Valued at a market cap of $399.2 billion, Palantir Technologies Inc. (PLTR) is a software company that specializes in data integration, analytics, and artificial intelligence platforms. The Denver, Colorado-based company provides tools that help governments and enterprises manage, analyze, and derive insights from complex and large-scale datasets, supporting decision-making across diverse areas.

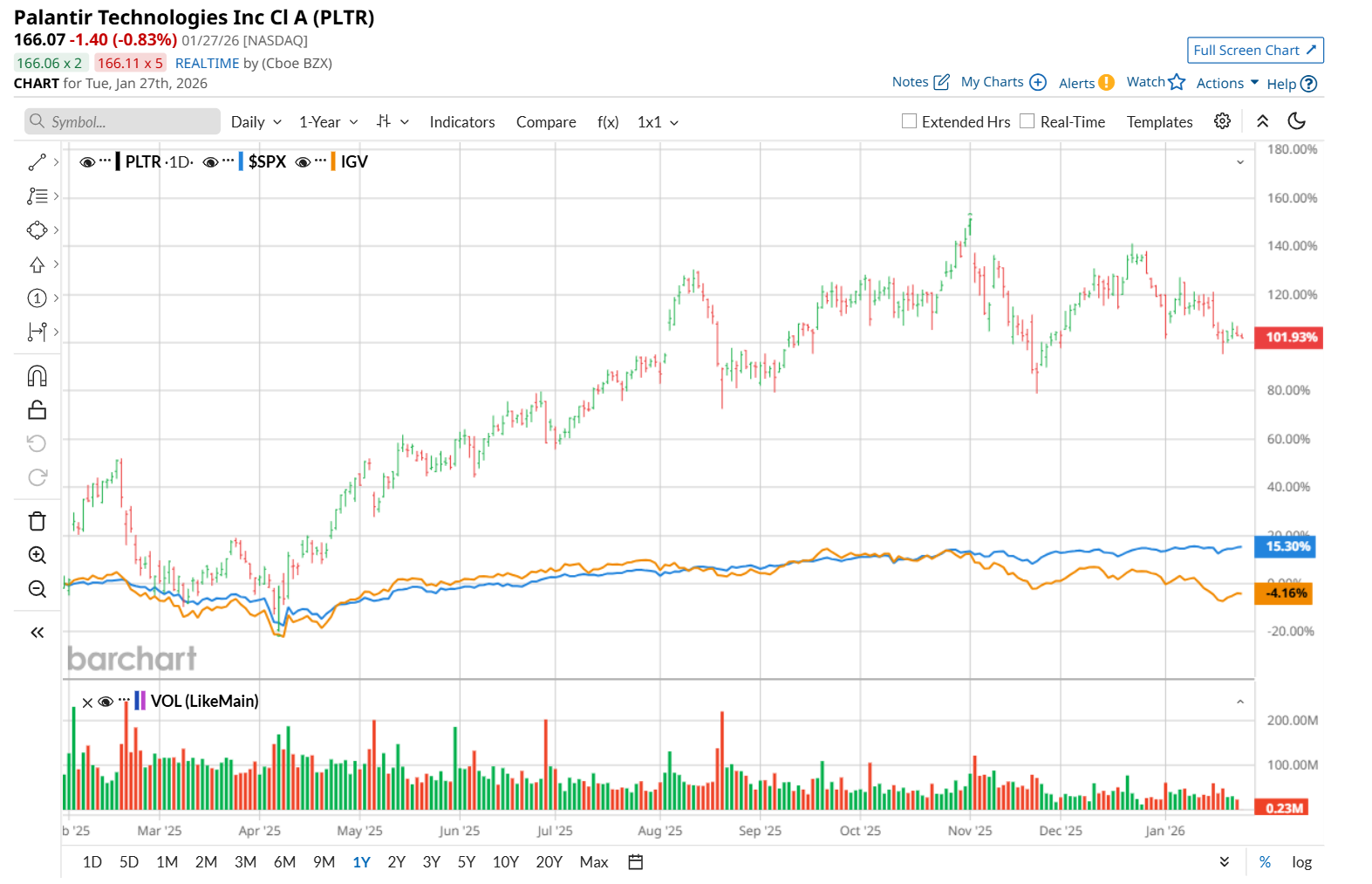

This software company has significantly outpaced the broader market over the past 52 weeks. Shares of PLTR have soared 122.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.9%. However, on a YTD basis, the stock is down 5.7%, lagging behind SPX’s 1.5% uptick.

Zooming in further, PLTR has also notably outperformed the iShares Expanded Tech-Software Sector ETF’s (IGV) 3.4% downtick over the past 52 weeks and 6.7% YTD drop.

On Jan. 23, shares of PLTR rose 2.2% following several positive catalysts that boosted investor sentiment. PLTR is said to have landed a substantial deal with South Korea’s Hyundai Motor Company, valued at an estimated “hundreds of millions” of dollars, and also announced a collaboration focused on data center projects across Europe, the Middle East, and Africa.

