With a market cap of $8.2 billion, Conagra Brands, Inc. (CAG) is a leading North American packaged foods company with a diverse portfolio of iconic brands such as Birds Eye, Healthy Choice, Slim Jim, Reddi-wip, and Marie Callender’s. Operating across four segments: Grocery & Snacks; Refrigerated & Frozen; International; and Foodservice, the company delivers innovative food products tailored to evolving consumer preferences.

Shares of the Chicago, Illinois-based company have significantly underperformed the broader market over the past 52 weeks. CAG stock has dropped 41.1% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.5%. Moreover, shares of the company are down 38.3% on a YTD basis, compared to SPX’s 15.1% increase.

Narrowing the focus, shares of Conagra Brands have lagged behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 6.1% dip over the past 52 weeks.

Shares of Conagra Brands climbed 5.4% on Oct. 1 after the company reported better-than-expected Q1 2026 revenue of $2.63 billion and adjusted EPS of $0.39. Investors reacted positively to the company maintaining its annual forecasts despite ongoing inflation and tariff pressures. Confidence was further supported by Conagra’s plans to offset rising costs, such as a 3% tariff impact and a 7% rise in cost of goods sold, through pricing actions and cost-saving initiatives.

For the fiscal year ending in May 2026, analysts expect CAG’s adjusted EPS to decrease 23.5% year-over-year to $1.76. The company’s earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

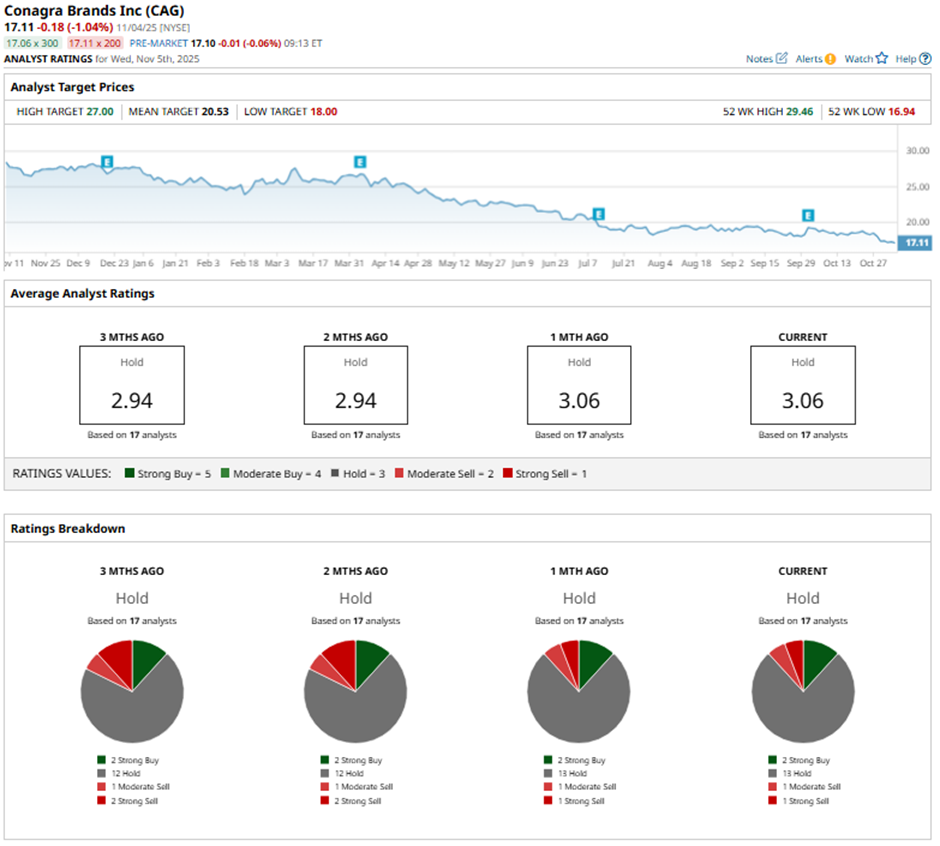

Among the 17 analysts covering the stock, the consensus rating is a “Hold.” That’s based on two “Strong Buy” ratings, 13 “Holds,” one “Moderate Sell,” and one “Strong Sell.”

On Oct. 3, Morgan Stanley’s Megan Alexander maintained a “Hold” rating on Conagra Brands and set a price target of $21.

The mean price target of $20.53 represents a nearly 20% premium to CAG’s current price levels. The Street-high price target of $27 suggests a 57.8% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Could Be the First Company to Reach $8.5 Trillion. Should You Buy NVDA Stock Here?

- Market Downturn Offers New Opportunities: Two 52-Week Low Stocks Worth a Bet

- Worried About an AI Bubble? Here's Exactly How to Limit Stock Risk by Hedging With Put Options

- Michael Burry Just Bet on This 1 Student Loan Stock. Should You Buy It Now?