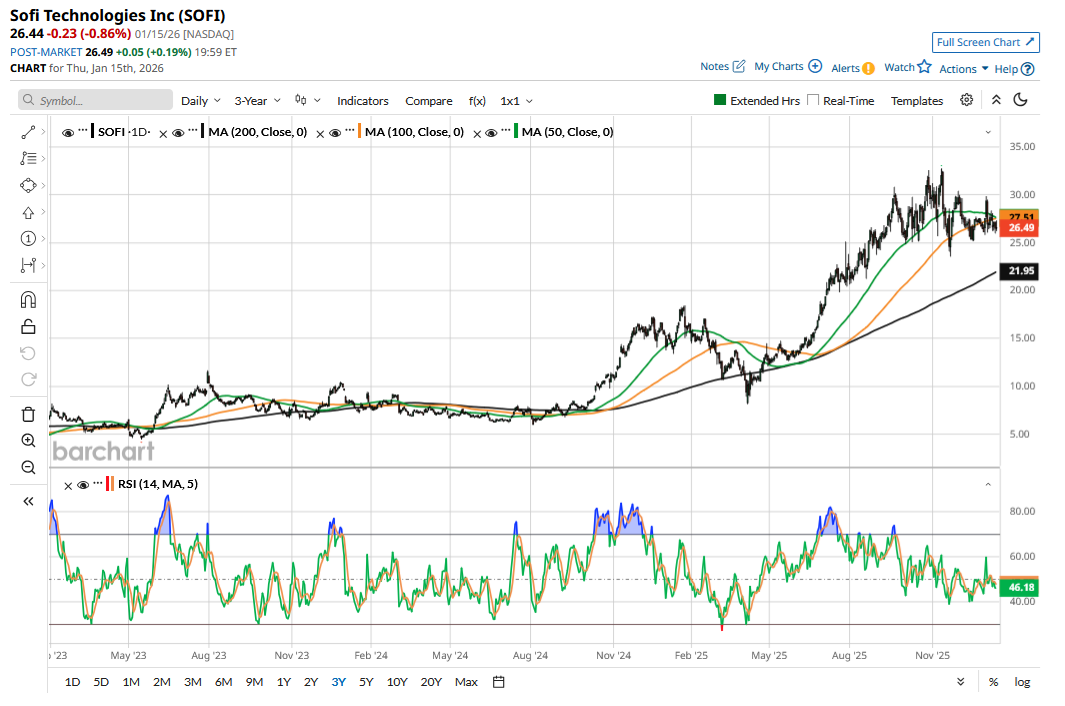

SoFi stock (SOFI), which rose 70% last year and has outperformed markets for the last three consecutive years, is slightly underperforming the S&P 500 Index ($SPX) this year. The stock has lost 1.4% over the previous three months and trades nearly 20% below its all-time high, which it reached in mid-November.

The fintech giant is set to release its Q4 2025 earnings on Jan. 30. Let's explore whether the confessional would help turn the tide for SoFi, which is among the rare success stories in the former special purpose acquisition company (SPAC) space.

Why Has SOFI Stock Underperformed Over the Last Three Months?

To begin with, let’s analyze why SOFI stock has underperformed since November. Firstly, the stock’s valuations were a bit stretched at the peak, as I noted in a previous article. While SoFi is among the best growth stories out there, bringing a mix of top-line and bottom-line growth to the table, the valuations were still difficult to justify.

Just when things were starting to stabilize, SoFi announced a $1.5 billion capital raise in early December. It didn’t help matters that the company priced the shares at $27.50, which was below their trading price at the time.

Finally, I suspect there is a crypto angle to SoFi’s underperformance. In November, it relaunched its cryptocurrency trading business after a nearly two-year halt and became the first nationally chartered bank to offer the service. Digital assets have looked weak over the last few months, and the pessimism is reflected in the price action of other cryptocurrency trading plays like Coinbase (COIN) and Robinhood (HOOD).