For the current fiscal year, ending in December, analysts expect PLTR’s EPS to grow 562.5% year over year to $0.53. The company’s earnings surprise history is mixed. It topped the consensus estimates in two of the last four quarters, while missing on two other occasions.

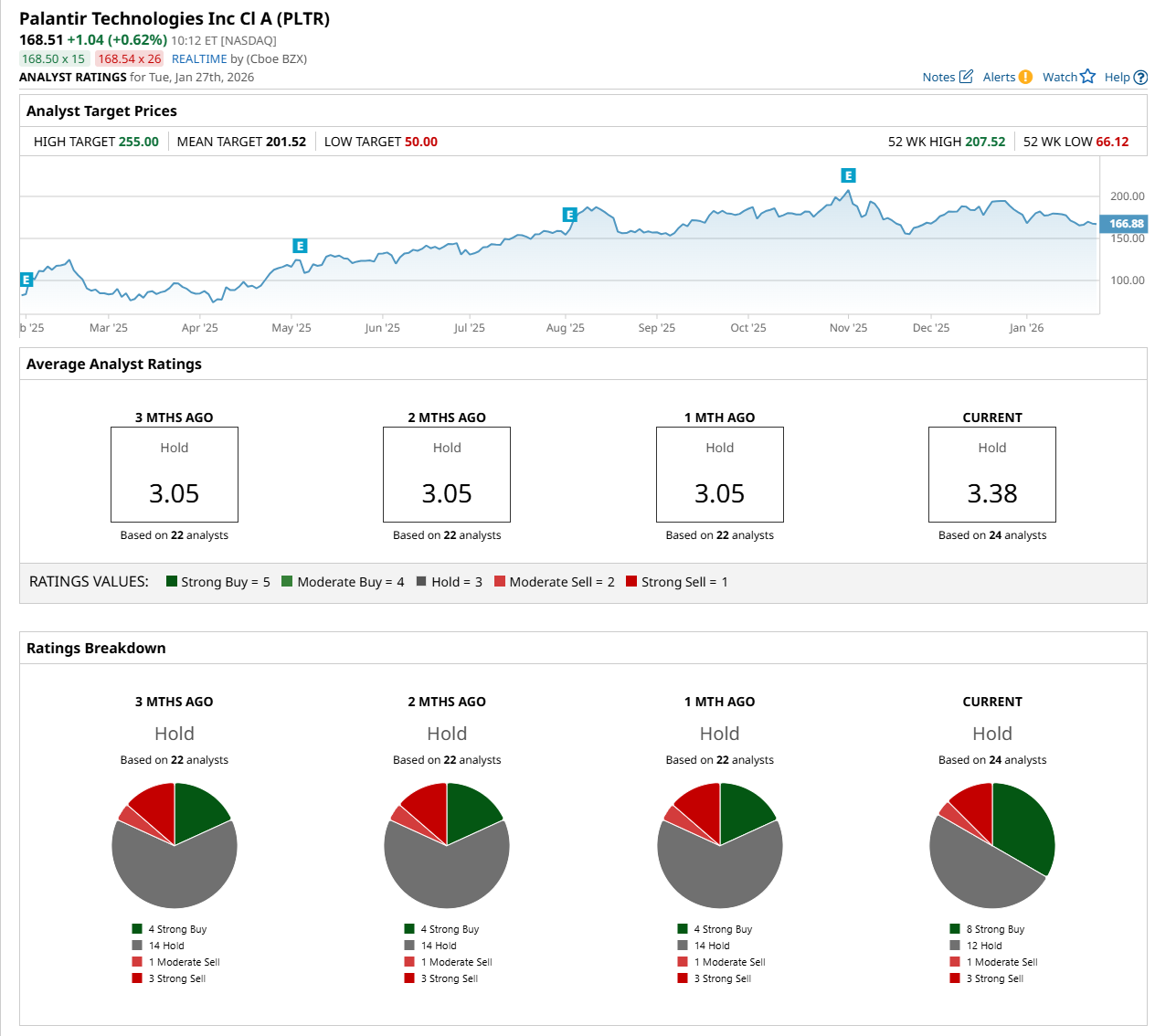

Among the 24 analysts covering the stock, the consensus rating is a "Hold,” which is based on eight “Strong Buy,” 12 "Hold,” one "Moderate Sell,” and three "Strong Sell” ratings.

The configuration is notably less bearish than a month ago, with four analysts suggesting a “Strong Buy” rating.

On Jan. 22, Phillip Securities analyst Alif Fahmi initiated coverage on PLTR with a “Buy” rating and set a $208 price target, implying a 23.4% upside potential from current levels..

The mean price target of $201.52 represents a 19.6% premium from PLTR’s current price levels, while the Street-high price target of $255 suggests an ambitious 51.3% potential upside from the current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart