After establishing its dominance in the GPU space with its cadence of chips over the years, chip giant and the world's most valuable company by market cap, Nvidia (NVDA), is slowly making a strategic shift. Following the emergence of Google's (GOOG) (GOOGL) TPU chips in a big way, Nvidia's hegemonic reign at the top of the chip industry was suddenly put into question. However, the Jensen Huang-led company is not doing nothing about it, with the company increasingly turning attention towards the enterprise side and catering to their specific applications. Basically, Nvidia is looking to make a serious splash in the domain of ASICs, in which Broadcom (AVGO) is the biggest player.

Routine Earnings Beat in Q3

In Q3 2025, Nvidia surpassed its revenue and earnings estimates again. Moreover, both metrics grew at a pace of greater than 50% again in the quarter.

While the revenues of $57.1 billion for the quarter represented an annual growth rate of 62%, earnings went up by 60% in the same period to $1.30 (vs. the consensus estimate of $1.26). Core data center revenues continued on their sharp upward trajectory in this quarter as well, rising by 66% on an annual basis to $51.2 billion.

Meanwhile, what helps Nvidia in carrying out these valuable acquisitions is its cash flow prowess, which again witnessed a strong showing in Q3. Net cash from operating activities increased to $23.8 billion from $17.6 billion in the previous year as free cash flow moved higher at an even sharper tick of 65% in the same period to $22.1 billion. Overall, Nvidia closed the quarter with a cash balance of $60.6 billion, with short-term debt of just under a billion on its books. In fact, the cash balance was more than eight times higher than its long-term debt levels of $7.5 billion.

For Q4, the company expects revenue to be $65 billion, which would denote an annual growth of 65.4%.

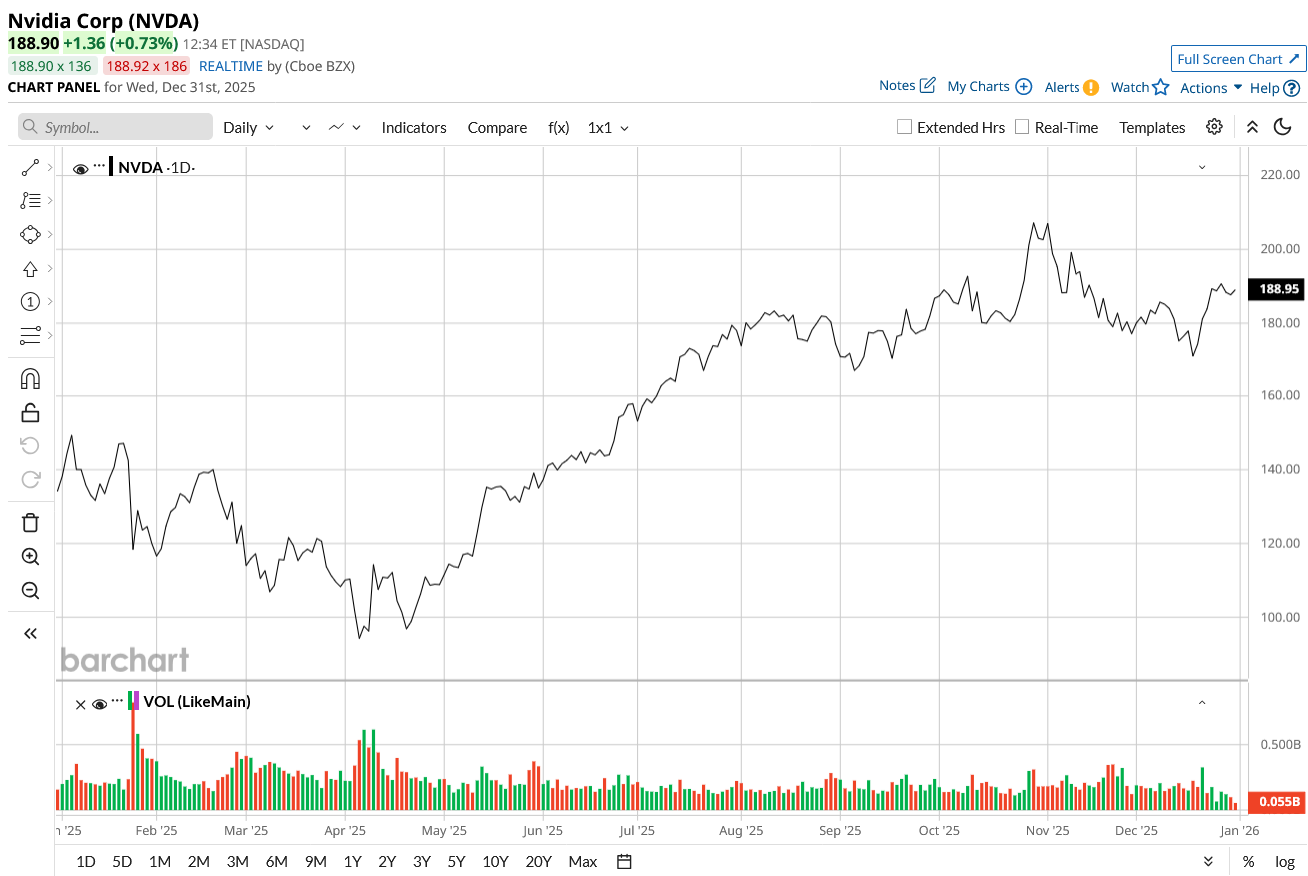

Meanwhile, despite its stark outperformance over the years, the NVDA stock is up over 40% this year.

Will AI21 Labs Be an A1 Purchase for Nvidia?

Armed with those solid financials, Nvidia is going down a familiar route to gain prominence in a relatively unfamiliar space for the company: acquisitions. While the $20 billion deal to purchase AI startup Groq is hailed as a significant signal of intent from the company to strengthen its footing in inference. Recent reports have emerged that it is looking to buy another AI startup based out of Israel, AI21 Labs.

A developer of large language models (LLMs), AI21 Labs builds custom generative AI applications for enterprises. Along with Google, Nvidia has also been an investor in the company, which had a purported valuation of $1.4 billion following its latest fundraising round in 2023. Notably, the firm today positions itself as a builder of “frontier” models and enterprise AI stacks rather than a pure consumer app shop, emphasizing secure, customizable on-prem/cloud deployments for customers in regulated industries and ISV partners.

AI21’s product set includes the Jurassic family of LLMs (e.g., Jurassic-1, Jurassic-2), developer APIs (AI21 Studio/Task APIs), user-facing writing tools such as Wordtune, and more recently enterprise orchestration and “AI systems” like Maestro and Jamba that claim to reduce hallucinations and improve long-context performance for document-centric workflows; the company touts architectural work on long-context, task-specific models and tooling for knowledge grounding and retrieval, which it uses to sell higher-margin enterprise deployments. That technical focus gives AI21 a mix of IP in model architecture, inference optimization, and data-centric tooling that appeals to customers who need accuracy, privacy controls, and vertical integration.

So, how will it help Nvidia?

Well, for starters, Nvidia will gain access to AI21’s ~200 research engineers with deep LLM and inference expertise, a scarce and strategically attractive commodity for Nvidia’s expanded AI-software push and planned Israeli campus. Further, AI21’s stack for long-context, low-hallucination enterprise inference complements Nvidia’s hardware+software strategy (GPUs + CUDA + Triton) and could accelerate Nvidia’s push into higher-value, software-driven services. Finally, AI21’s direct enterprise contracts and tooling offer a route for Nvidia to monetize more than silicon by selling vertically integrated AI systems. Those three drivers explain why a premium north of AI21’s last public valuation ($1.4 billion) could be defensible to Nvidia.

Thus, buying AI21 would accelerate Nvidia’s software/service monetization and deepen its Israel R&D footprint. However, Nvidia should be mindful of the potential integration risks for AI21’s inference stack into its software ecosystem (Triton, TensorRT, NeMo).

Analyst Opinion on NVDA Stock

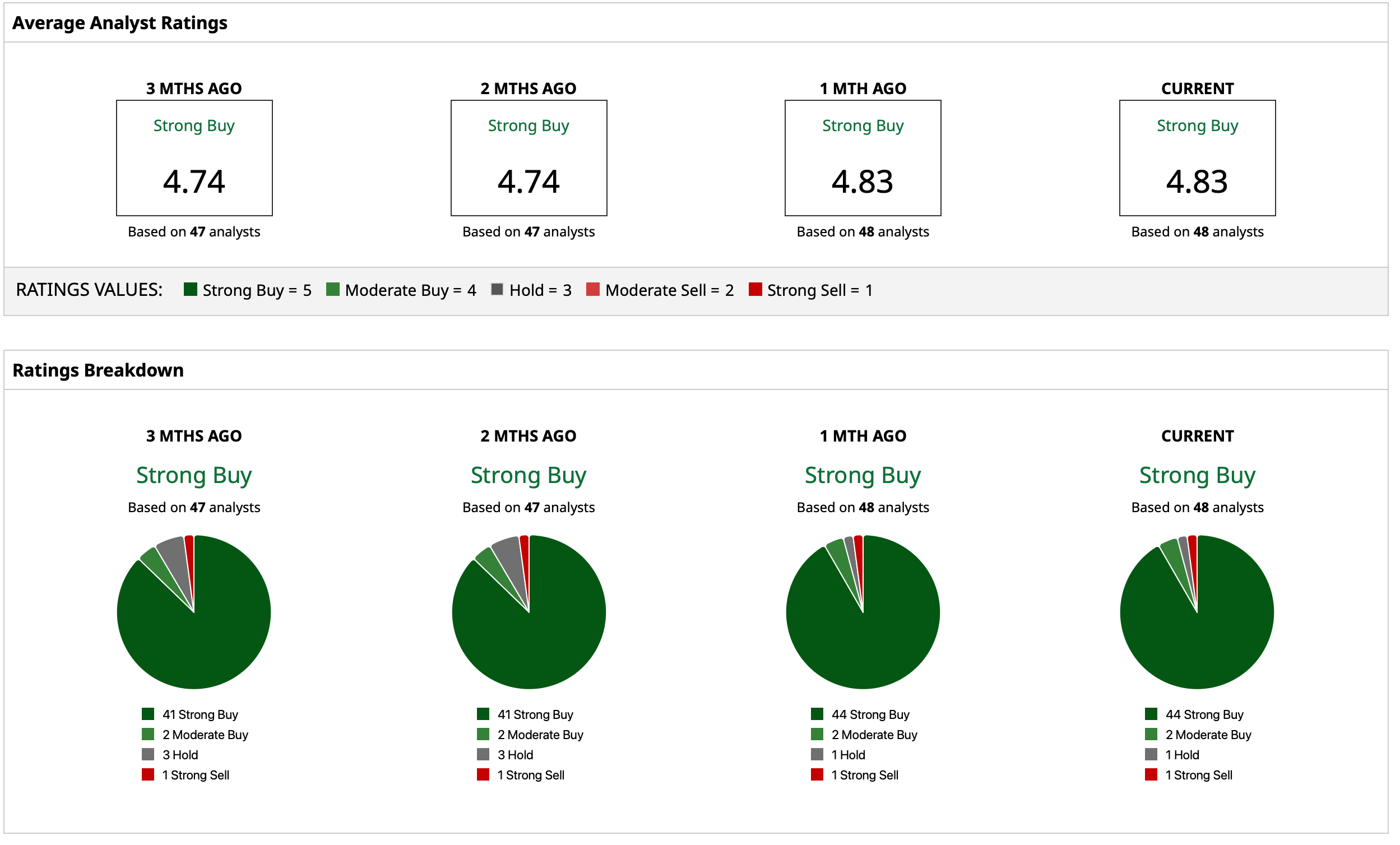

Thus, analysts have deemed the stock to be a consensus “Strong Buy,” with a mean target price of $256. This indicates an upside potential of about 36.5% from current levels. Out of 48 analysts covering the stock, 44 have a “Strong Buy” rating, two have a “Moderate Buy” rating, one has a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jefferies Is Betting Big on Mining Stocks for 2026. Here Is Barchart’s Top-Rated Name.

- A $100 Million Reason to Buy This Critical Minerals Stock in 2026

- Unusual Activity in Occidental Petroleum Call Options - A Signal Investors Expect a Dividend Hike

- Ulta Stock ‘Unleashed’ Gains in 2025. Should You Keep Buying Shares in 2026?