SOFI Stock Forecast

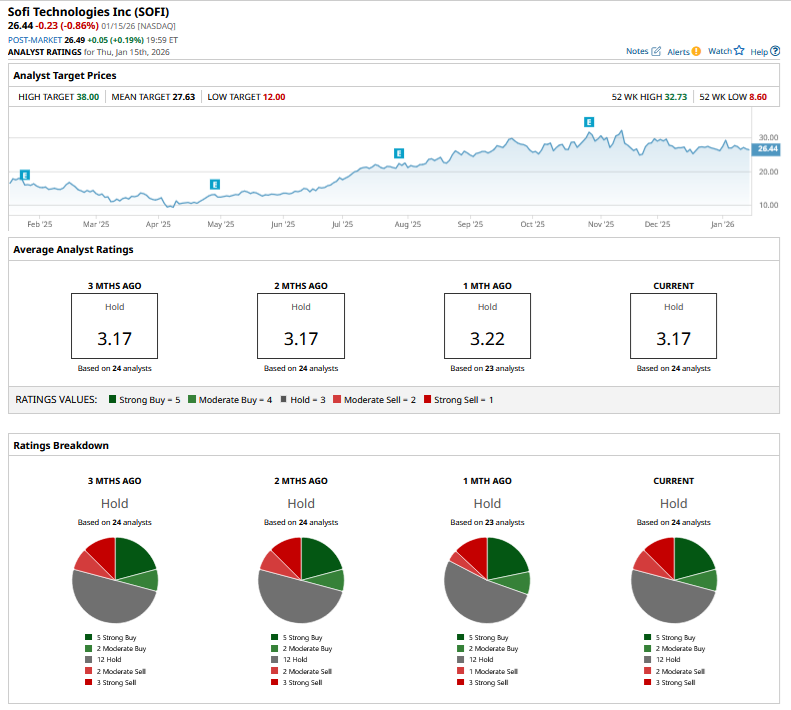

Recent analyst action has also been bearish, and Goldman Sachs lowered SoFi's target price from $27 to $24 earlier this year. Bank of America also resumed coverage on SoFi with an “Underperform” rating and a $20.50 target price. Barclays was somewhat of an exception and raised its target price from $23 to $28 while maintaining its “Equal Weight” rating.

While most sell-side analysts were horribly wrong on SoFi over the last three years and the stock defied all the pessimism to soar to new highs over the period, gloomy commentary from brokerages also added to the selloff in SoFi shares.

Why SOFI Stock Still Looks Like a Buy

I have been bullish on SoFi for quite some time, and while I did exit the bulk of my positions last year to capitalize on the rally that pushed the stock above what I believed was its worth then, I have since gradually built positions amid the weakness.

I find SoFi a structural growth story available at reasonable valuations. A rising member base where the quarterly additions are nearing 1 million is key to SoFi’s success. The company comes up with new and innovative products, most recently the SoFi Smart Card account, which it can cross-sell to its widening member base.

SoFi also has quite conservative lending practices in an industry that often indulges in excesses. Its annual charge-off rate in personal loans fell by 20 basis points to 2.6% in Q3, despite concerns over rising delinquencies amid the economic stress in low- and middle-income households.

SoFi has pivoted to an aggregator model and originates loans for third parties through its loan platform business. According to SoFi, annually, it cannot lend to about $100 billion worth of potential loan applicants and anticipates that nearly a quarter of these loans could be serviced by other lenders, which is a major opportunity.

During Q3 2025, SoFi originated $3.4 billion of loans through its loan platform business. SoFi’s tech platform segment is another capital-light business and provides backend infrastructure for other firms to build and manage financial products. The loan platform and tech business have been growing steadily, with the growth outstripping lending revenues. In Q3, fee-based revenue accounted for 43% of SoFi’s revenues, while the corresponding number in 2021 was a mere 26%. That’s high-margin and low-risk revenues that need far less capital than the lending business.

SoFi trades at a forward price-to-earnings (P/E) multiple of 46x, while the price-to-book value is 3.72x. While SoFi’s valuations are a breaking point for many, I believe a high (and rising) share of fee-based revenues, coupled with the 30%+ year-over-year revenue growth that the company has been posting, makes SoFi different from traditional banks and hence worthy of premium valuations.

Overall, I remain bullish on SoFi and expect the Q4 earnings release to be the trigger that can pull the stock out of its current trading range. Along with the Q4 numbers, I will watch out for color on 2026 guidance as it would set the pace for the year. SoFi has a long history of under-promising and overdelivering, and I have no reason to believe that it would be different this year.

On the date of publication, Mohit Oberoi had a position in: SOFI . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart