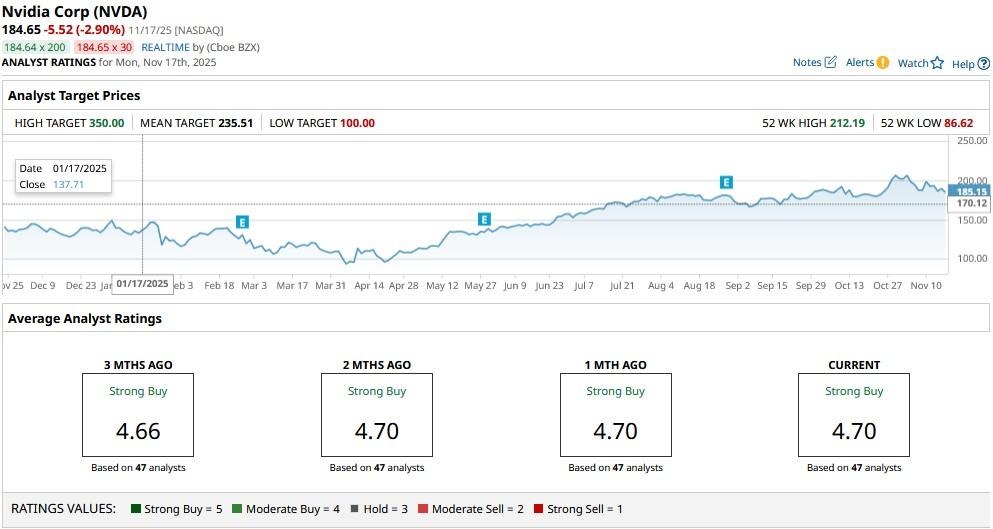

The consensus rating on NVDA stock remains at “Strong Buy” with the mean target of about $236 indicating potential upside of roughly 28% from current levels.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart