Beginning in 2026, Greg Abel will become Berkshire Hathaway’s (BRK.A) (BRK.B) CEO, taking over the baton from long-time CEO Warren Buffett. It is not just another leadership transition at an enterprise but the end of an era as the “Oracle of Omaha” hangs up his boots. Buffett would go down in history as among the best—if not the best—investors of all time. Known for his value investing credentials and witty quotes, the nonagenarian’s investment principles are followed by many investors, including this writer.

Notably, apart from Abel taking over as Berkshire’s CEO, several other significant changes are underway at the $1.1 trillion conglomerate. Tedd Combs, for instance, has resigned from the company to join J.P. Morgan Chase (JPM), where he will head the $10 billion “Strategic Investment Group.”

Berkshire’s CFO, Marc Hamburg, also intends to retire next year and will be succeeded by Charles Chang, who is currently the CFO of Berkshire Hathaway Energy. Berkshire has appointed NetJets’ CEO, Adam Johnson, as the president of the company’s consumer products, services, and retailing businesses. The company also got its first general counsel in the form of Michael O’Sullivan.

Buffett Has Admitted to Making Many Mistakes

One of Buffett's hallmarks has been humility, and he has admitted to making many mistakes, which include both omission and commission. He, for instance, regrets not buying Amazon (AMZN) and Alphabet (GOOG) (GOOGL) early. The investing great has acknowledged that he was wrong about IBM (IBM) and airlines and said that he sold Disney (DIS) and Apple (AAPL) shares early. He also admitted to overpaying for Precision Castparts and Kraft during the merger with Heinz (KHC).

Meanwhile, Berkshire bought 17.8 million Alphabet shares in Q3, which were valued at around $4.3 billion at the end of September. While we don’t know as yet whether the investment decision was taken by Buffett, Abel, or either of Ted Weschler and Todd Combs, the size of the investment seems to suggest that it was either Buffett or Abel.

What Could Change at Berkshire After Buffett’s Departure?

There are bound to be changes at Berkshire after Buffett retires as the CEO. However, since he will continue to be the chairman of the board of directors, there will be some continuity. Furthermore, Abel has vowed to preserve the culture at Berkshire that Buffett built over many decades.

Speaking at the annual meeting earlier this year, Abel said, “It’s really the investment philosophy and how Warren and the team have allocated capital for the past 60 years.” Abel emphasized, “Really, it will not change. And it’s the approach we’ll take as we go forward.”

All said, while it would be fair to expect changes once Abel takes over, we shouldn’t expect drastic changes in the investment philosophy, and Berkshire will continue to practice Buffett’s value investing principles. No one expects Berkshire to go out and start buying bitcoins (BTCUSD) from tomorrow or Abel’s investment philosophy to be closer to Cathie Wood rather than Buffett. However, the recent purchase of Alphabet shares indicates that the company might not be as averse to investing in tech stocks as it was under Buffett.

Buffett Shied Away from Tech Stocks

To be sure, Buffett did not hold any grudge against tech companies, and despite selling three-quarters of his Apple stake, the iPhone maker is still Berkshire’s top holding. It was just that he found tech companies to be outside his “circle of competence.” Abel hasn’t publicly talked about investing in tech stocks, but it would be fair to assume that he would take a more constructive approach than Buffett, who was using a flip phone until early 2020. He still doesn't have a computer at his desk in the office.

Abel Could Invest in AI and Tech Stocks if Available at Reasonable Valuations

It won’t be an easy task for Abel, though, as valuations of tech stocks are not cheap by historical standards, let alone on the higher (or rather lower) bar that Buffett has set. Meanwhile, while Buffett and Berkshire largely missed the tech boom, Abel now has the opportunity to invest in artificial intelligence (AI) companies. While the current valuations of AI stocks might not seem enticing enough to the new Berkshire CEO, I won’t be surprised to see him use any dips to add positions in tech names.

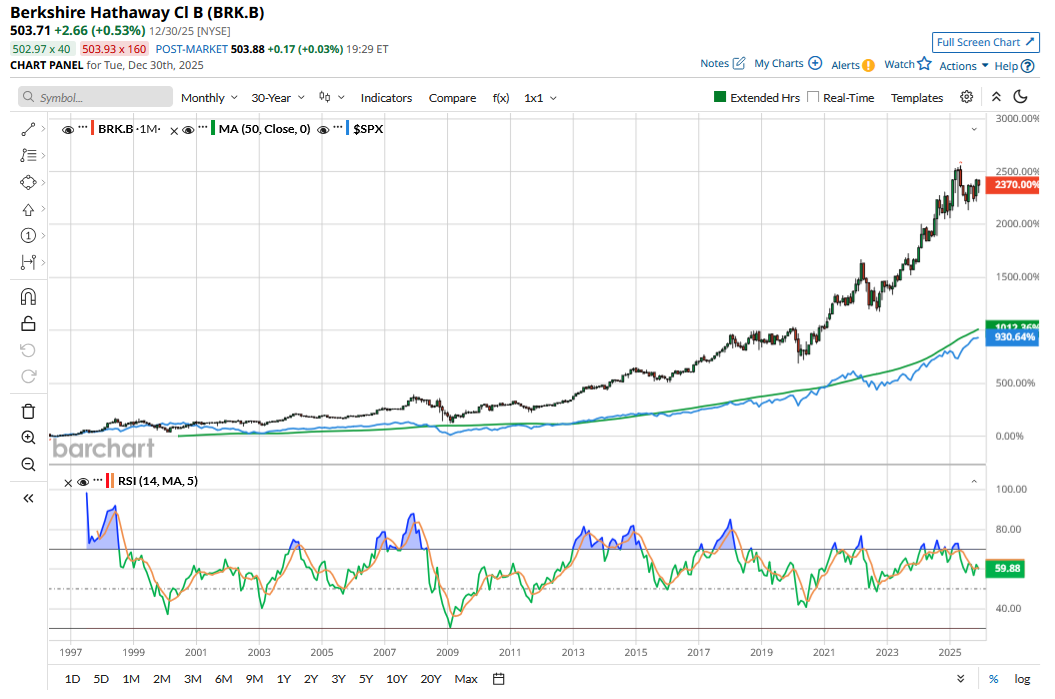

All said, despite shying away from tech companies and many admitted “mistakes,” Buffett managed to achieve market-beating returns, which is no mean feat, given that tech stocks have led the market rally this century. Abel has colossal shoes to fill as he takes over the baton from one of the most successful and admired investors of all time. While Berkshire's “circle of competence” might expand, particularly if Abel adds more people to the investment team, it remains to be seen whether he can beat the markets like Buffett did. It won't be prudent to expect the kind of outperformance as we saw under Buffett, as that was a different era and Berkshire was a much smaller company, making outperformance relatively easier. However, while Buffett had a nearly free hand despite periods of underperformance, the incoming CEO might not have that leeway.

On the date of publication, Mohit Oberoi had a position in: BRK.B , AAPL . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Next GEICO? Michael Burry Is Pounding the Table on This 1 Warren Buffett-Esque Stock.

- This Was the Top-Performing Stock in the World in 2025. You Probably Have Never Heard of It.

- Donald Trump Jr. Is Betting Big on This Penny Stock. Should You Buy Shares First?

- Meta Platforms Just Bought AI Agent Startup Manus. Should You Buy META Stock?