The calendar page has just turned to November, meaning the Holiday Season has begun. At least in the United States. I know my friends in Canada had their Thanksgiving Day during October, a holiday that focuses more on an actual day of giving thanks than the day of gluttony and sloth it has become south of the Canda/US border. But I digress. Since time will now accelerate into the New Year, what market sector stands out to me as we close out 2025?

Keep in mind I’ve spent my life studying the commodity complex. Global stock markets remain red hot, meaning you can’t go to a financial news page without reading the latest gibberish regarding Nvidia, Amazon (this time of year in particular), Meta, and Palantir. Given this partial list of hot stocks, it’s not a huge surprise the Nasdaq ($NASX) continues to rocket higher while the S&P 500 and Dow Jones Industrial Average are content to chug along showing seasonal strength as well. The idea is money is being created by the gains in stocks and stock indexes, with investors looking for fundamentally sound markets and/or market sectors in which to diversify.

Since the global economic and political situation isn’t going to regain its sanity any time soon, investors and central banks alike will continue to buy Gold (GCY00) as a safe haven hedge against the certain uncertainty. We also know inflation isn’t going away any time soon, though the next couple months could be a test of consumer sentiment in the US given higher prices for everything. Those looking to diversify their gold positions have also become interested in Silver over the last number of months, again due to its industrial quality in “green” technologies (solar panels, EVs, AI, etc.), except in the US where “green” is a four-letter word. (Feel free to judge the intelligence of that.)

Energies look to be a lot of markets going nowhere. Sure, forward curves are in backwardation (Brent crude, WTI crude, distillates), but as the great philosopher Inigo Montoya said, “You keep using that word. I do not think it means what you think it means.” This market situation used to indicate bullish supply and demand (in storable commodities), but it’s just one of the many things that don’t seem to be true these days. At least not in global energy markets. Let me put it this way: When the clearest read, from a technical point of view, is natural gas (the famed Widow Maker), I’ll look elsewhere for opportunities.

I wouldn’t go out to the Barn (Livestock sector) for any reason at this time given it gained the fleeting attention of the US president. Are cattle markets still fundamentally bullish? Yes, based on silly things like basis and futures spreads. But as one investment fund manager I talked to said, “How can you be in a market when all it takes is one social media post to wreck it?” Unfortunately, this is true for nearly every market in nearly every market sector these days. One person. One social media post. Chaos. But I digress again.

The sector that stood out to me as October came to an end was Grains. I know trading futures isn’t for everyone, what with all the rolling of positions and calculating full commercial carry. There are other avenues for long-term investment traders, with one being Exchange Traded Funds (ETFs). I track the Teucrium Funds for the three major grain markets – corn, soybeans, and wheat. As November gets under way, there looks to be opportunities in all three.

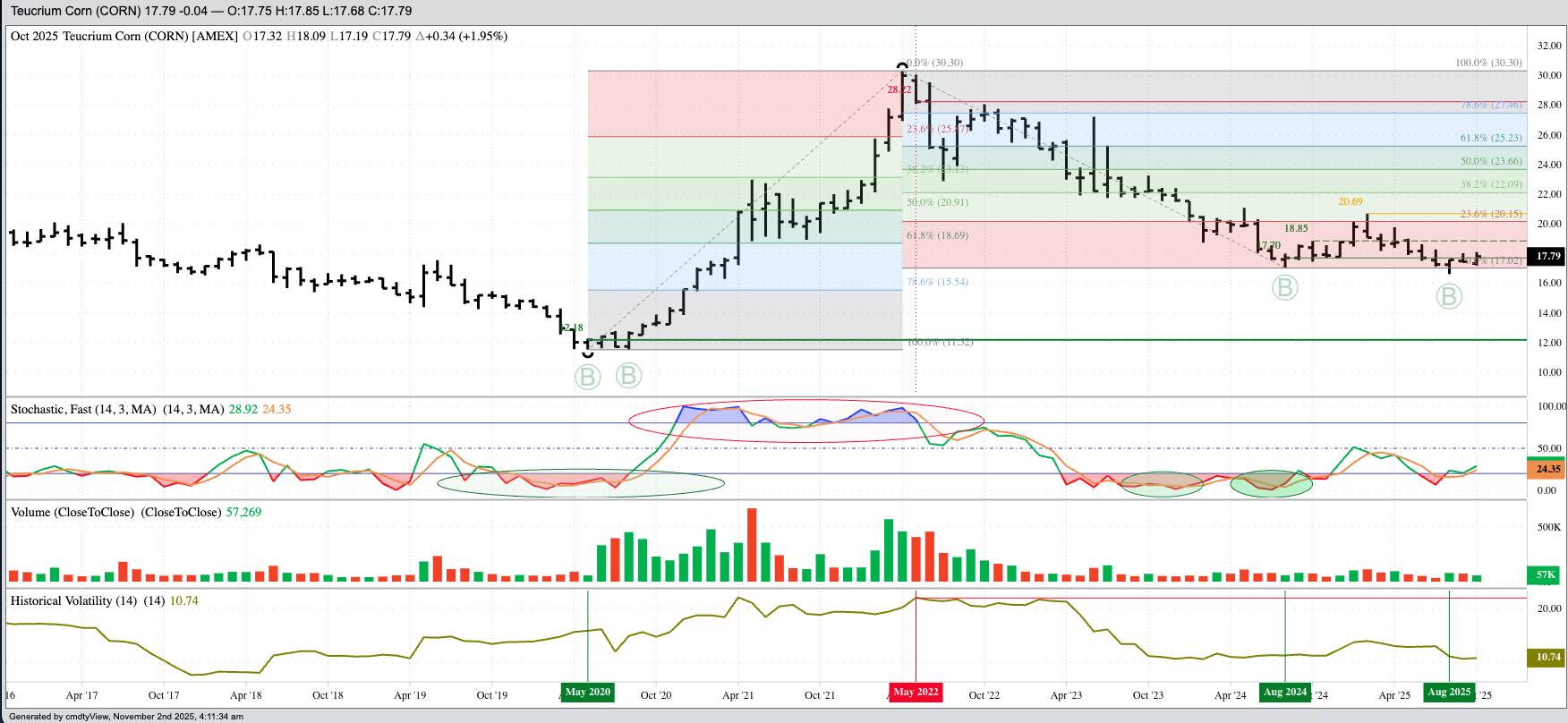

Corn

- From a technical point of view, (CORN) has been in an uptrend since completing a bullish spike reversal during August 2024. A similar pattern was completed this past August, made more interesting by the move to a new 12-month low of $16.61. Setting that aside, investors might’ve bought near the settlement of both months (August 2024 and 2025), then watched as the fund posted a bullish outside range during October 2025.

- Fundamentally, the US corn market is similar to what was seen last year at this time. As October ended, the December-July futures spread covered 37% calculated full commercial carry, leaning neutral-to-bullish, as compared to the final weekly close of October 2024 when the Dec24-July25 spread covered 35%.

- Outlook: Long-term investors would be looking for a similar trend over the winter of 2025-2026 as to what was seen last year, with the fund hitting a high of $20.69 during February (2025).

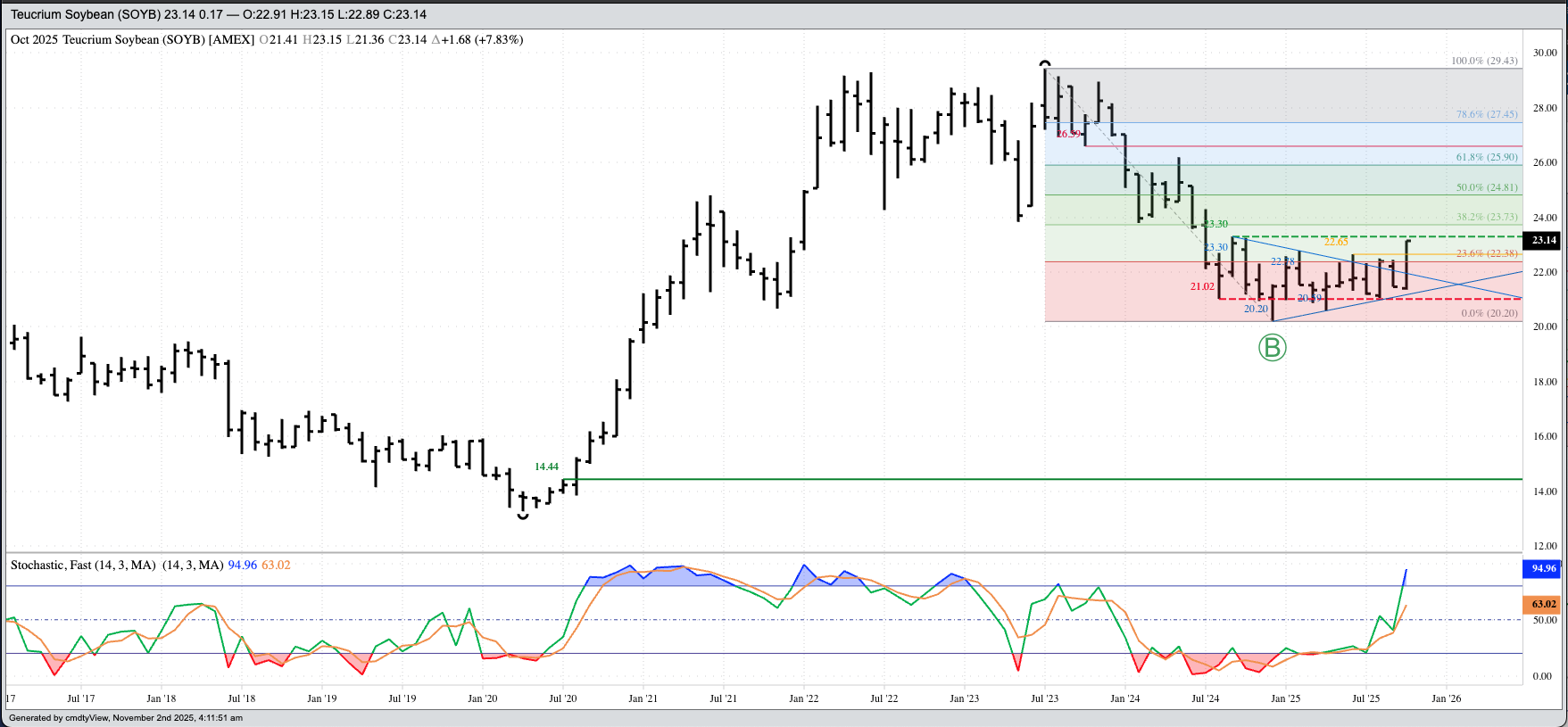

Soybeans

- Technically, (SOYB) took out its previous 4-month high of $22.65 during October, reaching as far as $23.15 before closing the month at $23.14. The next key price is $23.30 from September 2024. If/when that is cleared, the fund could start to gain bullish momentum. Though the operative word in that sentence is “could”.

- Fundamentally the soybean futures market saw a change during October. Much of this was due to the US government shutting down, allowing the world’s largest buyer to lock in some unreported secondary supplies. As I discussed previously, the “deal” made between the US and China was nothing spectacular and we’ll see if the parties live up to the imaginary agreement. That being said, at the end of September the November-July futures spread covered a neutral 55% calculated full commercial carry. When October closed, the same spread covered 38%. The previous year’s edition of the spread finished October covering 41%.

- As with cattle, SOYB are vulnerable to whatever mood strikes the US president each day. Setting this issue aside, long-term investors could look at it as a buy, but not one just to own and forget about.

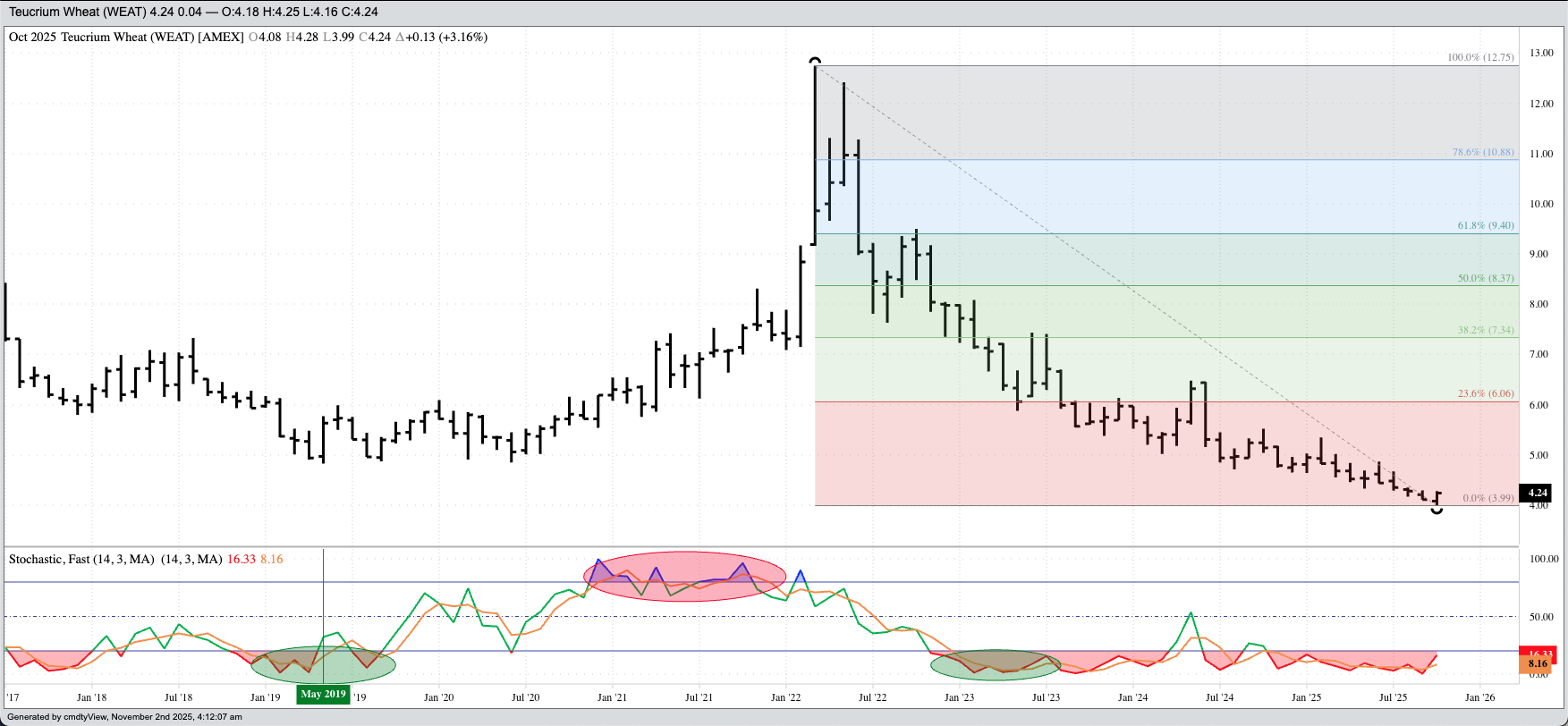

Wheat

- Technically, (WEAT) completed a bullish spike reversal during October. As you might recall, from a technical point of view, spike reversals are not the most reliable, with WEAT’s monthly chart showing a number of failed similar patterns, most recently at the end of May 2025. Still, it is what it is, and it is a bullish technical reversal pattern.

- Fundamentally, at the end of October 2025 the nearby Dec-March SRW futures spread covered 44% calculated full commercial carry, a neutral read on short-term supply and demand. A year ago, the previous edition of the spread closed October 2024 covering 57%, also a neutral read but leaning more bearish. Looking ahead, the July26-May27 futures spread covered 44% at the end of October compared to the same week last year settlement of 30%.

- Bottom Line: It is difficult for me to be bullish wheat, in any form. Fundamentally, this would be the last choice for long-term investment money. However, the risk is minimal as well. Theoretically, if WEAT is bought near the October close of $4.24, then sell stops could be placed below the October low of $3.99, putting risk at roughly $0.25.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart